|

市場調查報告書

商品編碼

1642197

瓦楞包裝和紙板箱:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Corrugated & Paperboard Boxes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

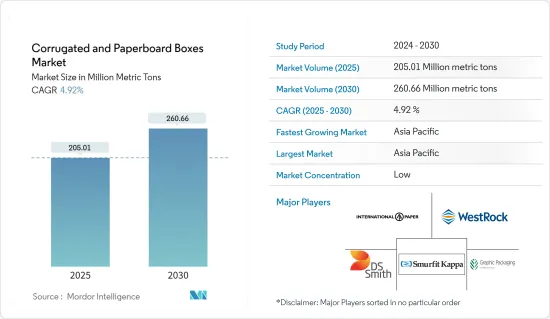

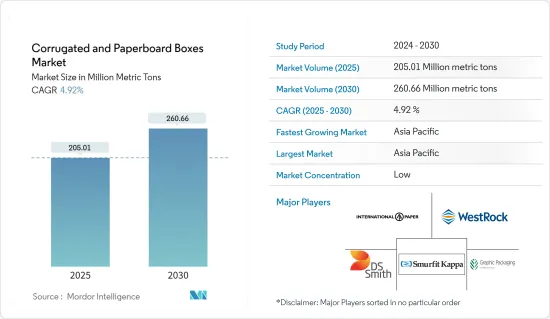

瓦楞包裝和紙板箱市場規模預計在 2025 年將達到 2.0501 億噸,預計在 2030 年將達到 2.6066 億噸,預測期(2025-2030 年)的複合年成長率為 4.92%。

關鍵亮點

- 瓦楞紙板和紙板箱市場已經發展起來。儘管如此,仍有獲利的機會,尤其是隨著盒子功能的興起,以適應更多直接面對消費者的應用程式並保持永續性。

- 瓦楞紙板和紙板箱用於包裝和運輸各種各樣的產品,近年來由於電子商務行業的加速成長,其重要性顯著提升。預計電子商務行業將繼續成為全球瓦楞紙板和紙板箱市場的主要推動力,因為它需要瓦楞紙板和紙板箱來運輸和儲存各種各樣的產品。

- 紙板包裝也是無災難性的和安全的,其回收材料覆蓋率為 88%,還有來自永續管理森林的新鮮纖維。亞馬遜等知名電子商務公司正在推廣使用紙板包裝作為電子商務包裝,因為它有助於控制成本並提供環保選擇。

- 雖然食品和飲料行業是瓦楞紙箱最成熟的終端用戶應用領域之一,但未來預計其他發展中領域也將成長,例如電子產品和配件包裝。亞太地區是全球最全面、成長最快的市場,受經濟成長、可支配所得增加和製成品消費加強等因素所推動。自 1992 年以來,瓦楞紙板廠的數量減少了近 200 家,但同一時期的年總產量卻增加了 5 億多平方英尺(Fiberbox Association)。

- 瓦楞包裝是一種多功能且經濟高效的解決方案,可用於保護、保存和運輸各種產品。紙板包裝的一些特性包括重量輕、生物分解性和可回收。瓦楞包裝是包裝食品市場的首選,可用於食品、食品和飲料、湯、調味品和乳製品等各種終端用戶行業。與玻璃或金屬等不同的包裝材料相比,它有助於減輕最終產品的總重量並保護它。

- 消費者越來越意識到包裝對環境的危害,並將購買習慣轉向更環保的選擇。消費者和政府的壓力不斷增加,迫使企業提高包裝和生產流程的環保性。人們願意為環保包裝支付更多錢。這導致對紙板包裝的需求增加。

- 禁止使用一次性塑膠的嚴格立法的實施進一步加劇了對環保包裝材料(尤其是紙質包裝解決方案)的需求。此外,該地區電子商務平台使用率的不斷提高可以歸因於日益成長的技術嫻熟的人口,他們越來越接受網路購物的便利性和可負擔性。

紙板和折疊紙盒市場的趨勢

食品和飲料預計將佔據較大的市場佔有率

- 在終端用戶應用中,食品和飲料是瓦楞包裝市場的主要終端用戶領域,預計在預測期內將快速發展。食品和飲料業主要使用塗佈未漂白紙板來包裝飲料,使用瓦楞紙箱來包裝蔬菜、水果和食品。對冷凍食品的需求不斷成長可能會增加對折疊紙盒包裝的需求。

- 生活方式的改變和人口的年輕化導致對品牌和包裝物質的需求不斷成長。根據軟包裝協會統計,美國飲料產業佔了包裝市場的近50%。超過 30% 的美國人每週訂兩次外賣,預計未來幾年這數字將成長到 3%。

- 食品和飲料領域是市場中成長迅速的一個領域。由於人們的生活方式忙碌,對簡便食品的需求很高。因此,無需花費很長時間準備的加工食品吸引了越來越多的消費者。人口不斷成長,推動了人們對方便、健康的加工食品的需求。

- 隨著消費者偏好轉向更方便、更環保的產品,食品業正在成長,對永續包裝解決方案的需求也日益增加。瓦楞包裝由於其強度高、適應性強、可回收性而成為食品領域的熱門選擇。

- 顧客和企業越來越意識到包裝對環境的影響。由於紙板可回收且生物分解性,越來越多的人選擇它,而不是塑膠等永續的材料。越來越多的公司採用瓦楞包裝來為客戶提供更好的效果,特別是在二次和三級包裝中,因為瓦楞包裝可以使產品遠離潮濕並且可以承受長時間的運輸。麵包、肉品和其他生鮮產品等加工食品需要這些一次性使用的包裝材料,這就是它們需求量很大的原因。

- 此外,外出消費也進一步推動了中國、日本、印度和澳洲等國家的需求。澳洲法規支持永續性並在 2025 年減少塑膠廢棄物,鼓勵使用環保包裝解決方案。例如,根據國家包裝目標,所有包裝必須可回收、可重複使用或可堆肥。

- 根據澳洲農業和資源經濟與科學局的數據,澳洲、加拿大、德國和法國是世界上糧食最安全的國家。食品業約佔全國製造業和服務業收益的20%。澳洲農民生產並供該國大部分食品市場。

- 在印度和中國等國家,對食品和飲料的需求達到了前所未有的高度。因此,它是紙板包裝市場的一股驅動力。預計食品和飲料行業的強勁成長將在整個預測期內推動對紙板包裝的需求。

亞太地區:預計將出現顯著成長

- 預計亞太地區將出現顯著成長。亞太地區製造工廠數量的不斷增加,加上消費者意識的不斷增強以及運輸包裝行業的不斷發展,推動了瓦楞包裝和紙板箱市場的成長。由於中國和印度等新興國家對紙漿和紙張的需求不斷成長,預計該地區將成為成長最快的地區。中國運輸包裝產業的發展,加上消費主義的興起,導致紙質包裝的需求量迅速擴大。

- 自2008年以來,該地區瓦楞紙市場的需求以6.5%的速度成長,遠超過世界其他任何地方。隨著對紙質包裝的需求不斷成長,對再生紙的需求也不斷成長。

- 零售商及其電子商務履約合作夥伴為改善客戶體驗而做出的共同努力,正在透過一流的客戶服務推動電子商務的成長,並最終滿足履行線上訂單所需的瓦楞包裝要求。商務的成長— 人與人之間的貿易。

- 例如,2024年1月,澳洲郵政公司與線上珠寶飾品零售商Myer結成策略合作夥伴關係,以涵蓋Myer的大部分線上訂單並改善Myer的線上客戶體驗。此次全面夥伴關係還包括澳洲郵政的城市服務,為墨爾本、雪梨、布里斯班和黃金海岸大都會圈的邁爾電子商務客戶提供隔天送達服務。在過去的 12 個月中,澳洲郵政為邁爾百貨運送了超過 500 萬件小包裹。

- 根據美國農業部(USDA)對外農業服務局(2023年7月報告),泰國是東南亞第二大經濟體。泰國仍然是一個強大的農業競爭對手,並且是米、糖、金槍魚罐頭、鳳梨罐頭、天然橡膠、冷凍蝦、已烹調和木薯的主要出口國。泰國也是美國第20大農產品出口國。

- 此外,不斷發展的技術環境、智慧型手機和社交媒體的使用日益增加以及電子商務顛覆該地區傳統的網路購物,正在推動顯著的成長。越來越多的企業主和企業家正在建立社交媒體商店,透過社群媒體平台進行交易和銷售。

- 全部區域網路購物的迅猛成長推動了對瓦楞包裝(如瓦楞紙箱,瓦楞包裝因其耐用性和成本效益而成為首選的包裝材料。網路購物的便利性和全天候購物的能力導致訂單更頻繁、訂單更小,需要獨特的包裝,進一步推動了對瓦楞包裝的需求。

- 隨著新興國家物流領域的出口成長,瓦楞紙箱預計將佔據該地區的市場主導地位。在快速消費品和化妝品等行業健康成長的推動下,快速成長的中階人口預計將推動該地區瓦楞紙箱市場的需求。

瓦楞紙板和紙板箱產業概況

瓦楞包裝和紙板箱市場細分化,由幾家領先的公司組成。從市場佔有率來看,目前主要幾家參與企業佔據著市場主導地位。由於區域和本地參與企業的產品差異化有限和低價策略,未來幾年供應商之間的參與程度可能會加劇。該市場的多個參與企業正在推行各種無機成長策略,包括收購、夥伴關係和協作。這些發展為市場參與企業擴大業務和基本客群鋪平了道路。

- 2023年11月,澳美私人公司公司Visy Industries在澳洲Hemmant開設了一家新的先進包裝瓦楞紙廠。該公司將向新廠投資 1.75 億澳元(1.11 億美元),新廠每天將生產多達 100 萬個瓦楞紙箱。該工廠將向昆士蘭食品和飲料公司、農民和生產商供應瓦楞紙箱。

- 2023 年 11 月,紙包裝供應商 Opal Packaging 在沃東加開設了一家新的高科技瓦楞包裝廠,投資 1.4 億美元。新廠每天的生產能力為 400 噸印刷和成品瓦楞紙箱。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 採用市場促進因素與限制因素

- 市場促進因素

- 電子商務銷售額成長

- 提高消費者對紙包裝的認知

- 市場限制

- 高性能替代品的可用性

- 營運成本上升

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按產品

- 紙板和固態纖維箱

- 折疊式紙箱

- 瓦楞紙箱

- 其他

- 按最終用戶產業

- 飲食

- 耐久性消費品

- 造紙與出版

- 化學

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- International Paper Company Inc.

- WestRock Company

- Smurfit Kappa Inc.

- DS Smith PLC

- Graphic Packaging International Inc.

- Mondi Group

- Georgia-Pacific LLC

- Cascades Inc.

- Klabin SA

- Oji Holding Corporation

- Nine Dragons Paper(Holding)Limited

- Packaging Corporation Of America

- Nippon Paper Industries Co. Ltd

- Orora Packaging Australia Pty Ltd

- Rengo Co. Ltd

第7章投資分析

第8章 市場機會與未來趨勢

The Corrugated & Paperboard Boxes Market size is estimated at 205.01 million metric tons in 2025, and is expected to reach 260.66 million metric tons by 2030, at a CAGR of 4.92% during the forecast period (2025-2030).

Key Highlights

- The corrugated and paperboard box market has been developed. Still, there are opportunities for gains, especially in the rise of box features, to account for more direct-to-consumer applications and maintain sustainability.

- Corrugated and paperboard boxes are utilized in the packaging and transportation of a wide variety of products and have become immensely significant in recent years due to the accelerated growth of the e-commerce industry, which is anticipated to remain a principal driving factor for the global corrugated and paperboard boxes market, as it requires corrugated and paperboard boxes for carrying and storing the wide variety of products it handles.

- Also, corrugated packaging covers 88% of recycled content with added fresh fibers originating from sustainably managed forests, so it is safe rather than catastrophic. Notable e-commerce businesses like Amazon are pushing towards corrugated board packaging for e-commerce packaging as it aids in controlling costs and gives an environment-friendly option.

- While the food and beverage industry ranks as one of the biggest established end-user application sectors for corrugated and paperboard boxes, future growth is anticipated from other developing fields, such as electronic products and accessory packaging. Asia-Pacific serves the most comprehensive and fastest-growing market globally, led by factors such as rising economies, increasing disposable incomes, and enhanced consumption of manufactured goods. Although the number of corrugator plants has declined by nearly 200 since 1992, the total production levels have increased by over 500 million square feet in the whole yearly production at a similar time (Fibre Box Association).

- Corrugated board packaging is an adaptable and cost-efficient solution to protect, preserve, and transport a range of products. The corrugated packaging features include light weight, biodegradability, and recyclability. It is the preferred option in the packaged food market and can be found in various end-user industries, such as food, beverage, soups, seasonings, and dairy products. Compared to different packaging materials such as glass and metal, it helps reduce and protect the final product's total weight and protect it.

- Consumers are becoming more aware of the environmental hazards of packaging and are moving their purchasing practices to more eco-friendly options. With the growing consumer and government pressure, it becomes necessary for companies to make their packaging and processes more environmentally friendly. Individuals are ready to pay more for environmentally friendly packaging. Thus, the demand for corrugated packaging is growing.

- The need for green packaging materials, particularly paper packaging solutions, is further fueled by the enforcement of strict legislation regarding the ban on single-use plastic. In addition, the increasing use of e-commerce platforms in the region is owing to the growth of a tech-savvy population that is increasingly embracing the convenience and affordability of online shopping.

Corrugated & Paperboard Boxes Market Trends

Food and Beverage Expected to Hold Significant Market Share

- Amongst end-user applications, food and beverage is the principal end-user segment of the corrugated and paperboard boxes market and are anticipated to advance at a fast speed in the forecast period. The food and beverage industry majorly utilizes coated, unbleached boards for packaging beverages and corrugated container boards for packaging vegetables, fruits, and food products. The accelerated demand for frozen foods is possible to push the demand for folding carton packaging.

- Alterations in lifestyle and a budding young population lead to a greater demand for branded and packaged substances. According to the Flexible Packaging Association, the beverage sector in the United States is valued at nearly 50% of the packaging market. Over 30% of Americans order meals twice a week, which is anticipated to grow to 3% in the coming years.

- Within the market, the food and beverage segment is quickly expanding segment. Because of people's hectic lifestyles, convenience foods are in high demand. As a result, processed food, which takes less time to prepare, attracts a growing number of consumers. The ever-increasing population drives the desire for processed food, which is both convenient and healthy.

- Consumer preferences are shifting toward more convenient and ecologically friendly products, the food industry is growing, and there is a growing need for sustainable packaging solutions. A popular option for the food sector is corrugated board packaging because of its strength, adaptability, and recyclable nature.

- Customers and companies are becoming more conscious of how packaging affects the environment. More people choose corrugated boards over plastic and other nonsustainable materials because they are recyclable and biodegradable. As corrugated paperboard packaging keeps moisture from products and can withstand long shipping times, companies are increasingly adopting this packaging to offer better customer outcomes, especially for secondary or tertiary packaging. Processed foods, such as bread, meat products, and other perishable items, need these packaging materials to be used just once, thus driving the demand.

- Furthermore, on-the-go consumption in countries like China, Japan, India, and Australia further feeds the demand. The use of environmentally friendly packaging solutions is encouraged by Australian regulations that support sustainability and reduction in plastic waste by 2025. For instance, all packaging is to be recyclable, reused, or compostable, according to the National Packaging Targets.

- According to the Australian Bureau of Agricultural and Resource Economics and Sciences, Australia, Canada, Germany, and France are among the world's most food-secure countries. About 20% of domestic manufacturing and service revenue comes from the food industry. Australian farmers grow and supply the great bulk of the food market in this country.

- In countries such as India and China, the demand for food and beverages is always high. This consequently drives the paperboard packaging market. Such assertive growth in the food and beverage industry is supposed to boost the need for paperboard packaging throughout the forecast period.

Asia-Pacific Expected to Have Significant Growth

- Asia-Pacific is supposed to have significant growth. The growing number of manufacturing plants all over the region, combined with the increasing consumerism and transit packaging sector in the APAC region, is adding to the growth of the corrugated and paperboard boxes market. Due to the growing demand for paper pulp in developing countries such as China and India, the region is anticipated to be the fastest-growing region. There is an addition to the transit packaging sector in China, combined with increasing consumerism, leading to a quickly expanding demand for paper packaging.

- Corrugated and paperboard boxes market demand in the region has been expanding at a rate of 6.5% since 2008, far greater than anywhere else in the world. Along with this requirement for paper packaging, the need for recycled paper is also growing.

- The collaborative initiative of retail businesses and e-commerce fulfillment partners in the country to improve customer experience further augments e-commerce growth among the larger population due to the best customer services driving e-commerce growth and, ultimately, the requirement for corrugated board packaging required for shipping online orders.

- For instance, in January 2024, Australia Post Corporation and Myer, an online Jewellery retailer, strategically partnered to improve Myer's online customer experience, covering most of Myer's online orders. The comprehensive partnership also includes Australia Post's Metro Service, which offers next-day delivery for Myer e-commerce customers in metropolitan Melbourne, Sydney, Brisbane, and the Gold Coast. During the past 12 months, Australia Postal Corporation delivered more than five million parcels for Myer.

- According to the United States Department of Agriculture (USDA), Foreign Agricultural Service, July 2023 Report, Thailand is Southeast Asia's second-largest economy. It remains a strong agricultural competitor and is a major exporter of rice, sugar, canned tuna, canned pineapples, natural rubber, frozen shrimp, cooked poultry, and cassava. Thailand is also the 20th largest export of US agricultural products.

- Moreover, the evolving technology environment, increasing use of smartphones and social media, and changes in the region's traditional online shopping through e-commerce are driving significant growth. More and more business owners and entrepreneurs are setting up social media stores to trade and sell through social media platforms.

- This exponential growth in online shopping across the region is driving demand for corrugated board packaging like corrugated boxes, which are the preferred packaging material owing to their durability and cost-effectiveness. The convenience of online shopping and the ability to shop 24/7 has led to more frequent and smaller orders requiring their own packaging, further driving demand for corrugated packaging.

- There is an escalating rate of exports in the developing logistics sector as corrugated boxes are supposed to dominate the market in this region. Due to sound growth in sectors like (FMCG) and cosmetics, the fast-growing middle-class population is anticipated to boost the demand for the corrugated and paperboard boxes market in the region.

Corrugated & Paperboard Boxes Industry Overview

The market for corrugated and paperboard boxes is fragmented and consists of several major players. In terms of market share, few of these major players currently dominate the market. The level of engagement among the vendors will strengthen in the years to come due to limited product differentiation and the underpricing strategy of the regional and local players. Various inorganic growth strategies are witnessed in the market by several players, including acquisitions, partnerships, and collaborations. These exercises have paved the way for augmentation of the business and customer base of market players.

- November 2023: Visy Industries, a privately owned Australian-American paper, packaging, and recycling company, opened a new advanced corrugated box factory in Hemmant, Australia. The company invested AUD 175 million (USD 111 million) in the new factory to manufacture up to one million boxes per day. The factory supplies cardboard boxes to food and beverage companies, farmers, and growers in Queensland.

- November 2023: Opal Packaging, a paper packaging provider, has opened its new high-tech corrugated cardboard packaging facility in Wodonga with an investment of USD 140 million. The new facility has the capacity to produce 400 tons of printed and finished corrugated boxes every day.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growth in E - commerce Sales

- 4.3.2 Growing Consumer Awareness on Paper Packaging

- 4.4 Market Restraints

- 4.4.1 Availability of High-performance Substitutes

- 4.4.2 Rising Operational Costs

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Corrugated and Solid Fiber Boxes

- 5.1.2 Folding Paperboard Boxes

- 5.1.3 Set-up Paperboard Boxes

- 5.1.4 Other Products

- 5.2 By End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Durable Goods

- 5.2.3 Paper & Publishing

- 5.2.4 Chemicals

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 International Paper Company Inc.

- 6.1.2 WestRock Company

- 6.1.3 Smurfit Kappa Inc.

- 6.1.4 DS Smith PLC

- 6.1.5 Graphic Packaging International Inc.

- 6.1.6 Mondi Group

- 6.1.7 Georgia-Pacific LLC

- 6.1.8 Cascades Inc.

- 6.1.9 Klabin SA

- 6.1.10 Oji Holding Corporation

- 6.1.11 Nine Dragons Paper (Holding) Limited

- 6.1.12 Packaging Corporation Of America

- 6.1.13 Nippon Paper Industries Co. Ltd

- 6.1.14 Orora Packaging Australia Pty Ltd

- 6.1.15 Rengo Co. Ltd