|

市場調查報告書

商品編碼

1851900

條碼印表機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Barcode Printer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

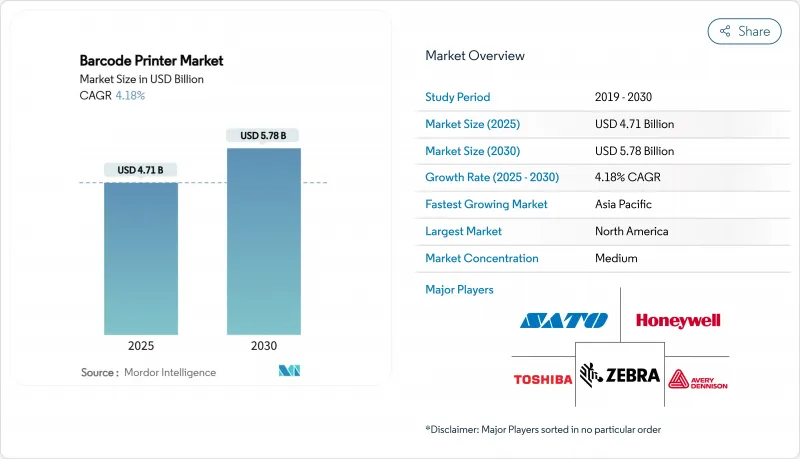

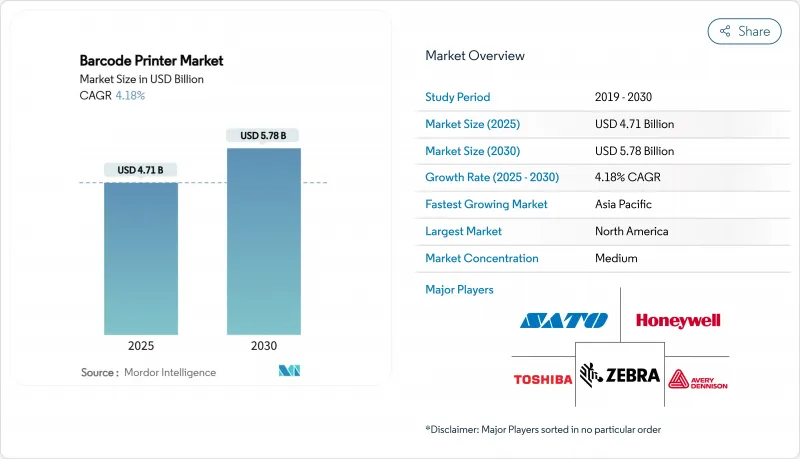

條碼印表機市場預計到 2025 年將達到 47.1 億美元,到 2030 年將達到 57.8 億美元,年複合成長率為 4.18%。

這一成長反映了企業在自動化和供應鏈數位化的持續投入,即使該行業已步入成熟階段,需求仍保持穩定。醫療保健和食品領域可追溯性要求的不斷提高、全通路零售的加速發展以及智慧工廠對序列化生產數據的需求,都為採購預算提供了支撐。熱轉印技術持續推動條碼印表機市場的發展,因為它能夠為注重合規性的環境提供耐用標籤;而直接熱感印表機則因其耗材成本更低、工作流程更簡化而日益普及。儘管工業印表機仍然是全球製造業的標配,但隨著末端配送網路和現場服務機構對即時標籤的需求不斷成長,行動印表機如今已成為明顯的成長引擎。隨著中國製造商不斷擴大規模並在價格上挑戰現有企業,競爭日益激烈,迫使老牌企業加強對軟體整合和專業服務的投入。

全球條碼印表機市場趨勢與洞察

全通路零售與電子商務物流的蓬勃發展

為了因應季節性需求波動,零售商在多個管道管理統一庫存時,需要在履約中心即時列印標籤。 American Eagle Outfitters 在其位於賓州、佔地 165 萬平方英尺的物流中心實施了基於影像的解決方案,將紙箱讀取準確率提升至 99%,這表明更高的掃描率能夠帶來更精準的列印效果。 Blue Sky Distribution 將客製印刷與路線規劃軟體同步,實現了 100% 的訂單準確率,並將履約效率提高了 80%。為了消除固定瓶頸並提高倉庫的靈活性,企業正在揀貨車上部署固定式印表機。雲端監控也越來越受歡迎,使 IT 團隊能夠遠端管理韌體和安全性修補程式。這些需求正推動條碼印表機市場向無線、堅固耐用型設備發展,這些設備可以透過集中式控制面板進行維護。

工業4.0主導的智慧工廠採用AIDC

智慧工廠依靠自動化識別和資料擷取,將生產資產與ERP和MES平台直接連接起來。斑馬公司的FS42固定式掃描器整合了神經處理技術,用於檢測條碼並為AI模型提供數據,從而標記生產線上的缺陷。條碼列印機將序號傳輸到工廠網路,支援基於組件ID的預測性維護程序。 Brady公司聲稱,基於列印條碼的自動化資料輸入可以消除高達90%的手動輸入錯誤,同時將營運效率提高40%。因此,製造商正在指定支援工業通訊協定、邊緣運算和高吞吐量的印表機。儘管各產業的資本支出大幅放緩,但硬體更新換代週期仍在持續。

熱感印表機頭的供應和價格波動

關稅和不斷上漲的原料價格將導致熱敏紙成本在2024年之前出現兩位數的成長。印表機頭生產集中在東亞少數幾家專業工廠,替換用刷頭% 。原始設備製造商(OEM)必須儲備更多庫存,這增加了營運成本熱感,並推高了終端用戶的價格。由於買家等待零件成本恢復正常,一些計劃被迫停滯。從長遠來看,製造商正在評估多供應商策略,但資金障礙限制了供應多樣性。

細分市場分析

到2024年,工業印表機將佔據條碼印表機市場57.1%的佔有率,並創造最高的收入。這些設備支援寬幅介質、鋼製底盤,並具備超過全天候運作的超長列印週期,因此對於製造商和物流中心而言,執行時間。 SATO的CL4NX Plus印表機列印速度高達14吋/秒,並配備基於韌體的印字頭磨損追蹤功能,可實現預測性零件更換。然而,到2030年,行動條碼印表機的複合年成長率將達到6.2%,因為零工經濟宅配業者、現場工程師和店內揀貨員需要輕巧易攜的設備。行動條碼印表機市場預計將從2025年的10.2億美元成長到2030年的13.9億美元,這表明便攜性正在重新定義客戶的期望。桌上型印表機憑藉其可接受的列印週期和適中的初始投資,在小型企業中越來越受歡迎。將工業引擎安裝在推車平台上的混合設計可能會模糊產品線,這表明未來的產品細分將更多地取決於工作流程而不是外形規格。

就出貨量而言,工業印表機仍佔最大佔有率。然而,中國OEM廠商的激進定價策略正在擠壓中端市場的利潤空間。隨著買家更加重視電池續航時間、無線安全性和抗摔性能,行動印表機的平均售價表現更為穩定。展望未來,工業印表機產品可能會專注於乙太網路、藍牙5和WPA3等連接方式的升級,而行動印表機產品則會在輕薄且麵向醫療保健的抗菌外殼方面展開競爭。工業領域根深蒂固的需求與行動領域的快速發展並存,凸顯了市場區隔即使某個細分市場日益成熟,也能持續成長的潛力。

條碼印表機市場按產品類型(桌上型印表機、行動印表機、工業印表機)、列印熱感(熱轉印、直熱式、雷射、噴墨等)、終端用戶產業(製造業、零售業、運輸物流業、醫療保健業及其他終端用戶產業)及地區進行細分。市場預測以美元計價。

區域分析

到2024年,北美將佔據條碼印表機市場31.7%的佔有率。聯邦政府的採購,例如美國郵政服務公司對數千台斑馬(Zebra)設備的更新換代,推動了硬體需求的成長。藥品供應鏈法規也要求醫院和藥局投資購買能夠處理GS1 DataMatrix條碼介質的印表機。加拿大零售業的現代化以及墨西哥加工廠的出口進一步提振了該地區的需求。預計北美條碼印表機市場規模將在2025年達到14.9億美元,並在2030年達到18.1億美元。該地區的用戶通常優先考慮整體擁有成本,因此他們傾向於採用遠端設備管理套件,以便無需現場維護即可安排韌體更新。

亞太地區是成長最快的區域,預計到2030年複合年成長率將達到4.9%。中國和印度持續興建家用電器和服裝新工廠,這些工廠都需要在線上貼標以滿足出口需求。 Gainsha擁有4萬平方公尺的生產空間,並持有50項熱感專利。其HPRT產品銷往80多個國家,體現了中國品牌的全球影響力。日本汽車工廠正加速推動工業4.0的整合,而東南亞地區則出現了近岸外包現象,推動了南方地區對貼標設備的需求。預計到2025年,亞太地區條碼印表機市場規模將達13.3億美元,2030年將超過16.9億美元。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全通路零售與電子商務物流的蓬勃發展

- 工業4.0主導的智慧工廠採用AIDC

- 醫療保健和食品產業對低溫運輸可追溯性的需求

- 行動和穿戴式條碼印表機市場

- 雲端原生遠端列印管理和安全

- 採用無底紙標籤以符合ESG標準

- 市場限制

- 熱感印表機頭的供應和價格波動

- 向2D碼/RFID技術的轉變將降低對基礎條碼的需求。

- 更嚴格的電子垃圾處理指令將推高生命週期成本。

- 在嚴苛的工業應用中,轉向直接零件標記和雷射蝕刻技術

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 依產品類型

- 桌上型印表機

- 行動印表機

- 工業印表機

- 透過印刷技術

- 熱傳遞

- 直接熱感

- 雷射

- 噴墨

- 其他

- 按最終用戶行業分類

- 製造業

- 車

- 電子學

- 食品/飲料

- 其他

- 零售

- 運輸與物流

- 衛生保健

- 其他終端用戶產業

- 製造業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Zebra Technologies Corporation

- Sato Holdings Corporation

- Honeywell International Inc.

- Toshiba Tec Corporation

- Avery Dennison Corporation

- Seiko Epson Corporation

- TSC Auto ID Technology Co. Ltd.

- Brother Industries Ltd.

- Postek Electronics Co. Ltd.

- Primera Technology Inc.

- Bixolon Co. Ltd.

- Citizen Systems Japan Co. Ltd.

- Godex International Co. Ltd.

- Wasp Barcode Technologies

- Cab Produkttechnik GmbH and Co KG

- Printronix Auto ID Inc.

- Gainscha Technology Group Ltd.

- Domino Printing Sciences plc

- IDPRT(Xiamen Hanin Co. Ltd.)

- Datamax

第7章 市場機會與未來展望

The barcode printer market size is valued at USD 4.71 billion in 2025 and is forecast to reach USD 5.78 billion by 2030, advancing at a 4.18% CAGR.

This growth reflects steady corporate investment in automation and supply chain digitization that keeps demand resilient even as the sector enters a more mature phase. Expanding traceability mandates in healthcare and food, the acceleration of omnichannel retail, and the need for serialized production data inside smart factories all sustain procurement budgets. Thermal transfer technology continues to anchor the barcode printer market because it supports durable labels for compliance-critical environments, yet direct thermal printers are gaining ground because users prefer their lower consumable costs and simplified workflows. Industrial printers remain the workhorse of global manufacturing sites, but mobile units are now the clear growth engine as last-mile delivery networks and field service organizations pursue real-time labeling. Competitive intensity is rising as Chinese manufacturers scale up and challenge incumbents on price, forcing established brands to double down on software integration and specialized service offerings.

Global Barcode Printer Market Trends and Insights

Omnichannel retail and e-commerce logistics boom

Retailers that manage unified inventories across multiple channels need labels printed in real time at fulfillment sites to cope with seasonal demand swings. American Eagle Outfitters lifted carton reading accuracy to 99% after installing image-based solutions in its 1.65 million sq ft Pennsylvania distribution center, illustrating how higher scan rates feed back into precise print requirements. Blue Sky Distribution recorded 100% order accuracy and an 80% jump in fulfillment efficiency once it synchronized on-demand printing with routing software, which cut single-day delivery errors as orders rose 70%. Retailers now deploy mobile printers on picking carts to remove stationary bottlenecks, enhancing flexibility on warehouse floors. Demand for cloud oversight is also rising so that IT teams can manage firmware and security patches remotely. These needs push the barcode printer market toward devices that are wireless, rugged, and serviceable through centralized dashboards.

Industry 4.0-driven smart factories adopting AIDC

Smart factories rely on automated identification and data capture to link production assets directly with ERP and MES platforms. Zebra's FS42 fixed scanner integrates neural processing to inspect codes and feed AI models that flag defects on the line. When barcode printers relay serial numbers to plant networks, they enable predictive maintenance programs that rely on component IDs. Brady Corporation observed that automated data entry based on printed codes can eliminate up to 90% of manual typing errors while increasing lifting efficiency by 40%. Manufacturers therefore specify printers that support industrial protocols, edge computing, and high-volume throughput. The result is sustained hardware refresh cycles despite the broader slowdown in capital expenditure across sectors.

Supply volatility and price swings for thermal printheads

Tariffs and rising input prices pushed thermal paper costs up by double digits in 2024. Printhead fabrication is concentrated among a handful of specialist plants in East Asia, and replacement heads wear 25-50% faster in direct thermal modes than in thermal transfer settings. OEMs must stock larger buffers, elevating working capital needs and pushing end-user prices higher. Some projects have slipped because buyers wait for component costs to normalize. Longer term, manufacturers are evaluating multi-supplier strategies, yet the capital barrier keeps supply diversity modest.

Other drivers and restraints analyzed in the detailed report include:

- Cold-chain traceability demand in healthcare and food

- Mobile and wearable barcode printers enhancing field productivity

- Migration toward QR / RFID reducing basic barcode demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial printers produced the highest revenue in 2024 by securing 57.1% of the barcode printer market. These devices deliver wide media widths, steel chassis, and duty cycles that exceed 24-hour operation, which manufacturers and logistics hubs value for uptime. SATO's CL4NX Plus prints at 14 ips while tracking head wear in firmware, ensuring predictive part replacement. Nonetheless, mobile units record a 6.2% CAGR to 2030 as gig-economy couriers, field engineers, and in-store pickers seek lightweight devices that roam with workers. The barcode printer market size for mobile models is projected to expand from USD 1.02 billion in 2025 to USD 1.39 billion by 2030, indicating that portability is redefining customer expectations. Desktop printers keep traction among small firms because they blend acceptable duty cycles with modest capex. Hybrid designs that mount industrial engines on cart platforms may blur product lines, suggesting future segmentation will hinge on workflow rather than form factor.

In volume terms, industrial printers still ship the largest absolute unit count because multi-line factories employ fleets for work-in-process tickets. However, price aggression by Chinese OEMs is compressing margins in the mid-tier. Mobile printer ASPs have proven more resilient because buyers prioritize battery life, wireless security, and drop resistance. Over the forecast, industrial SKU turnover will center on connectivity upgrades-Ethernet, Bluetooth 5, and WPA3-while mobile SKUs will compete on weight reductions and antimicrobial casings for healthcare. The coexistence of entrenched industrial demand with agile mobile adoption underscores how the barcode printer market can grow even as one segment matures.

Barcode Printer Market is Segmented by Product Type (Desktop Printers, Mobile Printers, Industrial Printers), Printing Technology (Thermal Transfer, Direct Thermal, Laser, Inkjet, Others), End-User Industry (Manufacturing, Retail, Transportation and Logistics, Healthcare, Other End-User Industries), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 31.7% of the barcode printer market in 2024. Federal procurement, such as the United States Postal Service's refresh of thousands of Zebra devices, anchors hardware volumes. Drug supply chain laws also oblige hospitals and pharmacies to invest in printers that handle GS1 DataMatrix media. Canada's retail modernization and Mexico's maquiladora exports further reinforce regional demand. The barcode printer market size for North America is estimated at USD 1.49 billion in 2025 and will edge toward USD 1.81 billion by 2030. Users in the region typically prioritize total cost of ownership, driving adoption of remote fleet management suites that schedule firmware updates without site visits.

Asia-Pacific is the fastest-expanding arena with a 4.9% CAGR to 2030. China and India keep building new factories for consumer electronics and apparel, each requiring inline labeling for export. Gainscha operates over 40,000 sqm of manufacturing space and holds 50 thermal patents, underscoring indigenous capability gains. HPRT reports distribution in more than 80 countries, reflecting the global reach of Chinese brands. Japan advances Industry 4.0 integration in automotive plants, while Southeast Asia wins near-shoring that moves labeling equipment demand southward. The barcode printer market size in Asia-Pacific is projected at USD 1.33 billion in 2025 and should exceed USD 1.69 billion by 2030.

- Zebra Technologies Corporation

- Sato Holdings Corporation

- Honeywell International Inc.

- Toshiba Tec Corporation

- Avery Dennison Corporation

- Seiko Epson Corporation

- TSC Auto ID Technology Co. Ltd.

- Brother Industries Ltd.

- Postek Electronics Co. Ltd.

- Primera Technology Inc.

- Bixolon Co. Ltd.

- Citizen Systems Japan Co. Ltd.

- Godex International Co. Ltd.

- Wasp Barcode Technologies

- Cab Produkttechnik GmbH and Co KG

- Printronix Auto ID Inc.

- Gainscha Technology Group Ltd.

- Domino Printing Sciences plc

- IDPRT (Xiamen Hanin Co. Ltd.)

- Datamax

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Omnichannel retail and e-commerce logistics boom

- 4.2.2 Industry 4.0-driven smart factories adopting AIDC

- 4.2.3 Cold-chain traceability demand in healthcare and food

- 4.2.4 Mobile and wearable barcode printer

- 4.2.5 Cloud-native remote print management and security

- 4.2.6 Adoption of linerless labeling for ESG compliance

- 4.3 Market Restraints

- 4.3.1 Supply volatility and price swings for thermal printheads

- 4.3.2 Migration toward QR/RFID reducing basic barcode demand

- 4.3.3 Tightening e-waste directives inflating lifecycle costs

- 4.3.4 Shift to direct-part marking and laser etching in harsh industrial use

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Assessment of the Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Desktop Printers

- 5.1.2 Mobile Printers

- 5.1.3 Industrial Printers

- 5.2 By Printing Technology

- 5.2.1 Thermal Transfer

- 5.2.2 Direct Thermal

- 5.2.3 Laser

- 5.2.4 Inkjet

- 5.2.5 Others

- 5.3 By End-user Industry

- 5.3.1 Manufacturing

- 5.3.1.1 Automotive

- 5.3.1.2 Electronics

- 5.3.1.3 Food and Beverage

- 5.3.1.4 Others

- 5.3.2 Retail

- 5.3.3 Transportation and Logistics

- 5.3.4 Healthcare

- 5.3.5 Other End-user Industries

- 5.3.1 Manufacturing

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 GCC

- 5.4.5.1.2 Turkey

- 5.4.5.1.3 Israel

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Kenya

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Zebra Technologies Corporation

- 6.4.2 Sato Holdings Corporation

- 6.4.3 Honeywell International Inc.

- 6.4.4 Toshiba Tec Corporation

- 6.4.5 Avery Dennison Corporation

- 6.4.6 Seiko Epson Corporation

- 6.4.7 TSC Auto ID Technology Co. Ltd.

- 6.4.8 Brother Industries Ltd.

- 6.4.9 Postek Electronics Co. Ltd.

- 6.4.10 Primera Technology Inc.

- 6.4.11 Bixolon Co. Ltd.

- 6.4.12 Citizen Systems Japan Co. Ltd.

- 6.4.13 Godex International Co. Ltd.

- 6.4.14 Wasp Barcode Technologies

- 6.4.15 Cab Produkttechnik GmbH and Co KG

- 6.4.16 Printronix Auto ID Inc.

- 6.4.17 Gainscha Technology Group Ltd.

- 6.4.18 Domino Printing Sciences plc

- 6.4.19 IDPRT (Xiamen Hanin Co. Ltd.)

- 6.4.20 Datamax

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment