|

市場調查報告書

商品編碼

1851865

穿透測試:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Penetration Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

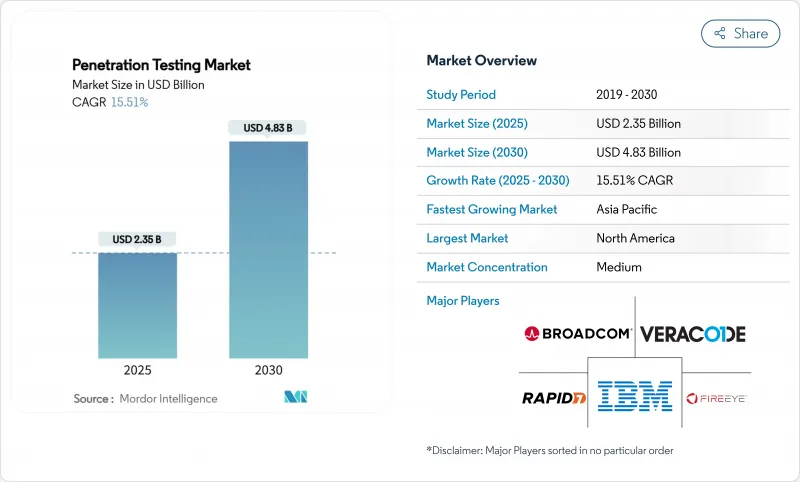

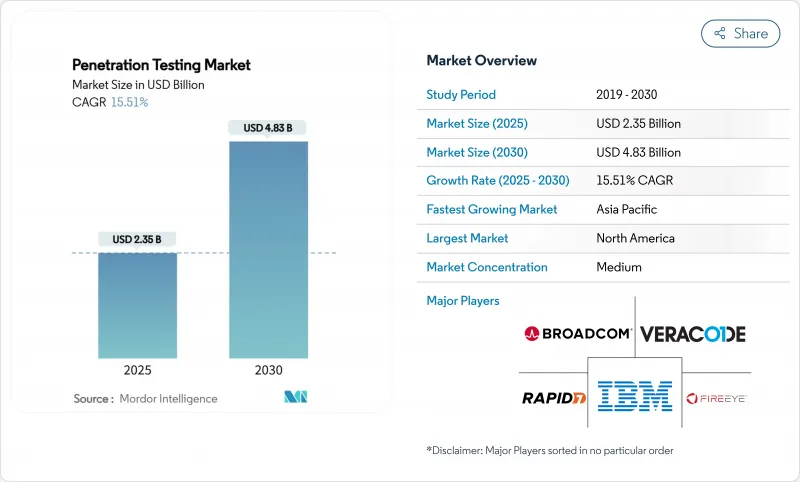

預計到 2025 年,穿透測試市場規模將達到 23.5 億美元,到 2030 年將達到 48.3 億美元,2025 年至 2030 年的複合年成長率為 15.51%。

網路攻擊技術的日益複雜、隱私法律的不斷完善以及網路保險需求的日益成長,推動了產業成長,使得獨立的安全檢驗成為董事會層面的優先事項。 HIPAA、PCI DSS 4.0 和《數位營運彈性法案》等新規要求企業必須向監管機構證明其持續控制措施的有效性,從而擴大了可支配支出。投資正轉向基於人工智慧和 API 的自動化測試,這縮短了測試週期,並為資源有限的團隊提供了更多存取權限。雲端技術的應用、DevSecOps 實踐以及銀行業、醫療保健業和製造業的積極數位化,為提供諮詢、工具和管理服務的供應商創造了新的收入來源。競爭對手則透過平台收購、人才引進和資金籌措來應對,旨在擴大全球交付能力並加快價值實現速度。

全球穿透測試市場趨勢與洞察

政府指令和特定產業法規

修訂後的框架,例如 FedRAMP 的 2024 年指南和即將發布的 HIPAA 更新,強制要求進行年度或持續的穿透測試,並要求受監管實體和雲端供應商將攻擊性評估納入其安全計畫。僅 PCI DSS 4.0 就引入了 63 條新的控制聲明,明確提及對持卡人資料環境進行更深入、基於情境的測試。歐盟金融機構在 DORA 下也面臨類似的審查,為專業服務供應商帶來了多年的發展機會。

人工智慧主導的自動化測試平台可降低成本和頻率

這款現代測試平台內建的機器學習引擎能夠以近乎即時的精度檢測出可利用的攻擊向量,從而減少人工操作,並幫助融資緊張的中小企業拓展市場。早期用戶回饋,測試週期最多可縮短 70%,訂閱門檻低於每月 100 美元,使供應商能夠將一次性合約轉化為持續的收入來源。

中小企業缺乏意識

儘管預算限制和人員短缺加劇了資料外洩的風險,但中小企業對穿透測試的採用率仍然很低。教育宣傳活動、折扣捆綁保險和價格合理的自動化套件正在逐步縮小差距,但它們在成熟度指標方面仍然落後於大型企業。

細分市場分析

隨著企業加大電子商務入口網站和SaaS工作負載的投入,預計到2024年,Web應用程式計劃將佔據穿透測試市場佔有率的36%。由於面向客戶的服務堆疊擴大包含基於瀏覽器的介面,因此需要定期驗證漏洞利用情況,市場需求保持穩定。同時,行動應用程式檢驗正以19.23%的複合年成長率快速成長,反映出銀行業和零售業的互動正向Android和iOS通路轉移。

應用商店安全隔離網閘和金融監管機構日益嚴格的審查迫使開發者整合行動端專屬的威脅建模、會話管理檢查和執行時間保護。雲端和以 API 為中心的架構進一步擴大了攻擊面,促使安全團隊採用統一的平台,以便在單一的部署計劃下掃描 Web、行動和微服務。

到 2024 年,本地部署方案仍將佔據 61% 的收入佔有率,這反映了資料駐留要求的必要性以及企業內部測試編配的便利性。然而,雲端基礎訂閱模式憑藉其能夠即時啟動代理並將測試結果即時傳輸到 DevSecOps 控制面板的功能,正以每年 20.27% 的速度成長。

為了讓受監管的買家放心,服務提供者正在增加零信任連接器、匿名資料室和地理隔離的工作負載。混合交付模式(將本地測試工具與雲端分析結合)正在成為企業平衡主權和效率的過渡狀態。

區域分析

2024年,北美將佔全球收入的39%,這主要得益於聯邦政府的強制規定,例如針對雲端供應商的FedRAMP測試指南和美國國稅局的生產規則。光是醫療改革方案就可能帶來46億美元的新增安全支出。完善的供應商生態系統、成熟的網路保險市場以及集中的創業融資進一步鞏固了該地區的領先地位。

亞太地區是成長最快的地區,年複合成長率高達17.04%,這主要得益於保險公司對檢驗的環境增加保費,以及各國政府對關鍵基礎設施制定正式的審核計畫。日本的「網路競技場」培訓體系、中國對自主型安全架構的推進以及印度金融科技的蓬勃發展,都在共同推動測試頻率的需求。東協二線經濟體也將管理服務外包,以彌補國內人才短缺。

在《一般資料保護規範》(GDPR) 和《數位營運彈性法案》的推動下,歐洲的業務穩步擴張,迫使銀行和保險公司對跨境營業單位的控制措施進行檢驗。現有的電訊和製造業叢集正透過委託進行工業控制和5G網路測試來擴大規模。東歐企業由於面臨鄰近衝突帶來的供應鏈衝擊,正迅速轉向持續參與叢集。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 各領域網路安全風險日益增加

- 安全評估和合規性審核的需求日益成長

- 政府和行業特定法規

- 人工智慧主導的自動化測試平台可降低成本和頻率

- 您的DevSecOps管線需要整合持續滲透測試

- 網路保險承保需要第三方滲透測試

- 市場限制

- 中小企業缺乏意識

- 熟練測試人員短缺和高成本

- 工具濫用和誤報疲勞會降低投資報酬率

- 在某些國家,主動攻擊可能引發法律/責任問題。

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場宏觀經濟趨勢

第5章 市場規模與成長預測

- 按測試類型

- 網路穿透測試

- Web應用程式穿透測試

- 行動應用穿透測試

- 社會工程穿透測試

- 無線網路穿透測試

- 雲端穿透測試

- 其他類型

- 按部署模式

- 本地部署

- 雲端基礎的

- 按組織規模

- 主要企業

- 小型企業

- 按服務類型

- 內部測試團隊

- 第三方管理服務

- 按最終用戶行業分類

- 政府/國防

- 銀行、金融服務和保險(BFSI)

- 資訊科技和電信

- 醫療保健和生命科學

- 零售與電子商務

- 製造業

- 能源與公共產業

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 中東

- GCC

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性措施與資金籌措

- 市佔率分析

- 公司簡介

- IBM Corporation

- Rapid7, Inc.

- Synopsys, Inc.

- Checkmarx Ltd.

- Acunetix Ltd.(Invicti Security)

- Broadcom Inc.(Symantec Corporation)

- FireEye Inc.

- Veracode, Inc.

- Qualys, Inc.

- Tenable Holdings, Inc.

- Palo Alto Networks, Inc.(Unit 42)

- Offensive Security, LLC

- Core Security(Fortra)

- Pentera Security Ltd.

- HackerOne, Inc.

- Trustwave Holdings, Inc.

- IOActive, Inc.

- NCC Group plc

- Cofense Inc.

- Bishop Fox, Inc.

第7章 市場機會與未來展望

The penetration testing market was valued at USD 2.35 billion in 2025 and is forecast to reach USD 4.83 billion in 2030, advancing at a 15.51% CAGR over 2025-2030.

Growth is propelled by sharper cyber-attack tactics, tighter privacy statutes, and rising cyber-insurance prerequisites that make independent security validation a board-level priority. New mandates under HIPAA, PCI DSS 4.0, and the Digital Operational Resilience Act are expanding the addressable spend as organizations must prove continuous control efficacy to regulators. Investment is shifting toward AI-enabled, API-driven test automation that cuts cycle time and broadens access for resource-constrained teams. Cloud adoption, embedded DevSecOps practices, and aggressive digitalization across banking, healthcare, and manufacturing create fresh revenue pools for providers willing to bundle consulting, tooling, and managed services. The competitive field is responding through platform acquisitions, talent roll-ups, and venture funding aimed at scaling global delivery and shortening time-to-value.

Global Penetration Testing Market Trends and Insights

Government Mandates and Industry-Specific Regulations

Revised frameworks such as FedRAMP's 2024 guidance and forthcoming HIPAA updates now specify annual or even continuous penetration tests, obliging covered entities and cloud vendors to hard-wire offensive assessments into security programs. PCI DSS 4.0 alone introduces 63 new control statements that explicitly reference deeper, scenario-based testing for cardholder data environments. Financial entities in the EU face similar scrutiny under DORA, guaranteeing a multi-year tailwind for specialist service providers.

AI-Driven Automated Testing Platforms Lower Cost and Frequency

Machine-learning engines embedded in modern testing platforms detect exploitable paths with near-real-time accuracy, trimming manual effort and widening market reach to cash-strapped SMEs. Early adopters report cycle-time reductions of up to 70% and subscription entry points under USD 100 per month, converting one-off engagements into recurring revenue streams for vendors.

Lack of Awareness Among SMEs

Budget limits and staffing shortages continue to dampen penetration testing uptake among smaller firms despite evidence of rising breach exposure. Education campaigns, bundled insurance discounts, and lower-priced automated suites are gradually narrowing the gap, but the segment still lags larger enterprises on maturity metrics.

Other drivers and restraints analyzed in the detailed report include:

- DevSecOps Pipelines Require Continuous Pen-Testing Integration

- Cyber-Insurance Underwriting Now Demands Third-Party Tests

- Shortage and High Cost of Skilled Testers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Web application projects generated 36% penetration testing market share in 2024 as companies fortified e-commerce portals and SaaS workloads. Demand stays stable because every customer-facing service stack now includes browser-based interfaces needing recurring exploit validation. Mobile application testing, however, is scaling at a 19.23% CAGR, reflecting the migration of banking and retail interactions to Android and iOS channels.

Intensifying scrutiny from app-store gatekeepers and financial supervisors forces developers to integrate mobile-specific threat modeling, session management checks, and runtime protections. Cloud and API-centric architectures further enlarge the attack surface, pushing security teams toward unified platforms that scan web, mobile, and micro-services in a single engagement cadence.

On-premise programs retained 61% of 2024 revenues, a testament to data-residency mandates and comfort with in-house test orchestration. Yet cloud-based subscriptions are growing 20.27% annually, buoyed by the ability to spin up agents instantly and stream findings back into DevSecOps dashboards.

Providers are adding zero-trust connectors, anonymized data chambers, and regionally segregated workloads to reassure highly regulated buyers. Hybrid delivery-local test harnesses coupled with cloud analytics-emerges as the transitional state for firms balancing sovereignty with efficiency.

The Penetration Testing Market Report is Segmented by Testing Type (Network Penetration Testing, and More), Deployment Mode (On-Premise, and Cloud), Organization Size (Large Enterprises, and SMEs), Service Delivery Mode (In-House Testing Teams, and Third-Party Managed Services), End-User Industry (Government and Defense, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39% of 2024 revenues, supported by federal directives such as FedRAMP test guidance for cloud vendors and IRS production-environment rules. Healthcare overhaul proposals alone could inject USD 4.6 billion in fresh security outlays once finalized. An advanced vendor ecosystem, mature cyber-insurance market, and venture funding concentration reinforce regional leadership.

Asia-Pacific is the fastest-growing arena, charting a 17.04% CAGR as insurers premium-price untested environments and governments formalize critical-infrastructure audit schedules. Japan's Cyber Colosseo training pipeline, China's push for self-reliant security stacks, and India's fintech surge combine to elevate test frequency requirements. Tier-2 economies in ASEAN are also commissioning managed services to plug local talent gaps.

Europe records steady expansion under GDPR and the Digital Operational Resilience Act, compelling banks and insurers to validate controls across cross-border entities. Incumbent telecom and manufacturing clusters add depth by commissioning industrial-control and 5G-network test scopes. Eastern European firms, confronted with supply-chain spillovers from nearby conflicts, are moving quickly toward continuous engagement models.

- IBM Corporation

- Rapid7, Inc.

- Synopsys, Inc.

- Checkmarx Ltd.

- Acunetix Ltd. (Invicti Security)

- Broadcom Inc. (Symantec Corporation)

- FireEye Inc.

- Veracode, Inc.

- Qualys, Inc.

- Tenable Holdings, Inc.

- Palo Alto Networks, Inc. (Unit 42)

- Offensive Security, LLC

- Core Security (Fortra)

- Pentera Security Ltd.

- HackerOne, Inc.

- Trustwave Holdings, Inc.

- IOActive, Inc.

- NCC Group plc

- Cofense Inc.

- Bishop Fox, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising cybersecurity risks across sectors

- 4.2.2 Increasing demand for security assessments and compliance audits

- 4.2.3 Government mandates and industry-specific regulations

- 4.2.4 AI-driven automated testing platforms lower cost and frequency

- 4.2.5 DevSecOps pipelines require continuous pen-testing integration

- 4.2.6 Cyber-insurance underwriting now demands third-party pen tests

- 4.3 Market Restraints

- 4.3.1 Lack of awareness among SMEs

- 4.3.2 Shortage and high cost of skilled testers

- 4.3.3 Tool-sprawl and false-positive fatigue reduce ROI

- 4.3.4 Legal/liability concerns over active exploitation in some nations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Testing Type

- 5.1.1 Network Penetration Testing

- 5.1.2 Web Application Penetration Testing

- 5.1.3 Mobile Application Penetration Testing

- 5.1.4 Social Engineering Penetration Testing

- 5.1.5 Wireless Network Penetration Testing

- 5.1.6 Cloud Penetration Testing

- 5.1.7 Other Types

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud-based

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Service Delivery Mode

- 5.4.1 In-house Testing Teams

- 5.4.2 Third-party Managed Services

- 5.5 By End-user Industry

- 5.5.1 Government and Defense

- 5.5.2 Banking, Financial Services and Insurance (BFSI)

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Retail and E-Commerce

- 5.5.6 Manufacturing

- 5.5.7 Energy and Utilities

- 5.5.8 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Israel

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Rapid7, Inc.

- 6.4.3 Synopsys, Inc.

- 6.4.4 Checkmarx Ltd.

- 6.4.5 Acunetix Ltd. (Invicti Security)

- 6.4.6 Broadcom Inc. (Symantec Corporation)

- 6.4.7 FireEye Inc.

- 6.4.8 Veracode, Inc.

- 6.4.9 Qualys, Inc.

- 6.4.10 Tenable Holdings, Inc.

- 6.4.11 Palo Alto Networks, Inc. (Unit 42)

- 6.4.12 Offensive Security, LLC

- 6.4.13 Core Security (Fortra)

- 6.4.14 Pentera Security Ltd.

- 6.4.15 HackerOne, Inc.

- 6.4.16 Trustwave Holdings, Inc.

- 6.4.17 IOActive, Inc.

- 6.4.18 NCC Group plc

- 6.4.19 Cofense Inc.

- 6.4.20 Bishop Fox, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment