|

市場調查報告書

商品編碼

1851094

固定無線存取:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Fixed Wireless Access - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

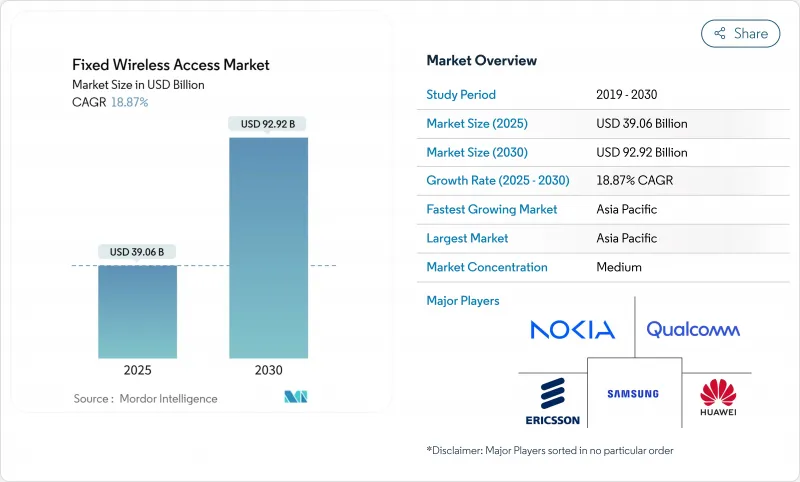

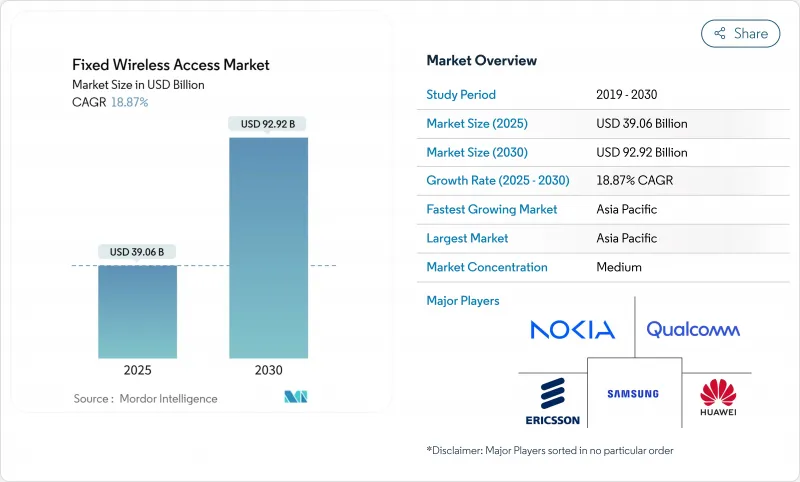

預計到 2025 年,固定無線接取市場規模將達到 390.6 億美元,到 2030 年將達到 927.2 億美元,複合年成長率為 18.87%,證實了固定無線接入市場是成長最快的寬頻細分市場之一。

此次擴張由三大支柱驅動:加速部署5G,將現有行動基地台改造為住宅寬頻;農村地區對經濟實惠的「最後一公里」連接的需求日益成長;以及用戶端設備持續創新,提供接近光纖的速度。北美和亞太地區的營運商已將資金從傳統的「光纖到戶」轉向固定無線,從而縮短了部署週期並顯著降低了每戶成本。 6GHz以下頻段頻譜的分配以及毫米波在都市區密集城區的推出,使營運商能夠更靈活地平衡覆蓋範圍和容量。同時,工業IoT試點計畫正在透過將固定無線存取鏈路轉變為工廠和物流中心的安全、低延遲骨幹網,創造新的收入來源。

全球固定無線接取市場趨勢與洞察

5G部署加速Gigabit級固定無線存取(FWA)。

5G的廣泛部署將使通訊業者能夠在同一無線網路上疊加固定無線接入,從而將行動宏基地台轉變為社區寬頻節點。美國通訊業者報告稱,其新增寬頻用戶主要來自固定無線套餐,這凸顯了固定無線存取市場對傳統有線基礎設施的蠶食作用。對大規模MIMO和波束成形技術的投資將提高室外CPE的吞吐量,同時在非視距環境下維持服務。愛立信的軟體升級無需新硬體即可擴展覆蓋範圍,簡化農村地區的覆蓋範圍。諾基亞等廠商展示了毫米波接收器,能夠在最遠7公里的距離上維持1Gbps的鏈路,證明了其在人口稠密的城市和人口稀少的郊區的可行性。這些進步將把用戶體驗提升到光纖水平,並推動家庭和企業採用5G網路。

農村寬頻推廣計劃

公共資金正透過資助無線接入設備和用戶終端設備 (CPE) 的建設,縮小光纖線路未覆蓋城鎮的數位落差。在美國,聯邦和州政府津貼數十億美元用於服務不足的普查區,通常優先發展固定無線接入,因為基地台的部署只需幾週而非幾個月。華盛頓州監管機構已證實,固定無線存取 (FWA) 解決方案的安裝成本更低、速度更快,儘管速度比光纖降低。歐洲的「數位十年」計畫也採用了類似的策略,透過靈活的頻譜規則吸引無線網路服務供應商使用農村頻寬。布拉特爾集團 (Brattle Group) 的一項成本效益研究發現,寬頻擴展(包括固定無線存取)可帶來數兆美元的房產價值和收入成長,這進一步支持了相關政策。

頻譜短缺和監管不確定性

中頻段頻譜兼具覆蓋範圍和容量優勢,但大部分已被傳統用途佔用或被現有廣播公司爭奪。美國圍繞著低頻段3GHz頻譜的遊說之爭,凸顯了政策決策的拖延如何阻礙營運商的投資。谷歌的頻譜存取系統等動態共享系統能夠實現靈活使用,但設備生態系統仍依賴明確的授權協議。區域性規則使全球設備設計複雜化,推高了成本,並延緩了大規模生產。包括美國國家電信和資訊管理局(NTIA)的《國家頻譜戰略》在內的國家藍圖承諾增加頻譜分配,但由於競標延遲和優先事項的調整,仍然存在不確定性。

細分市場分析

到2024年,硬體仍將佔據固定無線存取市場65%的佔有率,這主要得益於早期對無線電和CPE(網路部署的核心組件)的重點投資。雖然室內設備將佔出貨量的60%,但由於室外設備單價較高且需要專業安裝,室外設備將佔大部分收入。營運商和供應商持續在熱感、天線增益和路由器軟體方面進行創新,為客戶提供類似Wi-Fi Mesh套件的自助安裝體驗。由硬體驅動的固定無線接取市場規模預計將以低於訂閱用戶成長的速度成長。

到2030年,服務板塊的複合年成長率將達到19.60%,超過固定無線存取產業的其他板塊,主要得益於營運商向託管Wi-Fi、 Over-the-Top視訊和雲端安全性捆綁服務等領域的多元化發展。超過40%的營運商正在轉向基於速度的定價模式,類似於光纖分級定價,這將加速提升每位用戶平均收入。網路API很快就會支援在實況活動和電競比賽期間按需提升吞吐量,進一步提高服務利潤率。隨著普及規模的擴大,獲利能力將取決於經常性費用,而非設備銷售。

到2024年,住宅寬頻將佔總收入的52%,這反映了頂級通訊業者積極的消費者宣傳活動。這些宣傳活動通常將串流媒體訂閱與免費硬體捆綁銷售,從而降低用戶流失率。相較之下,到2030年,住宅寬頻的複合年成長率將達到22.32%。工廠正在生產線和邊緣伺服器之間部署固定無線閘道器,以支援即時機器視覺、機器人和安全系統。試驗顯示,使用載波聚合頻譜,下行鏈路的平均速度可達648 Mbps,峰值速度超過1 Gbps。這些指標滿足了汽車和半導體工廠通常嚴格的可用性目標。

快餐店等商業場所需要快速推出和靈活的合約來連接銷售點系統數位電子看板,而教育和醫療行業則更傾向於快速部署而非申請線路許可。因此,這些行業的公司正在客製化垂直行業套餐,將專用 5G 核心網與零接觸配置相結合。

區域分析

亞太地區維持了37%的收入佔有率,並以21.07%的複合年成長率實現了最快成長,這主要得益於中國、韓國和日本超過85%的5G人口覆蓋率。印度兩大業者將AirFiber服務與每日儲值券捆綁銷售,在不到一年的時間內吸引了數百萬首次寬頻用戶。印度政府在「數位印度」計畫下的激勵措施,為未覆蓋村莊的基地台安裝提供高達80%的報銷,進一步加速了部署。固定無線接入市場參與者也受益於全部區域的設備製造地,從而縮短了供應鏈。

北美地區正受到大規模5G獨立組網核心網和頻譜政策的推動。隨著通訊業者重新部署從衛星服務中釋放出來的中頻段頻譜資源,美國固定無線存取市場規模正在不斷擴大。營運商通常報告每季淨新增用戶60萬至70萬,這一趨勢迫使有線電視營運商實施對稱分級服務。加拿大大力推動農村寬頻建設,為農場和旅遊旅館的屋頂無線網路提供資金,因為在這些地方,挖掘穿過永久凍土層的光纖線路是不切實際的。

歐洲呈現出碎片化的格局。光纖覆蓋率高的北部國家主要利用固定無線網路來實現冗餘,而南部和東部國家則利用固定無線網路直接跳過銅纜升級階段。 26GHz頻段的監管彈性促進了跨境設備協調,降低了用戶端設備(CPE)的成本。中東和非洲的新興市場正在採用無線優先解決方案來實現最後一公里接取。各國寬頻計畫將在兩年內將固定無線網路作為連接學校和診所的主要方式,這將使固定無線接入市場成為推動整個歐洲大陸數位包容性的催化劑。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 5G部署加速Gigabit級固定無線存取(FWA)。

- 農村寬頻推廣計劃

- FWA 作為一種經濟高效的「最後一公里」光纖替代方案

- 企業SD-WAN備援連線的需求

- 市場限制

- 頻譜稀缺性和監管不確定性

- 毫米波密集化資本支出

- 價值鏈分析

- 監管環境

- 技術展望

- FWA採用的關鍵推動因素

- 供應商計畫與夥伴關係

- 商業考量和前提條件

- FWA與FTTH/FTTdp的比較

- 農村、半都市區和都市區用例模型

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 硬體

- 消費性電子產品(CPE)

- 接入單元(飛毫微微蜂窩和微微型基地台)

- 服務

- 硬體

- 透過使用

- 住宅

- 商業的

- 工業的

- 按頻寬

- 6 GHz 以下頻段

- 毫米波(24 GHz 以上)

- 透過部署模式

- 室內CPE

- 戶外CPE

- 按地區

- 北美洲

- 南美洲

- 歐洲

- 亞太地區

- 中東和非洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- Ericsson AB

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Verizon Communications Inc.

- ATandT Inc.

- T-Mobile US Inc.

- US Cellular Corp.

- Airspan Networks Inc.

- Siklu Communication Ltd.

- Starry Group Holdings Inc.

- Arqiva Ltd.

- Inseego Corp.

- ZTE Corporation

- Deutsche Telekom AG

- Vodafone Group Plc

- Telstra Corp. Ltd.

- Orange SA

- Globe Telecom Inc.

第7章 市場機會與未來展望

The fixed wireless access market is valued at USD 39.06 billion in 2025 and is forecast to reach USD 92.72 billion by 2030, reflecting an 18.87% CAGR and confirming the fixed wireless access market size as one of the most rapidly expanding broadband segments.

Expansion rests on three pillars: accelerated 5G roll-outs that repurpose existing mobile towers for home broadband, growing demand for affordable last-mile connectivity in rural districts, and continuous innovation in customer-premises equipment that delivers near-fiber speeds. Operators in North America and Asia Pacific have redirected capital from traditional fiber-to-the-home toward fixed wireless, trimming deployment timelines and reducing per-household costs by wide margins. Spectrum allocations in Sub-6 GHz, coupled with millimeter-wave launches in dense urban zones, give providers the flexibility to balance coverage and capacity. Meanwhile, industrial IoT pilots are turning fixed wireless access links into secure, low-latency backbones for factories and logistics hubs, thereby opening fresh revenue streams.

Global Fixed Wireless Access Market Trends and Insights

5G Roll-out Accelerating Gigabit-class FWA

Widespread 5G deployment allows operators to layer fixed wireless access on the same radio network, turning mobile macro sites into neighborhood broadband nodes. U.S. carriers report the majority of net broadband additions coming from fixed wireless packages, underscoring how the fixed wireless access market is eating into cable's traditional base. Investments in massive MIMO and beamforming raise outdoor CPE throughput while sustaining service in non-line-of-sight environments. Ericsson software upgrades extend usable range without new hardware, simplifying rural coverage. Vendors such as Nokia have showcased mmWave receivers that hold a 1 Gbps link at distances up to 7 km, proving viability in both dense cities and sparsely populated fringes. Taken together, these advances lift customer experience to fiber-like benchmarks and boost adoption across homes and enterprises.

Rural Broadband Stimulus Programmes

Public funding is narrowing digital divides by underwriting radio access equipment and CPE for towns bypassed by fiber trenching. In the United States, federal and state grants funnel billions into unserved census blocks, and fixed wireless access often receives priority because towers are deployed in weeks rather than months. Washington State regulators confirm that FWA solutions can be installed rapidly at lower cost, albeit with modest speed trade-offs compared with fiber. Europe's Digital Decade agenda mirrors this approach through flexible spectrum rules that invite wireless internet service providers into rural bands. Cost-benefit studies from The Brattle Group link broadband expansion, including fixed wireless, to trillions in property-value and income gains, fueling more policy support.

Spectrum Scarcity & Regulatory Uncertainty

Mid-band spectrum sits at the sweet spot between coverage and capacity, yet much of it is tied up in legacy use or contested by incumbent broadcasters. Lobbying battles over the lower 3 GHz block in the U.S. illustrate how protracted policymaking can stall operator investment. Dynamic sharing systems such as Google's Spectrum Access System allow opportunistic use, but device ecosystems still rely on clear, licensed holdings. Varied regional rules complicate global equipment design, raising costs and slowing volume manufacturing. Although national road maps, including the NTIA National Spectrum Strategy, promise additional allocations, uncertainty lingers through auction delays and shifting priorities.

Other drivers and restraints analyzed in the detailed report include:

- FWA as Cost-effective Last-mile Alternative to Fibre

- Enterprise SD-WAN Back-up Connectivity Demand

- High mmWave Densification CAPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware retained a 65% share of the fixed wireless access market in 2024 thanks to intensive early-stage spending on radios and CPE that anchor network roll-outs. Indoor devices make up 60% of units shipped, while outdoor models dominate revenue because of higher unit pricing and professional installation. Operators and vendors continue to innovate on thermals, antenna gains, and router software, giving customers a self-install experience that parallels Wi-Fi mesh kits. The fixed wireless access market size attributable to hardware is projected to expand, yet at a slower clip than subscriptions.

The services segment is set for a 19.60% CAGR through 2030, outstripping the rest of the fixed wireless access industry as providers diversify into managed Wi-Fi, over-the-top video, and cloud security bundles. More than 40% of operators have migrated to speed-based tariff menus that mimic fiber grade tiers, accelerating average revenue per user. Network APIs will soon enable on-demand throughput boosts during live events or e-sports tournaments, further lifting service margins. As adoption reaches scale, recurring fees rather than equipment sales will define earnings power.

Residential broadband accounted for 52% of overall revenue in 2024, reflecting aggressive consumer campaigns by Tier-1 mobile carriers. Promotions often bundle streaming subscriptions and zero-cost hardware, which compresses churn. Industrial deployments, in contrast, record a 22.32% CAGR to 2030. Factories insert fixed wireless gateways between production lines and edge servers, supporting real-time machine vision, robotics, and safety systems. Trials have demonstrated a median downlink of 648 Mbps and peaks above 1 Gbps using carrier-aggregated spectrum. These metrics satisfy stringent availability targets common in automotive and semiconductor plants.

Commercial sites such as quick-service restaurants rely on fast turn-ups and flexible contracts to connect point-of-sale systems and digital signage. Education and healthcare settings also favor rapid deployment over trenching permits. Consequently, fixed wireless access market players tailor vertical packages that integrate private 5 G cores with zero-touch provisioning.

The Fixed Wireless Access Market Report is Segmented by Type (Hardware [Consumer Premise Equipment (CPE), Access Units [Femto and Picocells]] and Services), Application (Residential, Commercial, and Industrial), Frequency Band (Sub-6 GHz and MmWave (above 24 GHz), Deployment Mode (Outdoor CPE and Indoor CPE), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific keeps a 37% revenue share and posts the fastest 21.07% CAGR as 5 G population coverage exceeds 85% in China, South Korea, and Japan. India's top two operators have bundled AirFiber services with pay-per-day vouchers, capturing millions of first-time broadband users in less than a year. Government incentives under Digital India reimburse up to 80% of tower equipment in unserved villages, further accelerating roll-out. Fixed wireless access market players also benefit from device-manufacturing hubs across the region that shorten supply chains.

North America follows, fueled by large-scale 5 G standalone cores and supportive spectrum policy. The fixed wireless access market size in the United States is climbing as telecoms redeploy mid-band holdings cleared from satellite services. Operators routinely report 600,000 to 700,000 net additions per quarter, a trend that has forced cable incumbents to introduce symmetrical tiers. Canada's rural broadband drive funds rooftop radios for farms and tourist lodges where fiber trenching through permafrost is impractical.

Europe shows a fragmented pattern. Northern nations with high fiber coverage use fixed wireless mainly for redundancy, while Southern and Eastern countries leverage it to leapfrog copper upgrades. Regulatory flexibility in the 26 GHz band encourages cross-border equipment harmonization, which lowers CPE cost. Emerging markets in the Middle East and Africa rely on wireless first solutions for last-mile access. National broadband plans treat fixed wireless as the primary method to connect schools and clinics within two years, positioning the fixed wireless access market as a catalyst for digital inclusion across the continent.

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- Ericsson AB

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Verizon Communications Inc.

- ATandT Inc.

- T-Mobile US Inc.

- US Cellular Corp.

- Airspan Networks Inc.

- Siklu Communication Ltd.

- Starry Group Holdings Inc.

- Arqiva Ltd.

- Inseego Corp.

- ZTE Corporation

- Deutsche Telekom AG

- Vodafone Group Plc

- Telstra Corp. Ltd.

- Orange S.A.

- Globe Telecom Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G roll-out accelerating gigabit-class FWA

- 4.2.2 Rural broadband stimulus programmes

- 4.2.3 FWA as cost-effective last-mile alternative to fibre

- 4.2.4 Enterprise SD-WAN back-up connectivity demand

- 4.3 Market Restraints

- 4.3.1 Spectrum scarcity and regulatory uncertainty

- 4.3.2 High mmWave densification CAPEX

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Key enablers for FWA adoption

- 4.6.2 Vendor initiatives and partnerships

- 4.6.3 Business considerations and prerequisites

- 4.6.4 FWA vs FTTH / FTTdp comparison

- 4.6.5 Rural, semi-urban and urban use-case models

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 Consumer Premise Equipment (CPE)

- 5.1.1.2 Access Units (Femto and Picocells)

- 5.1.2 Services

- 5.1.1 Hardware

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 By Frequency Band

- 5.3.1 Sub-6 GHz

- 5.3.2 mmWave ( above 24 GHz)

- 5.4 By Deployment Mode

- 5.4.1 Indoor CPE

- 5.4.2 Outdoor CPE

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 South America

- 5.5.3 Europe

- 5.5.4 Asia-Pacific

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huawei Technologies Co. Ltd.

- 6.4.2 Nokia Corporation

- 6.4.3 Ericsson AB

- 6.4.4 Qualcomm Technologies Inc.

- 6.4.5 Samsung Electronics Co. Ltd.

- 6.4.6 Verizon Communications Inc.

- 6.4.7 ATandT Inc.

- 6.4.8 T-Mobile US Inc.

- 6.4.9 US Cellular Corp.

- 6.4.10 Airspan Networks Inc.

- 6.4.11 Siklu Communication Ltd.

- 6.4.12 Starry Group Holdings Inc.

- 6.4.13 Arqiva Ltd.

- 6.4.14 Inseego Corp.

- 6.4.15 ZTE Corporation

- 6.4.16 Deutsche Telekom AG

- 6.4.17 Vodafone Group Plc

- 6.4.18 Telstra Corp. Ltd.

- 6.4.19 Orange S.A.

- 6.4.20 Globe Telecom Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment