|

市場調查報告書

商品編碼

1643045

智慧電線桿:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Pole - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

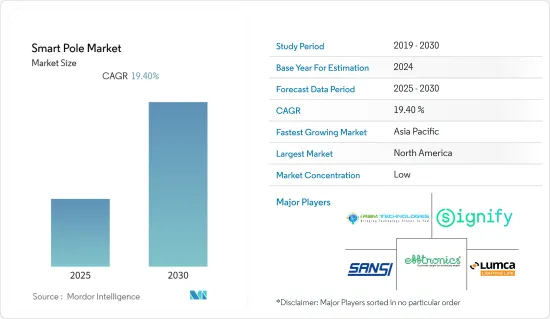

預測期內,智慧桿市場預計將實現 19.4% 的複合年成長率

關鍵亮點

- 政府支持智慧城市發展的計劃和對節能路燈不斷成長的需求預計將推動全球智慧燈桿市場的成長。此外,預計在研究期間,避免交通堵塞和事故的日益成長的需求將成為採用智慧電線桿的關鍵因素。

- 為了利用現有趨勢,市場的主要企業正在致力於開發整合保全攝影機、交通管理系統、無線感測器網路和其他設施等先進技術的智慧桿。預計在預測期內,市場參與者提出的此類新穎創新解決方案也將增加全球對智慧電線桿的需求。

- 此外,用於監測城市基礎設施、管理交通流量、停車供水和空氣品質的智慧城市計劃和物聯網平台基礎設施的興起也在推動市場成長。都市化加快、私人和公共車輛使用增多,導致城市交通堵塞,迫使地方政府加強城市周邊的交通管理。

- 此外,交通堵塞被認為是導致城市生活品質不佳的一個原因。因此,為緩解交通擁擠、防止事故發生,能夠為交通管理提供交通監控、交通誘導、車輛監控、停車引導等功能的智慧桿在城市中越來越普遍。

- 根據印度政府公路運輸和公路部 (GOI) 的數據,大約 35-40% 的事故發生在十字路口。為了應對這些挑戰,智慧城市正在轉向移動即服務 (MaaS) 解決方案,將各種交通方式整合為可按需使用的單一服務,以減少道路上的汽車數量。內建攝影機的智慧桿可以監控道路狀況。透過使用智慧桿不斷監控交通狀況,市政當局可以獲得寶貴的資料來改善交通流量、指導維護決策並加快緊急應變調度。此外,追蹤資料可用於將道路交通收益並為私人商業開發和其他城市規劃提供資訊。

- 然而,智慧桿的高初始成本對預測期內的市場成長構成了挑戰。智慧電線桿運作所需的綠色能源是導致其安裝初期成本高的一個主要因素。此外,智慧桿需要在惡劣的天氣條件下持續維護。由於前期成本較高,智慧桿計劃大多由政府部門承擔。

智慧桿市場趨勢

世界各國政府擴大智慧城市計劃

- 不斷加快的都市化和基礎設施管理的需求正在推動世界各國投資智慧城市計劃。世界各國政府都在引進智慧桿解決方案,推動智慧城市發展。例如,2021 年 7 月,清奈市警察局宣布計劃透過在其指揮中心安裝更多智慧桿來改善交通管理。該設施是大金奈政府和其他單位正在實施的價值 90 億印度盧比(約 1.08 億美元)的智慧城市計劃的一部分。

- 此外,為了加強其智慧城市使命,新德里市政公司(NDMC)在德里康諾特廣場安裝了 55 個節能智慧電線桿。電線杆上裝有空氣感應器、節能 LED 照明和 WiFi 連接。這些電線杆上的燈可以在非交通高峰時段自動調暗,以節省能源。

- 2022年4月,歐盟委員會宣布100個歐盟城市將加入歐盟的使命,即在2030年建成100個氣候中立的智慧城市。這 100 個城市將從所有 27 個成員國中選出,另外還有 12 個城市從與歐盟研究和創新計畫「地平線歐洲」相關的或可能相關的國家中選出。

- LED燈泡的壽命比傳統燈泡長4到40倍,減少了維護需求。即使是簡單的維護變更通常也需要鏟鬥卡車或液壓升降機。當智慧桿降低時,不需要鏟鬥車。單是其使用壽命期間減少的維護量就使 LED 燈桿燈成為任何市政當局的良好解決方案。

- 此外,全球LED滲透率仍低於15%,且各國差異較大,如日本、加拿大等LED滲透率較高的國家。即使在同一個國家,LED滲透率也有很大差異,有些大城市已達100%(如米蘭、紐約)。這顯示基礎設施發展得有多快,進而也顯示智慧桿市場成長得有多快。

- 2021 年 12 月,電力部下屬合資企業能源效率服務有限公司宣布,計劃在 2024 年全國安裝 1.6 億盞智慧 LED 路燈。迄今為止,EESL 已在印度各地安裝了 120 億盞 LED 路燈,每年可節省約 7.8 BU 電力,並減少 530 萬噸二氧化碳排放量。政府的這些措施可能會推動市場研究的需求。

亞太地區市場成長顯著

- 由於中國、印度、日本和澳洲等國家的政府加大對智慧城市技術的投入,亞太地區可望成為智慧燈桿的主要市場之一。

- 根據瑞銀《智慧城市:轉變中的亞洲》報告,到2025年,亞太地區將佔全球智慧城市計劃市場成長的40%,即8,000億美元。亞洲各國政府正在投資智慧城市計畫並與私部門合作。例如,中國已投資5,000億元建立國家智慧城市,目前已有500個智慧城市處於不同的發展階段,利用巨量資料、雲端運算、物聯網等智慧系統。因此,智慧城市計劃的重大發展正在推動該地區智慧桿市場的成長。

- 在中國,為了有效利用可再生能源並解決電動車(EV)路邊快速充電問題,同濟大學(上海)的研究人員提案了一種可再生能源路燈桿(SLP)和電動車充電相結合的智慧混合桿系統。雲端管理平台可以對電線杆儲混合系統進行控制,方便的根據不同電價決定充電還是放電。

- 智慧混合桿解決方案促進電動車充電和可再生能源的有效利用。白皮書資料顯示,到2030年印度需要安裝4.6萬個電動車充電站才能達到全球標準。中國和荷蘭的電動車充電器比例為6,美國為19,印度為135。這意味著印度每 135 輛電動車配備一個充電器,而中國每 135 輛電動車配備六個充電器。

- 此外,印度的各種智慧城市計劃預計將為市場成長提供機會。例如,2021 年,iRAM Technologies訂單了達霍德、皮姆普里欽奇瓦德、科希馬和拉傑果德等智慧城市的四個大型計劃,包括智慧路燈、智慧電線桿和智慧停車場。

智慧桿產業概況

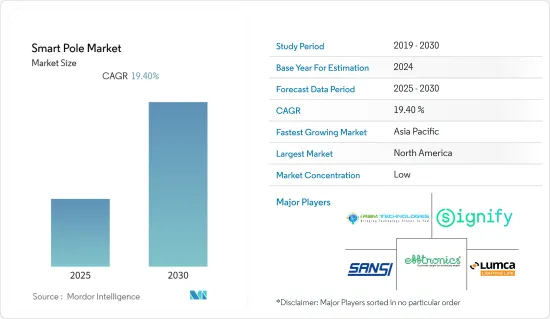

智慧桿市場競爭激烈,由多家大大小小的參與者組成。隨著智慧桿整合應用,許多公司正在透過產品和軟體供應擴大其市場佔有率,進一步加劇了市場的激烈競爭。主要參與企業包括 Signify Holding BV 和 Iram Technologies Pvt. Ltd.

2022年6月,芬蘭Edzcom與Signify利用路燈等道路基礎設施,為芬蘭坦佩雷共同開發了私人智慧城市5G和物聯網網路。 Edzcom 和 Signify 希望快速建造並增強該網路,將其用於智慧城市監控和追蹤應用程式、城市與居民的互動以及市政和商業資料收益。

2022 年 5 月,Signify 以 2.72 億美元的價格從歐司朗手中收購了美國Fluence 公司。透過此次收購,Signify 獲得了 Fluence 在北美工廠照明市場的多通路打入市場策略。同時,Fluence現有的知識和專業技能將補充Fluence的植物照明技術。此外,Fluence的植物照明專利將有助於Signify進一步擴大其北美照明市場。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 緩解交通擁擠和預防事故的需求日益增加

- 智慧城市計畫正在世界各國政府中逐漸興起

- 市場問題

- 通訊協定缺乏標準化

- 初期成本高

- 市場機會

- 支援物聯網的產品、連網街道照明和資料分析

第 6 章按應用程式技術類型使用案例(硬體單元、遠端系統管理軟體應用程式和部署區域)

- 高速公路和道路

- 公共設施

- 鐵路和港口

第7章 市場區隔

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第8章 競爭格局

- 公司簡介

- Iram Technologies Pvt. Ltd

- Signify Holding BV

- Efftronics Systems Pvt. Ltd

- Shanghai Sansi Electronic Engineering Co. Ltd

- Lumca Inc.

- SmartCiti Solutions Inc.

- Valmont Structures Pvt. Ltd

- Keselec Lighting Private Limited

- LEDbow Technologies Ltd

- Norsk Hydro ASA

- Energasia Smart Poles

- Streetscape International

- American Tower Corporation

- HUB Group

- ELKO EP

- ENE.HUB Pty Ltd

第9章投資分析

第10章 市場展望

The Smart Pole Market is expected to register a CAGR of 19.4% during the forecast period.

Key Highlights

- Government programs supporting the development of smart cities and the growing demand for energy-efficient streetlights are expected to aid the growth of the Smart Pole market globally. In addition, the rising need to avert traffic jams and avoid accidents is projected to be a pivotal contributor to adopting smart poles during the study period.

- To capitalize on the existing trend, key players in the market are engaged in developing smart poles with the integration of advanced technology, such as security cameras, traffic management systems, wireless sensor networks, and other facilities. Such new and innovative solutions by the companies in the market are also expected to increase the demand for smart poles globally during the forecast period.

- Moreover, the rising infrastructure for smart city projects and Internet of Things platforms to monitor city infrastructure, manage traffic flows, and parking water and air quality is driving the market growth. The growing urbanization and rising use of personal and public vehicles make the city traffic-congested and push municipalities for better traffic management around the cities.

- Additionally, traffic congestion has been a specifically cited reason for the city's poor quality of life. Thus, to reduce traffic jams and prevent accidents, smart poles are gaining traction in the cities, as they can provide traffic management with the following attributes: traffic monitoring, traffic guidance, vehicle monitoring, and parking guidance.

- According to the Ministry of Road Transport and Highways, Government of India (GOI), approximately 35 to 40% of total accidents occur at traffic junctions. To resolve such a challenge, smart cities look to Mobility-as-a-Service (MaaS) (integration of different forms of transport into a single service, which can be accessed on-demand) solutions to reduce the number of vehicles on the road. Smart poles embedded with cameras can observe road conditions. With constant smart pole traffic monitoring, municipalities with valuable data can help improve traffic flows, guide maintenance decisions, and facilitate emergency crew deployment. Furthermore, tracking data can monetize street traffic for private commercial development and other city planning applications.

- However, the high initial costs of smart poles are challenging the market's growth over the forecast period. The requirement of green energy to run smart poles is a major factor contributing to the high initial cost of installing smart poles. In addition, smart poles require constant maintenance in harsh weather conditions. Due to the high initial costs, government authorities mostly take up smart pole projects.

Smart Pole Market Trends

Growing Smart City Initiatives by Various Governments

- The rising urbanization and the need to manage infrastructure are prompting countries worldwide to invest in smart city projects. Various governments across the world are implementing the smart pole solution to fuel their smart city development. For instance, in July 2021, the Chennai city police announced that they plan to improve traffic management by installing more smart poles integrated into a command center. The installation is part of a smart city project implemented by the Greater Chennai Corporation and other departments at the cost of INR 900 crores (~USD 108 million).

- Further, to augment the Smart City Mission, New Delhi Municipal Corporation (NDMC) installed 55 energy-saving smart poles in Connaught place in Delhi. The poles boast air sensors, energy-saving LED lighting, and WiFi connectivity. The lights of these poles can automatically be dimmed to save energy during non-peak traffic hours.

- On similar lines, in April 2022, the European Commission announced the 100 EU cities participating in the EU mission for 100 climate-neutral and smart cities by 2030. The 100 cities come from all 27 Member States, with 12 additional cities coming from countries associated with or potentially associated with Horizon Europe, the EU's research and innovation program.

- The lifetime of LED bulbs is four to forty times longer than conventional bulbs, which provides maintenance savings. Even simple maintenance changes usually require a bucket truck or hydraulic lift. Even if SmartPoles descend, it does not need a bucket truck. The reduced maintenance based on lifespan alone makes LED pole lights a good solution for every municipality.

- Further, LED penetration worldwide is still below 15%, with significant differences among countries, such as Japan and Canada showing higher LED penetration rates. Even within the same countries, LED penetration is quite different, as some big cities have already reached 100% (such as Milan and New York). This states the rate of development of infrastructure and further signifies the rate of growth of the smart poles market.

- In December 2021, Energy Efficiency Services Limited, a joint venture under the Ministry of Power, announced its plans to install 1.6 crores of smart LED street lights across the country by 2024. EESL has so far installed 1.2 crore LED streetlights in India, resulting in around 7.8 BU of annual electricity savings and an annual reduction of 5.3 million tCO2. Such initiatives from the government would likely fuel the demand for market studied.

Asia-Pacific Witnesses a Significant Market Growth

- Asia-Pacific is expected to be one of the significant markets for smart poles due to the increasing government initiatives in countries, such as China, India, Japan, and Australia, toward smart city technology.

- According to the "Smart Cities: Shifting Asia" report by UBS, the APAC will account for 40% of the global addressable market growth for smart city projects, or USD 800 billion, by 2025. Asian governments are investing in smart city initiatives and partnering with the private sector. For instance, China invested CNY 500 billion in China's National Smart City Program, and there were 500 smart cities in various stages of development, leveraging Big Data, cloud computing, IoT, and other smart systems. Thus, a significant development in smart city projects is augmenting the region's smart pole market growth.

- In China, to efficiently utilize renewable energy and solve the roadside fast charging of the electric vehicle (EV) problem, a smart hybrid pole system is proposed by Tongji University, Shanghai researchers, which is integrated with renewable energy Street Lighting Pole (SLP) and EV charging. A cloud management platform can control the hybrid pole energy storage system, so it is convenient to decide whether to charge or discharge according to different power prices.

- The smart hybrid pole solution is conducive to EV charging and the efficient application of renewable. According to data from a white paper, India needs to set up 46,000 electric vehicle charging stations by 2030 to reach the global benchmark. The EV charger ratio is six for China and the Netherlands, 19 for the U.S., and 135 for India. That means there is one charger per 135 EVs in India compared to 6 in China.

- Moreover, various smart city projects in India are expected to provide opportunities for market growth. For instance, in 2021, iRAMTechnologies received four large projects for smart street lighting, smart pole, and smart parking city assets in smart cities of Dahod, Pimpri Chinchwad, Kohima, and Rajkot.

Smart Pole Industry Overview

The smart pole market is highly competitive and consists of several major and minor players. With smart pole integration applications, many companies are increasing their market presence through product and software offerings, further catering to intense rivalry in the market. Key players are Signify Holding BV and Iram Technologies Pvt. Ltd, among others.

In June 2022, Edzcom of Finland and Signify collaborated to develop a private smart-city 5G and IoT network for Tampere, Finland, using street lighting and other road infrastructure. The network, which Edzcomand Signify wants to construct and densify quickly, will be used for smart-city monitoring and tracking applications, city engagement with residents, and municipal and commercial data monetization.

In May 2022, Signify acquired the US-based Fluence from OSRAM for USD 272 million. With this acquisition, Signify will obtain Fluence's multi-channel market entry strategy in the North American plant lighting market. At the same time, its existing knowledge and expertise will complement Fluence's plant lighting technology. Fluence's patents in plant lighting will also help Signify expand the North American lighting market further.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Reducing Traffic Jams and Preventing Accidents

- 5.1.2 Growing Initiative by Various Government for Smart Cities

- 5.2 Market Challenges

- 5.2.1 Lack of Standardization of Communication Protocols

- 5.2.2 High Initial Cost

- 5.3 Market Opportunities

- 5.3.1 IoT-enabled Products, Networked Streetlights, and Inclusion of Data Analytics

6 USE CASES BY APPLICATION AND TYPE OF TECHNOLOGY (HARDWARE UNITS, SOFTWARE APPLICATION FOR REMOTE MANAGEMENT, AND AREA OF DEPLOYMENT)

- 6.1 Highway and Roadways

- 6.2 Public Places

- 6.3 Railways and Harbors

7 MARKET SEGMENTATION

- 7.1 By Geography

- 7.1.1 North America

- 7.1.2 Europe

- 7.1.3 Asia-Pacific

- 7.1.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Iram Technologies Pvt. Ltd

- 8.1.2 Signify Holding BV

- 8.1.3 Efftronics Systems Pvt. Ltd

- 8.1.4 Shanghai Sansi Electronic Engineering Co. Ltd

- 8.1.5 Lumca Inc.

- 8.1.6 SmartCiti Solutions Inc.

- 8.1.7 Valmont Structures Pvt. Ltd

- 8.1.8 Keselec Lighting Private Limited

- 8.1.9 LEDbow Technologies Ltd

- 8.1.10 Norsk Hydro ASA

- 8.1.11 Energasia Smart Poles

- 8.1.12 Streetscape International

- 8.1.13 American Tower Corporation

- 8.1.14 HUB Group

- 8.1.15 ELKO EP

- 8.1.16 ENE.HUB Pty Ltd