|

市場調查報告書

商品編碼

1642205

感知無線電-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Cognitive Radio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

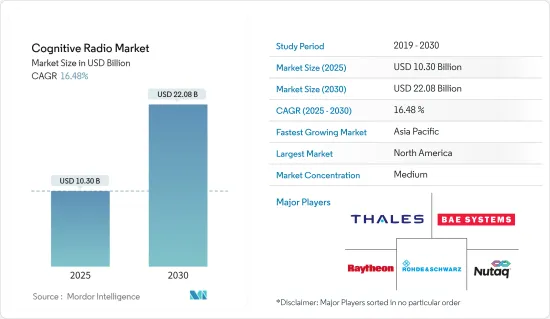

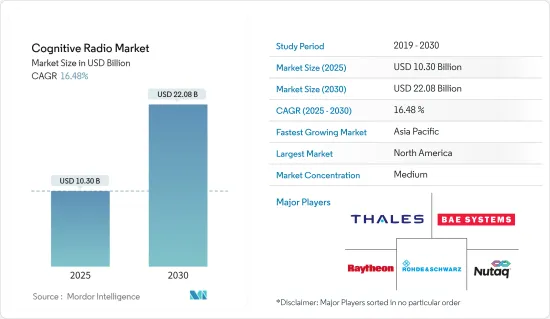

感知無線電市場規模預計在 2025 年為 103 億美元,預計到 2030 年將達到 220.8 億美元,預測期內(2025-2030 年)的複合年成長率為 16.48%。

新興的5G技術將用於滿足未來無線技術的大量行動資料流量。更大的容量將需要更多的頻譜,從而導致CR整合到5G網路中。 CR 會不斷調整自身以提供最佳的通訊管道,但重點在於實現更有效率的頻譜利用率。

關鍵亮點

- 當今世界,經濟與通訊基礎設施緊密依存。感知無線電從多個維度提高了頻譜效率,使得行動通訊模式更加個人化。 CR 識別頻段內的可用通道,並透過動態改變傳輸參數利用這些通道進行通訊。

- 為了在現實場景中實現這項技術,必須克服幾個技術障礙。感知無線電必須更加敏感,才能在衰退期間區分出主訊號和閒置頻段。使用本地感知的單一感知無線電可能無法在嚴重衰落條件下實現這種增加的靈敏度,因為所需的感知時間可能比感知週期更長。

- 在新冠肺炎疫情期間和之後,人們許多日常業務對網路的依賴增加了。網路流量的重大轉變推動了對更多頻率頻譜的需求,從而產生了感知無線電市場的需求。

- 農村寬頻通訊業者廣泛使用感知無線電將有助於農村獨立通訊業者避免在低度開發農村市場部署無線電的高成本和有限的頻譜問題,從而增加其在公共中的應用。

感知無線電市場趨勢

隨著 5G 應用的出現,通訊領域正在獲得發展動力。

- 大多數無線通訊系統基於固定頻率分配,導致頻率利用率低。工業IoT、連網汽車和其他 IT 應用的需求不斷成長,加速了對更多頻譜的需求。感知無線電在這裡起著關鍵作用,因為它可以自動偵測無線電頻段內的可用頻道,從而允許更多通訊同時進行,而不會干擾授權使用者。

- 根據GSMA統計,截至2022年11月底,已有87個國家的225多家業者推出了5G服務。到2023年終,5G行動連線數預計將達到15億。這種成長將需要各個頻段的額外頻譜資源。

- 為提升大容量情境下的動態使用者體驗,中興通訊與中國電信共同開發了基於中興通訊Radio Composer的自適應時空認知網路。此網路解決方案分析了不同時間內交通空間的分佈趨勢。

愛立信與 AXIAN Telecom 宣佈建立夥伴關係,為馬達加斯加提供更快、更可靠的行動服務,同時降低網路能耗並加強 5G 生態系統。透過此次合作,AXIAN 旨在加速馬達加斯加和坦尚尼亞的數位化進程,提高網路容量並為客戶提供更快的通訊。

預測期內,亞太地區將成為成長最快的地區

- 亞太國家處於5G行動技術的前沿。首個商用5G網路在韓國開通。 5G技術的建立需要時間,但預計到2025年將達到18億個連接。

- 700MHz頻段,特別是3500MHz頻段,是目前適合5G發展的頻段,應盡可能優先分配。 3,500MHz 的特定頻率範圍因國家而異。可能需要進行大量的重新分配工作,以允許行動電話營運商最大限度地利用可用頻寬,同時仍提供不受干擾的頻譜存取。

- Nokia、Docomo 和 NTT 正在合作開發新的 6G 技術。這三家公司預計將致力於新頻率技術、網路感測器、認知、自動化和專用架構的研發。

- 日本內務部將推出頻譜競標,包括毫米波(mmWave)頻譜。該頻譜預計將用於固定無線接入,以擴大體育場和其他大型場館的覆蓋範圍,並為住宅提供寬頻。

感知無線電產業概況

由於少數參與企業滿足了需求,因此該市場競爭適中。這些感知無線電提供者正在與各種公司簽訂合約並進行投資,以幫助擴展他們的服務。隨著對更快、更穩定的網路連接的需求不斷成長,感知無線電解決方案的增強發展正在擴大業務成長的範圍。該領域的一些主要參與者包括 BAE Systems PLC、Thales Group、Raytheon Company 和 Rohde &Schwarz GmbH & Co.KG。

2022年10月,STC採用愛立信技術,確保在其網路流量激增期間提供主動支援並改善客戶體驗。基於人工智慧的認知軟體解決方案利用自動化、巨量資料可擴展性、速度、準確性和一致性來改善網路最佳化。該解決方案有望有助於排放虛擬驅動測試和遠端自動頻譜分析等營運活動產生的碳排放。

2022年6月,印度理工學院曼迪分校開發了一種合作頻譜感測器,以提供尖端通訊解決方案並提高無線電頻譜的再生性。該解決方案的想法是為次要用戶使用的無線設備(如行動電話)配備自己的感測器,這些感測器可以檢測主要用戶未使用的頻譜空洞,並在主頻道不可用或擁塞時使用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 頻譜最佳化需求日益增加

- 5G業務在終端產業應用發展不斷加強

- 市場限制

- 缺乏適當的計算安全基礎設施

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章 市場區隔

- 按應用

- 頻譜感知與分配

- 位置偵測

- 認知路由

- QoS(服務品質)最佳化

- 其他

- 按服務

- 專業服務

- 託管服務

- 按最終用戶產業

- 通訊業

- IT 和 IT 公司

- 政府和國防

- 運輸

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- BAE Systems PLC

- Thales Group

- Raytheon Company

- Innovation Nutaq Inc.(NuRAN Wireless Inc.)

- Shared Spectrum Company

- Rohde & Schwarz GmbH & Co KG

- Spectrum Signal Processing(Vecima)

- Rockwell Collins Inc.(United Technologies Company)

第7章投資分析

第8章 市場機會與未來趨勢

The Cognitive Radio Market size is estimated at USD 10.30 billion in 2025, and is expected to reach USD 22.08 billion by 2030, at a CAGR of 16.48% during the forecast period (2025-2030).

The emerging 5G technologies are used to meet future wireless technologies' heavy mobile data traffic. More capacity will demand more spectrum, resulting in the integration of CR in 5G networks. The focus of CR is to enable much more efficient use of the spectrum, though it adapts itself to provide the optimum communications channel.

Key Highlights

- In today's world, the economy and communication infrastructure closely depend on each other. With improved spectrum utilization efficiency in numerous dimensions, cognitive radio will make the mobile communication paradigm more personal. CR identifies the free channels in the spectrum and uses them for communication by dynamically changing the transmission parameters, leading to better utilization of channel resources.

- Some technical hurdles must be overcome before the technology can be implemented in a real-world scenario. To differentiate between a primary signal that is fading and white space, cognitive radios must be more sensitive. A single cognitive radio using local sensing may not be able to achieve this improved sensitivity in cases of severe fading since the necessary sensing time may be longer than the sensing period.

- There was an increased reliance on the internet for numerous daily tasks during and after the COVID-19 pandemic. The heavy shift towards network traffic urged the need for more spectrums with multiple frequencies, which created a demand for the cognitive radio market.

- The extensive usage of cognitive radio by rural broadband telcos helps independent local carriers get around the issue of high costs and limited spectrum to deploy wireless in underdeveloped rural markets, thereby increasing its use for public safety.

Cognitive Radio Market Trends

Telecommunication Sector is Gaining Traction Due to Emergence of 5G Applications

- As most wireless communication systems are based on fixed frequency allocation, this results in low spectrum utilization. The growing demand for IoT for industrial use, connected vehicles, and other IT-enabled applications is accelerating the need for more spectrums. Cognitive radio hence plays an important role here as it automatically detects available channels in a wireless spectrum, enabling more communication to run concurrently without obstructing the licensed users.

- According to the GSMA, at the end of November 2022, more than 225 operators from 87 countries launched 5G services. By the end of 2023, the number of 5G mobile connections is expected to reach 1.5 billion. This growth will require additional spectrum resources in different frequency bands.

- To enhance dynamic user experiences in high-capacity scenarios, ZTE Corporation and China Telecom jointly developed a self-adaptive spatiotemporal cognitive network based on ZTE's Radio Composer. The network solution analyzes the traffic space distribution trend in different periods.

Ericsson and AXIAN Telecom announced a partnership to provide faster and more reliable mobile services throughout Madagascar while reducing network energy consumption and enhancing the 5G ecosystem. Through this partnership, AXIAN aims to boost digitalization across Madagascar and Tanzania, increasing network capacities and providing enhanced speeds to its customers.

Asia-Pacific to Register the Fastest Growth During the Forecast Period

- Countries in the Asia-Pacific region have been at the forefront of 5G mobile technologies. The first commercial 5G network was launched in South Korea. Though establishing 5G technology will take time, it is expected that it will reach 1.8 billion connections by 2025.

- The 700 MHz bands, particularly the 3500 MHz range, are the currently preferred frequencies for 5G and should be the primary focus for awards wherever feasible. The precise range of spectrum within 3500 MHz varies by country. There may be a need for extensive refarming work to ensure that mobile operators have access to a spectrum that does not suffer from interference while maximizing the bandwidth available.

- Nokia, Docomo, and NTT have partnered on emerging 6G technologies. The trio is projected to work to develop new spectrum technologies, a network as a sensor, and cognitive, automated, and specialized architectures.

- Japan's Ministry of Internal Affairs and Communications (MIC) will introduce a spectrum auction, including a millimeter-wave (mmWave) spectrum. The spectrum is expected to be used for fixed wireless access to increase coverage in stadiums and other extensive facilities and deliver broadband in residential areas.

Cognitive Radio Industry Overview

A few players meet the demand, this market has moderate competition. These cognitive radio providers sign contracts and invest with various companies to help expand their services. As the demand for fast and stable network connections increases, they have a broader scope of expansion with the development of enhanced cognitive radio solutions. Some significant companies offering services in this sector include BAE Systems PLC, Thales Group, Raytheon Company, and Rohde & Schwarz GmbH & Co. KG.

In October 2022, STC adopted Ericsson's technologies to ensure proactive support and elevate customer experiences during surges in high traffic on the network. The AI-based Cognitive Software solution leverages automation, big data scalability, speed, accuracy, and consistency for improved network optimization. The solution was expected to contribute to reducing carbon dioxide emissions from operational activities like the use of virtual drive testing and remote automatic spectrum analysis.

In June 2022, the Indian Institute of Technology, Mandi, developed cooperative spectrum sensors to offer cutting-edge telecom solutions and improve the radio-frequency spectrum's reusability. The idea of this solution was that a wireless device, such as a cell phone, used by the secondary user could be fitted with a unique sensor that could detect spectrum holes that the primary user does not use and use them when the main channel is unavailable or crowded.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Need to Optimise the Spectrum Utilisation

- 4.2.2 Rising Development of 5G Service Applications Among End-user Industries

- 4.3 Market Restraints

- 4.3.1 Lack of Proper Computational Security Infrastructure

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of COVID-19 impact on the industry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Spectrum Sensing & Allocation

- 5.1.2 Location Detection

- 5.1.3 Cognitive Routing

- 5.1.4 QoS (Quality of Service) Optimisation

- 5.1.5 Other Applications

- 5.2 By Service

- 5.2.1 Professional Services

- 5.2.2 Managed Services

- 5.3 By End-user Industry

- 5.3.1 Telecommunication

- 5.3.2 IT & ITes

- 5.3.3 Government & Defense

- 5.3.4 Transportation

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 BAE Systems PLC

- 6.1.2 Thales Group

- 6.1.3 Raytheon Company

- 6.1.4 Innovation Nutaq Inc. (NuRAN Wireless Inc.)

- 6.1.5 Shared Spectrum Company

- 6.1.6 Rohde & Schwarz GmbH & Co KG

- 6.1.7 Spectrum Signal Processing (Vecima)

- 6.1.8 Rockwell Collins Inc. (United Technologies Company)