|

市場調查報告書

商品編碼

1642137

互聯物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Connected Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

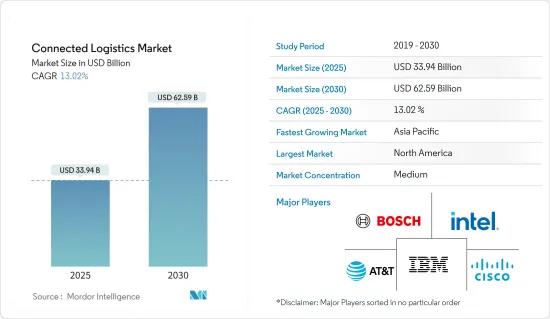

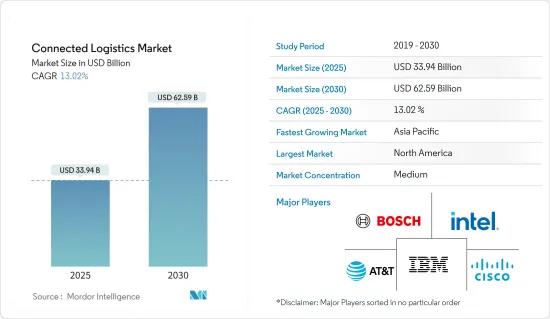

2025 年互聯物流市場規模預估為 339.4 億美元,預計到 2030 年將達到 625.9 億美元,預測期內(2025-2030 年)的複合年成長率為 13.02%。

在技術進步和對高效、即時供應鏈管理日益成長的需求的推動下,互聯物流市場正在經歷重大變革時期。該領域的特點是整合物聯網、數位平台和智慧物流解決方案,以提高可視性、最佳化營運並提供整個供應鏈的無縫連接。隨著互聯物流解決方案擴大被採用,對基於雲端基礎的物流、車隊管理技術和預測物流分析的需求也日益增加。

主要亮點

- 物聯網與物流的整合:物流中的物聯網將在提高供應鏈的可視性和效率方面發揮關鍵作用。物聯網設備和感測器的整合實現了資產的即時監控,包括最佳化物流網路至關重要的車隊管理技術。這些技術提供準確、及時的資料,幫助做出更好的決策並降低與供應鏈中斷相關的風險。數位物流平台的採用也正在增加,使企業能夠透過利用雲端基礎的物流解決方案和物流預測分析更有效地管理物流業務。

- 跨各垂直領域的應用:此市場廣泛應用於汽車、製造業、醫療保健等各行業。這些行業受益於互聯物流系統,該系統實現了即時追蹤系統、物流自動化和物流,所有這些都有助於提高業務效率。此外,採用智慧物流和互聯貨運系統對於實現端到端供應鏈整合至關重要,這已成為希望在全球市場保持競爭力的公司的首要任務。

擴大物聯網在各產業的應用

物聯網在物流中的整合已成為提高供應鏈可視性和效率的重要要素。物聯網設備和感測器可以即時監控資產,包括最佳化物流網路至關重要的車隊管理技術。這些技術提供準確、及時的資料,幫助做出更好的決策並降低與供應鏈中斷相關的風險。

主要亮點

- 智慧物流的角色:利用物聯網的智慧物流支援物流自動化和倉庫管理系統,進而降低營運成本並提高生產力。數位物流平台的採用也正在增加,使企業能夠透過利用雲端基礎的物流解決方案和物流預測分析更有效地管理物流業務。隨著物聯網的普及,各行各業都能更好地實現即時追蹤和互聯貨物系統,確保更快、更靈活的供應鏈。

- 製造業的重要性:這一趨勢在製造業等最需要物流網路最佳化和無縫供應鏈可視性的領域尤其明顯。物聯網和互聯物流解決方案的整合可協助製造商提高效率並降低營運成本,保持競爭力。

採用基於感測器的技術

基於感測器的技術透過實現準確的即時追蹤系統在互聯物流市場中發揮關鍵作用。這些感測器將整合到物流網路的各個元件中,從車隊管理技術到倉庫管理系統,以提供連續的資料流,提高供應鏈的可視性。

主要亮點

- 透過感測器提高效率:智慧物流中使用感測器可以提高物流的自動化程度,實現更有效率的操作並減少人為錯誤。這對於汽車和醫療保健等精度和可靠性至關重要的行業尤其重要。採用基於感測器的技術使公司能夠更好地控制物流流程,從資產管理到端到端的供應鏈整合。

- 數位物流平台的興起:此外,數位物流平台的興起受到基於感測器的技術對即時資料和分析的需求的推動。這些平台使公司能夠最佳化物流網路,提高整體效率和回應能力。利用感測器資料在物流中整合預測分析將實現主動決策和風險管理,進一步提高互聯物流解決方案的有效性。

此互聯物流市場分析強調了物聯網和基於感測器的技術對產業的變革性影響,並強調了即時追蹤、物流自動化和供應鏈可視性對於獲得市場競爭優勢的重要性。

互聯物流市場趨勢

各行業物聯網應用的增加推動了互聯物流的採用

- 跨產業物聯網的應用日益廣泛:互聯物流市場擴大受到跨產業物聯網整合的驅動。隨著企業優先考慮效率和供應鏈視覺性,物流中的物聯網對於即時資料分析以實現更明智的決策變得至關重要。這一趨勢在製造業、零售業和醫療保健等行業尤為明顯,這些行業對物流自動化和即時追蹤系統的需求激增。

- 遠端資訊處理和預測分析:物流中的遠端資訊處理使用物聯網進行車隊管理,允許公司透過監控車輛性能和駕駛員行為來最佳化營運。這將導致物流網路營運的顯著改善。此外,物流中的預測分析增強了預測需求波動的能力,從而減少延誤並確保無縫的供應鏈管理。

- 雲端基礎的物流平台:雲端基礎的物流平台在端到端供應鏈整合中發揮關鍵作用,提供一個集中的系統來管理物流的各個方面,從倉儲到連接的貨運系統。這些平台對於使供應鏈營運更加靈活和響應至關重要,這在當今快節奏、變化的市場環境中變得越來越重要。

- 轉向數位化物流:持續轉向數位物流平台凸顯了產業向自動化和連結性的轉變。隨著企業不斷投資於互聯物流解決方案,市場可望經歷顯著成長。這種成長是由對更高的供應鏈可視性和業務效率的不斷成長的需求所推動的。

亞太地區成長最快

- 亞太地區引領成長:由於經濟不斷擴張、技術不斷進步以及對高效供應鏈解決方案的需求不斷成長,亞太地區預計將引領互聯物流市場。受電子商務產業蓬勃發展和龐大製造地的推動,中國、印度和日本等國家在採用互聯物流技術方面處於領先地位。

- 物流最佳化重點:亞太地區的政府和私人企業都在大力投資最佳化物流網路。這包括實施智慧物流和即時追蹤系統來管理該地區複雜而分散的供應鏈。這些努力對於維持全部區域供應鏈的效率和可靠性至關重要。

- 物聯網和車隊管理的應用:物聯網在物流以及車輛管理和倉庫管理系統中的應用日益廣泛,進一步推動了亞太地區市場的發展。這些技術對於提高配送的準確性和及時性至關重要,特別是在交通網路龐大且多樣化的國家。

- 數位轉型和經濟成長:亞太地區也受益於廣泛的數位轉型,企業的數位化不斷增強。這項變革得到了政府推動先進技術的措施的支持。隨著亞太地區都市化進程加速和中等收入階層的擴大,對互聯物流解決方案的需求預計將成長,鞏固該地區作為全球互聯物流市場主要企業的地位。

利用物聯網及其他先進技術,互聯物流市場呈現強勁成長軌跡。亞太地區憑藉其強勁的經濟基本面和對創新的承諾,將處於這一擴張的前沿。隨著行業趨勢不斷發展,公司必須透過投資互聯物流解決方案來適應變化,以在全球市場上保持競爭力。

互聯物流行業概況

由關鍵技術參與者主導的適度整合的市場:互聯物流市場的特點是適度整合的格局,全球技術參與者發揮重大影響力。成熟的企業集團和專業技術供應商共用優勢,從而形成了創新與市場主導地位平衡的競爭環境。跨國公司的存在凸顯了該市場的全球性,其重點是透過先進的連接解決方案來加強物流業務。

推動市場創新的主要企業:市場的主要企業包括 IBM 公司、英特爾公司、羅伯特博世有限公司、思科系統公司、AT&T 公司等。這些公司利用其在技術、硬體和軟體解決方案方面的豐富專業知識,提供全面的物流服務,以提高效率、降低成本並增強即時決策能力。這些公司的優勢很大程度上在於他們能夠將物聯網、人工智慧和雲端運算等最尖端科技融入物流系統,從而製定行業標準並佔據相當大的市場佔有率。

未來成功的因素隨著互聯物流市場的發展,人工智慧和物聯網的融合、向永續物流的轉變以及網路安全日益重要等趨勢變得至關重要。想要在這個市場取得成功的公司必須專注於開發提供更高透明度、安全性和適應不同法規環境的解決方案。此外,夥伴關係和策略性收購有望成為保持競爭地位和擴大市場佔有率的關鍵策略。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對市場的影響

第5章 市場動態

- 市場促進因素

- 物聯網在各行各業的採用率不斷提高

- 採用基於感測器的技術

- 市場限制

- 政府對智慧科技缺乏統一的監管

- 冠狀病毒疫情影響電子產業

第6章 市場細分

- 按軟體

- 資產管理

- 倉庫物聯網

- 安全功能

- 資料管理

- 網管

- 流分析

- 依產品類型

- 設備管理

- 應用程式管理

- 連線管理

- 按交通方式

- 路

- 鐵路

- 航空

- 海運

- 按最終用戶產業

- 車

- 製造業

- 石油和天然氣

- 資訊科技/通訊

- 衛生保健

- 資訊科技/通訊

- 零售

- 飲食

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Bosch Service Solutions GmbH

- Cisco Systems, Inc

- AT&T Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Oracle Corporation

- Freightgate Inc.

- Orbcomm Inc.

- HCL Technologies Limited

- Honeywell International Inc.

- Microsoft Corporation

- Siemens AG

第8章投資分析

第9章:市場的未來

The Connected Logistics Market size is estimated at USD 33.94 billion in 2025, and is expected to reach USD 62.59 billion by 2030, at a CAGR of 13.02% during the forecast period (2025-2030).

The connected logistics market is undergoing significant transformation, driven by advancements in technology and the growing need for efficient and real-time supply chain management. This sector is characterized by the integration of IoT, digital platforms, and smart logistics solutions that enhance visibility, optimize operations, and provide seamless connectivity across the supply chain. As industries increasingly adopt connected logistics solutions, the demand for cloud-based logistics, fleet management technology, and predictive analytics in logistics continues to rise.

Key Highlights

- Integration of IoT in Logistics: IoT in logistics plays a critical role in enhancing supply chain visibility and efficiency. The integration of IoT devices and sensors enables real-time monitoring of assets, including fleet management technology, crucial for logistics network optimization. These technologies provide accurate and timely data, allowing for better decision-making and reducing the risks associated with supply chain disruptions. The adoption of digital logistics platforms is also on the rise, enabling companies to manage their logistics operations more effectively by leveraging cloud-based logistics solutions and predictive analytics in logistics.

- Adoption Across Various Industries: The market is seeing widespread adoption across various industries such as automotive, manufacturing, and healthcare. These industries benefit from connected logistics systems that enable real-time tracking systems, logistics automation, and telematics in logistics, all of which contribute to enhanced operational efficiency. Furthermore, the implementation of smart logistics and connected freight systems is crucial for achieving end-to-end supply chain integration, which is becoming a priority for companies aiming to stay competitive in the global market.

Expanding IoT Adoption Across Industries

The integration of IoT in logistics has become a critical component for enhancing supply chain visibility and efficiency. IoT devices and sensors enable real-time monitoring of assets, including fleet management technology, which is crucial for logistics network optimization. These technologies provide accurate and timely data, allowing for better decision-making and reducing the risks associated with supply chain disruptions.

Key Highlights

- Role of Smart Logistics: Smart logistics, powered by IoT, supports logistics automation and warehouse management systems, leading to reduced operational costs and improved productivity. The adoption of digital logistics platforms is also on the rise, enabling companies to manage their logistics operations more effectively by leveraging cloud-based logistics solutions and predictive analytics in logistics. With IoT adoption expanding, industries are better equipped to achieve real-time tracking and connected freight systems, ensuring a more responsive and agile supply chain.

- Importance in Manufacturing Sector: This trend is particularly noticeable in sectors like manufacturing, where the need for logistics network optimization and seamless supply chain visibility is paramount. The integration of IoT and connected logistics solutions allows manufacturers to maintain a competitive edge through improved efficiency and reduced operational costs.

Adoption of Sensor-Based Technologies

Sensor-based technologies play a crucial role in the connected logistics market by enabling precise and real-time tracking systems. These sensors are integrated into various components of the logistics network, from fleet management technology to warehouse management systems, providing continuous data streams that enhance supply chain visibility.

Key Highlights

- Enhancing Efficiency with Sensors: The use of sensors in smart logistics facilitates logistics automation, allowing for more efficient operations and reducing human error. This is particularly important in industries such as automotive and healthcare, where precision and reliability are essential. By incorporating sensor-based technologies, companies can achieve greater control over their logistics processes, from asset management to end-to-end supply chain integration.

- Rising Digital Logistics Platforms: Moreover, the rise of digital logistics platforms has been driven by the need for real-time data and analytics, which are made possible by sensor-based technologies. These platforms enable companies to optimize their logistics network, improving overall efficiency and responsiveness. The integration of predictive analytics in logistics, powered by sensor data, allows for proactive decision-making and risk management, further enhancing the effectiveness of connected logistics solutions.

This connected logistics market analysis highlights the transformative impact of IoT and sensor-based technologies on the industry, emphasizing the importance of real-time tracking, logistics automation, and supply chain visibility for achieving competitive advantage in the market.

Connected Logistics Market Trends

Increasing use of IoT in Various Industries will Drive the Adoption of Connected Logistics

- Increasing Use of IoT in Various Industries :The connected logistics market is increasingly driven by the integration of IoT across various industries. As companies prioritize efficiency and supply chain visibility, IoT in logistics has become crucial for real-time data analytics, enabling smarter decision-making. This trend is particularly evident in sectors like manufacturing, retail, and healthcare, where the demand for logistics automation and real-time tracking systems is surging.

- Telematics and Predictive Analytics: Telematics in logistics, which involves using IoT for fleet management, allows businesses to optimize operations by monitoring vehicle performance and driver behavior. This leads to significant improvements in logistics network operations. Additionally, predictive analytics in logistics enhances the ability to forecast demand fluctuations, thereby reducing delays and ensuring seamless supply chain management.

- Cloud-Based Logistics Platforms: Cloud-based logistics platforms are playing a pivotal role in end-to-end supply chain integration, offering centralized systems to manage various logistics aspects, from warehouse management to connected freight systems. These platforms are critical for enhancing agility and responsiveness in supply chain operations, which is increasingly important in today's fast-paced market environment.

- Shifting to Digital Logistics: The ongoing shift towards digital logistics platforms underscores the industry's move towards automation and connectivity. As businesses continue to invest in connected logistics solutions, the market is poised for substantial growth. This growth is fueled by the rising need for enhanced supply chain visibility and operational efficiency across industries.

Asia Pacific Region to Exhibit Maximum Growth

- Leading Growth in APAC: The Asia Pacific region is expected to lead in the connected logistics market, driven by economic expansion, technological advancements, and a growing demand for efficient supply chain solutions. Countries such as China, India, and Japan are at the forefront of adopting connected logistics technologies, propelled by their booming e-commerce sectors and vast manufacturing bases.

- Focus on Logistics Optimization: Both governments and private enterprises in Asia Pacific are heavily investing in logistics network optimization. This includes deploying smart logistics systems and real-time tracking systems to manage the region's complex and fragmented supply chains. These efforts are crucial for maintaining efficiency and reliability in supply chains across the region.

- Adoption of IoT and Fleet Management: The increasing adoption of IoT in logistics, along with fleet management and warehouse management systems, is further driving the market in Asia Pacific. These technologies are essential for improving the accuracy and timeliness of deliveries, particularly in countries with large and diverse transportation networks.

- Digital Transformation and Economic Growth: The region is also benefiting from a broader digital transformation, with businesses increasingly digitizing their operations. This shift is supported by government initiatives aimed at promoting advanced technologies. As the region continues to urbanize and its middle class expands, the demand for connected logistics solutions is expected to grow, solidifying Asia Pacific's position as a key player in the global connected logistics market.

By leveraging IoT and other advanced technologies, the connected logistics market is on a strong growth trajectory. The Asia Pacific region, with its robust economic fundamentals and commitment to technological innovation, is set to be at the forefront of this expansion. As industry trends continue to evolve, businesses must adapt by investing in connected logistics solutions to remain competitive in the global market.

Connected Logistics Industry Overview

Moderately Consolidated Market Dominated by Leading Technology Companies: The Connected Logistics market is characterized by a moderately consolidated landscape, where major global technology companies hold significant influence. Dominance is shared among well-established conglomerates and specialized technology providers, leading to a competitive environment that balances innovation and market control. The presence of multinational corporations underscores the global nature of this market, with a focus on enhancing logistics operations through advanced connectivity solutions.

Key Players Driving Market Innovation: The market's major players include IBM Corporation, Intel Corporation, Robert Bosch GmbH, Cisco Systems, Inc., and AT&T Inc. These companies leverage their extensive expertise in technology, hardware, and software solutions to offer comprehensive logistics services that improve efficiency, reduce costs, and enhance real-time decision-making. Their dominance is largely due to their ability to integrate cutting-edge technologies such as IoT, AI, and cloud computing into logistics systems, thus setting industry standards and securing substantial market shares.

Factors for Future Success: As the Connected Logistics market evolves, trends such as the integration of AI and IoT, the shift towards sustainable logistics, and the growing importance of cybersecurity are becoming pivotal. Companies aiming to succeed in this market must focus on developing solutions that offer greater transparency, security, and adaptability to varying regulatory environments. Additionally, partnerships and strategic acquisitions are expected to be key strategies for maintaining a competitive edge and expanding market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption on IoT in Various Industries

- 5.1.2 Adoption of Sensor Based Technologies

- 5.2 Market Restraints

- 5.2.1 Lack of Uniform Government Regulations for Smart Technologies

- 5.2.2 Coronavirus Outbreak Influencing Electronic Industry

6 MARKET SEGMENTATION

- 6.1 By Software

- 6.1.1 Asset Management

- 6.1.2 Warehouse IoT

- 6.1.3 Security

- 6.1.4 Data Management

- 6.1.5 Network Management

- 6.1.6 Streaming Analytics

- 6.2 By Product Type

- 6.2.1 Device Management

- 6.2.2 Application Management

- 6.2.3 Connectivity Management

- 6.3 By Transportation Mode

- 6.3.1 Roadways

- 6.3.2 Railways

- 6.3.3 Airways

- 6.3.4 Seaways

- 6.4 By End-user Industry

- 6.4.1 Automotive

- 6.4.2 Manufacturing

- 6.4.3 Oil and Gas

- 6.4.4 IT & Telecom

- 6.4.5 Healthcare

- 6.4.6 IT and Telecommunication

- 6.4.7 Retail

- 6.4.8 Food and Beverage

- 6.4.9 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bosch Service Solutions GmbH

- 7.1.2 Cisco Systems, Inc

- 7.1.3 AT&T Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Intel Corporation

- 7.1.6 SAP SE

- 7.1.7 Oracle Corporation

- 7.1.8 Freightgate Inc.

- 7.1.9 Orbcomm Inc.

- 7.1.10 HCL Technologies Limited

- 7.1.11 Honeywell International Inc.

- 7.1.12 Microsoft Corporation

- 7.1.13 Siemens AG