|

市場調查報告書

商品編碼

1642182

密度計 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Density Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

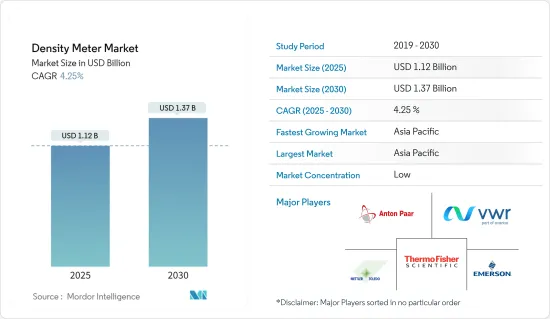

密度計市場規模預計在 2025 年為 11.2 億美元,預計到 2030 年將達到 13.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.25%。

關鍵亮點

- 密度計市場的成長歸因於智慧工廠的發展以及對各種生產過程中使用的流體密度的精確測量的需求不斷成長。此外,美國和歐洲國家政府對排放控制的嚴格規定也推動了市場的成長。

- 涵蓋整個生產過程的全面品質保證對於任何工業活動至關重要。密度測量在化學、製藥、石化和食品飲料行業尤其常見。密度測量使製造商能夠以多種方式分析原料、半成品、最終產品和生產過程。

- 例如,在化工廠中,出於多種原因,密度計用於測量一般散裝化學品、特殊化學品和專有產品。使用密度計測量酸、腐蝕劑、溶劑、樹脂、漿液、聚合物、合成橡膠等。此外,也測量純化學品和溶液。

- 此外,快速的工業化以及水處理技術的進步也對液體密度計的需求起著至關重要的作用。用水和污水行業的高成長和技術創新使得易於維護和操作的實驗室設備的需求增加。這導致超音波液體密度計的需求大幅增加。此外,密度計在塑膠和橡膠工業中的廣泛應用也創造了成長機會。

密度計市場趨勢

石油和天然氣產業佔很大市場佔有率

- 石油和天然氣是一個廣泛的行業,涵蓋許多流程和應用。這些大致分為基本類別:探勘、開採、生產、加工、分配和運輸。大多數應用涉及監測各種目的運輸的石油和天然氣的密度。

- 石油和天然氣產業是密度計最大的終端用戶之一。在石油和天然氣工業中,密度計用於下游工藝,在生產之前測量精製樣品的精製和評估程度。此外,密度計也用於各種應用領域,例如油輪和鐵路車輛裝卸碼頭的產品識別、多產品管道、生產過程中的產品品管以及飛機用油應用中的品質測量。

- 隨著工業化進程的加速和對能源資源的需求,石油和天然氣產業也不斷擴張。例如,根據國際能源總署(IEA)的數據,亞太地區是世界上最大的天然氣進口地區和消費量。光是中國就佔了世界天然氣需求的三分之二。

- 此外,製程工業依靠技術設備來保持原料的一致性和質量,其中密度計起著至關重要的作用。石油和天然氣生產行業被迫加快生產速度,增加了對機械和測試設備(包括密度計)的需求,這將推動市場成長。

- 石油和天然氣產業是密度計的主要終端用戶之一。主要市場需求來自下游石油和天然氣產業。工廠和精製等下游設施在生產前會測試樣品的純度,以確保安全且有效率的運作。

- 根據OPEC預計,2023年包括生質燃料在內的全球原油需求量將達到1.0221億桶/日。預測顯示,經濟活動的活性化可能使石油需求在年終飆升至每天 1.04 億桶以上。

亞太地區成長強勁

- 亞太地區由於工業化進程迅速,是密度計的潛在市場之一。過程自動化產業也有望利用亞太地區的各種機會。印度得益於其政治和全球改革,預計將在未來幾年為流程自動化產業提供更多機會。

- 據印度品牌資產基金會稱,2022 年 5 月,印度石油天然氣公司宣布計劃在 22-25 會計年度期間投資 40 億美元,加強其在印度的探勘活動。預計到 2045 年印度的石油需求將成長一倍,達到每天 1,100 萬桶。

- 到2050年,亞太地區對石油產品的需求預計將成長到每天3,880萬桶。石油產品需求的增加是由於該地區的快速發展,特別是印度、中國、印尼和日本等國家。

- MOSPI的數據顯示,化肥產業是印度最大的天然氣消費產業,佔2023會計年度總消費量的32%。石化、海綿鐵產業以及化肥產業佔同年印度天然氣非能源消費量的37%左右。

- 此外,亞太地區食品飲料和製藥公司的數量不斷增加,並致力於擴大其在亞太地區的業務和製造部門,預計將極大地推動對密度計的需求。此外,政府在用水和污水處理行業的主導對於亞太密度計市場的發展至關重要。

密度計行業概況

全球密度計市場競爭激烈。市場參與企業,有大有小,市場集中度較高。所有主要參與者都擁有相當大的市場佔有率,並致力於擴大全球消費群。

市場的主要企業包括 ABB、Azbil Corporation、Endress+Hausar AG、艾默生電氣公司、東芝公司和霍尼韋爾國際公司。為了在預測期內獲得競爭優勢,公司正在建立多種夥伴關係並投資推出新產品以增加市場佔有率。

2023 年 2 月,安東帕開發了 Modulyzer 香精香料,這是一種新型分析系統,結合了密度計、旋光儀和屈光以及自動化選項,可提供有關香精香料行業物質的全面資訊。一個測量週期。品管領域的使用者可以透過各種功能享受成本節約的好處,例如每次測量只需要 10 毫升樣品,並且測量後可以回收並重複使用樣品。此外,透過與 Anton Paar 的實驗室運行軟體 AP Connect 整合,您可以直接從桌上型電腦收集、檢視和分類測量資料。

2022年3月,數位密度計現在已應用於製藥業的品管、研究和開發。賽默飛世爾科技和 Symphogen 擴大了合作,以改善資料工作流程,支持新癌症治療方法的發現和開發。兩家公司正在為生物製藥發現和開發實驗室提供創新工具和簡化的工作流程,以有效表徵複雜的治療性蛋白質。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對密度計市場的影響

第5章 市場動態

- 市場促進因素

- 工業化的擴張

- 嚴格監管食品品質和安全

- 市場問題

- 密度測量設備的精度與成本權衡

第6章 市場細分

- 按類型

- 桌面型

- 模組

- 可攜式的

- 按應用

- 科里奧利

- 核能

- 超音波

- 微波

- 重力

- 按最終用戶產業

- 用水和污水

- 化學

- 採礦和金屬加工

- 飲食

- 醫療和製藥

- 電子產品

- 石油和天然氣

- 其他終端用戶產業(電力和公共產業、研究)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Anton Paar GmbH

- Mettler-Toledo International Inc.

- VWR International(Avantor)

- Berthold Technologies GmbH & Co.KG

- Emerson Electric Co.

- Red Meters LLC

- Schmidt+Haensch GmbH & Co.

- Thermo Fisher Scientific

- RUDOLPH RESEARCH ANALYTICAL

- Rhosonics Analytical BV

- KRUSS Optronic GmbH

- Ametek Inc.

- Yokogawa Electric Corporation

- Koehler Instrument

- Toshiba Infrastructure Systems & Solutions Corporation

第8章投資分析

第9章:市場的未來

The Density Meter Market size is estimated at USD 1.12 billion in 2025, and is expected to reach USD 1.37 billion by 2030, at a CAGR of 4.25% during the forecast period (2025-2030).

Key Highlights

- The growth of the density meter market can be attributed to smart factories' development and the increased demand to accurately measure the density of the fluids used in or during various production processes. Also, the stringent government regulations in the United States and European countries to regulate emissions drive market growth.

- A comprehensive quality assurance covering the entire production process is essential in any industrial operation. Density measurements are commonly used for this purpose, especially in the chemical, pharmaceutical, petrochemical, and food & beverage industries. They allow the manufacturer to analyze raw materials, semi-finished and finished products, and the manufacturing steps regarding several factors.

- For instance, in chemical plants, a density meter is used for many reasons for the common bulk chemicals and the specialty and proprietary products. Acids, caustics, solvents, resins, slurries, polymers, elastomers, and more are measured using a density meter. Furthermore, pure chemicals and solutions are also measured.

- Also, rapid industrialization, in line with the technological advancement in water treatment technology, plays an essential role in the demand for liquid density meters. High growth and innovation in the water and wastewater industry create the need for a simple laboratory device to maintain and operate. Because of this, the demand for ultrasonic liquid density meters increased significantly. Further, growing applications of density meters in the plastics and rubber industry create growth opportunities.

Density Meter Market Trends

Oil and Gas Industry to Hold Significant Market Share

- Oil and gas is a wide-ranging industry encompassing many processes and applications. Some of these might be roughly grouped into basic categories: exploration, extraction, production, processing, distribution, and transportation. Most applications include monitoring the density of oil and gases transported for various purposes.

- The oil and gas sector is one of the largest end-users of density meters. In the oil and gas industry, density meters are utilized in downstream processes, wherein purification and assessment of the purified sample are measured before manufacturing. Also, the dense meter is used in various application sectors such as tanker truck and railcar loading stations, product identification on multi-product pipelines, product quality control in the production process, and mass measurement in aircraft refueling applications.

- The oil and gas industry is expanding with the growth of industrialization and the demand for energy resources. For instance, according to the International Energy Agency, the Asia-Pacific region was the highest importer and consumer of natural gas. China alone accounted for two-thirds of the demand for natural gas globally.

- Moreover, the process industries depend on technical equipment to maintain uniformity and quality throughout the crude material, wherein the density meter plays an important role. The transition would force the oil and gas production sector to accelerate the production rate, increasing demand for machinery and testing equipment, including density meters, thereby driving the market's growth.

- The oil and gas sector is one of the key end users of density meters. The primary market demand comes from the downstream sector of oil and gas. The purity of the sample is measured before manufacturing to ensure operational safety and efficiency in downstream facilities, such as plants and refineries.

- According to OPEC, in 2023, global crude oil demand, inclusive of biofuels, stood at 102.21 million barrels per day. Forecasts anticipate a rise in economic activity, projecting a potential surge in oil demand to over 104 million barrels per day by year-end.

Asia-Pacific to Witness Significant Growth

- The increasing industrialization in Asia-Pacific makes the region one of the potential markets for density meters. The process automation industry is also expected to avail of various opportunities in Asia-Pacific. India is expected to provide more opportunities for the process automation industry in the coming years because of its political and global reformation.

- According to the India Brand Equity Foundation, in May 2022, ONGC announced plans to invest USD 4 billion from FY22-25 to increase its exploration efforts in India. The oil demand in India is projected to register a 2 times growth to reach 11 million barrels per day by 2045.

- The Asia-Pacific's oil product demand by 2050 is expected to rise to 38.8 million b/d. The increased demand for oil products can be ascribed to the rapid development in the region, particularly in countries such as India, China, Indonesia, and Japan.

- According to MOSPI, the fertilizer industry is India's largest natural gas consumer, accounting for 32 percent of total consumption in the financial year 2023. The petrochemical and sponge iron sectors along with the fertilizer industry is approximatly 37 percent of India's non-energy consumption of natural gas that year.

- Further, owing to the increase in the number of food & beverage and pharmaceutical companies in Asia-Pacific and the focus on expanding the operations & manufacturing units across different parts of Asia-Pacific, the demand for density meters is predicted to grow substantially. Moreover, the water and wastewater treatment industry's government initiative is vital in developing the density meter market across the Asia-Pacific region.

Density Meter Industry Overview

The global density meter market is very competitive. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world.

Some of the significant players in the market are ABB Ltd, Azbil Corporation, Endress+Hausar AG, Emerson Electric Corporation, Toshiba Corporation, Honeywell International Inc., and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

In February 2023, Modulyzer Flavour and Fragrance is a new analytical system developed by Anton Paar that combines density meters, polarimeters, and refractometers with an automated option to provide comprehensive information - in a single measurement cycle - on substances in the flavor and fragrance industry. Users in the quality control field can benefit from cost-reduction opportunities due to a variety of features, such as the requirement for only 10 ml sample per measurement and the ability to recover and reuse samples after a measurement. Additionally, the system can be integrated with AP Connect - Anton Paar's lab execution software - to enable the collection, review, and categorization of measurement data directly from a desktop computer.

In March 2022, digital density meters were used in the pharmaceutical industries for quality control, research, and development. Thermo Fisher and Symphogen have extended the collaboration involving improved data workflow, which supports the discovery and development of new cancer treatments. The companies provide biopharmaceutical discovery and development laboratories with innovative tools and streamlined workflows to characterize complex therapeutic proteins efficiently.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Density Meter Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Expansion in Industrialization

- 5.1.2 Stringent Regulations with Regard to Food Quality and Safety

- 5.2 Market Challenges

- 5.2.1 Tradeoff Between the Accuracy and Cost of the Density Meter Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Benchtop

- 6.1.2 Module

- 6.1.3 Portable

- 6.2 By Application

- 6.2.1 Coriolis

- 6.2.2 Nuclear

- 6.2.3 Ultrasonic

- 6.2.4 Microwave

- 6.2.5 Gravitic

- 6.3 By End-user Industry

- 6.3.1 Water and Wastewater

- 6.3.2 Chemicals

- 6.3.3 Mining and Metal Processing

- 6.3.4 Food and Beverage

- 6.3.5 Healthcare and Pharmaceuticals

- 6.3.6 Electronics

- 6.3.7 Oil and Gas

- 6.3.8 Other End-user Industries (Power and Utilities, Research)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Anton Paar GmbH

- 7.1.2 Mettler-Toledo International Inc.

- 7.1.3 VWR International (Avantor)

- 7.1.4 Berthold Technologies GmbH & Co.KG

- 7.1.5 Emerson Electric Co.

- 7.1.6 Red Meters LLC

- 7.1.7 Schmidt + Haensch GmbH & Co.

- 7.1.8 Thermo Fisher Scientific

- 7.1.9 RUDOLPH RESEARCH ANALYTICAL

- 7.1.10 Rhosonics Analytical BV

- 7.1.11 KRUSS Optronic GmbH

- 7.1.12 Ametek Inc.

- 7.1.13 Yokogawa Electric Corporation

- 7.1.14 Koehler Instrument

- 7.1.15 Toshiba Infrastructure Systems & Solutions Corporation

![密度計市場:趨勢、機遇、競爭分析 [2023-2028]](/sample/img/cover/42/1300033.png)