|

市場調查報告書

商品編碼

1642172

機械安全:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Machine Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

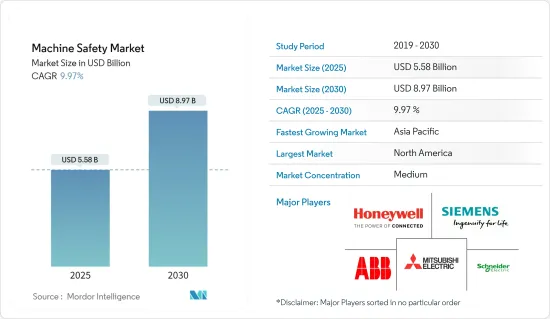

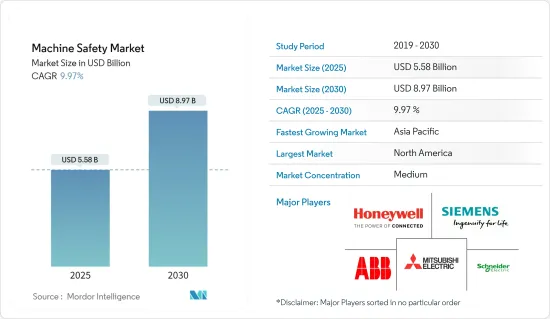

機器安全市場規模預計在 2025 年為 55.8 億美元,預計到 2030 年將達到 89.7 億美元,預測期內(2025-2030 年)的複合年成長率為 9.97%。

該地區的工業和製造設施需要遵守標準和法規,這推動了機器安全市場的發展。世界各國正努力實現全球標準的協調。這在機器安全領域尤其明顯。

關鍵亮點

- 全球機器安全標準由 IEC 和 ISO 管轄。此外,區域和國家標準仍然存在並繼續支持當地的要求。儘管如此,各國仍在積極使用 ISO 和 IEC 制定的國際標準。

- 各行各業都在尋求採用先進的機械來提高生產力。他們主要關注機器的安全性並確保機器的生產力不受影響。這遠非一個新的要求;在工業4.0時代它變得更加重要。在這方面,越來越多的機器製造商從設計新系列的早期階段開始尋求機器安全專家的合作,將安全功能融入機器功能中,以在實現高水平安全性的同時最大限度地提高生產率。其目的是整合。

- 此外,環保電動車的快速成長正在創造一個新的汽車細分市場,對機器安全產生巨大的需求,並推動機器安全市場向前發展。同樣,在預測期內,擴大採用物聯網來確保更好地管理和提高工業資產的性能,以及新興經濟體對職場安全標準的接受度不斷提高,也將成為機械設備成長的驅動力。

- 在世界各地快速工業化的推動下,新工廠的建立推動了市場的成長。例如,ABB 印度公司正在擴建和升級其位於班加羅爾 Nelamangala 的智慧發電工廠,以滿足對其解決方案強勁成長的需求。該智慧設施利用人工智慧(AI)和先進的數位化技術以及先進的協作機器人技術來改善人機介面。

- 世界各國政府和製造商正在認真考慮減少對中國生產的過度依賴的計劃。例如,日本政府已朝這個方向邁出了一步,宣布投入22億美元支持國內企業將生產從中國轉移出去。這些建立製造設施的投資預計將增加對機器安全市場的需求。

- 廣泛採用數位技術來減輕COVID-19的影響並促進組織安全也刺激了機器安全市場的成長。對人員和資產保護的更加重視也對市場成長產生了正面影響。此外,由於機器狀況不安全而導致各行業案例數量的增加,以及由於全球人口購買力不斷提高而導致的汽車需求不斷增加,都成為機器安全市場的積極成長動力。

- 此外,新冠肺炎疫情迫使全球工業幾乎停止了所有工業活動。此外,在新冠疫情蔓延的背景下,依賴製造業的機器安全設備市場預計將在工業領域廣泛應用,因為疫情改變了各公司在疫情期間的投資計劃。

機器安全市場趨勢

石油和天然氣產業佔很大佔有率

- 石油和天然氣產業對工業自動化產品的需求不斷成長,預計也將為機器安全創造機會。這使得現有機械可以升級,從而產生了對新機器安全裝置的需求,以適應升級的設備。

- 美國內政部計劃在2019年至2024年期間,根據國家大陸棚石油和天然氣租賃計劃(國家OCS計劃),允許在其約90%的大陸棚(OCS)土地上進行海上探勘。該地區的石油和天然氣產業預計將為市場帶來新的機會。

- 此外,安全因素也影響機器安全裝置的需求,尤其是在石油和天然氣產業。例如,在墨西哥這樣的國家,管道經常遭受叛亂分子的襲擊和盜竊,因此對支援遠端操作的自動化、強大的緊急關閉系統和設備的需求日益成長。

- 在印度等亞洲國家,艾哈默德巴德(古吉拉特邦)當地警方在 2021 年回收了約 24,000 加侖原油。他們逮捕了一名來自達斯克羅伊(古吉拉特邦)巴雷賈村的男子,該男子涉嫌參與薩拉亞-馬圖拉管道 (SMPL)計劃。 2020 年 12 月,SMPL 管線被盜事件首次被發現,當時印度石油公司艾哈默德巴德鄉村公司的官員注意到達斯克羅伊縣巴雷賈村的 SMPL 管道一段的壓力下降。官員發現管道上有一個裂口,上面有一個閥門,還有一根長 50 公尺、直徑 2 英吋的管道穿過地面的一個洞。

- 在這種情況下,政府加大對管道安全相關自動化流程的投入,預計將增加對先進緊急關閉系統的需求。石油和天然氣產業擴大採用涉及感測器的創新物聯網解決方案,大大增加了對自動化安全系統的需求,從而支持了市場的成長。

- 該技術可以幫助用戶追蹤卡車中的石油量並發現任何地方的管線洩漏。這是一種支援物聯網的設備,它使用體積感測器來檢測汽油水平的細微變化並迅速向當局發出警報。它還使用戶能夠即時監測氣體濃度,確保危險工業環境中的設備和人員安全。此外,氣體檢測感測器有助於為工人(特別是在礦井地下工作的工人)維持足夠的氧氣水平。

亞太地區佔很大佔有率

- 預計亞太地區在預測期內將出現顯著成長,這主要歸因於工業領域投資的大幅增加。此外,技術安全標準的逐步完善、個人安全意識的不斷加強、市場參與企業的逐步參與到市場推廣中,都推動著全國機械安全市場的快速成長。

- 該地區國家正在積極推動國內製造業。例如,「中國製造2025」計畫鼓勵先進製造業,並更重視安全。中國可望成為亞太地區最大的機械安全產品市場。此外,技術安全標準的不斷提高,國民個人安全意識的不斷加強,以及國家和企業不斷參與市場的推動,都加速了我國機械安全市場的成長。

- 中國正在大力投資汽車產業並增加新計畫。電動車的發展刺激了資本投資的大幅成長,其中很大一部分集中在新機器上。此外,中國的「十三五」規劃預計將推動中國安全標準的發展,並增加對安全產品的投資。該計劃強調整體製造業的安全,並旨在透過採用新技術和更嚴格的監管來減少工作場所的傷害。該計劃明確提到要升級農業機械和專用設備,以滿足安全要求。

- 隨著韓國和日本企業尋求生產多元化並減少對中國製造產品的過度依賴,預計新冠疫情將進一步加速這一進程。此外,2020 年與南亞和東南亞製造工廠相關的建築生產成長放緩,反映了 COVID-19 造成的嚴重破壞,影響了機器安全市場的成長。

- 世界各國政府和製造商正在認真考慮減少對中國生產的過度依賴的計劃。例如,日本政府率先採取這項舉措,宣布向尋求將生產遷出中國的國內企業提供 22 億美元的支援計畫。預計建立製造設施的支出將增加對機器安全的需求。

機械安全產業概況

機械安全市場本質上競爭激烈,並且似乎由幾個主要企業分割。根據對市場參與企業近期趨勢的分析,關鍵策略包括協議和夥伴關係、收購、擴張和產品推出。這些主要企業致力於透過先進的技術和功能提供全面的安全解決方案。預計市場的產品創新和技術成長也將為全球參與企業提供重大的投資機會。

- 2022 年 9 月-Nvidia 推出用於安全可靠的自主系統的 IGX 邊緣 AI 運算平台。 IGX將硬體與可編程的安全增強功能、商業作業系統支援和強大的AI軟體結合,使企業能夠以安全有保障的方式提供支援人機協作的AI。這個一體化平台為醫療和工業邊緣 AI 用例提供了下一代安全性、保障性和感知能力。

- 2021 年 10 月-歐姆龍宣布推出新的檢查系統:VT-S10 系列。新的檢測系統採用人工智慧和成像技術,實現了 PCB 組件高精度製程的自動化,無需操作員具備專業技能。新上線的系統確保了生產的安心與安全。

- 2021 年 5 月-IDEC 公司透過 SX5E-HU085B 8 連接埠非管理型工業乙太網交換器在產品系列中新增了安全埠。該交換器支援 QoS、IGMP 偵聽和廣播風暴保護,以解決關鍵且具有挑戰性的商業和工業場所中日益增多的乙太網路、物聯網和工業物聯網設備的問題。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 對機器安全市場的影響評估

第5章 市場動態

- 市場促進因素

- 工作事故增加

- 嚴格的政府法規和強制性安全標準

安全標準

- 市場限制

- 與機器安全系統相關的額外成本

第6章 市場細分

- 執行

- 單一組件

- 內建組件

- 成分

- 安全感應器

- 緊急停止裝置

- 安全聯鎖切換

- 安全控制器/模組/繼電器

- 其他

- 最終用戶

- 電子和半導體

- 石油和天然氣

- 醫療

- 飲食

- 車

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Rockwell Automation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Omron Corporation

- Pilz GmbH & Co. KG

- ABB Limited

- Honeywell International Inc.

- Siemens AG

- Keyence Corporation

- IDEC Corporation

- Sick AG

- Banner Engineering

第8章投資分析

第9章:市場的未來

The Machine Safety Market size is estimated at USD 5.58 billion in 2025, and is expected to reach USD 8.97 billion by 2030, at a CAGR of 9.97% during the forecast period (2025-2030).

The need for industries and manufacturing facilities to comply with the standards and regulations across the region has been driving the market for machine safety. Several countries across the world are working towards the global harmonization of standards. This is especially evident in the area of machine safety.

Key Highlights

- Global safety standards for machinery are governed by the IEC and ISO organizations. Also, regional and country standards are still in existence and continue to support local requirements. Still, in various countries, there has been a move toward using the international standards produced by ISO and IEC.

- Industrialists are aiming to deploy advanced machinery to increase their productivity. They mainly focus on machine safety, not impairing the productivity of their machines. Though this is far from a new requirement, it has become far more critical in the age of Industry 4.0. In this regard, increasing numbers of machine builders seek cooperation from machine safety experts early on in the design of the new series, intending to integrate safety functions into machine functions in such a way that productivity is maximized alongside high levels of safety.

- Furthermore, the rapid growth of environmentally friendly electric vehicles has resulted in the formation of a new segment of automobiles, creating a huge demand for machine safety and propelling the machine safety market forward. Similarly, the increasing use of IIOT to ensure better management and improved performance of industrial assets, as well as the increasing acceptance of workplace safety standards in emerging economies, will provide ample new opportunities that will lead to the growth of the machine safety market during the forecasted period.

- The establishment of new factories, fueled by the world's rapidly growing industrialization, has aided the market's growth. ABB India, for example, has expanded and upgraded its smart power factory in Nelamangala, Bengaluru, to meet the strong demand growth for its solutions. The smart facility makes use of advanced collaborative robotics technology to improve the human-machine interface, as well as artificial intelligence (AI) and advanced digitalization technologies.

- Governments, and manufacturers, across the world, are seriously pondering plans to decrease their overdependence on Chinese production. For instance, the Japanese government became the first to take steps in this direction by announcing a USD 2.2 billion in assistance to domestic companies to shift production from China. Such investments in establishing manufacturing facilities are anticipated to augment the demand for the machine safety market.

- The widespread use of digital technology to mitigate the impact of COVID-19 and promote organizational safety is also fueling the growth of the machine safety market. The increased emphasis on personnel and asset protection is also positively impacting the market growth. Furthermore, increased cases of accidents in various industries due to unsafe machine conditions, as well as rising demand for automobiles due to an increase in population with purchasing power globally, are acting as active growth drivers in the machine safety market.

- Furthermore, the COVID-19 outbreak has forced industries to halt almost every industrial operation globally. Also, amidst the pandemic spread of COVID-19, the market for machine safety equipment, which relies on the manufacturing sector and substantial adoption on the industrial front, is very likely to be impacted, as the pandemic has resulted in changes in the planned investments of various companies over the forecast period.

Machine Safety Market Trends

Oil and Gas Industry to Hold a Significant Share

- The growing demand for industrial automation products in the oil and gas industry is also expected to create opportunities for machine safety. It enables the upgradation of existing machinery, creating a demand for new machine safety equipment that can comply with the upgraded equipment.

- The US Department of the Interior, under the national outer continental shelf oil and gas leasing program (National OCS Program) for 2019-2024, is planning to enable offshore exploratory drilling in about 90% of the outer continental shelf (OCS) acreage. The oil and gas sector in the region is anticipated to open up new opportunities in the market.

- Further, in several cases, security factors also impact the demand for machine safety equipment, especially in the oil and gas industry. For instance, in countries like Mexico, where pipelines are often prone to insurgent attacks and theft, there is an increased need for automated and robust emergency stop systems and devices that support remote operations.

- In Asian countries such as India, in 2021, the Ahmedabad (Gujrat) rural police recovered almost 24,000 gallons of crude oil. They apprehended a man suspected of the Salaya Mathura pipeline (SMPL) project in Bareja village in Daskroi (Gujrat). The theft of the SMPL pipeline was first discovered in December 2020, when officials from the Indian Oil Corporation in Ahmedabad rural noticed low pressure in an SMPL pipeline section in Bareja village, Daskroi taluka. Officials discovered a breach in the pipeline with a valve attached and a two-inch-diameter, 50-meter-long pipe put through a hole in the ground.

- In such cases, the governments are increasingly spending on process automation related to pipeline security, which is expected to raise the demand for advanced emergency shutdown systems. The increasing adoption of innovative IoT solutions, including sensors in oil and gas, is creating considerable demand for automated safety systems, supporting the market's growth.

- With this technology, users can track the amount of oil in a truck and discover leaks in pipelines anywhere. It's an IoT-powered device that uses volume measuring sensors to detect even the tiniest change in gasoline levels and warn authorities quickly. It also allows users to monitor gas concentrations in real-time, assuring equipment safety and workers in hazardous industrial environments. Furthermore, it assists personnel working underground, particularly in mines, in maintaining proper oxygen levels through gas detection sensors.

Asia Pacific to Hold Significant Share

- The Asia-pacific is expected to witness significant growth over the forecast period, primarily owing to the region's significantly growing industrial sector investments. Furthermore, the gradual improvement of technical safety standards, the continuous strengthening of personal safety awareness, and the gradual participation of the state and enterprises in market promotion have all contributed to the country's machine safety market's rapid growth.

- Countries in the region are actively promoting the manufacturing of in-home products. For instance, the "Made in China 2025" policy encourages advanced manufacturing, increasing the focus on safety. China is expected to be the largest market in the Asia-Pacific for machine safety products by revenue. In addition, the continuous improvement of technical safety standards, the constant strengthening of personal safety awareness in the country, and the constant participation of the state and enterprises in market promotion accelerated the country's machine safety market.

- China is investing significantly in the automotive industry, increasing new projects. The development of electric vehicles considerably drove capital investment, with most of this focused on new machinery. Moreover, China's 13th five-year plan is expected to drive the development of Chinese safety standards and increase investment in safety products. The project emphasizes the overall safety of manufacturing, intending to reduce accidents in the workplace by adopting new technologies and enforcing regulations. The plan explicitly mentions the upgrade of agricultural machinery and specialized equipment to satisfy the safety requirements.

- The COVID-19 outbreak is anticipated to accelerate this process further, as South Korean and Japanese companies are looking to diversify their production and reduce their overdependence on Chinese manufactured products. Additionally, the construction output value growth associated with South and Southeast Asian manufacturing plants dropped in 2020, reflecting the significant disruption caused by COVID-19, impacting machine safety market growth.

- Governments and manufacturers worldwide are seriously pondering plans to decrease their over-dependence on Chinese production. The Japanese government, for example, was the first to take measures in this approach by unveiling a USD 2.2 billion aid package for domestic companies looking to move production away from China. The demand for machine safety is expected to increase due to such expenditures in establishing manufacturing facilities.

Machine Safety Industry Overview

The machine safety market is highly competitive by nature and appears to be fragmented due to the presence of several prominent players. Key strategies traced from the analysis of recent developments of the market players include agreements and partnerships, acquisitions, expansion, and product launches. These key players strive to deliver comprehensive safety solutions with adept technology and features. Growth in terms of product innovations and techniques in the market is also expected to create substantial investment opportunities for global players.

- September 2022 - NVIDIA unveiled the IGX edge AI computing platform for autonomous systems that are secure and safe. IGX combines hardware with programmable safety extensions, commercial operating-system support, and powerful AI software, allowing organizations to deliver AI in support of human-machine collaboration in a safe and secure manner. The all-in-one platform enables next-generation safety, security, and perception for healthcare and industrial edge AI use cases.

- October 2021 - OMRON Corporation announced the launch of its new inspection system, the VT-S10 Series. The new inspection system employs artificial intelligence and imaging technology to automate high-precision processes for PCB sub-assemblies, removing the need for specialized operator skills. The newly launched system will ensure the production's security and safety.

- May 2021 - IDEC Corporation added the safety port named as SX5E-HU085B 8-port unmanaged industrial Ethernet switch to its product portfolio. The switch supports QoS, IGMP snooping, and broadcast storm protection functionalities and is aligned with the expansion of Ethernet, IoT, and IIoT devices used in critical and challenging commercial and industrial locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of Impact of COVID-19 on the Machine Safety Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Industrial Accidents

- 5.1.2 Stringent Government Regulations and Mandatory Safety

Standards

- 5.2 Market Restraints

- 5.2.1 Additional Costs Associated with Machine Safety Systems

6 MARKET SEGMENTATION

- 6.1 Implementation

- 6.1.1 Individual Components

- 6.1.2 Embedded Components

- 6.2 Component

- 6.2.1 Presence Sensing Safety Sensors

- 6.2.2 Emergency Stop Devices

- 6.2.3 Safety Interlock Switches

- 6.2.4 Safety Controller/Modules/Relays

- 6.2.5 Other Components

- 6.3 End-User

- 6.3.1 Electronics and Semiconductors

- 6.3.2 Oil and Gas

- 6.3.3 Healthcare

- 6.3.4 Food and Beverage

- 6.3.5 Automotive

- 6.3.6 Other End-Users

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation

- 7.1.2 Schneider Electric SE

- 7.1.3 Mitsubishi Electric Corporation

- 7.1.4 Omron Corporation

- 7.1.5 Pilz GmbH & Co. KG

- 7.1.6 ABB Limited

- 7.1.7 Honeywell International Inc.

- 7.1.8 Siemens AG

- 7.1.9 Keyence Corporation

- 7.1.10 IDEC Corporation

- 7.1.11 Sick AG

- 7.1.12 Banner Engineering