|

市場調查報告書

商品編碼

1643088

過程儀器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Process Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

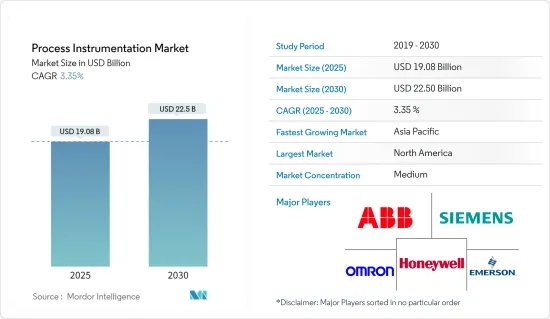

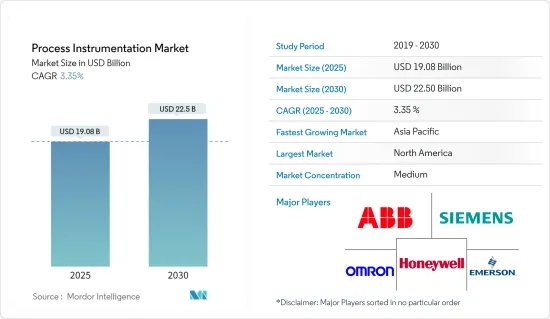

製儀器市場規模預計在 2025 年為 190.8 億美元,預計到 2030 年將達到 225 億美元,預測期內(2025-2030 年)的複合年成長率為 3.35%。

技術創新和對過程控制系統日益成長的需求推動著市場的發展。此外,成本效率、縮短工程時間、資產利用率和能源效率是推動製程儀器市場成長的關鍵因素。

關鍵亮點

- 許多終端行業都需要製程儀器。使用過程儀器有許多好處,包括提高產品品質、減少排放、減少人為錯誤和節省成本。記錄、定位、測量和控制等關鍵參數對於製造設備的平穩運作至關重要,因此對於製程設備來說,實現關鍵水準的絕對可靠性、精度和準確性是重中之重,從而促進市場成長。

- 對於製程儀器解決方案供應商來說,長期合約具有顯著的優勢,因為它們可以提供財務保障。因此,它已成為主要企業的關鍵技術,尤其是在獲得政府合約方面。例如,西門子於 2022 年 9 月透露,它已被選中對國有埃及電力控股公司旗下亞歷山大電力配電公司 (AEDC) 的配電控制網路和增強計量網路進行現代化改造。

- 在製造業中,連網設備和感測器的激增以及 M2M通訊的實現正在產生越來越多的資料點。根據 Zebra 最新的工業視覺研究,預計到 2022 年,由物聯網和 RFID 驅動的智慧資產追蹤系統將取代傳統的基於電子表格的方法。

- 製造業最近大力推廣自動化,推動了市場的成長。這是因為業界越來越認知到自動化在上市速度、投資成本和生產品質方面的多種優勢。然而,預測期內高昂的初始投資和維護成本預計將阻礙市場成長。

- 由於勞動力短缺,新冠疫情推動了對工業自動化的需求。自新冠肺炎疫情以來,企業在其生產過程中加大了對智慧機器人和技術的採用。機器人被視為提高產量的重要工具。機器人技術的大部分應用發生在工業領域,機器比人類更有效率、更可靠地執行許多手動任務。

過程儀器市場趨勢

用水和污水處理預計將實現最高成長

- 製程儀器用於監測製程工廠中的各種參數,例如流量、壓力、溫度、pH 值、電導率、液位、濁度、速度、力、濕度以及用水和污水處理中的其他因素。

- SCADA 系統廣泛用於監控和調節水和污水處理流程。這些使操作員能夠監控水箱、運河、水庫等的消費量、流量和內容。此外,它還提供您所處理的水的狀況的資料。 SCADA 技術經常用於管理雨水排水基礎設施和調節污水處理廠。

- 當前水資源供應和永續性面臨的挑戰主要是由於需求的大幅增加。然而,根據美國環保署(EPA)2022年5月的數據,美國家庭漏水每年浪費約9,000億加侖的水。這相當於約1100萬戶家庭一年的用水量。這就需要採用流量控制閥等製程儀器,刺激市場成長。

- 此外,美國環保署(EPA)正在加快對老化水利基礎設施的投資。例如,2022年11月,美國環保署核准向德克薩斯州普弗格維爾市提供5,200萬美元的水基礎設施融資和創新法案(WIFIA)贈款,以支持水處理廠現代化計劃。利用 WIFIA 貸款,EPA 正在幫助該設施增加其可處理的飲用水量,同時使用現代化的處理和過濾設備保持水質更健康。

- 預計未來幾年政府在污水處理方面加大力度的措施將促進該領域的成長。例如,2022年10月,紐約州長在布法羅鳥島污水處理廠啟動了一項耗資5,500萬美元的污水升級舉措。

亞太地區成為快速成長的市場

- 由於工業活動的快速成長、成本壓力和生產率的上升以及中國和印度等開發中國家政府的有利舉措,預計亞太地區將在預測期內以最快的速度成長。

- 該地區產業部門的擴張和石油和天然氣使用的增加正在推動工業向前發展。例如,中國計劃在2025年將其龐大的天然氣管道網路擴建至163,000公里,需要投資1.9兆美元。

- 預計該地區終端用途開發的不斷增加將為市場參與企業創造有利可圖的機會來改善他們的足跡。 2022 年 1 月,阿達尼集團與道達爾能源的夥伴關係阿達尼道達爾天然氣有限公司 (ATGL) 獲得許可,在另外 14 個地區開發城市燃氣發行(CGD) 基礎設施,投資額為 2000 億印度盧比(約合 2000 億美元)。

- 石油和天然氣消費量的增加必然導致新的生產設施的建立,從而增加了對製程儀器的需求。根據國際能源總署預測,到2040年,石油產量預計將超過1,500萬桶/日。此外,根據IBEF的數據,到2040年天然氣使用量預計將超過1.4308億噸。因此,預計石油和天然氣需求的增加將促進該地區市場的成長。

- 政府在向大眾宣傳技術的好處以及增加用於在工業中採用技術先進的機械的資金方面發揮積極作用,對於該地區的市場成長至關重要。預計未來幾年市場將受到金屬和採礦、化學品、食品和飲料以及石油和天然氣等主要終端行業的強勁成長的推動。

製程儀器產業概況

過程儀器市場細分程度適中,包括全球和區域參與企業,例如霍尼韋爾國際公司、西門子股份公司、歐姆龍參與企業、ABB 有限公司和艾默生電氣公司。這些主要企業正在採用各種策略,例如新產品發布、擴張、協議、合資、夥伴關係和收購,以擴大其在市場上的影響力。

2022 年 11 月,Equilibar推出了專門的一次性技術分店,以滿足製藥業不斷變化的流體管理要求。 SDO 閥門是 Equilibar 首款可精確調整背壓和流量的一次性流體控制設備。該公司聲稱:“SDO 是一種液體潤濕的一次性閥門,在製藥製造領域是獨一無二的。” 2022 年 9 月,領先的工業技術和物聯網 (IoT) 解決方案開發商 OleumTech 在其快速擴展的 H 系列硬連線製程儀器線中增加了智慧差壓 (DP) 變送器。創新的 DP 變送器提供了石化、上游石油和天然氣、電力、化學和污水等行業所需的卓越性能、可靠性和準確性。 2022 年 7 月,艾默生推出了 TESCOM Anderson Greenwood Instrumentation H2 閥門系列,該系列支援高達 15,000 psi (103.4 MPa) 的壓力。這項創新技術可靠地隔離製程壓力,減少逸散污染物,並提高氫氣加註設施和長管拖車等高壓氣體操作的安全性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 節能生產流程的需求不斷增加

- 以最小的成本實現高效率

- 市場限制

- 研發成本上升

- 引入和維護解決方案和設備的成本上升

- 價值鏈分析

- 波特五力模型

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 測量儀器

- 發射機

- 控制閥

- 科技

- 可程式邏輯控制器 (PLC)

- 分散式控制系統(DCS)

- 監控和資料採集 (SCADA)

- 製造執行系統(MES)

- 最終用戶

- 用水和污水處理

- 化學製造

- 能源公共產業

- 石油和天然氣開採

- 金屬和採礦

- 其他製程工業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭格局

- 公司簡介

- Honeywell International Inc.

- Siemens AG

- Omron Corporation

- ABB Ltd.

- Emerson Electric Company

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Danaher Corporation

- Metso Corporation

- Yokogawa Electric Corporation

- Endress+Hauser AG

第7章投資分析

第8章 市場機會與未來趨勢

The Process Instrumentation Market size is estimated at USD 19.08 billion in 2025, and is expected to reach USD 22.50 billion by 2030, at a CAGR of 3.35% during the forecast period (2025-2030).

The market is driven by technological innovations and increasing demands for process control systems. Moreover, cost efficiency, reduction in engineering time, asset utilization, and energy efficiency are some of the major factors driving the growth of the process instrumentation market.

Key Highlights

- Process instrumentation equipment is needed in a wide range of end-use industries. The use of process instrumentation equipment offers a host of benefits, including improvement in the quality of the product, emission reduction, reduction in human errors, and cost-savings. Significant parameters like recording, positioning, measuring, and controlling fuel the market's growth as they are essential for the smooth functioning of a manufacturing unit and are top priorities for process instruments for achieving significant levels of absolute reliability, accuracy, and precision.

- A long-term contract is a significant gain for process instrumentation solution suppliers because it ensures a steady stream of money. As a result, it is a critical technique for top companies to secure contracts, particularly from governments. Siemens, for example, revealed in September 2022 that it had been selected to modernize the distributing control network and enhanced metering network for Alexandria Electricity Distribution Company (AEDC), a part of the state-owned Egyptian Electrical Holding Company.

- The manufacturing business has seen an increase in data points created due to the widespread use of connected equipment and sensors and the enablement of M2M communication. According to Zebra's newest industrial vision research, intelligent asset tracking systems centered on IoT and RFID are predicted to outperform conventional spreadsheet-based approaches by 2022.

- The recent surge in the adoption of automation in the manufacturing sector has contributed to market growth. This is due to a greater industrialist understanding of the several advantages of automation in respect of speed to market, investment outlay, and output quality. However, high initial and maintenance investment cost is expected to hamper the market growth over the forecast period.

- The COVID-19 pandemic boosted the demand for industrial automation due to labor shortages. Post Covid-19, companies are increasingly adopting intelligent robotics and technology across the production processes. Robotics are seen as critical instruments for increasing production. The majority of robotic acceptance has happened in the industrial sector, wherein machines do numerous manual jobs more effectively and reliably than humans.

Process Instrumentation Market Trends

Water and Wastewater Treatment is Expected to Witness the Highest Growth

- Process instrumentations are used to monitor various parameters in process plants, such as flow, pressure, temperature, pH, conductivity, level, turbidity, speed, force, humidity, and other factors in water & wastewater treatment.

- SCADA systems are widely employed in monitoring and regulating water and waste treatment processes. These enable operators to monitor the consumption, flows, and contents of water tanks, canals, reservoirs, and others. Furthermore, these give data on the condition of the water being handled. SCADA technologies are frequently utilized to manage stormwater draining infrastructure and regulate wastewater purification plants.

- The current challenges of water availability and sustainability are primarily attributed to an enormous increase in demand. However, as per U.S. EPA in May 2022, Household leaks waste around 900 billion gallons of water per year in the United States. That is equivalent to roughly 11 million households' annual water use. This necessitates the adoption of process instrumentation, such as flow control valves, fueling market growth.

- Moreover, the United States Environmental Protection Agency (EPA) has accelerated investment in the nation's aging water infrastructure. For instance, in November 2022, the U.S. The EPA approved a USD 52 million Water Infrastructure Finance and Innovation Act (WIFIA) grant to the City of Pflugerville, Texas, to support the Water Treatment Plant Modernization Project. With the WIFIA loan, the EPA is assisting the facility in increasing the amount of drinking water it can process while also keeping the water healthier to consume with modern treatment and filter equipment, which in turn is expected to propel the growth of the process instrumentation market in the industry.

- Increasing government initiatives in wastewater treatment are expected to contribute to segment growth over the coming years. For instance, in October 2022 New York Governor launched a USD 55 million wastewater upgrade initiative at Buffalo's Bird Island Wastewater Processing Facility.

Asia Pacific to Emerge as the Fastest Growing Market

- Asia Pacific is expected to have the fastest growth over the forecast due to rapidly increasing industrial activities, rising cost pressure and production rate, and favorable government policies in developing nations such as China and India in this region.

- The region's expanding industrial sector and increased oil & gas usage are propelling the industry ahead. For instance, China intends to increase its massive gas pipeline networks to 163,000 kilometers by 2025, requiring a USD 1.9 trillion investment.

- Increasing end-use developments in the region are expected to create lucrative opportunities for market participants to improve their footprints. In January 2022, Adani Total Gas Ltd (ATGL), a collaborative partnership among the Adani Group and TotalEnergies, secured licenses to develop its City Gas Distribution (CGD) infrastructure to 14 additional geographical regions with an INR 20,000-crore (~USD 200 Billion) investment.

- The rising consumption of oil & gas will necessitate the establishment of new production facilities, boosting the requirement for process instrumentation. According to the IEA, daily oil output is expected to exceed 15 million barrels by 2040. Further, according to the IBEF, natural gas usage is expected to surpass 143.08 million tons by 2040. Thus, increasing demand for oil & gas is expected to contribute to regional market growth.

- The active role of governments in educating the masses regarding the benefits of technology and rising funds being diverted towards adopting technologically advanced machinery in industries has been of prime importance for market growth in the region. In the next few years, the market will be driven by the thriving growth of key end-use industries such as metal and mining, chemical, food and beverages, oil & gas, and others.

Process Instrumentation Industry Overview

The process instrumentation market is moderately fragmented, with the presence of both global and regional players such as Honeywell International Inc., Siemens AG, Omron Corporation, ABB Limited, and Emerson Electric Co., among others. These key players are adopting various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in the market.

In November 2022, Equilibar launched a dedicated Single Use Technology Branch to address the pharmaceutical industry's ever-changing fluid management requirements. The SDO valves are Equilibar's first single-usage fluid control device, which precisely regulates back pressures and flow. "The SDO is the unique wetted per-use valve in the pharmaceutical production area," claims the company. In September 2022, OleumTech, a leading developer of industrial technology and Internet of Things (IoT) solutions, added a Smart Differential Pressure (DP) Transmitter to its rapidly expanding H Series range of hardwired processes instrumentation. The innovative DP Transmitter provides the superior performance, dependability, and precision required by industrial industries such as petrochemical, upstream oil and gas, electricity, chemical, and wastewater. In July 2022, Emerson introduced the TESCOM Anderson Greenwood Instrumentation H2 Valve Range for hydrogen operations with pressures up to 15,000 psi (103.4 MPa). The innovative technology reliably separates process pressures in high-pressure gas operations, including hydrogen filling facilities and tube trailers, lowering fugitive pollutants and increasing safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for energy-efficient production processes

- 4.2.2 High level of efficiency with minimum cost

- 4.3 Market Restraints

- 4.3.1 Higher cost of research and development

- 4.3.2 Higher cost of implementation and maintenance of solutions and devices

- 4.4 Value Chain Analysis

- 4.5 Porters Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Instrument

- 5.1.1 Transmitter

- 5.1.2 Control Valve

- 5.2 Technology

- 5.2.1 Programmable Logic Controller (PLC)

- 5.2.2 Distributed Control System (DCS)

- 5.2.3 Supervisory Control and Data Acquisition (SCADA)

- 5.2.4 Manufacturing Execution System (MES)

- 5.3 End-User

- 5.3.1 Water and Wastewater Treatment

- 5.3.2 Chemical Manufacturing

- 5.3.3 Energy & Utilities

- 5.3.4 Oil and Gas Extraction

- 5.3.5 Metals and Mining

- 5.3.6 Other Process Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Honeywell International Inc.

- 6.1.2 Siemens AG

- 6.1.3 Omron Corporation

- 6.1.4 ABB Ltd.

- 6.1.5 Emerson Electric Company

- 6.1.6 Rockwell Automation Inc.

- 6.1.7 Mitsubishi Electric Corporation

- 6.1.8 Danaher Corporation

- 6.1.9 Metso Corporation

- 6.1.10 Yokogawa Electric Corporation

- 6.1.11 Endress+ Hauser AG