|

市場調查報告書

商品編碼

1643042

MulteFire:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)MulteFire - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

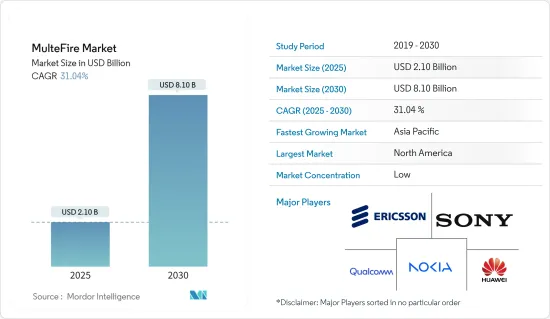

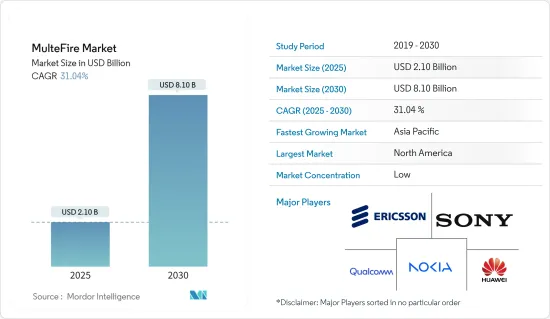

MulteFire 市場規模預計在 2025 年為 21 億美元,預計到 2030 年將達到 81 億美元,預測期內(2025-2030 年)的複合年成長率為 31.04%。

人們越來越依賴無線連接來向越來越多的設備傳遞大量訊息,這導致了網路容量有限。這促使 MulteFire 的創建,作為解決行動資料流程量不斷成長的問題的關鍵組件。

主要亮點

- MulteFire 將發揮關鍵推動作用,讓企業在全球未經授權的區域和全球頻譜中部署 LTE 專用網路,而無需行動網路營運商參與,包括 2.4 GHz 和 5 GHz 全球頻段、800/900 MHz 和 1.9 MHz 區域頻段。

- 憑藉其獨立功能,MulteFire 將向許多新參與者開放未經授權的頻譜,包括無線 ISP、全球企業、專業垂直行業甚至網路營運商,所有這些參與者都可以部署基於 MulteFire 的 LTE 專用網路。

- MulteFire 將 LTE 的卓越性能與未經授權頻譜的部署簡單性相結合,能夠在更多地方推出更先進的寬頻服務。由於 MulteFire 是基於 LTE,因此它在高達 20MHz 的寬頻頻寬上運行,支援高容量和低延遲,並實現高達 400Mbps 的峰值資料速率。

- MulteFire 可以允許企業和有線電視供應商使用未經授權的頻譜建立自己的 LTE 網路。結合增強安全性等 LTE 功能,MulteFire 預計將被港口、礦山和機場等工業領域的大型企業採用,這些領域沒有授權頻譜,而且需要比 Wi-Fi 通常提供的更高的移動性。此外,預計MulteFire 將成為物聯網部署的首選連線。

- 工業IoT(IIoT) 應用對更具可擴展性和更先進的網路連接的日益成長的需求是預計在預測期內推動多火市場擴張的關鍵因素之一。此外,對高效能且易於部署的無線連接網路的不斷成長的需求預計將推動多火力市場擴張。

- 然而,對高容量、具成本效益網路的日益成長的需求預計將限制多火力市場擴張。另一方面,有關共用頻譜利用的決策延遲預計將進一步阻礙該期間多火市場的成長。

- COVID-19 對多火市場產生了重大影響。各類製造企業和企業的快速關閉,為市場帶來了重大影響。第一中期,受新冠肺炎疫情影響,網路使用發生變化,各地基於網路品質的伺服器監測到的下載速度出現變化,導致流量增加。在學校停課和居家令等官方政策宣布後,幾乎所有地方的交通量都出現了最顯著的成長。

MulteFire 市場趨勢

工業物聯網 (IIoT) 應用對更好、更具可擴展性的網路連接的需求日益增加

- MulteFire 可能使企業和有線電視供應商能夠使用未經授權的頻譜建立自己的 LTE 網路。結合增強安全性等 LTE 功能,MulteFire 預計將被港口、礦山和機場等工業領域的大型企業採用,這些領域沒有授權頻譜,而且需要比 Wi-Fi 通常提供的更高的移動性。此外,MulteFire 有望成為物聯網部署的連接選擇,從而促進市場成長。

- 此外,MulteFire 聯盟將企業和工業IoT的私人 LTE 網路視為將從 MulteFire 技術中受益的重要用例。該聯盟歡迎與工業網際網路聯盟(AII)的合作,以推進在共用非授權頻譜中採用 LTE 和下一代蜂窩技術的目標。這些措施將大大促進市場成長。

- 此外,在評估物聯網部署的連接選項時,行動性和安全性被視為關鍵業務促進因素。 MulteFire 等私有 LTE 網路僅使用未經授權或共用的頻譜即可滿足這兩個要求。對於專注於基於感測器的物聯網設備的尺寸和擴充性的行業來說,這是一個理想的網路選擇。 MulteFire 是物聯網網路架構的重要組成部分,它透過實現頻譜共用和共存促進了私有 LTE 的部署。

- 此外,根據愛立信的報告,到2022年物聯網連接的總價值將達到約132億。這些技術將推動2021年連網設備數量大幅增加,預計到2022年終將達到約5億台。透過實現FDD頻寬上大規模物聯網與4G、5G之間的頻譜共用,網路能力的提升將促進大規模物聯網技術的發展。物聯網連接性的增加構成了工業物聯網技術的主要部分,從而推動了市場成長。

北美佔有最大市場佔有率

- 北美是部署基於MulteFire技術的網路最重要的地區之一。 MulteFire 聯盟舉措探索在免執照頻段中為工業製造、採礦業、醫療保健和商業等各個垂直領域的各種應用啟用 LTE 技術的可行性,這可能會推動 MulteFire 市場的成長。

- 該地區是許多 MulteFire 聯盟成員大公司的所在地,包括高通、英特爾、Wave Wireless、SpiderCloud Wireless、TMobile 和 Verizon。該地區這些主要企業的存在對增加市場佔有率做出了巨大貢獻,從而增加了該地區在預測期內創造商機的可能性。

- 該地區正朝著在未經授權的頻譜中營運 5G NR 的標準化方向發展,這可以實現私有網路的快速擴張。這被稱為獨立 NR-U,與 LTE MultiFire 中的獨立 NR-U 類似。 NR在非授權頻譜上獨立運行,已成為MulteFire向5G演進的路徑,美國已見證5G網路的大規模部署。

- MulteFire 市場預計將受益於物聯網設備、工業 4.0 解決方案和智慧製造解決方案的日益成長的使用,這推動了對可靠和安全的資料傳輸網路的需求。例如,2023 年 2 月,國際工程服務公司 L&T Technology Services Limited 推出了一系列專注於工業 4.0 技術的新產品,用於交通、醫療設備和先進技術進步等關鍵垂直領域,利用人工智慧 (AI)、機器人技術、3D 視覺系統和連網機器的最新進展。此類技術整合將極大地促進 MulteFire 技術提供增強的服務,從而增加其在該地區的市場佔有率。

- 此外,該地區也正在推出私人物聯網網路,使企業能夠利用未經授權的頻譜提供的 LTE 功能。此外,該地區還正在大力發展工業IoT應用,用於追蹤貨物和貨櫃、提供安全和環境資訊以及監控運輸網路,並有望擴大 MulteFire 的使用範圍,以開發下一代營運。

MulteFire 產業概覽

MulteFire 市場相對集中,高通、諾基亞和華為等少數大公司佔據了相當大的市場佔有率。公司正在積極尋求技術創新和合作以增加市場佔有率。此外,該市場的所有公司都是 MulteFire 聯盟的成員。著名的市場參與企業包括高通科技公司、諾基亞公司、華為科技公司、愛立信公司和Sony Corporation。

- 2023 年 2 月 - 諾基亞與 Kindrill 在使用 4G/5G 專用無線網路和多重存取邊緣運算 (MEC) 技術實現工廠自動化的合作再次延長三年。這些公司認為,由於政府分配工業用途的授權頻譜和引入未經授權的無線網路解決方案(如美國的 CBRS 和 MulteFire),頻譜短缺問題正在迅速減少。

- 2023 年 1 月-德國電信宣布將部署更多小型基地台以增強其 5G 網路。該通訊業者透露,小型基地台將提高市場、零售商場、火車站和汽車站等人口密集地區的網路品質。德國電信表示,到 2025 年,它將把大約 3,000 部舊付費電話改造成 5G小型基地台。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 共用和未授權頻寬的頻寬

- 工業物聯網 (IIoT) 應用對更好、更具可擴展性的網路連接的需求日益增加

- 低成本部署,無需頻譜許可

- 市場限制

- 與 Wi-Fi 技術相比,在存取頻道方面存在劣勢

- 共用頻譜使用決策延遲

- 技術簡介

第6章 市場細分

- 依設備類型

- 小型基地台

- 轉變

- 控制器

- 按最終用戶產業

- 商業設施

- 供應鏈和分銷

- 零售

- 飯店業

- 公共設施

- 衛生保健

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Qualcomm Technologies, Inc.

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Sony Corporation

- Intel Corporation

- Samsung Electronics Co Ltd

- InterDigital Inc.

- Baicells Technologies

- DEKRA India Private Limited

第8章投資分析

第9章 市場機會與未來趨勢

The MulteFire Market size is estimated at USD 2.10 billion in 2025, and is expected to reach USD 8.10 billion by 2030, at a CAGR of 31.04% during the forecast period (2025-2030).

The network's capacity has become limited as a result of the rising reliance on wireless connections to provide rich information to an ever-growing number of devices. Therefore, this encouraged the creation of MulteFire, which was intended to be a vital component of the solution to the growing mobile data traffic issue.

Key Highlights

- MulteFire will be a critical enabler allowing enterprises to deploy LTE private networks without the involvement of a mobile network operator in unlicensed regional and global spectrum bands around the world, which includes the 2.4 GHz and 5 GHz global bands and the 800/900 MHz and 1.9 MHz regional bands.

- MulteFire, with its standalone feature, will open up an unlicensed spectrum to a host of new players, including wireless ISPs, global enterprises, specialist verticals, and even network operators, where all can deploy MulteFire-based LTE private networks.

- MulteFire enables the deployment of enhanced broadband services in more places with the combination of the enhanced performance of LTE with the deployment simplicity of the unlicensed spectrum. Since MulteFire is based on LTE, it will operate in wider bandwidths that support up to 20 MHz to support high capacity and low latency, capable of peak data rates up to 400 Mbps.

- The use of unlicensed spectrum by businesses or cable providers to create their own LTE networks may be made possible by MulteFire. When paired with LTE features like increased security, major organizations that lack licensed spectrum and desire greater mobility than Wi-Fi generally offers are expected to embrace MulteFire in industrial sectors like shipping ports, mines, and airports, among others. Additionally, MulteFire is predicted to be a connection choice for IoT deployments.

- The rise in the need for more scalable and advanced network connectivity for industrial IoT (IIoT) applications is one of the key factors anticipated to propel multefire market expansion over the projected period. Additionally, the increased need for high-performance and simple-to-deploy wireless connection networks is expected to fuel the multefire market's expansion.

- However, the increased need for high-capacity, cost-effective networks is predicted to limit the multefire market's expansion. On the other side, the growth of the multefire market in the timeframe period is further anticipated to be hampered by the delay in decisions relating to the utilization of shared spectrum.

- The COVID-19 has had a significant impact on the Multefire market. The rapid closure of various manufacturing firms and businesses significantly impacted the market. During the mid-first phase, the COVID-19 outbreak has caused changes in internet usage and download speeds monitored on servers based on internet quality to be seen in various places, increasing traffic volume. The most significant increases in traffic volume were observed practically everywhere immediately following announcements of official policies, such as school closings and instructions to stay at home.

MulteFire Market Trends

Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- The use of unlicensed spectrum by businesses or cable providers to create their own LTE networks may be made possible by MulteFire. When paired with LTE features like increased security, major organizations that lack licensed spectrum and desire greater mobility than Wi-Fi generally offers are expected to embrace MulteFire in industrial sectors like shipping ports, mines, and airports, among others. Additionally, MulteFire is expected to be a connection choice for IoT deployments, thereby driving market growth.

- Moreover, the MulteFire Alliance considers private LTE networks for enterprise and industrial IoT to be critical use cases that will benefit from MulteFire technology. The alliance welcomed this collaboration with the Alliance of Industrial Internet (AII) to advance its goal of employing LTE and next-gen cellular technologies in unlicensed and shared spectrum. Such initiatives significantly drive growth in the market.

- Further, mobility and security are considered significant businesses that assess connectivity alternatives for their IoT deployments. Private LTE networks like MulteFire meet both requirements while solely employing unlicensed or shared spectrum. This is an ideal network option for sectors concerned about the size and extensiveness of their sensor-based IoT devices. MulteFire is essential in the IoT network architecture because it makes private LTE installations easier by providing spectrum sharing and coexistence.

- Furthermore, according to Ericsson's report, in 2022, the total IoT connections were reported to be valued at around 13.2 billion. These technologies enabled a significant increase in the number of connected devices in 2021, projected to reach about 500 million by the end of 2022. Increased network capabilities promote the development of Massive IoT technologies by enabling spectrum sharing between Massive IoT and 4G and 5G in FDD bands. Such rise in IoT connections would significantly comprise IIoT technologies, thereby driving the market growth.

North America to Hold a Largest Market Share

- North America would be among the most significant regions for deploying MulteFire technology-based networks. The MulteFire Alliance's initiatives to investigate possibilities for making LTE technologies available in the unlicensed band for a variety of applications in several verticals, such as industrial manufacturing, mining, healthcare, and commercial, are likely to be a driving force behind the growth of the MulteFire market.

- Numerous significant businesses that are MulteFire Alliance members are based in the region, including Qualcomm, Intel, Wave Wireless, SpiderCloud Wireless, TMobile, and Verizon. Such prominent player presence in the region significantly contributes to the considerable market share, thereby enhancing the potential of the region in creating opportunities during the forecast period.

- The region is witnessing standardization in the operation of 5G NR in an unlicensed spectrum, and this has the potential to enable private networks to expand rapidly. This is called standalone NR-U and is analogous to standalone NR-U in MulteFire for LTE. The NR operating standalone in the unlicensed spectrum will become the MulteFire evolution path to 5G, and the United States witnessed a massive rollout of the 5G network.

- The market for MulteFire is anticipated to benefit from the rising usage of IoT devices, industry 4.0 solutions, and smart manufacturing solutions, which have increased the demand for a dependable and secure network for data transfers. For instance, in February 2023, L&T Technology Services Limited, an international engineering services firm, introduced a new suite of offerings focused on Industry 4.0 technologies for crucial verticals like transportation, medical devices, and high technological advancements, using the most recent advances in Artificial Intelligence (AI), robotics, 3D-vision systems, and connected machines. Such tehnology integrations would significantly drive the MulteFire technology in offering enhanced services, thereby increasing the region's market share.

- Futhermore, the region is also witnessing the deployment of Private IoT networks where enterprises can take advantage of the capabilities of LTE delivered over the unlicensed spectrum. Moreover, emerging Industrial IoT applications in the region to track goods and containers, provide safety and environmental information, and monitor transportation networks is also expected to boost the usage of MulteFire to develop next-generation operations.

MulteFire Industry Overview

The MulteFire market is relatively consolidated with a few prominent companies, such as Qualcomm, Nokia, and Huawei, which account for a significant market share. The companies significantly engage in innovations and partnerships to enhance their market shares. Moreover, all the companies in this market are a part of The MulteFire Alliance. A few of the prominent market players include Qualcomm Technologies, Inc., Nokia Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Sony Corporation, etc.

- February 2023 - the partnership between Nokia and Kyndryl, which automates factories utilizing 4G/5G private wireless networks and multi-access edge computing (MEC) technology, has been extended for another three years. The companies claimed that the lack of spectrum availability is rapidly declining due to governments distributing licensed spectrum for industrial usage and the introduction of unlicensed wireless networking solutions (such as CBRS in the US and MulteFire).

- January 2023 - Deutsche Telekom stated that the firm would deploy additional small cells to strengthen its 5G network. The carrier clarified that small cells enhance network quality in densely populated regions like markets, retail malls, and railway or bus stops. By 2025, Deutsche Telekom stated it would convert about 3,000 outdated public payphones into 5G small cells.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Availability of Shared and Unlicensed Spectrum Bands

- 5.1.2 Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- 5.1.3 Low Cost of Deployment that doesn't Require Spectrum License

- 5.2 Market Restraints

- 5.2.1 Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel

- 5.2.2 Delay in Decision-Making Regarding Use of Shared Spectrum

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 Equipment Type

- 6.1.1 Small Cells

- 6.1.2 Switches

- 6.1.3 Controllers

- 6.2 End User Vertical

- 6.2.1 Commercial & Institutional Buildings

- 6.2.2 Supply Chain and Distribution

- 6.2.3 Retail

- 6.2.4 Hospitality

- 6.2.5 Public Venues

- 6.2.6 Healthcare

- 6.2.7 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies, Inc.

- 7.1.2 Nokia Corporation

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 Sony Corporation

- 7.1.6 Intel Corporation

- 7.1.7 Samsung Electronics Co Ltd

- 7.1.8 InterDigital Inc.

- 7.1.9 Baicells Technologies

- 7.1.10 DEKRA India Private Limited