|

市場調查報告書

商品編碼

1642123

融合式基礎架構:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Hyper-Converged Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

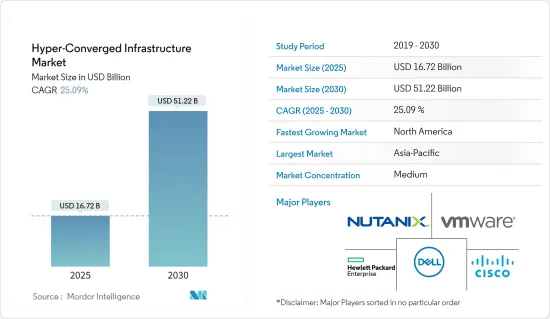

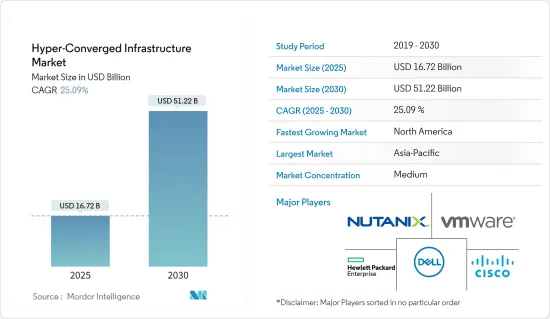

融合式基礎架構市場規模在 2025 年估計為 167.2 億美元,預計到 2030 年將達到 512.2 億美元,預測期內(2025-2030 年)的複合年成長率為 25.09%。

主要亮點

- 超融合基礎架構 (HCI) 已成為 IT 產業的變革性解決方案,徹底改變了企業管理資料的方式。隨著企業尋求簡化基礎設施、提高營運效率和實現數位轉型,HCI 市場正在經歷顯著的成長和採用。

- 超融合式基礎架構市場的主要驅動力是雲端運算的日益普及。各行各業的企業都在將其工作負載轉移到雲端,以利用其擴充性、成本效益和靈活性。 HCI 解決方案透過無縫整合內部部署和雲端資源來補充雲端環境。 HCI 讓企業能夠輕鬆地在私有雲端雲和公共雲端雲之間移動工作負載,從而實現結合兩種環境優勢的混合雲端部署。 HCI 與雲端處理之間的這種協同效應正在加速市場成長,並預計將繼續推動對融合式基礎架構解決方案的需求。

- 對於希望最佳化IT基礎設施並降低營運成本的組織來說,資料中心虛擬與整合已變得至關重要。融合式基礎架構基礎設施為資料中心管理提供了統一的方法,讓企業將多個元件組合成一個整合系統。透過利用虛擬技術,HCI 能夠更有效地分配和利用運算資源,從而提高效能並減少硬體佔用空間。 HCI 提供的擴充性和靈活性使其成為資料中心整合和虛擬計劃的理想解決方案。因此,在高效資料中心營運需求的推動下,超融合式基礎架構市場正經歷顯著成長。

- 由於各種應用導致IT基礎設施基礎設施效率的提高,全球融合式基礎架構市場的需求正在增加。這種需求激增的原因是融合式基礎架構基礎設施系統能夠提供簡介、複製和加密等功能來保護本地資料中心內的資料。因此,各行各業的組織都在尋找這樣的解決方案。

- 然而,部署HCI解決方案的高昂初始投資成本阻礙了市場的發展。雖然 HCI 提供了許多好處,包括簡化管理、提高可擴展性和降低營運成本,但部署這些解決方案所需的初始投資卻相當大。硬體、軟體授權和專業服務的成本可能相當高,尤其是對於 IT 預算有限的中小型企業 (SME) 而言。高昂的初始投資成本是採用的障礙並阻礙了市場成長。然而,隨著市場成熟和技術進步,HCI 解決方案的成本預計會下降,使更廣泛的組織能夠使用它們。

- 新冠疫情大大加速了各行各業的數位轉型進程。世界各地的組織已經意識到敏捷且有彈性的IT基礎設施對於支援遠距工作、線上協作和數位服務的重要性。融合式基礎架構透過提供擴充性和靈活的基礎設施基礎,使這種轉變成為可能。這場疫情凸顯了企業對敏捷性和適應性的必要性,進而導致對 HCI 解決方案的採用增加。因此,隨著企業繼續投資於增強其數位化能力的技術,預計後疫情時代將進一步推動融合式基礎架構市場的發展。

融合式基礎架構市場趨勢

對更強力的資料保護的需求不斷成長,推動了市場成長

- 現今的企業對於可靠、高效能儲存的需求日益增加。融合式基礎架構(HCI) 將網路、儲存和運算結合到單一系統中,以提供安全且有效率的解決方案。這種資源整合簡化了管理、降低了成本,對許多企業的策略 IT 重點至關重要。

- 由於 HCI 解決方案的採用日益廣泛,尤其是在資料安全和災難復原等領域,HCI 市場正在不斷擴大。社群媒體、知識平台等數位科技平台的傳播也促進了人機互動需求的成長。根據 IBM 最新的資料外洩報告,資料外洩的平均成本增加 2.6%,達到 435 萬美元(包括罰款)。 HCI 系統透過其元件和應用程式降低資料安全漏洞的風險,並且通常採用具有內建安全功能的高安全性 AMD 處理器。

- 此外,與傳統儲存解決方案相比,HCI 提供了更高的資料安全性和擴充性。隨著連接設備和物聯網 (IoT) 的數量不斷成長,HCI 在集中系統中收集和儲存分析資料的能力變得越來越有價值。此功能與 5G 網路的未來非常契合,其中 HCI 透過統一介面呈現其收集的資料的能力將被證明是有利的。根據GSMA預測,今年5G連線數將超過10億,到2025年將達到20億,將進一步推動HCI市場的發展。

- 與雲端為基礎的服務一樣,HCI 針對虛擬工作負載進行了最佳化,並提供靈活的、基於消費的基礎架構經濟性。透過新增 HCI 建置模組,企業可以快速擴展資源,快速回應業務需求並提高 IT 服務的靈活性。透過將集中管理、運算、儲存和資料安全等基本雲端處理服務整合到整合系統中,HCI 成為一個全面的解決方案。

- 自動化和機器學習被廣泛認為能夠幫助企業提高應用程式效能、處理大量資料並提高生產力。 HCI 利用 AI 來滿足工作負載需求、最佳化應用程式工作負載並最佳化儲存。透過彌合私有雲端、公有雲和現有資料中心基礎架構之間的差距,混合多重雲端模型中的 HCI 使企業能夠管理端到端資料工作流程,並確保輕鬆存取 AI 應用程式的資料。正如去年的人工智慧指數報告所強調的那樣,企業對人工智慧的投資不斷增加也推動了人機互動市場的發展,去年全球投資達到約 940 億美元,較前一年的 678.5 億美元大幅成長。

北美有望創下最快成長

- 北美 HCI 市場的成長主要受到該地區超大規模雲端服務供應商擴張的推動。批發和零售領域的主機託管服務也正在成長。行動資料使用量的增加和自帶設備 (BYOD) 法規的實施對支援虛擬桌面的基礎設施提出了更高的要求。因此,預計北美的 HCI市場佔有率將會成長。

- 一些資料中心公司正在對超大規模資料中心進行大量投資。例如,Equinix 已宣布計劃在全球主要市場建造 32 個超大規模資料中心。 Equinix 投資超過 69 億美元,總容量達到 600 兆瓦,旨在擴大其影響力並利用不斷成長的超大規模資料中心格局。區域資料中心的興起預計將進一步推動 HCI 市場的發展。

- 夥伴關係和聯盟也正在塑造北美 HCI 市場。例如,聯想和 Kindrill 擴大了合作,以開發和提供可擴展的混合運算、先進的運算實施和雲端解決方案。透過利用聯想在 PC、儲存和伺服器效能方面的專業知識以及 Kyndryl 的IT基礎設施服務,此次夥伴關係旨在為客戶提供跨混合雲、HCI 和高階運算應用的全面解決方案。

- 此外,企業中 HCI 採用的激增也推動了對軟體定義儲存的需求。為了因應這一趨勢,DataCore Software 收購了物件儲存專家 Caringo Inc.此次收購使 DataCore Software 能夠提供統一的區塊、檔案和物件儲存包。 Caringo 的 Swarm 平台專為超大規模資料存取和儲存而設計,可滿足資料管治需求並減少對硬體的依賴。 DataCore資料管理解決方案的最新版本擴展了跨分散式儲存資源的資料存取能力。

融合式基礎架構產業概覽

融合式基礎架構基礎設施市場競爭適中,主要企業很少。目前,少數幾家公司在市場佔有率佔有率上佔據主導地位。然而,隨著使用雲端平台的基礎設施服務的進步,新參與者正在增加其在市場上的佔有率,並在新興國家擴大企業發展。市場主要企業不斷建立聯盟、合併和投資以保持其市場地位。

2023年2月,華為宣布計畫透過採用巨量資料、人工智慧、邊緣運算和智慧製造等先進技術來加速企業數位轉型。其中超融合式基礎架構正快速演進,從傳統資料中心走向邊緣,從結構化資料走向非結構化資料,從單一通用算力走向多元化算力。這種演變已經成為建立資料中心的主流方法之一。

此外,為了支撐這一趨勢,華為正準備推出超融合策略和新產品,包括鯕鵬超融合、藍鯨應用商城、超融合軟體、支撐工具等。這些產品全面升級生態系統發展、使用者體驗和業務能力。

2022 年 4 月,Equinix 和戴爾擴大了夥伴關係,以提供超融合資料中心。作為此次擴展的一部分,Equinix 正在擴展其 Equinix Metal 裸機設備系列。此外,公告還推出了多項新服務,包括 Equinix Metal 上的 Dell PowerStore、Equinix Metal 上的 Dell VxRail 和 Equinix Metal 上的 Dell EMC PowerProtect DDVE。這些新解決方案旨在透過將戴爾的先進硬體與 Equinix 的強大裸機基礎設施相結合來提供增強的功能和性能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對市場的影響

第5章 市場動態

- 市場促進因素

- 對更強力的資料保護的需求日益增加

- 雲端平台整合需求日益成長

- 市場限制

- 商業生態系中資料隱私的喪失

第6章 市場細分

- 按服務

- 專業的

- 託管

- 按組織類型

- 大型企業

- 中小型企業

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 衛生保健

- 零售

- 政府和國防

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Nutanix Inc.

- Dell Inc.

- VMware Inc.

- Hewlett Packard Enterprise Development LP

- Cisco System Inc.

- Oracle Corp.

- Microsoft Corp.

- NetApp Inc.

- IBM Corp.(Red Hat Inc.)

- Huawei Technologies Co. Ltd

- StarWind Software Inc.

- Datacore Software Corp.

- Maxta Inc.

- Pivot3 Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Hyper-Converged Infrastructure Market size is estimated at USD 16.72 billion in 2025, and is expected to reach USD 51.22 billion by 2030, at a CAGR of 25.09% during the forecast period (2025-2030).

Key Highlights

- Hyper-convergence infrastructure (HCI) has emerged as a transformative solution within the IT industry, revolutionizing the way organizations manage their data centers. The market for HCI has experienced significant growth and adoption as businesses seek to streamline their infrastructure, enhance operational efficiency, and embrace digital transformation.

- The increasing adoption of cloud computing has been a major driving factor for the hyper-converged infrastructure market. Enterprises across various industries are shifting their workloads to the cloud to leverage its scalability, cost-effectiveness, and flexibility. HCI solutions complement cloud environments by seamlessly integrating on-premises and cloud resources. With HCI, organizations can easily migrate workloads between private and public clouds, enabling hybrid cloud deployments that combine the benefits of both environments. This synergy between HCI and cloud computing has accelerated the market growth and is expected to continue driving the demand for hyper-converged infrastructure solutions.

- Data center virtualization and consolidation have become imperative for organizations seeking to optimize their IT infrastructure and reduce operational costs. Hyper-converged infrastructure offers a consolidated approach to data center management, enabling organizations to combine multiple components into a single, unified system. By leveraging virtualization technologies, HCI enables the efficient allocation and utilization of computing resources, leading to improved performance and reduced hardware footprint. The scalability and flexibility offered by HCI make it an ideal solution for data center consolidation and virtualization initiatives. As a result, the market for hyper-converged infrastructure is experiencing substantial growth driven by the demand for efficient data center operations.

- The global hyper-converged infrastructure market is experiencing increasing demand due to various applications, leading to greater efficiency in IT infrastructure. This surge in demand is fueled by the ability of hyper-converged infrastructure systems to safeguard data within on-premises data centers, offering features such as snapshots, replication, and encryption. Consequently, organizations across various sectors are seeking these solutions.

- However, the high initial investment cost of implementing HCI solutions is hampering the market. While HCI offers numerous benefits, including simplified management, improved scalability, and reduced operational costs, the upfront investment required to deploy these solutions can be significant. The costs of hardware, software licenses, and professional services can be challenging, particularly for small and medium-sized enterprises (SMEs) with limited IT budgets. The high initial investment cost is a barrier to adoption, hindering market growth. However, as the market matures and technology advancements occur, the cost of HCI solutions is expected to decline, making them more accessible to a broader range of organizations.

- The COVID-19 pandemic significantly accelerated digital transformation initiatives across industries. Organizations worldwide realized the importance of agile and resilient IT infrastructure to support remote work, online collaboration, and digital services. Hyper-converged infrastructure enabled these transformations by providing a scalable and flexible infrastructure foundation. The pandemic highlighted the need for businesses to be agile and adaptable, leading to increased adoption of HCI solutions. As a result, the post-COVID-19 era is expected to witness a further boost in the hyper-converged infrastructure market as organizations continue to invest in technologies that enhance their digital capabilities.

Hyper converged Infrastructure Market Trends

Growing Need for Enhanced Data Protection Driving the Market Growth

- Organizations today have a growing need for reliable and high-performance storage. Hyperconverged infrastructure (HCI) provides a secure and efficient solution by integrating networking, storage, and computation into a single system. This consolidation of resources streamlines management, reduces costs, and is considered crucial by many enterprises for their strategic IT priorities.

- The market for HCI is expanding due to the increasing adoption of HCI solutions, particularly in areas such as data security and disaster recovery. The widespread use of digital technology platforms like social media and knowledge platforms has also contributed to the growing demand for HCI. According to the IBM Data Breach's recent report, the average cost of data breaches has increased by 2.6% to USD 4.35 million, with penalties included. HCI systems mitigate the risk of data security breaches through their components and applications, and they often incorporate high-security AMD processors with security capabilities.

- Furthermore, HCI offers improved data security and scalability compared to traditional storage solutions. As the number of connected devices and the Internet of Things (IoT) continue to rise, the ability of HCI to gather and store analytics in a centralized management system becomes increasingly valuable. This feature aligns well with the future of 5G networks, where HCI's ability to view collected data through a unified interface proves advantageous. According to the GSMA, 5G connections are expected to surpass 1 billion this year and reach 2 billion by 2025, further driving the HCI market.

- HCI is optimized for virtual workloads, similar to public cloud-based services, and offers flexible, consumption-based infrastructure economics. It enables enterprises to rapidly scale their resources by adding HCI building blocks, allowing them to respond quickly to business demands and enhance IT service agility. With essential cloud computing services such as centralized administration, computation, storage, and data security embedded into hyper-converged systems, HCI becomes a comprehensive solution.

- Automation and machine learning are widely recognized as productivity boosters for businesses, enabling improved application performance and handling large amounts of data. HCI leverages AI to handle workload demands, optimize application workloads, and optimize storage. By bridging the gaps between on-premises private cloud, public cloud, and existing data center infrastructure, HCI in a hybrid multi-cloud model allows businesses to manage end-to-end data workflows and ensure easy accessibility of data for AI applications. The increasing corporate investment in AI, as highlighted by the Artificial Intelligence Index previous year's report, also drives the HCI market forward, with last year's global investment reaching almost USD 94 billion, a significant increase from the prior year's acquisition of USD 67.85 billion.

North America is Expected to Register the Fastest Growth

- The expansion of hyper-scale cloud service providers in the region primarily drives the growth of the HCI market in North America. Colocation services have also experienced growth in both the wholesale and retail sectors. The demand for infrastructure to support virtual desktops has increased due to rising mobile data usage and the implementation of bring-your-own-device (BYOD) regulations. As a result, HCI's market share is expected to increase in North America.

- Several data center companies have made significant investments in hyperscale data centers. Equinix, for instance, has announced plans to build 32 hyperscale data centers in major global markets. With a substantial investment of over USD 6.9 billion and a total capacity of 600 megawatts, Equinix aims to expand its presence and capitalize on the growing hyper-scale data center landscape. The increasing number of regional data centers will drive the HCI market further.

- Partnerships and collaborations are also shaping the HCI market in North America. For instance, Lenovo and Kyndryl expanded their collaboration to develop and deliver scalable hybrid and advanced computing implementations and cloud solutions. Leveraging Lenovo's expertise in PCs, storage, and server performance, along with Kyndryl's IT infrastructure services, the partnership aims to provide customers with comprehensive solutions across the hybrid cloud, HCI, and advanced computing applications.

- Moreover, the surge in enterprise deployments of HCI has led to a growing demand for software-defined storage. In response to this trend, DataCore Software acquired Caringo Inc., a specialist in object storage. This acquisition enables DataCore Software to offer a unified block, file, and object storage package. Caringo's Swarm platform, designed for hyperscale data access and storage, addresses data governance needs and reduces reliance on hardware. The latest version of DataCore's data management solution expands data access capabilities across distributed storage resources.

Hyper converged Infrastructure Industry Overview

The hyper-converged infrastructure market is moderately competitive and has a few major players. Some of the players currently dominate the market in terms of market share. However, with the advancement in infrastructure services across the cloud platform, new players are increasing their market presence, expanding their business footprint across emerging economies. The Key players in the market are continuously making partnerships, mergers, and investments to retain their market position.

In February 2023, Huawei announced its plans to accelerate the digital transformation of enterprises by implementing advanced technologies such as big data, artificial intelligence, edge computing, and intelligent manufacturing. In this context, hyper-converged infrastructure is evolving rapidly, shifting from traditional data centers to the edge, from structured to unstructured data, and from single general-purpose computing power to diversified computing power. This evolution has become one of the mainstream approaches for constructing data centers.

Moreover, to support this trend, Huawei is preparing to launch its hyper-convergence strategy and new products like Kunpeng Hyperconvergence, Blue Whale Application Mall, hyper-convergence software, and supporting tools. These offerings will comprehensively upgrade ecosystem development, user experience, and business capabilities.

In April 2022, Equinix and Dell expanded their partnership to provide hyper-converged data center offerings. As part of this expansion, Equinix extended its Equinix Metal line of bare metal appliances. Moreover, the expansion includes introducing several new offerings, including Dell PowerStore on Equinix Metal, Dell VxRail on Equinix Metal, and Dell EMC PowerProtect DDVE on Equinix Metal. These new solutions aimed to deliver enhanced capabilities and performance by combining Dell's advanced hardware with Equinix's robust bare metal infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Enhanced Data Protection

- 5.1.2 Rising Demand for Integration Over Cloud Platform

- 5.2 Market Restraints

- 5.2.1 Loss of Data Privacy Over the Business Eco-system

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Professional

- 6.1.2 Managed

- 6.2 By Organization Type

- 6.2.1 Large Enterprise

- 6.2.2 Small & Medium Enterprise

- 6.3 By End-user Industry

- 6.3.1 IT & Telecommunication

- 6.3.2 BFSI

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Government and Defence

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nutanix Inc.

- 7.1.2 Dell Inc.

- 7.1.3 VMware Inc.

- 7.1.4 Hewlett Packard Enterprise Development LP

- 7.1.5 Cisco System Inc.

- 7.1.6 Oracle Corp.

- 7.1.7 Microsoft Corp.

- 7.1.8 NetApp Inc.

- 7.1.9 IBM Corp. (Red Hat Inc.)

- 7.1.10 Huawei Technologies Co. Ltd

- 7.1.11 StarWind Software Inc.

- 7.1.12 Datacore Software Corp.

- 7.1.13 Maxta Inc.

- 7.1.14 Pivot3 Inc.