|

市場調查報告書

商品編碼

1643106

泰國瓷磚:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Thailand Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

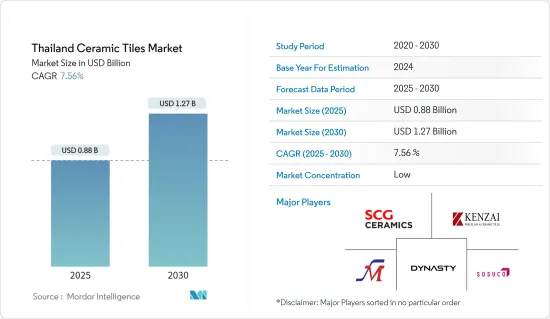

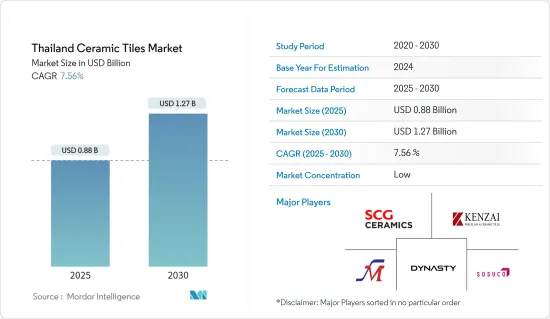

泰國瓷磚市場規模預計在 2025 年為 8.8 億美元,預計到 2030 年將達到 12.7 億美元,預測期內(2025-2030 年)的複合年成長率為 7.56%。

泰國是瓷磚行業的主要企業,其產量正在激增。成長的動力來自於全球出口需求的不斷成長以及滿足國內需求的需求。該國的瓷磚市場受到強勁的建築業、住宅和商業基礎設施不斷成長的需求以及持續的都市化趨勢的支撐。瓷磚因其耐用性和抗裂性而被廣泛應用於住宅和商業建築。此外,保護塗層進一步增強了防水和防污性能。泰國的瓷磚行業獨具特色,企業積極投資最尖端科技,以推動創新和生產效率,同時控制成本。

泰國的陶瓷產業有著豐富的傳統。瓷磚需求的主要驅動力是建築業的蓬勃發展、住宅單元數量的增加、私人消費的成長和快速的都市化。在泰國,從公寓到辦公室和購物中心等大型開發項目,住宅和承包商都對瓷磚趨之若鷯。建築師和室內設計師對瓷磚市場的消費者選擇有很大影響。其中,美國、澳洲、德國、新加坡、荷蘭等是泰國釉藥瓷磚和馬賽克瓷磚的主要海外市場。泰國是全球最大、最具創新精神的瓷磚製造商的所在地,未來幾年,泰國的瓷磚需求將持續成長。

泰國瓷磚市場的趨勢

泰國瓷磚進口量增加

- 泰國瓷磚進口量的增加表明對這些產品的需求不斷增加。這背後可能有幾個原因,包括建築業的成長、都市化進程的加速以及消費者可支配收入的增加。過去幾年,泰國建設產業穩定成長,對帶動瓷磚等建材的需求增加。

- 此外,中國的都市化不斷提高,導致越來越多的人遷移到城市和都市區。因此,在建築施工和重建過程中使用瓷磚的需求日益增加。

- 此外,消費者可支配收入的增加也導致泰國瓷磚進口量增加。隨著消費者可支配收入的增加,他們更有可能投資住宅裝修計劃,而這通常涉及瓷磚。總體而言,泰國瓷磚進口量的增加對於建築裝修行業以及泰國整體經濟成長來說是一個積極的趨勢。

瓷磚引領泰國住宅市場

泰國的住宅產業是瓷磚需求旺盛的重要力量。瓷磚用於住宅建築的地板材料、牆壁材料和裝飾目的。住宅領域在推動泰國瓷磚市場的重要性由多種因素所支撐。

首先,泰國快速的都市化和人口成長正在刺激住宅建設活動。這包括建築物、公寓和住宅計劃的開發。隨著人口的成長和人們向都市區的活性化,這些新住宅對瓷磚的需求正在激增。瓷磚因其美觀度和功能耐用性而受到追捧。它具有防潮、防塵、防磨損等特點,非常適合廚房、浴室和起居空間等人流量大的區域。

此外,泰國住宅對房屋重建和改造的日益成長的趨勢也推動了對瓷磚的需求。隨著住宅希望更新生活空間,瓷磚已成為一種流行的選擇。瓷磚不僅可以使您的室內和室外外觀煥然一新,還可以增加房產價值並創造反映您的生活偏好的客製化生活環境。

泰國瓷磚行業概況

泰國瓷磚市場分散且競爭激烈,主要參與者有SCG Ceramics、Kenzai和Dynasty Ceramics。國際瓷磚製造商也在該地區佔據一席之地,當地企業不斷尋求創新產品,提高產品質量,推出多樣化設計,以保持市場競爭力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 洞察市場趨勢/消費者偏好分析

- 洞察電子商務趨勢

- 洞察產業技術趨勢

- COVID-19 市場影響

第5章 市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 機會

- 產業價值鏈分析

- 波特五力分析

第6章 市場細分

- 按產品

- 釉藥

- 瓷

- 無刮痕

- 其他產品

- 按應用

- 地磚

- 牆磚

- 其他用途

- 依建築類型

- 新建築

- 更換和翻新

- 按最終用戶

- 住宅

- 商業的

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- SCG Ceramics

- Kenzai

- Stone Mark Ceramics

- Sosuco Ceramics company Limited

- Viglacera Thang long Ceramics JSC

- UMI Group

- Dynasty Ceramic

- TT Ceramic Company Limited

- Tongfa Ceramic Limited

- Lam Pang Thai Ceramic Company limited

第8章 市場機會與未來趨勢

第 9 章 附錄

第 10 章:出版商

The Thailand Ceramic Tiles Market size is estimated at USD 0.88 billion in 2025, and is expected to reach USD 1.27 billion by 2030, at a CAGR of 7.56% during the forecast period (2025-2030).

Thailand, a key player in the ceramic tile sector, is witnessing a surge in production. This uptick is driven by rising global export demands and the need to meet domestic needs. The country's ceramic tile market is buoyed by a robust construction sector, escalating demand for both residential and commercial infrastructure, and the ongoing urbanization trend. Ceramic tiles, valued for their durability and crack resistance, are extensively used in residential and commercial buildings. Additionally, their water resistance and stain protection are further enhanced by protective coatings. Thailand's ceramic tile sector stands out, with companies actively investing in cutting-edge technologies to drive innovation and production efficiency, all while managing costs.

The ceramics industry in Thailand boasts a rich heritage. Key drivers of ceramic tile demand include a booming construction sector, heightened residential unit expansion, increased consumer spending, and rapid urbanization. In Thailand, ceramic tiles are sought after by homeowners and contractors alike, for projects ranging from condominiums to large-scale developments like office and shopping complexes. Architects and interior designers wield significant influence over consumer choices in the ceramic tile market. Notably, the United States, Australia, Germany, Singapore, and the Netherlands are major foreign markets for Thai glazed ceramic and mosaic tiles. With some of the largest and most innovative tile manufacturers, Thailand is poised to witness a sustained surge in ceramic tile demand in the coming years.

Thailand Ceramic Tiles Market Trends

Rising Imports of Ceramic Tiles in Thailand

- The rising imports of ceramic tiles in Thailand indicate an increasing demand for these products. This could be due to several reasons such as a growing construction industry, rising urbanization, and an increase in disposable income among consumers. Thailand's construction industry has been growing steadily over the past few years, which has led to an increase in demand for building materials such as ceramic tiles.

- Additionally, the country's urbanization rate has been increasing, with more people moving to cities and urban areas. As a result, there is a greater need for the construction and renovation of buildings, which includes the use of ceramic tiles.

- Furthermore, the increase in disposable income among consumers has also contributed to the rise in imports of ceramic tiles in Thailand. As consumers have more money to spend, they are more likely to invest in home renovation projects, which often involve the use of ceramic tiles. Overall, the rising imports of ceramic tiles in Thailand indicate a positive trend for the construction and renovation industry, as well as for the country's overall economic growth.

Residential Sector in Thailand Ceramic Tiles are Driving the Market

The residential sector in Thailand is a pivotal force behind the surging demand for ceramic tiles. These tiles find applications in flooring, wall cladding, and decorative purposes within residential properties. Several factors underscore the residential sector's significance in propelling Thailand's ceramic tiles market.

Firstly, Thailand's rapid urbanization and population growth have spurred a flurry of residential construction activities. This includes the development of buildings, condominiums, and housing projects. As the population swells and urban migration intensifies, the need for ceramic tiles to furnish these new residential units has soared. Ceramic tiles are sought after for their aesthetic appeal and functional durability. They boast resistance to moisture, stains, and wear, making them ideal for high-traffic areas like kitchens, bathrooms, and living spaces.

Furthermore, a rising trend of home renovation and remodeling projects among Thai homeowners is bolstering the demand for ceramic tiles. As homeowners strive to revamp their living spaces, ceramic tiles have become a go-to choice. They not only refresh interior and exterior surfaces but also elevate property values, creating bespoke living environments that mirror their lifestyle preferences.

Thailand Ceramic Tiles Industry Overview

The Thai ceramic tiles market is fragmented and competitive, with the presence of some major players, like SCG Ceramics, Kenzai, and Dynasty Ceramics. International Ceramic tile manufacturers are also gaining prominence in the region, and the local players are constantly trying to innovate their product offerings by enhancing product quality and introducing varied designs to sustain the rising competition in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Insights into market trends/consumer preference analysis

- 4.2 Insights into E commerce trends

- 4.3 Insights into Technological Trends in the industry

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.3 Market Restraints

- 5.4 Opportunities

- 5.5 Industry Value Chain Analysis

- 5.6 Porter's Five Forces Analysis

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Glazed

- 6.1.2 Porcelain

- 6.1.3 Scratch Free

- 6.1.4 Other Products

- 6.2 By Application

- 6.2.1 Floor Tiles

- 6.2.2 Wall Tiles

- 6.2.3 Other Applications

- 6.3 By Construction Type

- 6.3.1 New Construction

- 6.3.2 Replacement and Renovation

- 6.4 By End-User

- 6.4.1 Residential

- 6.4.2 Commercial

7 COMPETITIVE LANDSCAPE

- 7.1 Market Competion Overview

- 7.2 Company Profiles

- 7.2.1 SCG Ceramics

- 7.2.2 Kenzai

- 7.2.3 Stone Mark Ceramics

- 7.2.4 Sosuco Ceramics company Limited

- 7.2.5 Viglacera Thang long Ceramics JSC

- 7.2.6 UMI Group

- 7.2.7 Dynasty Ceramic

- 7.2.8 TT Ceramic Company Limited

- 7.2.9 Tongfa Ceramic Limited

- 7.2.10 Lam Pang Thai Ceramic Company limited