|

市場調查報告書

商品編碼

1642173

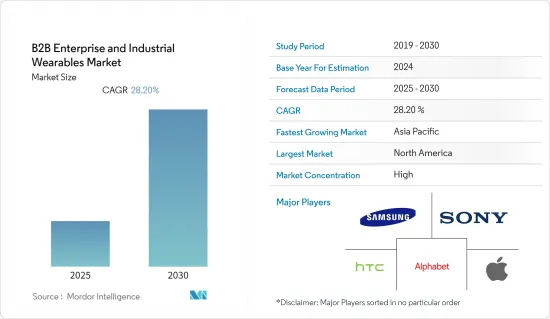

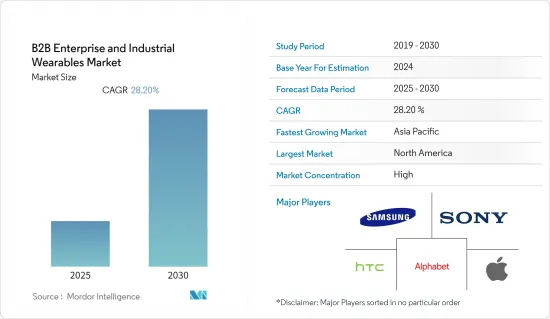

B2B 企業和工業穿戴裝置:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)B2B Enterprise & Industrial Wearables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,B2B 企業和工業穿戴式裝置市場預計複合年成長率為 28.2%

關鍵亮點

- 企業穿戴式裝置市場尚處於起步階段,旨在改善客戶體驗的應用佔據很大佔有率。穿戴式裝置被廣泛用於存取即時客戶資料、查看業務分析、提供身臨其境型客戶體驗、營運工廠、培訓等。

- 全球企業 IT 組織現在已經意識到穿戴式裝置的好處,並因此正在開發為企業大規模自動化部署現代應用程式的方法。行動應用程式可以幫助您建立忠誠的基本客群並提供有見地的客戶資料。企業需要了解這些應用程式如何增強他們的 CX,尤其是當他們與客戶和業務夥伴保持密切關係時。

- 對智慧工廠設置的需求將有助於穿戴式裝置市場的成長。世界各國政府都意識到創新製造技術的巨大潛力。因此,預計政府將支持和資助工業物聯網等技術的研究和開發,並成為該技術的潛在採用者和私人公司。他們正在資金上支持新的物聯網計劃和實施,以建立和運行智慧工廠設定。

- 目前,技術障礙包括延長受電池壽命和其他電源限制的操作時間,平衡高速資料傳輸(用於即時操作)與低功耗、輕量化設計和生物相容性。資料隱私問題可能會減緩穿戴式裝置在 B2B 環境中的採用,因為敏感資料會透過穿戴式裝置的網路進行傳播。

- COVID-19 疫情對穿戴式裝置市場產生了重大影響。 NFC 晶片和 RFID 標籤等關鍵零件面臨供應鏈中斷。不過,後疫情時代的市場表現積極,加速了數位經濟的崛起,特別是智慧型手錶等穿戴式裝置。

B2B 企業與工業穿戴式裝置市場趨勢

智慧工廠設定的需求預計將推動穿戴式裝置的成長

- 由於零件成本的穩定下降和從消費領域吸取的經驗推動的功能不斷增強,工業穿戴式裝置的普及程度越來越高。工業穿戴裝置可提高效率、改善安全性、縮短溝通環節、加速新員工入職和培訓流程,並允許遠距專家討論技術問題。

- 不幸的是,培訓本質上是非常不干涉的,特別是在製造業。缺乏經驗可能導致嚴重的設備損壞、人員受傷以及性能不佳。透過利用穿戴式技術,雇主可以使這個古老的流程變得現代化和有效率。例如,通用汽車使用擴增實境(AR)眼鏡谷歌眼鏡為員工提供獨特且改進的培訓流程。

- 根據國際勞工組織 (ILO) 的數據,每 15 秒就有 151 名工人遭遇工作事故。國際勞工組織進一步透露,全球每年至少有3.17億工人遭受非致命的職業傷害。穿戴式和嵌入式感測器可用於追蹤工人,以防止因跌倒、重型機械和過度勞累而受傷。未來,製造業可望利用物聯網和聯網機器的興起,使職場更加安全。擴增實境(AR)智慧眼鏡有望成為製造業的下一個大熱點。

- IBM 正在與全球建築業鋼鐵製造商 North Star BlueScope Steel 合作開發一個認知平台,幫助員工在職場中更加安全。該系統採用IBM Watson IoT作為穿戴式安全技術。作為 IBM 員工健康與安全解決方案的一部分,該技術從嵌入在頭盔和腕帶中的感測器收集資料,對其進行分析並向員工及其經理提供即時警報。

- 用於免持指導和通訊的穿戴式設備是該技術的一個明確而實際的應用。例如,石油天然氣和汽車工人經常需要記錄複雜的指令。此類培訓沒有審核追蹤,因此從紙上不容易知道是否正確遵循了說明。 Intoware 目前的軟體產品 WorkfloPlus 使用各種裝置(穿戴式裝置、智慧型手機、平板電腦等)上的應用程式為員工提供可靠的資訊,表明流程已正確執行。

北美預計將佔據 B2B 企業和工業穿戴式裝置的主要市場佔有率

- 由於技術採用率的提高、網際網路普及率的提高以及政府在研究方面的投入推動了軍事等高階用途技術的開發,預計北美將佔據 B2B 企業和工業穿戴式設備最大的市場佔有率。

- 北美有幾家強大的市場參與企業以低價提供穿戴式設備,讓消費者負擔得起。許多國際參與企業將穿戴式裝置的製造和組裝外包給該地區的本地製造商,並進行相應的品牌推廣。美國和加拿大是家用電子電器產品普及率最高的國家。例如,在美國,BMW使用智慧眼鏡進行車輛檢查和品質保證。該公司已經實施了基於檢查的系統,允許檢查員資料照片和影片來記錄製造品質中的潛在偏差。 BMW能夠消除紙質的品質保證檢查,簡化審查並提供更多與帳單相關的背景資訊。

- 穿戴式裝置製造商不斷創新穿戴式裝置以獲得競爭優勢。一些製造商正在將 NFC 技術融入穿戴式裝置以實現付款功能。此外,生活水準的提高也推動了該地區對穿戴式裝置的需求。

- 據思科稱,在美國,網路用戶總數預計將從 2022 年的 3.07 億(佔人口的 92%)成長到 2023 年的 3.27 億(佔人口的 94%)。到 2022年終,預計 32% 的連網裝置將實現行動連線,從而推動穿戴式裝置的需求。

- 科學家正在將物聯網應用於生物識別穿戴式設備和整合戰鬥裝備,幫助士兵識別敵人並在戰鬥中表現更好,並使用邊緣運算為設備和武器系統提供情報。未來是預計將是高科技。美國實驗室最近向戰場物聯網發展智慧目標驅動網路研究聯盟(IoBT REIGN)撥款 2,500 萬美元,用於開發新的戰場預測分析。美國政府是此類技術的最大投資者和消費者之一。

B2B 企業與工業穿戴裝置產業概覽

B2B 企業和工業穿戴裝置市場正在整合,少數參與企業佔據市場主導地位。但是,隨著降低成本技術的普及以及勞動密集型服務領域應用的擴大,市場規模預計還會擴大。因此,我們預計未來將有多個參與企業該市場。

2022 年 5 月,B2B 獨角獸 Zetwerk 在諾伊達開設了一家最先進的 ODM(目的地設計製造商)工廠,用於生產可聽設備、穿戴式設備和 IoT(物聯網)設備。諾伊達工廠佔地 50,000 平方英尺,包含 16 條配備先進測試儀的生產線和一個用於產品開發的創新實驗室。

此外,2022年1月,主要企業的視覺AI軟體公司Neurala宣布推出旨在改善智慧工廠品質檢測的新型檢測技術。製造商努力透過創新的解決方案和技術來最佳化其智慧生產線。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 不斷發展的應用生態系統將推動企業採用

- 智慧工廠需求可望推動穿戴式裝置的成長

- 市場限制

- 缺乏商業用途是穿戴式裝置普及的一大挑戰

- 長期以來對資料安全和現有技術整合問題的擔憂

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響

第5章 市場區隔

- 依設備類型

- HMD

- 腕戴式裝置(智慧型手錶、健身帶)

- 商務智慧眼鏡

- 智慧服裝和身體感應器

- 穿戴式相機

- 其他設備類型

- 按最終用戶產業

- 資訊科技/通訊

- 醫療

- 零售

- 保險

- 製造業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭格局

- 公司簡介

- Oculus VR LLC(Facebook)

- Alphabet Inc.

- Samsung Electronics Co. Ltd

- Sony Corporation

- HTC Corporation

- Apple Inc.

- Fitbit Inc.

- Xiaomi Inc.

- Seiko Epson Corporation

- Microsoft Corporation

- Texas Instruments Inc.

- Toshiba Corporation

第7章投資分析

第8章 市場機會與未來趨勢

The B2B Enterprise & Industrial Wearables Market is expected to register a CAGR of 28.2% during the forecast period.

Key Highlights

- The wearables market in an enterprise setup is in its infancy, with a significant share of the applications designated to enhancing customer experience. Wearables are extensively used to access customer data in real-time, view business analytics, and produce immersive customer experiences, factory operations, and training.

- Global enterprise IT organizations have now recognized the benefits of wearables, thereby developing and providing businesses with a way to automate the deployment of modern applications at scale, which drives the demand for enterprise adoption with the growing mobile app ecosystem. Mobile apps can build loyal customer bases, provide insightful customer data, and more. Businesses should understand how these apps can enhance CX, especially if they maintain close contact with customers or business partners.

- The demand for smart factory setups aids the growth of the wearables market. Governments worldwide are becoming aware of the significant potential of innovative manufacturing technologies. Therefore, they support and fund R&D for technologies such as IIoT and expect to become potential adopters of the technology and private firms. They financially support new IoT projects and implementations to build and run smart factory setups.

- Technical obstacles such as longer operating times, which are currently constrained by battery life and the limitations of other power sources, the balance between faster data transmission (for real-time operations) and low power consumption, weight reduction, and biocompatibility are expected to hinder the growth of B2B wearables. Data privacy concerns may slow the adoption of wearables in the B2B setup, where sensitive data is circulated through a network of wearables.

- The COVID-19 pandemic highly impacted the wearables market. The global prices of consumer electronics witnessed a rise initially owing to the partial clampdown on manufacturing facilities; critical components such as NFC chips and RFID tags faced a slowdown in their supply chain. However, the market was positively impacted post-pandemic, accelerating the rise of the digital economy, particularly wearable devices such as smartwatches.

B2B Enterprise & Industrial Wearables Market Trends

Demand for Smart Factory Setups are Expected to Aid Growth of Wearables

- Industrial wearables are being increasingly used due to the steady decline in component costs and improvements in functionality driven by learnings from the consumer sector. Industrial wearables increase efficiency, improve safety, shorten communication loops, accelerate onboarding and training processes, and enable remote experts to discuss technical issues.

- Unfortunately, training is very hands-off by nature, especially in the manufacturing sector. This is because inexperience can lead to severe equipment damage, injuries, or poor performance. Employers can leverage wearable technology to make this age-old process modern and efficient. General Motors, for instance, leveraged Google Glass, an augmented reality glass, to provide a unique, improved training process for its employees.

- According to the International Labor Organization, every 15 seconds, 151 workers have a work-related accident. ILO further divulged that yearly, at least 317 million workers have non-fatal occupational accidents worldwide. With wearable and embedded sensors, workers can be tracked to prevent injury from falls, heavy machinery, or overexertion. In the future, manufacturing units are expected to leverage the rise of IoT and connected machinery to make workplaces safer. Smart glasses with Augmented Reality (AR) are expected to be the next big thing in manufacturing facilities.

- IBM is working with North Star BlueScope Steel, a global building and construction industry steel producer, to develop a cognitive platform to ensure employees stay safer at workplaces. The system uses IBM Watson IoT for wearable safety technology. The technology, a part of the IBM Employee Wellness and Safety Solution, gathers data from sensors embedded in helmets and wristbands and analyzes it to alert employees and their managers in real time.

- Wearable devices for hands-free instructions and communication is a straightforward, practical application of the technology. For instance, oil, gas, and automotive workers often need to give complicated, documented instructions. Since there is no audit trail for these kinds of education, with paper, it is not easy to know whether instructions have been followed correctly or not. The software product that Intoware now has, WorkfloPlus, allows employees to use apps on different devices (wearables, smartphones, tablets, etc.) to provide reliable information to show that a process has been followed properly.

North America is Expected to hold the Major Market Share for B2B and Industrial Wearables

- North America is expected to hold the largest market share for B2B & Industrial Wearables because of the adoption of the technology, penetration of the internet, and government expenditure on research leading to the development of technology for high-end applications like the military.

- North America has the presence of prominent market players who offer wearable devices at a low price, making them affordable for customers. Many international players get their wearable devices manufactured and assembled by local manufacturers based in the region and then brand their names. The US and Canada account for the high adoption rate of consumer electronics. For instance, in the United States, BMW has been using smart glasses for inspection checking and quality assurance of its cars. The company's pilot allowed inspectors to take data through photos and videos to document potential deviations in production quality, allowing BMW to get rid of paper-based quality assurance checks, making the reviews efficient, and providing more contextual information related to the statements.

- Wearable device manufacturers continuously innovate their wearable devices to attain a competitive advantage. Several manufacturers have integrated NFC technology into their wearable devices to enable payment functionalities. Also, the improved standard of living has led to a growing demand for wearable devices in this region.

- According to CISCO, in the United States, there are expected to be 327 million total Internet users (94% of the population) by 2023, up from 307 million (92% of the population) in 2022. 32% of all networked devices are expected to be mobile-connected by the end of 2022, which drives the demand for the Wearables Market.

- The future of military combat is expected to be high-tech as scientists use the Internet of Things for combat gear integrated with biometric wearables to help soldiers identify the enemy, perform better in battle, and access devices and weapons systems using edge computing. The United States Army Research Lab recently awarded USD 25 million to the Alliance for the Internet of Battlefield Things Research on Evolving Intelligent Goal-driven Networks (IoBT REIGN) to develop new predictive battlefield analytics. The US Govt remains one of the largest investors and consumers of such technology leading to the proliferation of technology in the region.

B2B Enterprise & Industrial Wearables Industry Overview

The B2B Enterprise & Industrial Wearables Market is consolidated, with a few players dominating the market. However, the proliferation of the technology that will reduce its cost and its increased applications in the labor-intensive service sector is expected to increase the market size. This is expected to attract several players into this market in the future.

In May 2022, B2B unicorn Zetwerk commissioned a state-of-the-art original design manufacturing (ODM) facility for hearables, wearables, and IoT (internet of things) devices in Noida. The Noida facility is spread over 50,000 square feet and comprises 16 manufacturing lines with advanced testers and an innovation lab for product development.

Additionally, in January 2022, Neurala, a leading vision AI software company, announced the launch of its new detection technology aimed at improving quality inspection at smart factories. Manufacturers strive to optimize their smart manufacturing lines via innovative solutions and technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing App Ecosystem Will Fuel Enterprise Adoption

- 4.2.2 Demand for Smart Factory Setups are Expected to Aid Growth of Wearables

- 4.3 Market Restraints

- 4.3.1 Lack of Business Applications is a Primary Challenge in Deploying Wearables

- 4.3.2 Perennial Concerns about Data Security and Existing Tech Integration Issues

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Device Type

- 5.1.1 HMDs

- 5.1.2 Wrist Wears (Smart Watch and Fitness Bands)

- 5.1.3 Enterprise Smart Glass

- 5.1.4 Smart Clothing and Body Sensors

- 5.1.5 Wearable Cameras

- 5.1.6 Other Device Types

- 5.2 By End-user Industry

- 5.2.1 IT and Telecom

- 5.2.2 Healthcare

- 5.2.3 Retail

- 5.2.4 Insurance

- 5.2.5 Manufacturing

- 5.2.6 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oculus VR LLC (Facebook)

- 6.1.2 Alphabet Inc.

- 6.1.3 Samsung Electronics Co. Ltd

- 6.1.4 Sony Corporation

- 6.1.5 HTC Corporation

- 6.1.6 Apple Inc.

- 6.1.7 Fitbit Inc.

- 6.1.8 Xiaomi Inc.

- 6.1.9 Seiko Epson Corporation

- 6.1.10 Microsoft Corporation

- 6.1.11 Texas Instruments Inc.

- 6.1.12 Toshiba Corporation