|

市場調查報告書

商品編碼

1643070

印度資產追蹤:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Asset Tracking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

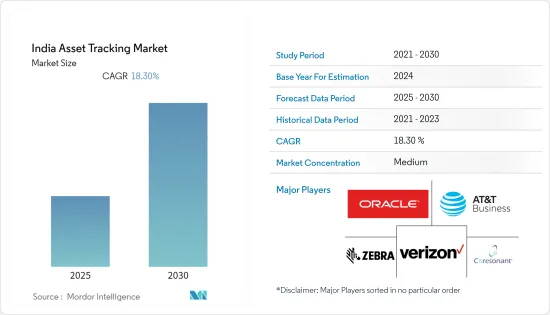

預測期內印度資產追蹤市場預計複合年成長率為 18.3%

關鍵亮點

- 物聯網技術的最新進展使得多個最終用戶能夠使用經濟高效的資產追蹤硬體。與標準的傳統資產追蹤系統相比,現代物聯網設備消耗的電力和基礎設施最少,正在推動該地區資產追蹤系統的銷售。

- 由於該地區擴大採用各種技術進步以及新興經濟體的重大貢獻,預計該國在預測期內將實現顯著成長。該地區幾乎所有終端用戶產業對物聯網和人工智慧的快速應用預計將成為關鍵促進因素。

- 此外,印度預計還將因中小企業的投資而實現成長。中小型企業正在投資在其業務流程中增加各種先進的技術解決方案。根據印度中小微型企業部的資料,印度是全球中小企業數量最多的國家,達5,000萬家。

- 此外,世界各國都在推動本地資料存儲,這也涵蓋資產追蹤市場。例如,印度目前正在製定本地化資料儲存的規則。由於這些努力,提供雲端基礎的服務的供應商將面臨限制,並且採用率預計會增加。

- 由於新冠疫情爆發,預計全球景氣衰退壓力將對全球出口水準產生直接影響。由於中小微型企業佔印度出口的40%以上,其影響可能十分嚴重且持久。由於客戶延遲付款,中小微型企業預計將面臨一些流動性問題,這可能很快就會導致企業資產追蹤採用率下降。

印度資產追蹤市場趨勢

國內資產追蹤硬體供應商和第三方服務供應商的影響力日益增強

- 物流公司擴大將物流業務外包給第三方物流服務供應商(3PL)。物流和供應鏈管理是全球商業的關鍵組成部分。

- 第三方物流市場的各個細分領域包括運輸、倉儲、貨運代理、附加價值服務等物流功能。第三方物流利用規模經濟來更快地交付產品,減少頻繁交付,並更有效地追蹤倉庫庫存。

- 本公司主要使用第三方物流物流(3PL) 來提供倉儲、運輸和出貨等核心履約服務。第三方物流提供更現代化的便利設施,通常稱為“附加價值服務”,以滿足快節奏、按需的業務需求。例如,電子商務公司需要根據消費者的需求、偏好和偏好,更細緻地交付產品和履行訂單,才能脫穎而出。專業運輸、客製化標籤和最終組裝都是附加價值服務的例子。

- 此外,條碼和2D碼是印度資產追蹤系統中越來越多使用的硬體類型。它們提高了用戶的業務效率,促進了更好的客戶服務,並提供了業務管理流程的可視性。由於條碼和2D碼的開發成本較低,因此它們多用於不可退貨且生命週期較短的產品。例如,食品包裝的運輸單元可能會被這樣標記。

運輸和物流領域預計將佔很大佔有率

在印度,運輸和物流業對行動資產追蹤解決方案的需求龐大。在當前的市場情況下,運輸物流參與企業正在使用最先進的自訂追蹤解決方案。由於該領域的巨大需求,市場上幾乎每個資產追蹤供應商都有量身定做的解決方案來服務運輸和物流行業。

- 此外,根據 IBEF 的數據,印度電子商務市場規模預計將從 2017 年的 385 億美元成長到 2026 年的 2,000 億美元。上述新興市場的發展很可能在不久的將來推動市場成長。此外,由於印度正在進行的數位轉型,印度網路用戶總數預計將從2019會計年度的6.3673億增加到2021會計年度的8.29億。運輸和物流可能是印度電子商務成長的主要因素,預計這將推動資產追蹤市場的發展。

- 此外,預計印度公共交通領域對資產追蹤系統的需求將很高。政府委託的公車和卡車車隊需要進行即時監控,以確保公共運輸的正常運轉,並利用資產追蹤解決方案提供的預測性維護功能最大限度地降低維護和營運成本。

- 由於新冠疫情和全球供需中斷,印度汽車產業大幅下滑,但其乘用車產量卻強勁成長。去年,該國生產了360萬輛乘用車,預計2020年將達到280萬輛。預計汽車產量的成長將推動資產追蹤市場的需求。

印度資產追蹤產業概況

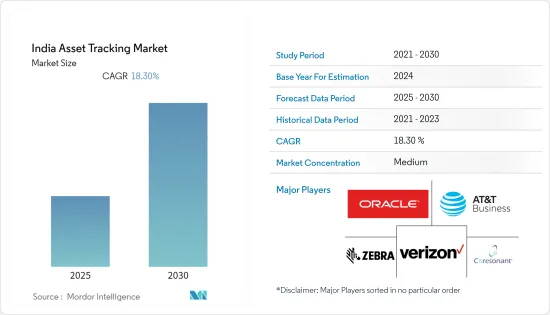

印度資產追蹤市場細分程度適中,由 Oracle、Verizon 和 AT&T Inc. 等多家全球和區域參與企業組成,在競爭激烈的市場領域中佔據突出地位。有許多參與企業成功進入了新進入者難以進入的市場。

2022年3月,全球區塊鏈技術供應商SettleMint宣布將與北阿坎德邦一所醫科大學啟動基於區塊鏈的資產追蹤解決方案先導計畫。該計劃的啟動標誌著該公司進軍該國公共部門領域。此次合作預計將提高庫存管理的效率和改進,有助於降低設備成本。

2022 年 2 月,為服務生命週期管理 (SLM) 提供先進 SaaS 解決方案的非上市公司 Syncron 宣布與印度第二大商用車製造商、全球第四大公車製造商 Ashok Leyland 建立合作夥伴關係。該合作夥伴關係將利用工業IoT為製造商的大型車隊開發預測性維護解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 工業影響評估

- 與印度相關的關鍵使用案例和採用案例

第5章 市場動態

- 市場概況

- 市場促進因素

- 國內資產追蹤硬體供應商和第三方服務供應商的影響力日益增強

- 車輛最佳化工作持續與技術進步同步進行

- 市場問題

- 缺乏最終用戶意識和實施成本仍然是主要問題

第6章 市場細分

- 類型

- 硬體

- 軟體

- 服務

- 最終用戶產業

- 運輸和物流

- 製造業

- 建設業

- 資訊科技/通訊

- 石油和天然氣

- 其他

第7章 競爭格局

- 公司簡介

- Coresonant Systems Private Limited

- AT&T Inc.

- Zebra Technologies India

- Quinta Systems Private Limited(Software)

- Oracle Corporation

- Hilti(Software)

- Chekra Business Solutions

- Trimble Inc.

- Identis

- Verizon Communications Inc.

- NFC Group

- SAP SE

- ORBCOMM India

- Omnitracs India

第8章投資分析

第9章 市場機會與未來趨勢

The India Asset Tracking Market is expected to register a CAGR of 18.3% during the forecast period.

Key Highlights

- Recent advancements in IoT technology have enabled several end users to acquire economical and efficient asset-tracking hardware. Compared to standard, traditional asset tracking systems, modern IoT equipment that uses minimal electricity and infrastructure is driving the sales of asset tracking systems in the region.

- The country is expected to witness a significant growth rate over the forecast period, owing to the rising adoption of various technological advancements in the region and the significant contributions made by emerging economies. Rapid adoption of IoT and AI in almost every end-user industry in the region is expected to be a major driver.

- Moreover, India is expected to witness growth owing to the investments of small and medium-sized organizations. SMEs are investing to increase the adoption of various technologically advanced solutions for their business processes. According to data from the Ministry of Micro, Small, and Medium Enterprises, India has 50 million MSMEs, which makes it among the world's largest.

- Also, various nations worldwide are pushing toward local data storage, which also covers the asset tracking market. For example, India is looking to move toward localized data storage rules. As a result of such initiatives, vendors who provide cloud-based services face constraints and are expected to see increased adoption.

- Due to the outbreak of COVID-19, recessionary pressures worldwide were anticipated to directly impact the level of global exports. Given that MSMEs contributed to over 40% of India's exports, the impact could be severe and could last for a long time. MSMEs were expected to experience several liquidity problems due to delayed customer payments, which could result in a lower conversion rate for enterprises to adopt asset tracking shortly.

India Asset Tracking Market Trends

Growing Presence of Hardware and Third-Party Service Asset Tracking Vendors in the Country

- Logistics companies are increasingly outsourcing their logistics activities to third-party logistics service providers (3PL). Logistics and supply chain management are critical components of global business.

- The various segments of the third-party logistics market are the logistics functions, such as transportation, warehousing, freight forwarding, and value-added services. Third-party logistics apply economies of scale to deliver the products more quickly, reduce frequent deliveries, and track inventory in warehouses more effectively.

- Companies mostly use third-party logistics providers (3PLs) for core fulfillment services like warehousing, transportation, and shipping. Third-party logistics offer more modern amenities, often known as "value-added services," due to fast-paced and on-demand business needs. For instance, e-commerce companies need to stand out due to consumer demands, tastes, and preferences due to the finer details in product delivery and order fulfillment. Specialized distribution, customized labeling, and final assembly are all examples of value-added services.

- Moreover, barcodes and QR codes are a type of hardware that has witnessed increased usage among the asset tracking systems in India. They improve the users' operational efficiency and foster better customer service, thus providing visibility into business management processes. Since the cost of developing a barcode or a QR code is low, they find applications on products that are non-returnable and have a shorter life cycle. For example, a unit shipment of any food package would bear such a tag.

Transport and Logistics Segment is Expected to Hold a Major Share

Transportation and logistics are witnessing a significant demand for mobile asset tracking solutions in India. Transportation and logistics players use some of the most advanced custom-built tracking solutions in the current market scenario. Due to the significant demand from the sector, almost all the asset-tracking vendors in the market have custom-built solutions to serve the transportation and logistics sector.

- Moreover, according to the IBEF, the Indian e-commerce market is expected to grow to USD 200 billion by 2026 from USD 38.5 billion as of 2017. The above developments may boost the market's growth in the near future, and the ongoing digital transformation in the country is expected to increase India's total internet user base to 829 million by 2021 from 636.73 million in FY19. Transport and logistics may be a big part of why e-commerce in India is growing, which is expected to help the asset-tracking market.

- Furthermore, asset tracking systems are expected to gain significant demand from the public transportation sector in India. Fleets of buses and trucks commissioned by the government need to be monitored in real-time in order to ensure the good health of public transport and minimize maintenance and operation costs through the predictive maintenance features offered by asset tracking solutions.

- India is witnessing a significant increase in the production of passenger cars after the country saw a major decline in the automotive industry owing to the COVID-19 pandemic and global supply-demand disruption. Last year, the country produced 3.6 million passenger cars, with 2.8 million expected in 2020. This increase in automotive production is expected to drive demand for the asset-tracking market.

India Asset Tracking Industry Overview

The Indian asset tracker market is moderately fragmented and comprises several global and regional players, like Oracle, Verizon, and AT&T Inc., vying for attention in a highly competitive market space. Even though it's hard for new players to get into the market, a number of them have been able to do so.

In March 2022, SettleMint, a global blockchain technology provider, announced the launch of a pilot project for blockchain-based asset tracking solutions with the Uttarakhand medical colleges. With the launch of this project, the company has initiated inroads into the public sector in the country. The collaboration would lead to multiple efficiencies and improvements in inventory management and help reduce the cost of equipment.

In February 2022, Syncron, a privately held provider of sophisticated SaaS solutions for service lifecycle management (SLM), announced a partnership with Ashok Leyland. as India's second-largest commercial vehicle manufacturer and the world's fourth-largest bus maker. The partnership would provide for the development of an industrial IoT-enabled predictive maintenance solution for the manufacturer's large fleet of vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of Impact of COVID-19 on the Industry

- 4.4 Key Use-cases and Implementation Case Studies Related to India

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Growing Presence of Hardware and Third-Party Service Asset Tracking Vendors in the Country

- 5.2.2 Ongoing Efforts Toward Fleet Optimization, Coupled with Technological Advancements

- 5.3 Market Challenges

- 5.3.1 Relative Lack of Awareness among End Users and Installation Cost Remain a Key Concern

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 End-user Industry

- 6.2.1 Transportation and Logistics

- 6.2.2 Manufacturing

- 6.2.3 Construction

- 6.2.4 IT and Telecommunication

- 6.2.5 Oil and Gas

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coresonant Systems Private Limited

- 7.1.2 AT&T Inc.

- 7.1.3 Zebra Technologies India

- 7.1.4 Quinta Systems Private Limited (Software)

- 7.1.5 Oracle Corporation

- 7.1.6 Hilti (Software)

- 7.1.7 Chekra Business Solutions

- 7.1.8 Trimble Inc.

- 7.1.9 Identis

- 7.1.10 Verizon Communications Inc.

- 7.1.11 NFC Group

- 7.1.12 SAP SE

- 7.1.13 ORBCOMM India

- 7.1.14 Omnitracs India