|

市場調查報告書

商品編碼

1642965

大型LNG接收站:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Large Scale LNG Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

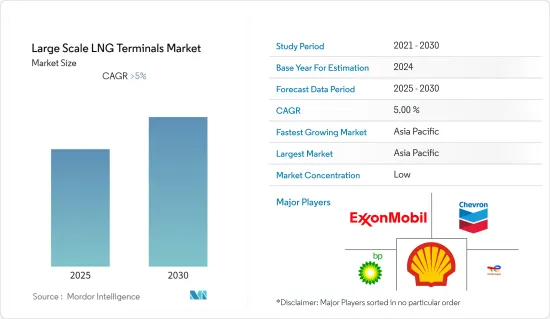

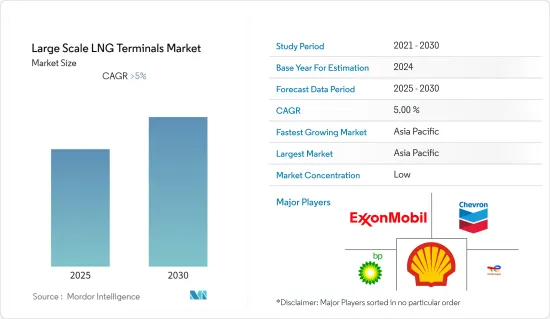

預計預測期內大型LNG接收站市場將以超過 5% 的複合年成長率成長。

市場受到了 COVID-19 的負面影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 天然氣是一種比原油更乾淨的燃料,有助於減少空氣污染,進而減少透過多種有毒大顆粒傳播的空氣傳播感染疾病。另一方面,交易是根據需求達成的。電力、化肥、城市燃氣發行網路以及煉油廠是國內液化天然氣市場的主要驅動力。

- 然而,天然氣價格波動預計會阻礙市場成長,因為它增加了建造大型液化天然氣終端的風險。

- 該地區的供應失衡可能會導致對其他地區的依賴增加,從而為LNG接收站公司創造機會。

- 亞太地區憑藉液化終端和再氣化終端佔據大型LNG接收站市場的主導地位。澳洲、印尼和馬來西亞擁有最大的液化終端容量,而日本、韓國、中國和印度擁有最大的液化天然氣再氣化基礎設施容量。

大型液化LNG接收站市場趨勢

再氣化液化LNG接收站佔市場主導地位

- 2021年,日本、韓國、中國和西班牙將在大型LNG再氣化終端市場佔據主導地位。 2021年日本的液化天然氣再氣化能力將達到每年2.114億噸,位居世界第一。

- 2021年歐洲天然氣消費量總量為4,120億立方米,較2020年成長4%(170億立方米)。 2021年,歐盟以液化天然氣形式進口的天然氣佔其天然氣總消費量的24%,其餘則透過管道進口,主要來自俄羅斯、挪威、英國和阿爾及利亞。

- 此外,截至 2022 年 2 月,歐洲已有 21 個終端運作,總合氣化能力為 1,600 億立方公尺/年,總合儲存量為 765 萬立方公尺液化天然氣。

- 歐洲還有 5 個計劃(包括現有終端的擴建)正在建設中,總計增加 195 億立方公尺/年的再氣化能力。因此,由於上述計劃和歐洲液化天然氣消費量的增加,預計液化天然氣再氣化終端部分將在預測期內成長。

- 隨著對天然氣的需求不斷增加,特別是在電力領域,預計預測期內將進一步進行大規模液化天然氣試運行。

亞太地區佔市場主導地位

- 根據《BP世界能源評論》,2021年亞太地區佔全球液化天然氣進口能力的72%。除了都市化和快速的經濟成長外,新的液化天然氣再氣化終端的建設也發揮關鍵作用。

- 2021年亞太地區液化天然氣進口量達3,718億立方公尺。預計進口量將繼續以 7.7% 的年成長率成長,這將在預測期內產生對大型LNG接收站的需求。

- 中國正在興建24座LNG接收站,總產能為8,500萬噸/年。總部位於新加坡的大西洋、海灣和太平洋有限公司也計劃在 2024 年前開設印度首個液化天然氣港口,但正在考慮該國南部地區以及其他可能的地點。

- 因此,由於即將上線的LNG接收站計劃和不斷增加的液化天然氣進口能力,該地區預計將在預測期內佔據市場主導地位。

大型LNG接收站產業概況

大型LNG接收站市場呈現細分化。市場上的主要企業(不分先後順序)包括道達爾能源公司、埃克森美孚公司、殼牌公司、雪佛龍公司和英國石油公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2022 年液化天然氣接收站清單(按容量和位置)

- 未來液化天然氣終端清單(按容量和位置)

- 至 2027 年LNG接收站市場資本支出(單位:十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 位置

- 陸上

- 海上

- 手術

- 液化

- 再氣化

- 地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Cheniere Energy Inc.

- China National Offshore Oil Corporation(CNOOC)

- TotalEnergies SE

- Exxon Mobil Corporation

- Shell PLC

- Chevron Corporation

- British Petroleum(BP)PLC

- Tokyo Electric Power Company Holding Inc.

- Tokyo Gas Co. Ltd

- Petronet LNG Ltd

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 68225

The Large Scale LNG Terminals Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Natural gas is a cleaner fuel than crude oil, helps to reduce air pollution, and thereby helps in reducing air-spread diseases that get spread through multiple toxic macro particles. On the other hand, trading takes place on the ground of requirements. The power, fertilizers, city gas distribution networks, and refineries majorly drive the liquefied natural gas market within a country.

- However, fluctuating natural gas price increases the risk associated with large-scale LNG terminal construction and, therefore, is expected to hinder the market's growth.

- The supply imbalance in the region would result in increased dependency on the other regions, which is expected to create an opportunity for the LNG terminal companies.

- The Asia-Pacific is dominating the large-scale LNG terminals market with the presence of both liquefaction and regasification terminals. Australia, Indonesia, and Malaysia have the highest capacity liquefaction terminals, while Japan, South Korea, China, and India have the highest capacity infrastructure for the regasification of LNG.

Large Scale LNG Terminals Market Trends

Regasification LNG Terminals to Dominate the Market

- In 2021, Japan, South Korea, China, and Spain dominated the market with a large capacity of LNG regasification terminals. Japan's regasification capacity for LNG accounted for 211.4 million metric tons per year in 2021, the highest in the world.

- In 2021, the total consumption of natural gas in Europe amounted to 412 billion cubic meters, up by 4% (17 billion cubic meters) compared to 2020. In 2021, the EU imported 24% of its total natural gas through LNG, with the remaining coming from pipelines, primarily from Russia, Norway, the UK, and Algeria.

- Moreover, In February 2022, 21 terminals were operating in Europe, with a combined regasification capacity of 160 bcm/year and a combined storage capacity of 7.65 million m3 LNG.

- There were five more projects (including expansion at existing terminals) under construction in Europe, adding up to an additional 19.5 bcm/year of regasification capacity overall. Thus, with the above projects and increasing LNG consumption in Europe, the LNG regasification terminals segment is expected to grow in the forecast period.

- With the increasing demand for natural gas, especially in the power sector, it is expected that more large-scale LNG is expected to get commissioned during the forecast period.

Asia-Pacific to Dominate the Market

- In 2021, According to the BP World Energy Review, the region accounted for 72% of the global capacity in LNG imports. In addition to urbanization and rapid economic growth, the construction of new LNG regasification terminals has played a key role.

- LNG imports accounted for 371.8 Billion cubic meters in Asia-Pacific in 2021. With an annual growth rate of 7.7%, imports are expected to increase in the future, which, in turn, will create demand for large-scale LNG terminals in the forecast period.

- China had 24 terminals under construction with a total capacity of 85 million tons per year. Additionally, By 2024, Singapore-based Atlantic, Gulf, and Pacific seek to open its first liquefied natural gas port in India, however, it is considering other locations in addition to the southern part of the nation as a potential site.

- Thus, with the upcoming LNG terminal projects and increasing LNG import capacity, the region is expected to dominate the market in the forecast period.

Large Scale LNG Terminals Industry Overview

The Large-Scale LNG Terminal Market is fragmented. Some of the key players in the market ( not in a particular order ) include TotalEnergies SE, Exxon Mobil Corporation, Shell PLC, Chevron Corporation, and BP PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 List of LNG Terminals by Capacity, and by Location, 2022

- 4.3 List of Upcoming Terminals by Capcity and Location

- 4.4 CAPEX Forecast for LNG Terminals Market in USD billion, till 2027

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Operation

- 5.2.1 Liquefaction

- 5.2.2 Regasification

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cheniere Energy Inc.

- 6.3.2 China National Offshore Oil Corporation (CNOOC)

- 6.3.3 TotalEnergies SE

- 6.3.4 Exxon Mobil Corporation

- 6.3.5 Shell PLC

- 6.3.6 Chevron Corporation

- 6.3.7 British Petroleum (BP) PLC

- 6.3.8 Tokyo Electric Power Company Holding Inc.

- 6.3.9 Tokyo Gas Co. Ltd

- 6.3.10 Petronet LNG Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219