|

市場調查報告書

商品編碼

1642168

行動電話半導體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Mobile Phone Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

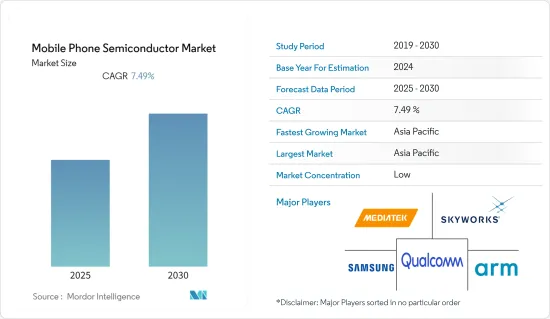

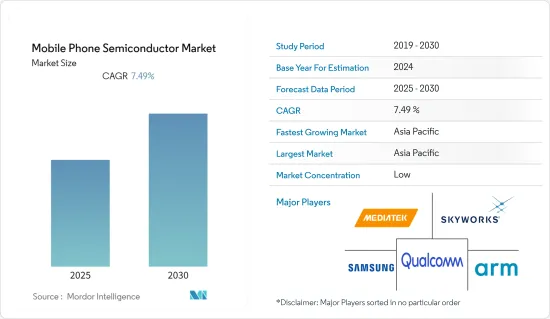

預計預測期內行動電話半導體市場複合年成長率為 7.49%。

主要亮點

- 半導體產業整體成長乏力,智慧型手機業務也出現波動。不過,由於智慧型手機中射頻應用的採用越來越多,行動電話半導體市場得以略微成長。在許多地區,尤其是亞太地區,智慧型手機業務是半導體產業的最大消費者。

- 過去一年,智慧型手機產業日趨成熟,這對行動電話半導體產業正在產生影響。然而,隨著5G技術的出現和政府對其採用的核准,智慧型手機用戶預計將從支援4G和LTE技術的行動電話遷移到5G技術,這將為研究市場創造巨大的機會。

- 平板電腦、智慧型手機和電子閱讀器等行動裝置的出貨量正在增加,推動了這些裝置中使用的各種半導體元件的成長,包括應用處理器、數據機、MEMS 感測器、無線連接 IC 和音訊 IC。

- 射頻收入的成長得益於更多頻寬、更多電信商和更高階 MIMO 配置的廣泛採用,以及智慧型手機平均售價的上漲。預計這一趨勢將在2019年持續下去,部分5G行動電話將增加5G的6GHz以下中頻頻段和mmWave模組。

- 由於半導體供應鏈的變化、美國貿易戰、俄烏戰爭以及經營模式的變化而導致的市場波動為一些製造商創造了機會,同時也對其他製造商構成了威脅。

- 然而,全球新冠疫情擾亂了供應鏈和生產,尤其是在亞太地區。由於亞太地區過去幾十年一直是全球製造業中心,核心半導體製造業受到了嚴重影響。

行動電話半導體市場趨勢

記憶體是市場的主要推動力

- 該領域的成長將主要受到雲端運算和智慧型手機等終端設備的虛擬實境等持續技術進步的推動。此外,動態隨機存取記憶體(DRAM)和NAND快閃記憶體晶片的平均銷售價格(ASP)的大幅上漲也將為收益帶來顯著的成長。

- 一般來說,預期的價格下跌將被快閃記憶體和 DRAM 的新容量所抵消,從而導致這些設備的供需更加平衡,以支援更多現代應用,如企業固態硬碟 (SSD)、增強智慧和虛擬實境、人工智慧、圖形和其他複雜的即時工作負載功能。

- 然而,新興記憶體技術即將蠶食該行業大量的 DRAM 需求。 2022年8月,美光科技公司宣布計畫在2030年投資400億美元擴大在美國的半導體製造產能。

- 美光的 DRAM 晶片廣泛應用於從智慧型手機到資料中心伺服器等設備的各種應用。該公司擴建美國製造工廠的計畫預計將獲得《晶片與科學法案》下各種信貸和津貼的支持。該公司的這些舉措預計將在預測期內對行動電話半導體市場產生積極推動作用,推動市場對記憶體的需求。

亞太地區主導行動電話半導體市場

- 亞太地區是行動電話和半導體技術的主要市場之一。該地區在半導體和智慧型手機製造業佔據主導地位。這兩個市場的主要企業大多位於亞太地區,其他參與者也正在向該地區擴張。

- 該地區也主導全球半導體市場。智慧型手機和半導體產量的增加(尤其是在新興國家)也推動了該地區對行動半導體的需求。越來越多的來自印度、越南、泰國和新加坡等國家的智慧型手機製造商正在該地區建立製造廠。

- 例如,2022 年 11 月,蘋果宣布計劃根據印度政府的「印度製造」計劃在印度開設其最大的製造部門之一。該新製造工廠預計將成為蘋果在該地區最大的製造工廠。該公司在該地區採取的此類舉措有望促進該地區的行動電話半導體市場的發展。

- 中國、韓國、日本、新加坡和台灣是該地區一些高度發展的半導體生產國家。然而,馬來西亞和印度等國家也正在成為潛在市場。這些國家的智慧型手機市場也非常龐大,因此對受訪市場而言,這意味著巨大的機會。馬來西亞已成為重要的半導體出口市場之一。

- 2021年5月,韓國宣布了雄心勃勃的計劃,未來10年投資約4,500億美元,打造全球最大的晶片製造基地。此外,各大公司也紛紛轉向行動電話半導體。

行動電話半導體產業概況

行動電話半導體市場是一個高度分散的市場,由幾家大公司主導。各種收購以及與大公司的聯盟已經完成或即將完成,並且專注於技術創新。市場的主要企業包括三星電子和高通科技公司。這些公司正在利用策略合作計劃來增加市場佔有率並提高盈利。

- 2022 年 8 月-美光科技公司宣布計畫在 2030 年投資 400 億美元擴大在美國的半導體製造產能。新的製造部門預計將幫助該公司提高其在市場上的製造能力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 快速引入下一代行動通訊標準LTE或4G

- “MultiCom”解決方案的出現

- 市場限制

- 製造複雜性

- 消費者需求超過工廠產能

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場區隔

- 依組件類型

- 行動處理器

- 記憶

- 邏輯晶片

- 模擬

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Samsung Electronics

- Qualcomm Technologies, Inc.

- MediaTek Inc.

- NXP Semiconductors NV

- Broadcom Inc.

- Skyworks Solutions Inc.

- Intel Corporation

- Huawei Technologies Co. Ltd

- Micron Technology Inc.

- Qorvo Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Mobile Phone Semiconductor Market is expected to register a CAGR of 7.49% during the forecast period.

Key Highlights

- The overall semiconductor industry witnessed lesser growth, and the smartphone business was also fluctuating. However, the mobile phone semiconductor market was able to witness marginal growth, owing to the increasing adoption of RF-based applications in smartphones. In many regions, especially Asia-Pacific, the smartphone business was the largest consumer of the semiconductor industry.

- Since the past year, the smartphone industry has been witnessing a nearing maturity state which is affecting the mobile phone semiconductor industry. However, with the advent of 5G technology and the government's approval for the adoption of 5G technology, it is expected to enable smartphone users to shift from phones supporting 4G and LTE technology to 5G technology which would create huge opportunities for the studied market.

- With the increasing shipments of mobile devices such as tablets, smartphones, and e-book readers have been growing and are driving the growth for a range of semiconductor components, including applications processors, modems, MEMS sensors, wireless connectivity ICs, and audio ICs in these devices.

- The increased revenue of RF was generated from its growing adoption among more bands, a larger number of carriers aggregated, and higher-order MIMO configurations supported by an increase in smartphone ASPs. This trend was expected to continue in 2019, with the addition of the mid-band spectrum for sub-6GHz 5G and mmWave modules in some 5G phones.

- Changes in the semiconductor supply chain, the market fluctuation due to the US-China trade war, the Russia-Ukrain war, and the shifting business models created opportunities for some manufacturers while posing a threat to others.

- However, the significant outbreak of the COVID-19 pandemic globally disrupted the supply chain and production, especially in the Asia-Pacific region. Major semiconductor manufacturing industries have been significantly affected as a result of Asia-Pacific being a world production center over the past two to three decades.

Mobile Phone Semiconductor Market Trends

Memory to Significantly Drive the Market

- A large portion of the growth in this segment would be driven by ongoing technological advancements such as cloud computing and virtual reality in end devices such as smartphones. Sharply higher average selling prices (ASPs) for dynamic random access memory (DRAM) and NAND flash chips also substantially generate revenues.

- In general, the expected price decreases would be offset by new capacity for flash memory and for DRAM, which would result in a better balance of supply and demand for these devices to support more latest applications such as enterprise solid-state drives (SSDs), augmented and virtual reality, artificial intelligence, graphics, and other complexes, real-time workload functions.

- However, emerging memory technologies are poised to cannibalize huge chunks of the DRAM demand in the industry. In August 2022, Micron Technology Inc., announced its plan to spend USD 40 billion through 2030 to expand its semiconductor production capacity in the United States.

- Micron's DRAM chips are used for applications in a variety of devices ranging from smartphones to data center servers. The company's plan to expand its manufacturing unit in the United States is expected to be supported by various credits and grants under the CHIPS and Science Act. Such initiatives by the company is expected to promote the demand for memory in the market providing a positive push to the mobile phone semiconductor market during the forecast period.

Asia-Pacific to Hold a Dominant Position in the Mobile Phone Semiconductor Market

- Asia-Pacific is one of the major markets for mobile phone and semiconductor technologies. The region is dominating semiconductor and smartphone manufacturing fields. Most of the major companies, in both the markets, are based in the Asia-Pacific region, while the remaining companies have a presence in the region.

- The region also dominates the global semiconductor market. The increasing smartphone and semiconductor production, especially in emerging countries, is also augmenting the mobile semiconductor demand in the region. Countries like India, Vietnam, Thailand, and Singapore, among others, are witnessing an increasing number of smartphone manufacturers setting up their manufacturing plants in the region.

- For instance, in November 2022, Apple announced its plan to open one of its largest manufacturing unit in India under the 'Make in India' initiative by the Indian Government. The new manufacturing unit is expected to be Apple's largest manufacturing unit in the region. Such initiatives by the company in the region are expected to ppromote the mobile pone semiconductor market in the region.

- China, South Korea, Japan, Singapore, and Taiwan are some of the highly developed semiconductor producers in the region. However, countries, like Malaysia and India, are also emerging as potential markets. The smartphone market is also massive in these countries; hence, they can offer enormous opportunity for the market studied too. Malaysia is emerging as one of the vital semiconductor export markets.

- In May 2021, South Korea announced its ambitious plans to spend roughly USD 450 billion to build the world's biggest chipmaking base over the next decade. joining China and the U.S. in a global race to dominate the key technology. Moreover, with the shift of various major companies to the

Mobile Phone Semiconductor Industry Overview

The Mobile Phone Semiconductor Market is a highly fragmented market, dominated by several major players. Various acquisitions and collaborations of large companies have taken place and are expected to take place shortly, which focus on innovation. Some of the key players in the market are Samsung Electronics and Qualcomm Technologies, Inc. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability.

- August 2022 - Micron Technology Inc. announced its plan to spend USD 40 billion through 2030 to expand its semiconductor production capacity in the United States. The new manufacturing unit is expected to help the company to increase its manufacturing capabilities in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rapid Introduction of Next-generation Mobile-communications Standard, LTE or 4G

- 4.3.2 Emergence of 'Multicom' Solutions

- 4.4 Market Restraints

- 4.4.1 Complexity Regarding Manufacturing

- 4.4.2 Consumer Demand Exceeding Factory Capacity

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

- 4.7 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Component Type

- 5.1.1 Mobile Processors

- 5.1.2 Memory

- 5.1.3 Logic Chips

- 5.1.4 Analog

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Samsung Electronics

- 6.1.2 Qualcomm Technologies, Inc.

- 6.1.3 MediaTek Inc.

- 6.1.4 NXP Semiconductors N.V.

- 6.1.5 Broadcom Inc.

- 6.1.6 Skyworks Solutions Inc.

- 6.1.7 Intel Corporation

- 6.1.8 Huawei Technologies Co. Ltd

- 6.1.9 Micron Technology Inc.

- 6.1.10 Qorvo Inc.