|

市場調查報告書

商品編碼

1642193

雷達液位傳送器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Radar Level Transmitter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

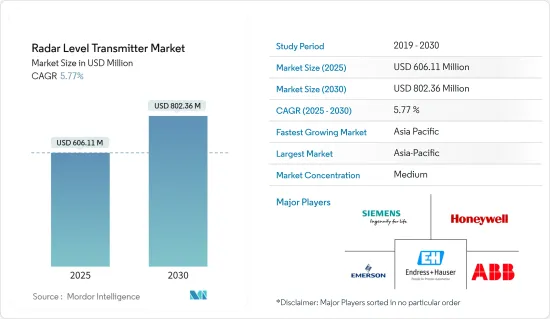

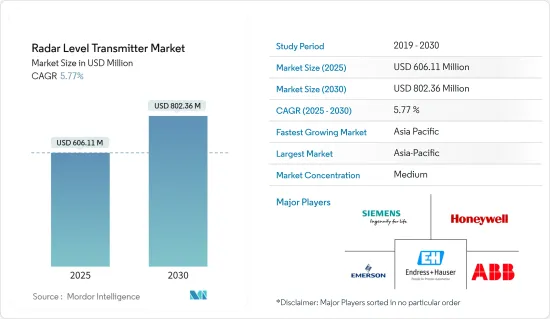

雷達液位傳送器市場規模預計在 2025 年為 6.0611 億美元,預計到 2030 年將達到 8.0236 億美元,預測期內(2025-2030 年)的複合年成長率為 5.77%。

由於一些供應商僅向食品業提供雷達液位變送器和服務,因此冠狀病毒的影響因供應商而異。相較之下,有些供應商只專注於石油和天然氣領域。如今,食品相關製造業已被視為一項基本服務,從事食品加工的供應商受益最多。然而,從供應方面來看,由於供應鏈中斷,供應商面臨零件採購問題。

主要亮點

- 液位測量技術廣泛應用於許多領域,包括建築、工業、污水、製造業和石油和天然氣。雷達液位測量是基於計算從感測器到被感測物位之間的行程所需的時間。

- 儘管雷達液位傳送器的性能多年來一直在不斷改進,但其成本並沒有以相同的速度增加。它也比其他一些液位測量技術更實惠。但該產品的經濟效益不僅限於投資回報率(ROI)。由於建立新水準技術所需的專業知識較少,安裝和運作成本也大幅下降。

- 數位訊號處理和雷達組件設計的顯著改進使得非接觸式和接觸式雷達能夠用於更廣泛的應用範圍,同時降低成本。對於一些雷達液位變送器來說,運作頻率正在轉移到W波段。在這個頻譜內,工作頻率為 78GHz 至 80GHz 及以上的設備比其他頻率的設備更為普遍。

- 對於最終用戶來說,運作頻率不應該是重點。此外,更高的頻率使得安裝方面具有前所未有的靈活性。因此,不需要修改安裝儀器的製程連接。較高頻率的另一個優點是儀器訊號比在 C 波段運作的儀器發出的訊號窄得多。

雷達液位傳送器市場趨勢

接觸式(導波雷達)技術佔據最大市場佔有率

- 雷達發射器在介電常數不同而導致電反射的應用上可能會遇到困難。丙烷或液化天然氣等導電性較差的物質可能會導致訊號反彈較弱。這正是 GWR 發揮作用的地方。 GWR 將能量聚焦在桿下,從而改變介電常數,提供以前看不見的測量結果。

- 訊號強度和效率的大大提高意味著 GWR 現在可以用於鍋爐級應用。透過感測器、微處理器和安裝方面的創新,新的 GWR 設計讓您更接近測量過程。高溫應用以前依靠壓力儀器來指示水平,但雷達和 GWR 的逐步改進意味著它們現在可以在這些環境中使用。

- 這種不準確性可能導致殘留物,造成關鍵鍋爐零件和渦輪葉片的塗層,或過度排污,浪費能源。為了確保每次操作過程中蒸氣鼓中的液位測量準確,使用者已經遷移到直接測量液位的 液位傳送器,因為該技術不受製程介質性質變化的影響。

- 公司正在致力於產品創新以克服這項挑戰。例如,Mangetrol International 開發了一種創新的探頭設計,將取得專利的自動蒸氣補償 (ASC) 與新的冷凝控制技術 (CCT) 結合。具有 CCT 的新型蒸汽探頭可消除冷凝引起的不準確性,並使您獲得最佳性能。羅斯蒙特提供基於 GWR 技術的 5300液位傳送器。此傳送器適用於液體、漿體和固體的複雜測量,為液位和介面應用提供現代化的可靠性和安全性功能。

亞太地區佔最大市場佔有率

- 由於化學、石化和採礦業已建立的工業基礎,亞太地區的雷達液位傳送器市場預計將以顯著的速度成長。隨著這些國家經濟的快速成長和大規模都市化,中國和印度為提供雷達液位傳送器的公司提供了令人興奮的機會。

- 除了各大廠商的產品以外,國內廠商的產品也不斷增加。例如,印度浦那的 SBEM Pvt. 有限公司提供非接觸式、連續脈衝雷達液位傳送器系列 138,用於指示散裝固體和液體的液位。

- 化工、石化、食品和飲料行業正在關注該地區的發展。這些耗水密集型的產業需要處理設施,預計將對所研究的市場產生更大的需求。此外,該地區的新興國家正在經歷都市化進程的加速,為現有的用水和污水基礎設施帶來越來越大的壓力。這推動了對水位監測解決方案的需求,以提高資產效率並實現節水目標。

雷達液位傳送器產業概況

全球雷達液位傳送器市場中等分散。市場上的公司正在利用策略合作計劃來提供專業產品、擴大市場佔有率並提高盈利。進入市場的公司也在與新興企業進行併購,這可以幫助他們改善其雷達液位傳送器市場產品組合併增強其產品能力,從而提供有利可圖的擴張機會。最近的市場發展趨勢包括:

- 2020 年 12 月 - AMETEK Drexelbrook 透過推出用於 Impulse GWR 的大型同軸感測器,擴展了其導波雷達、液位測量產品線。新型 1.66 英吋直徑探頭即使在高黏度流體中也能提供可靠的精度。 Impulse GWR 的新型同軸感測器選項可讓材料在與黏性流體一起使用時輕鬆流出探頭。

- 2021 年 3 月-AMETEK 宣布已完成三家公司的收購:Magnetrol International、Crank Software 和 EGS Automation (EGS)。該公司在這些收購中投資了約 2.7 億美元,總合年銷售額約為 1.2 億美元。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- COVID-19 對市場的影響

- 市場促進因素

- 用水和污水產業對雷達液位傳送器的需求不斷增加

- 雷達液位傳送器具有高可靠性、準確性和穩定性

- 市場挑戰

- 與測量精度和高成本相關的技術挑戰

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按技術領域

- 聯絡方式(導波雷達)

- 非接觸式方法(自由空間雷達)

- FMCW 雷達

- 脈衝雷達

- 按應用

- 液體、漿體、界面

- 固體的

- 按最終用戶產業

- 石油和天然氣

- 飲食

- 用水和污水

- 化工和石化

- 金屬與礦業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭格局

- 公司簡介

- Siemens AG

- Emerson Electric Co.

- Endress+Hauser Management AG

- ABB Limited

- Honeywell International Inc.

- VEGA Grieshaber KG

- Krohne Messtechnik

- Yokogawa Electric Corporation

- Ametek Inc.

- Magnetrol International Inc.

- Schneider Electric SE

- Pepperl+Fuchs Pvt. Ltd

- Automation Products Group Inc.

- Nivelco Process Control Corp.

- Matsushima Measure Tech Co. Ltd

第7章投資分析

第 8 章:市場的未來

The Radar Level Transmitter Market size is estimated at USD 606.11 million in 2025, and is expected to reach USD 802.36 million by 2030, at a CAGR of 5.77% during the forecast period (2025-2030).

Coronavirus's impact has not been the same on the vendors since some of them offer and service radar-level transmitters only for the food sector. In contrast, others provide only for the oil & gas sector. Nowadays, vendors who cater to food processing are most profitable since the manufacturing of food-related items has been deemed under essential services, and those facilities have been working extra hours to fulfill the demand. However, from the supply side, the vendors face issues procuring the components due to disruption in the supply chain

Key Highlights

- Level measurement technology is widely used across many sectors such as construction, industrial, wastewater, manufacturing, oil, and gas, among others. Radar level measurement is based on calculating the time required for completion of the trip between the transducer and the sensed material level.

- The performance of radar level transmitters has improved over the last few years, but their costs haven't increased at a similar rate. They have become more affordable compared to several other level measurement technologies. However, the product's economic benefit isn't limited to return on investment (ROI) also. As the expertise required to set up newer level technologies has decreased, installation and operations costs have even gone down significantly.

- For both non-contacting or contacting radar, significant improvements in digital signal processing and radar component design have allowed them to handle a broader range of applications even as the price has dropped. In the case of some radar level transmitters, the operating frequency has moved to the W band. Within this frequency spectrum, instruments operating from 78 GHz to over 80 GHz are now more popular than other variants.

- To an end-user, the focus should not be the operating frequency because some level applications are better-suited for lower operating frequencies. Moreover, the higher frequency provides unprecedented flexibility in terms of installation. Thus, the need to retrofit the process connections where instruments are installed has decreased. Another benefit of higher frequency is the instrument signal is much narrower than the signal from instruments operating in the C band.

Radar Level Transmitter Market Trends

Contact System (Guided Wave Radar) Technology to Hold Maximum Market Share

- Radar transmitter can have a hard time in applications with different dielectric constants that cause electric reflectivity. If there is a material with low conductivity like propane or LNG, signals can bounce back weak. This is where GWR can help because it focuses energy down a rod, which shows changes in the dielectric constant, and allows readings that couldn't be seen before.

- The significant increase in signal strength and efficiency allows GWR to be used in boiler-level applications. Newer GWR designs have sensors, microprocessors and mounting innovations that enable them to get even closer to the process they're measuring. While high-temperature applications used to rely on pressure devices to indicate level, gradual improvement in radar and GWR are allowing them to also serve in these environments.

- For instance, in case of power and steam generation which undergo fast starts and cycling operations, dynamics in the steam drum rapidly change causing inaccuracies in traditional level measurement techniques that rely on pressure.This inaccuracy may lead to carryover which can cause coating of critical boiler components and turbine blades, or it may waste energy due to excessive blowdowns. To ensure accurate level measurement in the steam drum during all operations, users have moved towards GWR level transmitters to directly measure the level as this technology is not affected by changes in process media characteristics.

- Companies are working towards product innovations, which is helping to overcome this challenge. For instance, Mangetrol International Inc has developed an innovative probe design that includes new Condensation Control Technology (CCT) coupled with its original patented Automatic Steam Compensation (ASC). Th e new steam probe with CCT eliminates inaccuracies caused by condensation so that optimal performance can be achieved. Rosemount provides 5300 Level transmitter based on GWR technology. This transmitter is suitable for challenging measurements on liquids, slurries, and solids, providing modern reliability and safety features in level and interface applications.

Asia Pacific Occupies the Largest market Share

- The market for radar level transmitters in the Asia-Pacific region is anticipated to witness significant growth owing to the established base of industries, such as chemicals & petrochemicals and mining industries. Due to rapid economic growth and large-scale urbanization in these countries, China and India provide exciting opportunities for players offering radar-level transmitters.

- In addition to the products offered by the key players, the market is also witnessing the growth of product offerings from domestic players. For example, SBEM Pvt., Pune, India, Ltd has been offering non-contact, continuous Pulsed Radar-based Level transmitter series 138 for level indication of bulk solids & liquids.

- The chemicals and petrochemicals, food & beverages industries are observing development in the region. Water-intensive industries such as these require treatment facilities and are expected to generate greater demand for the market studied. Besides, the high rate of urbanization in emerging countries across the region has increased the pressure on existing water and wastewater infrastructure. This, in turn, has pushed the demand for level monitoring solutions, partly to improve asset efficiency and partly to meet water conservation goals.

Radar Level Transmitter Industry Overview

The global radar level transmitter market is moderately fragmented. The companies operating in the market are leveraging strategic collaborative initiatives to offer specialized products, increase their market share, and increase their profitability. The companies operating in the market are also into mergers and acquisitions of start-ups that help in improving the served market portfolio on radar level transmitters to strengthen their product capabilities, thus offering lucrative expansion opportunities. Some of the recent developments in the market are:

- December 2020 - AMETEK Drexelbrook expanded its guided wave radar, level measurement offering with the introduction of an enlarged coaxial sensor for The Impulse GWR. The new 1.66' diameter probe offers reliable accuracy within high viscosity liquids. The new coaxial sensor option for The Impulse GWR allows the material to easily flow off of the probe when used with viscous fluids.

- March 2021 - AMETEK announced that it had completed the acquisition of three companies, including Magnetrol International, Crank Software, and EGS Automation (EGS). The company spent nearly USD 270 million on these acquisitions, which have combined annual sales of approximately USD120 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Rising Demand for Radar Level Transmitters in the Water and Wastewater Industry

- 4.3.2 High Reliability, Precision, and Stability Offered by Radar Level Transmitters

- 4.4 Market Challenges

- 4.4.1 Technical Challenges Related to Accuracy in Measurements and High Cost

- 4.5 Industry Value Chain Analysis

- 4.6 Porters Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Contact System (Guided Wave Radar)

- 5.1.2 Noncontact System (Free Space Radar)

- 5.1.2.1 FMCW Radar

- 5.1.2.2 Pulsed Radar

- 5.2 Application

- 5.2.1 Liquids, Slurries, and Interfaces

- 5.2.2 Solids

- 5.3 End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Food and Beverages

- 5.3.3 Water and Wastewater

- 5.3.4 Chemicals and Petrochemical

- 5.3.5 Metals and Mining

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Emerson Electric Co.

- 6.1.3 Endress+Hauser Management AG

- 6.1.4 ABB Limited

- 6.1.5 Honeywell International Inc.

- 6.1.6 VEGA Grieshaber KG

- 6.1.7 Krohne Messtechnik

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 Ametek Inc.

- 6.1.10 Magnetrol International Inc.

- 6.1.11 Schneider Electric SE

- 6.1.12 Pepperl+Fuchs Pvt. Ltd

- 6.1.13 Automation Products Group Inc.

- 6.1.14 Nivelco Process Control Corp.

- 6.1.15 Matsushima Measure Tech Co. Ltd