|

市場調查報告書

商品編碼

1643012

工業吸塵器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Industrial Vacuum Cleaner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

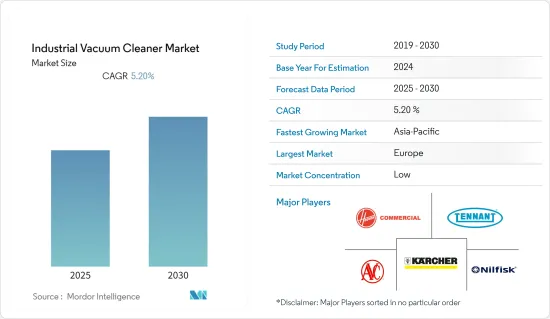

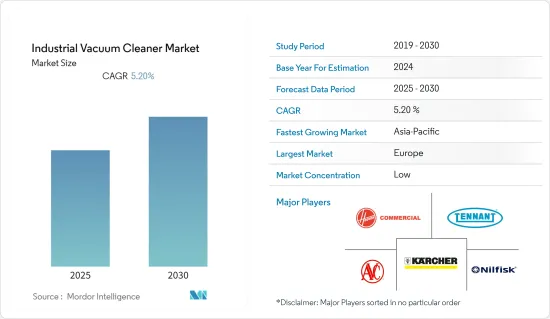

預計預測期內工業吸塵器市場複合年成長率為 5.2%。

主要亮點

- 氣動技術是市場上成長最快的領域,因為它是採用伯努利原理工作的壓縮空氣驅動幫浦運作的系統。各種類型的吸塵器(例如罐式、直立式和背包式)在商業和工業用途上的廣泛普及正在推動全球市場上這一細分市場的成長。

- 製造工廠和其他行業的高人事費用和日益增加的任務複雜性不斷增加,導致受傷的威脅不斷增加,促使工業吸塵器的採用越來越多。然而,機器成本高、機器結構複雜且關鍵、備件可用性低將限制工業吸塵器市場的成長。

- 此外,製藥業需要最大限度地控制空氣中的顆粒物(蒸氣和灰塵)。此外,必須遵守高標準的衛生、消毒和清洗規定,以防止實驗室、無塵室和生產現場受到污染。這就是為什麼工業界依賴氣動工業吸塵器的原因。其中一個例子就是 DU-PUY 提供的工業吸塵器。該機器採用不銹鋼設計,具有 ATEX 認證、絕對 H 級過濾、最低噪音水平和機器的客製化修改。

- 此外,根據美國人口普查局的數據,2021 年美國商業建築建設投資達 910.3 億美元,而 2020 年為 868.2 億美元。商業建築的復甦預計將推動工業吸塵器的需求,工業吸塵器可能用於清潔水泥、混凝土、大理石、木材、金屬、鋁、石膏和花崗岩產生的灰塵。

- 由於供應鏈和物流中斷,COVID-19 疫情的爆發在頭幾個月影響了真空技術市場。然而,隨著製造工廠在封鎖初期後重新開放,這些解決方案開始受到青睞。 AltasCopco 表示,疫情期間設備訂單增加,主要受半導體產業對真空設備需求增加的推動。伴隨著真空設備市場的這些變化,對吸塵器的需求也隨之增加。

工業吸塵器的市場趨勢

食品飲料產業大幅成長

- 政府對食品和飲料行業安全和衛生的嚴格規定將成為推動工業吸塵器市場成長的主要動力。

- 在食品和飲料行業中,工業吸塵器不僅用於清潔生產區域、生產線、烤箱和實驗室,還可以用於運輸粉末和顆粒(糖、可可、咖啡等)、吸取食物廢棄物(液體、固體和灰塵)以及吸取包裝機的碎屑和切口。

- 2021年,英國消費者支出達到約1,180億英鎊(約1,400億美元)。據 gov.uk 稱,食品業在政府 2022 年 6 月的升級議程中也發揮核心作用。食品工業遍布全國每個地區。它是英國最大的製造業,重要性比汽車和航太工業的總合還要高。

- 許多市場參與者提供用於自動清潔過程的吸塵器。例如,2022年2月,Piab推出了用於食品產業自動化的吸塵器和夾持器。 piSoftgrip100-4 有四個抓握手指和一個真空腔,可以吸塵和清洗寬度達 100 毫米的物體。它是一體式的,堅固且易於理解。這款真空夾持器可以自動處理和清洗新鮮、未包裝的精緻食物,而不會壓碎它們。 piSoftgrip 吸塵器對於清潔精緻和易碎的物體是一種強大的解決方案。

- 食品業最大的風險是食品污染。對於不遵守良好生產規範 (GMP) 規定或在製造過程中實施 HACCP通訊協定的企業,預防微生物污染和交叉污染至關重要,以避免受到嚴厲的經濟制裁。由於工業吸塵器的使用消除了食品污染的可能性,這些法規將增加對吸塵器的需求。

亞太地區是成長最快的市場

- 工業和商業領域擴大採用最新技術,推動了亞太地區工業吸塵器市場的需求。成長將主要受到中國、日本和印度日益成長的需求的推動。

- 工業自動化的成長和工業消費者不斷成長的需求是推動亞太地區工業吸塵器市場快速成長的一些關鍵因素。

- 2022 年 3 月,無袋吸塵器的發明者戴森宣布將在未來四年內在新加坡投資 15 億新元(約 11 億美元),這是其 49 億新加坡元(約 35 億美元)全球投資計畫中的最新投資。

- COVID-19 不僅在亞太地區而且在世界其他地區都產生了不利影響,這可能會增加人們對工作場所清潔的重視程度。這可能會對工業吸塵器的成長產生正面影響。

工業吸塵器產業概況

工業吸塵器市場競爭激烈。由於大大小小的參與者眾多,市場較為分散。市場的主要企業包括 Quirepace Limited、Delfin Industrial Vacuums、Pullman Ermator Inc.、Hoover Commercial、Polivac International Pty Ltd 和 VAC-U-MAX。為了在預測期內獲得競爭優勢,公司正在建立多種夥伴關係並投資新產品的推出以增加市場佔有率。

- 2021 年 8 月 – Alfred Karcher SE & Co. KG 與 European Customer Synergy 合作。在未來幾年,凱馳和 ECS 旨在加強合作並專注於技術創新,降低 ECS 的營運成本和永續性。為此,凱馳提供全面、協調的清洗機器、數位產品、清洗劑和手動設備。 Karcher 提供軟體解決方案,以數位方式繪製建築服務提供者所進行的所有工作所涉及的流程。人工智慧使得以需求為導向、高效和透明的方式組織日常吸塵程序和更高層級的管理流程成為可能。

- 2021 年 3 月 - RGS Vacuum Systems 與 Energy Group-3D Printing Solutions 合作,進軍全球塑膠和金屬積層製造市場。能源集團 (Energy Group) 是積層製造市場的技術和印表機領導者和主要參與者,它選擇了 RGS 真空系統可靠且功能強大的吸塵器系列。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對工業吸塵器市場的影響

第5章 市場動態

- 市場促進因素

- 提高工業自動化

- 嚴格的健康和安全標準

- 市場挑戰

- 吸塵器機器成本高,結構笨重

第6章 市場細分

- 依產品類型

- 直立

- 罐

- 背包

- 按電源分類

- 電的

- 氣壓

- 按最終用戶產業

- 飲食

- 金工

- 藥品

- 製造業

- 建築和施工

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Quirepace Limited

- Delfin Industrial Vacuums

- Pullman Ermator Inc.

- Hoover Commercial

- Polivac International Pty Ltd

- VAC-U-MAX

- Tennant Company

- Robert Bosch GmbH

- Numatic International Ltd

- Nilfisk Inc.

- Kerstar UK Ltd

- Oreck Corporation

- British Vacuum Company

- American Vacuum Company

- Alfred Karcher GmbH and Co. KG

- RGS Vacuum Systems

第8章投資分析

第9章:市場的未來

The Industrial Vacuum Cleaner Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- Pneumatic technology is the fastest-growing segment in the market as these systems operate on compressed air-driven pumps that function on Bernoulli's principle. The wide availability of electrical vacuums of different types, such as canisters, upright, and backpacks for commercial and industrial purposes, is augmenting the growth of this segment in the global market.

- High labor costs and increasing complexity of operations in manufacturing stations and other industries constantly increasing the threat of injuries contribute to the increased adoption of industrial vacuum cleaners. However, high machinery costs, complex and significant structures of the machines, and lesser availability of spare parts would restrict the industrial vacuum cleaners market growth.

- Furthermore, the pharmaceutical industries require maximum control of suspended substances (vapors and DUST). In addition, a high degree of hygiene, sterilization, and cleaning is mandatory to prevent contamination in laboratories, clean rooms, and production sites. Therefore, industries depend on pneumatic industrial vacuum cleaners. One such example is the industrial vacuum cleaner offered by DU-PUY. The machine is designed with stainless steel, ATEX certification, absolute class H filtration, minimum sound level, and customized modifications on the machines.

- Moreover, according to the US Census Bureau, the value of US commercial building construction reached USD 91.03 billion in 2021 compared to USD 86.82 billion in 2020. Commercial construction recovery is expected to drive more demand for industrial vacuum cleaners that are likely to be used for cleaning the dust generated by cement, concrete, marble, wood, metal, aluminum, gypsum, and granite.

- The outbreak of the COVID-19 pandemic affected the market for vacuum technologies in the initial months due to supply chain and logistics disruption. However, these solutions started to gain traction as the manufacturing units reopened after the initial stages of the lockdown. According to AltasCopco, order volumes for equipment increased during the pandemic, mainly due to increased demand for vacuum equipment in the semiconductor industry. With such a change in the vacuum equipment market, the demand for vacuum cleaners increased.

Industrial Vacuum Cleaner Market Trends

Food and Beverages Industry to Witness Significant Growth

- The stringent government regulations regarding safety and hygiene in the food and beverage industry prove to be a significant driver for the growth of Industrial Vacuum Cleaners in the market.

- In the food and beverages industry, industrial vacuum cleaners are not only used for cleaning the production area, production lines, ovens, and laboratories but also for the transport of powders and granules (sugar, cocoa, coffee, etc.), the suction of food waste (liquid, solid, dusty), and suction of scraps and cut-outs from packaging machines.

- In 2021, consumer spending reached almost GBP 118 Billion (~USD 140 Billion) in the United Kingdom. According to gov.uk, the food industry also had a central role in the government's leveling up agenda in June 2022. It is present in every part of the country. It is the largest manufacturing sector in the United Kingdom, more significant than automotive and aerospace combined.

- Many market players are providing vacuum cleaners for automated cleaning processes. For instance, in February 2022, Piab launched a vacuum cleaner and gripper for food industry automation. The piSoftgrip100-4 has four gripping fingers and a vacuum cavity, allowing it to hold objects up to 100 mm wide for suction cleaning. It is made in one piece, producing a robust and straightforward product. The vacuum gripper can automate the handling and cleaning of fresh, unpackaged, and delicate food items without the risk of crushing them. The piSoftgripvacuum cleaner is a robust solution for sensitive and fragile objects.

- The highest risk for the food industry is food contamination. Preventing microbial and cross-contamination becomes crucial to avoid paying the heavy economic sanctions provided for those who do not abide by the rules of good manufacturing practices (GMP) or those who do not implement the HACCP protocol in the manufacturing process organization. Using industrial vacuums eliminates the possibility of food contamination; therefore, such regulations will boost the demand for vacuum cleaners.

Asia-Pacific to be the Fastest Growing Market

- The rising adoption of modern technologies in industrial and commercial uses will drive the demand in the Asian-pacific industrial vacuum cleaner market. The increased demand from China, Japan, and India primarily drives the growth.

- Growing industrial automation and rising demand from industrial consumers are some of the significant factors contributing to the fastest growth of the industrial vacuum cleaners market in the Asia-Pacific.

- In March 2022, Dyson, the bagless vacuum cleaner inventor, announced investing SGD 1.5 billion (~USD 1.1 Billion) in Singapore over the next four years, the newest phase of an SGD 4.9 billion (~USD 3.5 billion) global investment plan.

- The negative impact of COVID-19 not only on APAC but also on the rest of the world would increase the emphasis on cleanliness in workspaces. This could positively impact the growth of industrial vacuum cleaners.

Industrial Vacuum Cleaner Industry Overview

The industrial vacuum cleaner market is very competitive. The market is fragmented due to various small and large players. Some of the significant players in the market are Quirepace Limited, Delfin Industrial Vacuums, Pullman Ermator Inc., Hoover Commercial, Polivac International Pty Ltd, VAC-U-MAX. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

- August 2021 - Alfred Karcher SE & Co. KG partnered with European Customer Synergy. In the coming years, Karcher and ECS aim to strengthen cooperation and focus on innovation, reducing operational costs for ECS and sustainability. For this purpose, Karcher provides a comprehensive, coordinated offer of cleaning machines, digital products, cleaning agents, and manual equipment. Karcher offers a software solution that digitally maps the processes relating to all tasks carried out by building service providers. Artificial intelligence enables the needs-oriented, efficient, and transparent organization of the daily cleaning sequences with vacuum cleaners and higher-level management processes.

- March 2021 - RGS Vacuum Systems collaborated with Energy Group-3D printing solutions to develop the Additive Manufacturing market for the world of plastic and metal. Energy Group, a leader in technology and printers and a key player in the additive manufacturing market, has chosen RGS VACUUM SYSTEMS, reliable and competent, with its range of vacuum cleaners.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industrial Vacuum Cleaner Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Industrial Automation

- 5.1.2 Stringent Safety and Hygiene Standards

- 5.2 Market Challenges

- 5.2.1 High Machinery Cost and Heavy Structure of Vacuums

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Upright

- 6.1.2 Canister

- 6.1.3 Backpack

- 6.2 By Power Source

- 6.2.1 Electric

- 6.2.2 Pneumatic

- 6.3 By End-user Industry

- 6.3.1 Food and Beverages

- 6.3.2 Metal Working

- 6.3.3 Pharmaceuticals

- 6.3.4 Manufacturing

- 6.3.5 Building and Construction

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Quirepace Limited

- 7.1.2 Delfin Industrial Vacuums

- 7.1.3 Pullman Ermator Inc.

- 7.1.4 Hoover Commercial

- 7.1.5 Polivac International Pty Ltd

- 7.1.6 VAC-U-MAX

- 7.1.7 Tennant Company

- 7.1.8 Robert Bosch GmbH

- 7.1.9 Numatic International Ltd

- 7.1.10 Nilfisk Inc.

- 7.1.11 Kerstar UK Ltd

- 7.1.12 Oreck Corporation

- 7.1.13 British Vacuum Company

- 7.1.14 American Vacuum Company

- 7.1.15 Alfred Karcher GmbH and Co. KG

- 7.1.16 RGS Vacuum Systems