|

市場調查報告書

商品編碼

1643006

印度木材:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Wood - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

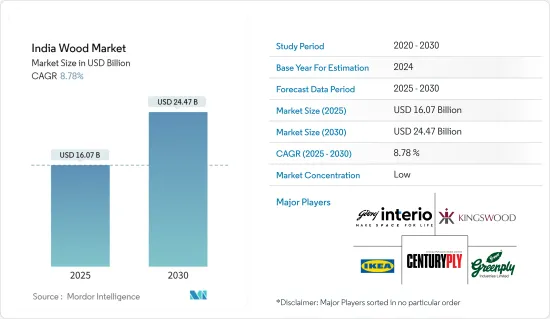

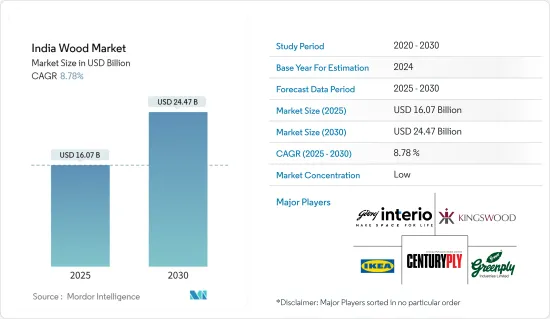

印度木材市場規模預計在 2025 年為 160.7 億美元,預計到 2030 年將達到 244.7 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 8.78%。

印度木材市場對該國經濟至關重要,快速的都市化和經濟成長推動了該國經濟的發展。它涵蓋廣泛的活動,從砍伐和鋸切到生產家具和人造板等成品木製品。本產業主要分為木材、膠合板、單板、人造板(如中密度纖維板(MDF)和塑合板)等主要領域。木材廣泛用於建築、包裝和家具製造,而膠合板和單板則是住宅和辦公室室內裝飾的必需品。

中產階級的不斷壯大和收入水準的提高推動了對傳統和現代木質家具的需求。此外,木質板材因其在模組化家具和建築中的多功能性和成本效益而越來越受歡迎。總體而言,在房地產行業的不斷擴張和消費者偏好的不斷變化推動下,印度木材行業預計將持續成長。

印度木材市場的趨勢

快速的都市化和持續的經濟成長推動印度木材市場

- 印度木材市場包括伐木、鋸切和家具、人造板等成品生產。隨著都市化的快速發展和經濟的持續成長,對木製品的需求不斷增加。該行業受益於多種市場促進因素,為國民經濟做出了重大貢獻。

- 成長的主要動力之一是蓬勃發展的房地產和建築業。都市化加快和政府推出的經濟適用住宅等措施推動了建築、家具和室內設計對木材的需求。可支配收入的增加和生活方式的改變也導致消費者在木質家具和家居裝飾上的支出增加,進一步推動了該行業的成長。

- 隨著越來越多的家庭尋求美觀、耐用的木製品,印度不斷壯大的中產階級也促進了該產業的發展。設計創新和先進製造技術的採用提高了產品品質和效率,使更多人能夠享用木製品。消費者轉向永續和環保材料為木材產業的發展創造了新的機會。

- 總體而言,在強勁的市場需求和不斷變化的消費者偏好的推動下,印度木材市場預計將繼續擴大。

印度木質家具市場網上零售的興起

- 印度木材市場正在經歷顯著成長,這得益於幾個關鍵因素,其中包括線上家具市場的快速擴張。網上家具銷售的大幅成長反映了消費者對便利性和可獲得性的偏好的改變。

- 這種成長很大程度上歸因於電子商務平台的興起,使消費者可以輕鬆購買到各種各樣的木質家具產品。此外,可支配收入的增加和都市化推動了對高品質、美觀的木質家具的需求。

- 該行業的擴張也推動了向永續和環保材料的轉變,符合鼓勵使用木質產品的全球趨勢。生產和設計方面的創新豐富了產品組合,以滿足印度中階不斷變化的偏好。總體而言,線上家具市場的強勁表現和良好的經濟環境有望推動印度木材產業繼續成長。

印度木材產業概況

印度木材產業比較分散,有大、中、小型企業。一些主要企業包括 Century Plyboards India Ltd、Godrej Interio、Greenply Industries Limited、Ikea India Pvt Ltd 和 Kingswood Group of Companies。儘管存在少數大型參與者,但市場仍然是多元化的。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場促進因素

- 消費者在住宅家具上的支出增加

- 線上零售平台的成長使消費者更容易買到木製家具

- 市場限制

- 採購和加工環保材料的成本可能很高,影響價格競爭力

- 遵守法規

- 市場機會

- 快速的都市化和房地產開發為建築和家居裝飾帶來對木材的穩定需求

- 木製家具進出口洞察

- 洞察最新市場趨勢與創新

- 波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 深入了解影響市場的各種監管發展

- COVID-19 市場影響

第5章 市場區隔

- 按類型

- 硬木

- 針葉樹

- 按材質

- 合板

- 層壓板

- MDF

- 其他材料

- 按產品

- 臥室

- 座位

- 廚房

- 其他產品

- 按應用

- 住宅

- 業務

- 按分銷管道

- 線上

- 離線

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Century Plyboards India Ltd

- Godrej Interio(Godrej & Boyce Mfg. Co)

- Greenply Industries Ltd

- Ikea India Pvt Ltd

- Kingswood Group of Companies

- Indroyal Furniture Pvt Ltd

- Merino Industries Ltd

- Nilkamal Ltd

- Zuari Furniture

- Durian*

第7章 未來市場趨勢

第8章 免責聲明

The India Wood Market size is estimated at USD 16.07 billion in 2025, and is expected to reach USD 24.47 billion by 2030, at a CAGR of 8.78% during the forecast period (2025-2030).

The wood market in India is vital to the country's economy, which is underpinned by the country's rapid urbanization and economic growth. It consists of a broad range of activities, from logging and sawmilling to the production of finished wood products like furniture and wood-based panels. The industry is segmented into key areas such as sawn timber, plywood, veneers, and wood-based panels like medium-density fiberboard (MDF) and particleboard. Sawn timber is widely used in construction, packaging, and furniture making, while plywood and veneers are essential for home and office interiors.

The growing number of middle class and rising income levels are driving increased demand for both traditional and modern wooden furniture. In addition, wood-based panels are gaining popularity due to their versatility and cost-effectiveness in modular furniture and construction. Overall, the Indian wood industry is poised for continued growth, supported by the expanding real estate sector and evolving consumer preferences.

India Wood Market Trends

Rapid Urbanization and Ongoing Economic Growth is Driving India's Wood Market

- The wood market in India encompasses activities from logging and sawmilling to the production of finished goods like furniture and wood-based panels. As the country urbanizes rapidly and economic growth continues, the demand for wood products is on the rise. The industry benefits from several market drivers, making it a major contributor to the nation's economy.

- One of the primary drivers of growth is the booming real estate and construction sectors. With increasing urbanization and government initiatives like affordable housing, there is a growing demand for wood in construction, furniture, and interior design. Rising disposable incomes and lifestyle changes have also led to higher consumer spending on wooden furniture and home decor, further fueling the industry's growth.

- The expanding middle class in India also contributes to the industry's growth, as more households seek aesthetically pleasing and durable wood products. Innovations in design and the adoption of advanced manufacturing techniques have enhanced product quality and efficiency, making wood products more accessible to a broader audience. The consumer shift toward sustainable and eco-friendly materials has opened new opportunities for growth in the wood industry.

- Overall, the Indian wood market is poised for continued expansion, driven by strong market demand and evolving consumer preferences.

Rise of Online Sales of Wooden Furniture Market in India

- The wood market in India is experiencing substantial growth, driven by several major factors, including the rapid expansion of the online furniture market. The significant increase in online furniture sales reflects changing consumer preferences for convenience and accessibility.

- This growth is largely fueled by the rise of e-commerce platforms, which provide consumers with easy access to a wide range of wood furniture products. Moreover, rising disposable incomes and urbanization are boosting demand for high-quality, aesthetically appealing wood furniture.

- The industry's expansion is also supported by a shift toward sustainable and eco-friendly materials, aligning with global trends and encouraging the use of wood-based products. Innovations in manufacturing and design are enhancing product offerings and catering to the ever-evolving tastes of the Indian middle class. Overall, the Indian wood industry is positioned for continued growth, bolstered by the strong performance of the online furniture market and a favorable economic environment.

India Wood Industry Overview

The wood industry in India is fragmented, featuring a mix of small to medium-sized enterprises and large players. Key companies include Century Plyboards India Ltd, Godrej Interio, Greenply Industries Limited, Ikea India Pvt Ltd, and Kingswood Group of Companies. Despite a few major players, the market remains highly diverse.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Consumer Spending on Residential Furniture

- 4.1.2 Growth in Online Retail Platforms Makes Wood Furniture More Accessible to Consumers

- 4.2 Market Restraints

- 4.2.1 The Cost of Sourcing and Processing Eco-Friendly Materials Can Be Higher, Affecting Pricing Competitiveness

- 4.2.2 Regulatory Compliance

- 4.3 Market Opportunities

- 4.3.1 Rapid Urbanization and Real Estate Development Create a Steady Demand for Wood in Construction and Home Furnishings

- 4.4 Insights into Export and Import of Wooden Furniture

- 4.5 Insights into Current Trends and Technological Innovations in the Market

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Various Regulatory Trends Shaping the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hardwood

- 5.1.2 Softwood

- 5.2 By Material

- 5.2.1 Plywood

- 5.2.2 Laminates

- 5.2.3 MDF

- 5.2.4 Other Materials

- 5.3 By Product

- 5.3.1 Bedroom

- 5.3.2 Seating

- 5.3.3 Kitchen

- 5.3.4 Other Products

- 5.4 By Application

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.5 By Distribution Channel

- 5.5.1 Online

- 5.5.2 Offline

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Century Plyboards India Ltd

- 6.2.2 Godrej Interio (Godrej & Boyce Mfg. Co)

- 6.2.3 Greenply Industries Ltd

- 6.2.4 Ikea India Pvt Ltd

- 6.2.5 Kingswood Group of Companies

- 6.2.6 Indroyal Furniture Pvt Ltd

- 6.2.7 Merino Industries Ltd

- 6.2.8 Nilkamal Ltd

- 6.2.9 Zuari Furniture

- 6.2.10 Durian*