|

市場調查報告書

商品編碼

1642217

自立袋:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Stand-Up Pouches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

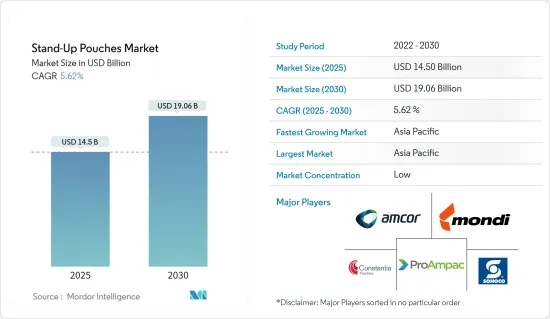

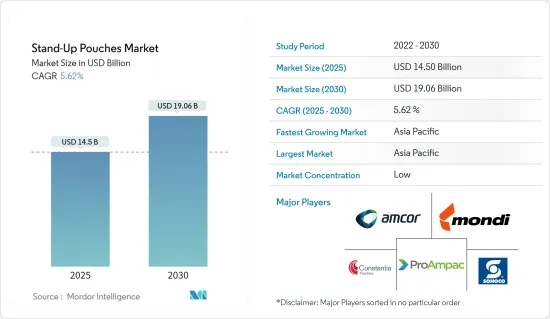

自立袋市場規模預計在 2025 年為 145 億美元,預計到 2030 年將達到 190.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.62%。

主要亮點

- 自立袋是軟質包裝解決方案,具有較寬的底座,可使袋子站立而不塌陷。這些袋子由多層阻隔材料製成,這些阻隔材料被層壓在一起形成一張連續的片材。這一層可保護和保存內容物免受外界因素的影響,因此自立袋的需求正在上升。

- 自立袋重量輕,省去了包裝和運輸的麻煩,對製造商來說是一種經濟高效的解決方案。為了最佳化品牌行銷舉措,對食品和飲料包裝自立袋的需求不斷成長,推動了全球市場的成長。自立袋由於其靈活性、耐用性以及保持內容物新鮮度的能力而擴大在寵物產品中使用,預計將在預測期內推動市場成長。

- 隨著人們對便攜零食的需求日益成長,對可重複密封的自立袋的需求也隨之增加,為消費者提供了便利。自立袋的使用越來越多,可以保持食物新鮮並防止其受潮,有助於延長保存期限,從而推動市場成長。消費者生活方式和飲食偏好的改變,加上食品技術的變化,正在創造進一步的市場需求。

- 包裝創新為個人護理包裝產業創造了豐厚的利潤。方便、易於使用的分配和運輸功能使 Amcor 的可回收自立袋成為液體、乳霜和凝膠的絕佳選擇。安姆科 (Amcor) 和歐萊雅 (L'Oreal) 合作開發採用可回收聚乙烯 (PE) 薄膜的環保包裝洗髮精填充用。自合作以來,歐萊雅已改用可回收自立袋,減少了 75% 的塑膠消費量。

- 然而,由於消費者對環境問題的認知不斷提高、監管規範不斷變化、永續性的持續努力以及對先進回收設施的需求,導致回收率低,對市場成長構成了挑戰。

- 人們對永續性的日益關注正推動供應商轉向可回收和永續的自立袋。預計市場將見證對永續產品創新和新興回收產業成長的資本投資。例如,2023 年 11 月,軟包裝公司 ProAmpac LLC 推出了 ProActive PCR殺菌袋,作為傳統袋的永續替代品。 ProActive PCR殺菌袋含有 30% 的消費後回收 (PCR) 材料,旨在幫助品牌實現永續性目標。

自立袋的市場趨勢

食品和飲料行業擴大採用軟質包裝解決方案

- 人口成長、消費者生活方式改變和消費能力增強推動了北美、歐洲和亞太地區食品和飲料產業的快速擴張。生活方式的改變和健康和營養資訊的便捷獲取正在推動對偏好健康食品、簡便食品和單份食品的需求。食品和飲料行業的快速變化催生了對自立袋等便捷包裝選擇的需求。

- 根據有機貿易協會的數據,美國有機包裝食品和飲料的消費量預計將從 2022 年的 247.8 億美元成長到 2025 年的 278.6 億美元。預計這將推動對包括站立袋的經濟高效且靈活的包裝解決方案的需求。

- 站立袋包裝可以增強您的企業品牌形象並增強您的視覺行銷。小袋用途廣泛、靈活且美觀,可以宣傳您的品牌並增加銷售量。根據您業務的具體需求,數位印刷站立袋可以顯著提升您的品牌形象。公司可以利用袋子的整個表面積來展示令人興奮的圖形、標誌、品牌訊息或產品細節。

- 消費者現在將自立袋視為品質的標誌,供應商需要透過這種包裝形式傳達優質化的訊息。自立袋可以隔絕濕氣、光線、空氣和細菌,為您的食物提供更優質的保護。

- 由於包裝食品以及食品和飲料因其便利性和價格實惠而導致的需求不斷增加等因素,市場持續擴大。自立袋通常由輕質材料製成,可大幅降低運輸成本。由於袋子配有各種封閉選項(如噴口、拉鍊、撕口等),因此需求也得到了推動,進一步促進了市場成長。

- 多家行業製造商專注於推出永續的解決方案,並始終致力於滿足客戶和市場的需求。例如,2024年1月,美國包裝公司API Group及其子公司Accredo Packaging與Fresh-Lock團隊合作,推出了一種由50%消費後回收(PCR)材料製成的用於食品包裝的軟性自立袋。該產品採用 ChildGuard Slider 技術,提供兒童防護閉合保護並促進循環經濟。

亞太地區可望成為自立袋成長最快的市場

- 自立袋在該地區不斷發展的食品加工行業中越來越受歡迎。隨著生活方式變得越來越忙碌,消費者越來越青睞輕便、易於攜帶的零食包裝來滿足他們的出行需求。緊湊尺寸且具有拉鍊等可重新密封功能的產品很受歡迎,滿足了人們對易於攜帶的需求。這個市場主要受攜帶式食品和日益成長的對保持貨架穩定性的蒸餾包裝產品的偏好所驅動。

- 有組織的食品零售商的擴張發揮著至關重要的作用,以誘人的折扣價格向消費者提供各種各樣的產品。隨著技術和社會的進步,印度食品加工產業正在經歷變革時期。因此,對方便、即食產品的需求凸顯了袋裝等高效創新包裝解決方案的重要性。

- 即食食品和零食等加工食品越來越受歡迎,尤其是在都市區。據印度品牌股權基金會稱,到 2030 年,印度家庭年加工食品消費量預計將成長兩倍,使該國成為一個利潤豐厚的市場。

- 2023 年 4 月,SIG 宣布將在印度帕爾加爾開設第二家生產工廠。該工廠生產 SIG 的襯袋紙盒和帶嘴袋包裝,之前以 Scholle IPN 和 Bossar 的名稱出售。

- 由於人口結構變化和收入水平提高導致寵物擁有量增加,亞洲的寵物護理行業實現了正成長。政府機構動物衛生組織估計,到 2024年終,中國將成為世界上寵物數量最多的國家,預計將推動中國對自立袋的需求。

- 泰國寵物食品出口市場的成長為袋裝包裝行業帶來了巨大的機遇,因為寵物人性化推動了對優質包裝解決方案的需求。袋裝包裝著重於便利性和新鮮度,在滿足寵物食品產業國內和出口市場不斷變化的需求方面發揮著至關重要的作用。

自立袋產業概況

市場較為分散,多家全球企業佔相當一部分市場佔有率。領先的市場參與者不斷升級產品系列,並採用各種有機和無機策略(如新產品發布、合作夥伴關係和收購)來佔領市場。

- 2024年2月,安姆科Group Limited(Amcor Group GmbH)與美國Stonyfield Organic合作,推出了有史以來第一款全聚丙烯(PP)帶嘴袋。這些包裝袋是 Stonyfield 冷藏優格產品 YoBaby 的環保設計。

- 2023 年 8 月 Mondi PLC 宣布正在與歐洲寵物食品供應商 Fressnapf 合作,為乾寵物食品產品提供一系列可回收、單一材料包裝解決方案。這種單一材料包裝可回收並設計為自立袋。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估地緣政治情勢對產業的影響

第5章 市場動態

- 市場促進因素

- 對簡便食品和已調理食品的需求不斷增加

- 對經濟高效的軟包裝解決方案和品牌提升的需求不斷增加

- 市場限制

- 嚴格的政府法規和日益嚴重的環境問題

第6章 市場細分

- 按材質

- 塑膠

- 聚對苯二甲酸乙二醇酯(PET)

- 聚乙烯 (PE)

- 聚丙烯(PP)

- 乙烯 - 乙烯醇(EVOH)

- 其他塑膠材質

- 紙

- 金屬(箔)

- 塑膠

- 按應用

- 飲食

- 居家護理

- 衛生保健

- 寵物護理

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Amcor Group GmbH

- Mondi PLC

- Sonoco Products Company

- Constantia Flexibles GmbH

- Smurfit Kappa Group PLC

- ProAmpac LLC

- Swiss PAC USA

- Winpak Ltd

- Uflex Limited

- Glenroy Inc.

- FLAIR Flexible Packaging Corporation

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 67683

The Stand-Up Pouches Market size is estimated at USD 14.50 billion in 2025, and is expected to reach USD 19.06 billion by 2030, at a CAGR of 5.62% during the forecast period (2025-2030).

Key Highlights

- The stand-up pouch is a flexible packaging solution with a wide bottom gusset that allows the pouch to stand prominently without collapsing. The pouch comprises multiple layers of barrier material, which are laminated to create one continuous sheet. The layers protect and preserve the contents from any external element, thus propelling the demand for stand-up pouches.

- Stand-up pouches are lightweight, which reduces packaging and transportation, making them a cost-effective solution for manufacturers. The growing demand for stand-up pouches for food and beverage packaging to optimize brand marketing initiatives drives global market growth. The increasing usage of stand-up pouches for pet products due to their flexibility, durability, and ability to keep the contents fresh is expected to boost the growth of the market during the forecast period.

- The rising demand for on-the-go snacks led to the need for re-closable stand-up pouches, which offer convenience to consumers. The growing use of stand-up pouches to keep food items fresh and secure from moisture helps to extend the shelf life, thus boosting the market growth. The changing lifestyle and food preferences among consumers, coupled with changing food technology, further create demand in the market.

- Innovation in packaging is introducing lucrative opportunities for the personal care packaging industry. Amcor's recyclable stand-up pouches' convenient and easy-to-use dispensing and transportability make them an excellent choice for liquids, creams, and gels. Amcor and L'Oreal partnered to create a refill eco-pack shampoo made of recyclable polyethylene (PE) monosodium bicarbonate film. Since the partnership, L'Oreal has switched to the recyclable stand-up pouch, which reduces plastic consumption by 75%.

- However, increasing consumer awareness of environmental concerns, dynamic regulatory standards, the ongoing drive for sustainability, and the poor recycling rate due to the need for advanced recycling facilities are challenging market growth.

- The growing concern over sustainability further pushes the vendors toward recyclable and sustainable stand-up pouches. The market is expected to witness capital investment in sustainable product innovation and the growth of new recycling industries. For instance, in November 2023, ProAmpac LLC, a flexible packaging company, launched its ProActive PCR retort pouches as a sustainable alternative to conventional pouches. The ProActive PCR pouches contain 30% post-consumer recycled (PCR) material designed to help brands achieve sustainability goals.

Stand-Up Pouches Market Trends

Rising Adoption of Flexible Packaging Solutions for Packaged Food and Beverage

- The rapidly expanding food and beverage sector in North America, Europe, and Asia-Pacific is attributable to the growing population, changing consumer lifestyle, and growing spending capacity. Lifestyle changes and easy access to information on health and nutrition are increasing the demand for indulgent and healthy foods, convenience foods, and single-serve options. These rapid changes in the food and beverage landscape create demand for convenient packaging options like stand-up pouches.

- According to the Organic Trade Association, the consumption of organic packaged food and beverages in the United States is projected to reach USD 27.86 billion in 2025 from USD 24.78 billion in 2022. This is expected to fuel the demand for cost-effective, flexible packaging solutions, including stand-up pouches.

- Stand-pouch packaging enhances business brand identity and strengthens visual marketing. Pouches are versatile, flexible, and attractive, promoting the brand and increasing sales. Stand-up pouches that are digitally printed can significantly elevate a brand's identity per the specific desires of the business. The company can utilize the whole surface of the pouch to display exciting graphics, logos, branding messages, or product details.

- Consumers now consider stand-up pouches a signifier of quality, making it necessary for vendors to communicate premiumization through such a form of packaging. Stand-up pouches offer superior protection for foods, keeping them safe from moisture, light, air, and bacteria.

- The ongoing expansion of the market can be attributed to factors such as the increasing demand for packaged food and beverages driven by convenience and affordability. Stand-up pouches are usually made with lightweight materials, significantly lowering transportation costs. The demand is also fueled by the fact that pouches come with various closure options, including a spout, zipper, and tear notch, further boosting the growth of the market.

- Several industry manufacturers focus on introducing sustainable solutions and have constantly worked on customer and market needs. For instance, in January 2024, API Group, a US-based packaging company, and its subsidiary Accredo Packaging, collaborated with the Fresh-Lock team to introduce a flexible stand-up pouch made with 50% post-consumer recycled (PCR) material for food packaging. The product is available with child-guard slider technology, resulting in child-safe closure protection and promoting a circular economy.

Asia-Pacific is Expected to be the Fastest-growing Market for Stand-up Pouches

- Stand-up pouches are gaining popularity in the region's growing food processing industry. Due to increasingly busy lifestyles, consumers favor lightweight, portable snack packaging to accommodate their on-the-go needs. Compact sizes with resealable features such as zippers are popular, meeting the demand for convenient on-the-go options. The market is driven by the growing preference for mostly on-the-go food products and retort-packed goods to maintain shelf stability.

- The expansion of organized food retail outlets plays a pivotal role, offering consumers diverse products with enticing discounts. The food processing industry in India is undergoing a transformative phase, embracing technological and social advancements. Thus, the demand for convenient and ready-to-consume products underscores the significance of efficient and innovative packaging solutions like pouches.

- Urban areas, particularly, witness a surge in the popularity of processed foods like ready-to-eat products and snacks. According to the India Brand Equity Foundation, the annual household consumption of processed foods in India is expected to triple by 2030, establishing the country as a lucrative market.

- In April 2023, SIG announced the inauguration of a second production plant in Palghar, India. The plant produces SIG's bag-in-box and spouted pouch packaging, previously marketed under Scholle IPN and Bossar.

- The pet care industry in Asia registered positive growth due to increasing pet ownership, driven by demographic changes and the rising income levels of the population. Health for Animals, a government organization, estimated that China will have the most pets in the world by the end of 2024, which is expected to drive the demand for stand-up pouches in the country.

- The growth of the Thai pet food export market presents a significant opportunity for the pouch packaging industry, as pet humanization drives demand for premium packaging solutions. With a focus on convenience and freshness, pouch packaging plays a pivotal role in meeting the evolving needs of domestic and export markets within the pet food industry.

Stand-Up Pouches Industry Overview

The market is fragmented, with many global players operating in the market, constituting considerable market share. The leading market players are constantly upgrading their product portfolios and adopting various organic and inorganic strategies, such as new product launches, collaborations, and acquisitions, to dominate the market.

- February 2024: Amcor Group GmbH partnered with Stonyfield Organic, a US-based company, to introduce the first-ever all-polypropylene (PP) spouted pouch. The pouch has an eco-friendly design for Stonyfield's YoBaby refrigerated yogurt product.

- August 2023: Mondi PLC announced its collaboration with Fressnapf, a European pet food supplier, to provide a new range of mono-material recyclable packaging solutions for the dry pet food range. The mono-material packaging is recyclable and is designed in stand-up pouches.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Geopolitical Scenario Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience and Ready-to-eat Food

- 5.1.2 Growing Requirements for Cost Effective Flexible Packaging Solutions and Brand Enhancement

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations and Growing Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.1.1 Polyethylene Terephthalate (PET)

- 6.1.1.2 Polyethylene (PE)

- 6.1.1.3 Polypropylene (PP)

- 6.1.1.4 Ethylene-vinyl Alcohol (EVOH)

- 6.1.1.5 Other Plastic Materials

- 6.1.2 Paper

- 6.1.3 Metal (Foil)

- 6.1.1 Plastic

- 6.2 By Application

- 6.2.1 Food and Beverage

- 6.2.2 Home Care

- 6.2.3 Healthcare

- 6.2.4 Pet Care

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Middle East and Africa

- 6.3.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Mondi PLC

- 7.1.3 Sonoco Products Company

- 7.1.4 Constantia Flexibles GmbH

- 7.1.5 Smurfit Kappa Group PLC

- 7.1.6 ProAmpac LLC

- 7.1.7 Swiss PAC USA

- 7.1.8 Winpak Ltd

- 7.1.9 Uflex Limited

- 7.1.10 Glenroy Inc.

- 7.1.11 FLAIR Flexible Packaging Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219