|

市場調查報告書

商品編碼

1642142

印尼自動化與控制系統:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Indonesia Automation And Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

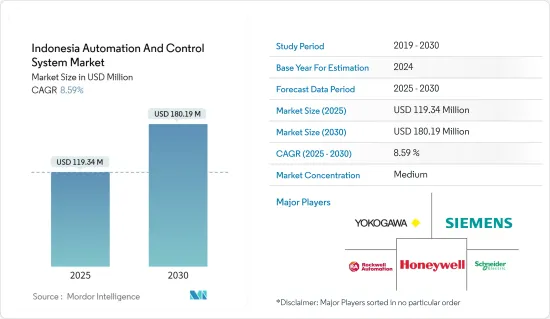

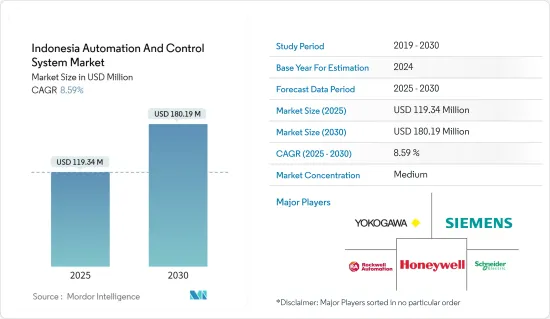

印尼自動化和控制系統市場規模預計在 2025 年為 1.1934 億美元,預計到 2030 年將達到 1.8019 億美元,預測期內(2025-2030 年)的複合年成長率為 8.59%。

隨著印尼穩步融入全球經濟,自動化和控制系統對於降低成本至關重要。

關鍵亮點

- 自動化和控制系統是指監督和控制涉及商品和服務生產和分配的廣泛過程的系統。從組裝到發電廠,許多通用和基本服務都依賴自動化和控制系統。例如,維持現代國家社會、工業和經濟福祉的大部分公共產業和通訊基礎設施都依賴自動化和控制系統。

- 印尼是著名的工業製造國,自動化程度很高。製造業對該國的國內生產毛額貢獻巨大。例如,根據印尼統計局的預測,到2022年,印尼製造業將佔國內生產總值(GDP)的18%以上,成為該國經濟的最大貢獻者。預計印尼和馬來西亞強勁的製造業活動將推動研究市場的需求。

- 政府加大資金投入,鼓勵眾多產業領域的自動化系統,各製造業對自動化的需求強勁,工業機器人創新不斷增加,製造業技術進步迅猛,為滿足不斷成長的人口,大規模生產和相關供應鏈是推動印尼自動化和製程控制系統市場成長的關鍵因素。

- 印尼礦產資源豐富且尚未開發,是世界上最大的錫、棕櫚油和動力煤出口國。它也是鎳、銅、礬土、橡膠、錳、鋅和鉛的主要出口國之一。礦業約佔印尼GDP的十分之一,多年來在該國經濟發展中發揮關鍵作用。對金屬和礦物的需求不斷成長,以及對半導體和電子產品的需求不斷增加,推動了採礦業採用自動化系統。

- 在能源領域,智慧城市計畫的出現正在增加對自動化和控制系統的需求。印尼在這方面發揮著主導作用,推出了“100 個智慧城市計劃”,這是一項旨在應對都市化挑戰的綜合數位化計劃。該舉措是政府應對都市化計畫的一部分,該計畫預測到 2045 年,印尼 83% 的人口將居住在都市區。

- 印尼也鼓勵透過創新的生質能混燒計畫利用生質能來改善現有蒸氣發電廠的綠化程度。該計畫的目標是到 2025 年建成 52 個生質能混燒站點,目前已經有 37 個站點混燒生質能,使用 306,000 噸生質能,到 2023 年達到 108 萬噸的目標。此類計劃以及發展該國電力和公共產業部門的新計劃和投資預計將為該國實施自動化和控制系統創造新的市場機會。

- 然而,與自動化和控制系統相關的初始成本很高。客製化和整合的複雜性增加了總體成本。此外,引入自動化設備可能需要改變工廠現有的基礎設施。這可能包括改變佈局、電氣系統和安全功能以適應新設備,從而產生額外的成本。這些因素可能會阻礙市場成長。

印尼自動化和控制系統市場趨勢

食品和飲料推動印尼自動化和控制系統市場

- 食品和飲料產業在印尼經濟中佔有重要地位,是該國 GDP 的重要貢獻者。該行業受益於豐富的自然資源和不斷成長的國內需求,增強了其韌性。尤其是2022年第二季度,食品飲料產業佔非石油和天然氣產業GDP的38.38%,鞏固了其作為印尼GDP貢獻領先子部門的地位。

- 根據印尼統計局 (BPS) 的資料,2022 年食品和飲料 (F&B) 行業以年度為基礎為 4.90%,達到 8,130.62 億印尼盾。這種情況與食品、飲料本身產量的增加密不可分。根據CRIF的2023年預測,食品和飲料行業預計與前一年同期比較%。影響這種成長的一個因素是食品和飲料產業對經濟環境變化的高度敏感性。 CRIF也認為,該產業仍具有良好的前景,尤其是在COVID-19疫情後國家經濟復甦的背景下。

- 「打造印尼4.0」策略旨在到2030年使印尼躋身世界十大經濟體之列,該策略將物聯網(IoT)、自動化、機器人、人工智慧和感測器技術等關鍵技術置於核心地位。我們將其定位為一個重要元素。在該策略的重點細分領域中,食品飲料產業尤為突出。因此,預計國內食品和飲料行業對數位轉型的需求將增加,從而導致自動化和控制系統的增加。為配合該國的工業 4.0 工業策略,印尼政府正在鼓勵當地食品和飲料產業採用數位化進步,並在生產中使用當地原料。

- 食品安全是食品和飲料產業的重要組成部分,而新冠肺炎疫情使得食品安全變得更加重要。製造商被迫檢查並加強其食品安全措施。引進機器人可以幫助提高食品安全,消除人工干預,從而顯著降低食品生產設施交叉污染的風險。此外,包括印尼在內的全球對包裝食品的需求正在激增,導致食品包裝設施採用先進的機械來取代體力勞動。

- 此外,根據印尼統計局的資料,Z世代和千禧世代消費者佔全國人口的52%,為了迎合他們,企業正在不斷發展,努力跟上數位化發展的步伐。正面的影響。食品和飲料 (F&B) 製造業正在採用 IIoT、AI、PLC 和機器人等工具來提高產量和品質。即時資料處理和預測分析的發展進一步促進了利用資料產生有效決策見解的新方法的引入。

DCS 主導印尼自動化與控制系統市場

- 分散式控制系統 (DCS) 是一種整合控制架構,包含一個監督層級的控制,可監督管理局部製程複雜性的多個整合子系統。 DCS 主要用於石油和氣體純化以及石油生產等工業製程。這些系統專門設計了冗餘和診斷功能,以提高控制的可靠性和效能。它為控制分散式離散現場設備及其操作站提供了更大的靈活性。

- 分散式控制系統 (DCS) 的可擴展性是一個關鍵優勢。它最初可以部署為一個完整的整合系統,也可以部署為一個可以根據需要擴展的獨立系統。預計對市場成長產生積極影響的因素包括電力能源領域的需求不斷成長以及該國工業基礎設施的發展。

- DCS 系統列出了顯著的優點,包括分散式控制器、工作站和其他計算元素之間的P2P存取。石化、核能、石油和天然氣等製程工業對能夠在設定點附近提供精確控制和製程接受度的控制器的需求越來越大。印尼石油和天然氣產業的投資不斷增加,為DCS應用創造了新的機會。 DCS 廣泛應用於石油和天然氣工業,以更好地控制生產過程。

- 印尼是世界知名天然氣生產國,天然氣蘊藏量位居亞太地區第三位,僅次於澳洲和中國。該國已提案分配10個石油和天然氣區塊,包括南海區塊,以促進能源生產和探勘。 2022 年將有 13 個天然氣田拍賣。此外,SKK Migas 致力於擴大 Gendallo Gehem計劃,到2022 年和2027 年實現天然氣產量高峰8.44 億立方英尺/天,但須遵守修訂後的開發計劃,該計劃將納入埃尼現有的附近天然氣生產設施。預計產業這些重大進步將推動該領域 DCS 設備的採用。

- 此外,由於該地區水產業對 DCS 的採用、投資數位化程度不斷提高,預計市場將出現巨大的需求。印尼當地水務公司 PDAM 正在透過採用數位技術來實現業務和服務的現代化。客戶抄表、數位計費、申訴管理、員工資料庫、薪資核算等應用程式已成功整合,從而實現了更快、更有效率的管理流程。

- 2023 年,Perumdam Tirta Sanjiwani 和 Bima Sakti Alterra 同意實施全面的 SWGM 解決方案,並在 Blahbatuh 科技區試行。這項進展將提高水處理業務的效率、可靠性和安全性,同時降低營運成本和環境影響,並可視為廣泛採用 DCS 的積極一步。

印尼自動化控制系統市場競爭模式

印尼自動化和控制系統市場競爭適中,由幾家大型企業組成。從市場佔有率來看,目前少數幾家大公司佔據著市場主導地位。憑藉顯著的市場佔有率,這些主要企業正致力於擴大其在多個國家的基本客群。

2022 年 5 月,ETAP 和施耐德電機宣布將 EcoStruxure Power Operation 與 ETAP 操作員訓練模擬器 (eOTS) 和 ETAP 電力系統監控與類比 (PSMS) 整合。這種特殊的整合確保所有 EcoStruxure Power Operation 系統都持續連接到 ETAP數位雙胞胎。

2022 年 4 月,羅克韋爾自動化與新加坡工業 4.0 技術供應商 CAD-IT 建立最新合作,加強了其合作夥伴網路。 CAD-IT 在東南亞擁有廣泛的網路,業務範圍涵蓋包括印尼在內的多個國家。透過此次合作,CAD-IT 將提供羅克韋爾自動化的智慧製造解決方案、自動化解決方案等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 印尼電力產業蓬勃發展,發電量不斷增加

- 印尼無線通訊協定與無線感測器網路技術的演進與發展

- 投資工業發展和能力建設

- 市場限制

- 高資本投入

- 大宗商品價格波動與經濟情勢動盪

第6章 市場細分

- 產品

- 可程式邏輯控制器

- 監控和資料採集

- 集散控制系統

- 人機介面

- 安全系統

- 工業機器人

- 馬達(包括交流、直流、EC、伺服和步進馬達)

- 驅動器(包括交流、直流和伺服)

- 最終用戶產業

- 石油和天然氣

- 力量

- 化工和石化

- 飲食

- 金屬與礦業

- 用水和污水

- 其他

第7章 競爭格局

- 公司簡介

- Yokogawa Corporation

- Siemens AG

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric Co.

- ABB Ltd.

- Emerson Electric Co.

- PT FANUC Indonesia

第8章馬達及工業機器人進口分析

第9章投資分析

第10章:投資分析市場的未來

The Indonesia Automation And Control System Market size is estimated at USD 119.34 million in 2025, and is expected to reach USD 180.19 million by 2030, at a CAGR of 8.59% during the forecast period (2025-2030).

With Indonesia's steady amalgamation with the world's economy, Indonesia's Automation and Control System will be essential in bringing costs down.

Key Highlights

- Automation and Control System refers to systems that oversee and control a wide range of processes involved in manufacturing and distributing goods and services. Many universal and essential services depend on Automation and Control Systems, from assembly lines to power stations. For example, many utility or telecommunication infrastructures that maintain a modern nation's social, industrial, and economic well-being rely on Automation and Control Systems.

- Indonesia is a prominent industrial manufacturer that highly adopts automation in its industries. Manufacturing contributes a considerable amount to a country's GDP. For instance, according to Statistics Indonesia, in 2022, Indonesia's manufacturing sector contributed over 18 percent of the country's GDP, the most significant contributor to the nation's economy. The robust manufacturing activities in Indonesia and Malaysia will likely augment the demand for the studied market.

- Growing government funding to encourage automated systems in numerous industrial verticals, booming demand for automation from different manufacturing sectors, increasing innovations in industrial robotics, swelling technological advancements in manufacturing, and the need for mass production and related supply chains to cater to the rising population are the crucial factors driving the growth of automation and process control systems market in Indonesia.

- Indonesia's mineral resources are vast and unexplored, and it is the world's largest exporter of Tin, palm oil, and thermal coal. It is also one of the major exporters of Nickel, Copper, Bauxite, Rubber, Manganese, Zinc, and Lead, among others. Mining accounts for about a tenth of Indonesia's GDP and has played a vital role in the country's economic development over the years. The rising demand for metals and minerals, with the growing demand for semiconductors and electronics, fuels the adoption of automated systems in the mining sector.

- The energy sector is experiencing an increase in demand for automation and control systems due to the emergence of smart city programs. Indonesia has taken the lead in this regard by launching the 100 Smart Cities Movement, a comprehensive digitalization program aimed at addressing urbanization challenges. This initiative is part of the government's plan to tackle the issue of urbanization, with projections indicating that 83 percent of the Indonesian population will reside in urban areas by 2045.

- Indonesia is also encouraging the use of biomass to improve the greening of existing Steam Power Plants through the innovative Biomass Co-Firing program. The program aims to co-fire biomass in 52 locations by 2025 and has already co-fired biomass in 37 areas, using 306 thousand tons to reach the 1.08 million ton target by 2023. Such programs and new projects and investments to develop the power and utility sector of the country are expected to create new market opportunities for the implementation of automation and control systems in the country.

- However, the initial costs associated with automation and control systems are high. The complexity of customization and integration adds to the overall costs. Moreover, installing automation equipment may require modifications to the existing infrastructure of the factory. This can include changes to the layout, electrical systems, and safety features to accommodate new equipment, which incur additional costs. Such factors might hinder the market growth.

Indonesia Automation and Control System Market Trends

Food and Beverages to Drive the Indonesia Automation and Control System Market

- The food and beverage sector holds a prominent position in Indonesia's economy, serving as a vital contributor to the nation's GDP. The industry benefits from abundant natural resources and a growing domestic demand, bolstering its resilience. Notably, during the second quarter of 2022, the food and beverage sector accounted for a substantial 38.38 percent of the non-oil and gas industry's GDP, solidifying its status as the leading sub-sector in terms of GDP contribution within Indonesia.

- Based on data from Statistics Indonesia (BPS), the food and beverage (F&B) industry increased by 4.90 percent on an annual basis in 2022 to IDR 813.062 billion. This condition is inseparable from the increased production of the food and beverage commodity itself. According to CRIF forecasts for 2023, the food and beverage industry is expected to experience an increase of around 5 percent compared to the previous year. Factors influencing this growth are the high sensitivity of the food and beverage industry to changes in the economic environment. CRIF also considers that this industry still has good prospects, especially in the context of national economic recovery after the COVID-19 pandemic.

- The Making Indonesia 4.0 strategy, which aims to position Indonesia as a global Top 10 economy by 2030, has identified critical technologies such as the Internet of Things (IoT), automation, robotics, artificial intelligence, and Sensor technology as its core components. Among the priority sectors in this strategy, the food and beverage industry stands out. Consequently, the country's food and beverage sector is expected to experience a growing demand for digital transformation, leading to an increase in automation and control systems. In line with the national Making Industry 4.0 industrial strategy, the Indonesian government is urging the local food and beverage industry to embrace digital advancements and transition towards using local raw ingredients for manufacturing.

- Food safety is a crucial element in the food and beverage industry, with COVID-19 further intensifying its significance. Manufacturers have been compelled to scrutinize and enhance their food safety measures. The deployment of robots can aid in improving food safety by eliminating the need for human intervention, thereby significantly reducing the risk of cross-contamination in food manufacturing facilities. Additionally, the demand for packaged food is surging globally, including in Indonesia, where sophisticated machines in food packaging facilities have replaced manual methods.

- Moreover, As per the data from the Indonesia Bureau of Statistics, the country comprises 52 percent of Gen Z and millennial consumers, and in order to deal with them, companies are evolving and working towards catching up in terms of digital evolutions, thus positively impacting the demand for automation and industrial control equipment and technologies. Food & Beverage (F&B) manufacturing has embraced IIoT, AI, PLC, Robotics, and more such tools to move up production and quality. Developments in real-time data processing and predictive analytics further help introduce new ways of utilizing data to generate insights for effective decision-making.

DCS Holds a Dominant Position in Indonesia Automation and Control System Market

- A Distributed Control System (DCS) is an integrated control architecture that includes a supervisory level of control overseeing multiple integrated sub-systems responsible for managing the intricacies of a localized process. DCS is primarily utilized in industrial processes such as oil and gas refineries, oil production, etc. These systems are specifically designed with redundancy and diagnostic capabilities to enhance control reliability and performance. They offer increased flexibility in controlling distributed discrete field devices and their operating stations.

- The scalability of a Distributed Control System (DCS) is a significant advantage. It can be initially implemented as a comprehensive, integrated system or as a standalone system that can be expanded as required. Anticipated positive influences on market growth include the growing demand in the power and energy sectors and the development of industrial infrastructure in the country.

- DCS systems offer significant benefits, including peer-to-peer access between distributed controllers, workstations, and other computing elements. In process industries such as petrochemical, nuclear, and oil and gas, there is a growing demand for controllers that provide precise control and process tolerance around a set point. The Indonesian oil and gas sector's increasing investments are creating new opportunities for DCS applications. DCS is widely used in the oil and gas industry and provides enhanced control over the production process.

- Indonesia is a prominent natural gas producer globally, possessing the third-largest gas reserves in the Asia Pacific region, following Australia and China. The nation has proposed the allocation of ten oil and gas working areas, including a block in the South China Sea, to enhance energy production and exploration. In 2022, 13 oil and gas fields were auctioned. Additionally, SKK Migas has projected that the Gendalo-Gehem project will reach a peak gas output of 844 million cfd by 2022, with production commencing in 2027, subject to a revised development plan that incorporates Eni's existing gas production facilities nearby. These significant advancements in the industry will promote the adoption of DCS devices in the sector.

- The market is also expected to witness a significant demand owing to the rising adoption of DCS, investments, and digitization in the region's water industry. Indonesia's local water companies, known as PDAMs, have embarked on a process of modernizing their operations and services by incorporating digital technology. They have successfully integrated applications for customer meter reading, digital billing, complaint management, employee databases, and payroll, resulting in faster and more efficient administrative processes.

- In 2023, Perumdam Tirta Sanjiwani and Bima Sakti Alterra agreed to implement a comprehensive SWGM solution, which was piloted in the Blahbatuh technical zone. This development can be seen as a positive step towards the widespread adoption of DCS, as it enhances the efficiency, reliability, and safety of water treatment operations while also reducing operational costs and environmental impacts.

Indonesia Automation and Control System Market Competitive Landscape

The Indonesian automation and control system market is moderately competitive and consists of several major players. In terms of market share, few major players currently dominate the market. These major players with a prominent market share are focusing on expanding their customer base across numerous countries.

In May 2022, ETAP and Schneider Electric announced the integration of EcoStruxure Power Operation with ETAP Operator Training Simulator (eOTS) and ETAP Power System Monitoring & Simulation (PSMS), enabling model-driven power system training and predictive analysis for operators and engineers. This specific integration ensures that all EcoStruxure Power Operation systems are connected to the ETAP Electrically Digital Twin continuously on a genuine time basis.

In April 2022, Rockwell Automation strengthened its partner network with its latest partnership with CAD-IT, a Singapore-based Industry 4.0 technologies provider. CAD-IT has a vast network in Southeast Asia, with a presence in multiple countries, including Indonesia. Through the partnership, CAD-IT will offer Rockwell Automation's smart manufacturing and automation solutions, among other solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Flourishing Power Sector and Increased Power Generation Capacities in Indonesia

- 5.1.2 Evolution and Development of Wireless Protocols and Wireless Sensor Network Technology in Indonesia

- 5.1.3 Development of Industries and Investments to Increase Capacities

- 5.2 Market Restraints

- 5.2.1 High Capital Investments

- 5.2.2 Fluctuating Commodity Prices and Volatile Economic Scenario

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Programmable Logic Controller

- 6.1.2 Supervisory Control and Data Acquisition

- 6.1.3 Distributed Control System

- 6.1.4 Human Machine Interface

- 6.1.5 Safety Systems

- 6.1.6 Industrial Robotics

- 6.1.7 Electric Motors (includes AC, DC, EC, Servo and Stepper Motors)

- 6.1.8 Drives (includes AC,DC and Servo)

- 6.2 End-User Industry

- 6.2.1 Oil & Gas

- 6.2.2 Power

- 6.2.3 Chemical & Petrochemical

- 6.2.4 Food & Beverage

- 6.2.5 Metals & Mining

- 6.2.6 Water and Wastewater

- 6.2.7 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Yokogawa Corporation

- 7.1.2 Siemens AG

- 7.1.3 Honeywell International Inc.

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 Schneider Electric Co.

- 7.1.6 ABB Ltd.

- 7.1.7 Emerson Electric Co.

- 7.1.8 PT FANUC Indonesia