|

市場調查報告書

商品編碼

1643118

基於 MEMS 的 IMU -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)MEMS-Based IMU - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

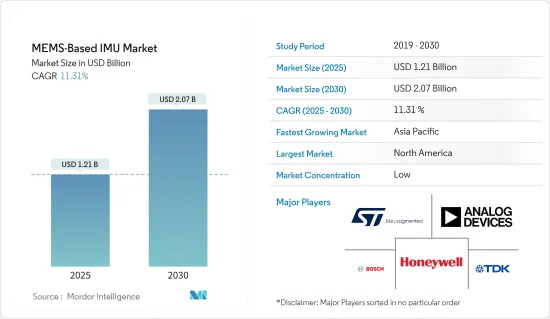

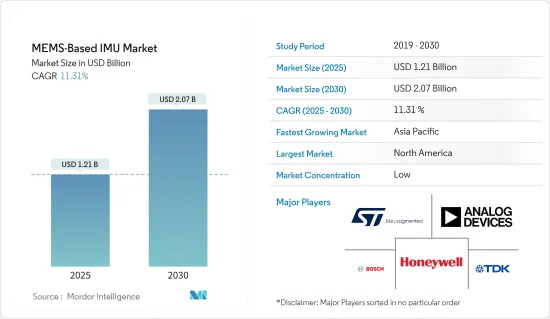

基於 MEMS 的 IMU 市場規模預計在 2025 年為 12.1 億美元,預計到 2030 年將達到 20.7 億美元,預測期內(2025-2030 年)的複合年成長率為 11.31%。

推動市場成長的關鍵因素是應用數量的增加、技術進步以及全球新興國家的需求不斷成長。 MEMS 技術在擴大慣性測量系統的應用基礎方面發揮關鍵作用,透過減小設備尺寸和功耗而不影響其性能指標來推動市場成長。

關鍵亮點

- 該裝置使用的MEMS慣性感測器極其堅固、可靠、快速且溫度穩定,從而推動了研究市場的不斷成長。甚至可以偵測到位置和加速度的微小變化。此外,物聯網設備的持續發展也推動了市場成長。

- 必須保護 MEMS IMU 的內部組件免受高溫、潮濕和腐蝕性化學物質等惡劣環境的影響。然而,由於對製造和環境變化的高度敏感性,微機械陀螺儀等IMU感測器的封裝成為一項具有挑戰性的任務,導致封裝成本增加,從而阻礙了市場的成長。由於 COVID-19 疫情,市場面臨巨大阻力。全球新冠疫情大流行導致的停工影響了設備製造,抑制了終端用戶產業的消費需求並影響了價格。不過,隨著復甦,市場需求可能會上升至趨勢線。

- 隨著全球國防組織越來越依賴精確武器,訊號鏈的性能、品質和設計變得更加關鍵。 MEMS 陀螺儀感測器在訊號鏈設計至關重要的三個關鍵方面增強了產業發展:

- 例如,2021年12月,霍尼韋爾宣布獲得美國國防高級研究計畫局(DARPA)的資助,用於開發下一代基於MEMS的慣性感測器技術,該技術將用於商業和國防導航應用。霍尼韋爾實驗室最近證明,這種新感測器的精度比霍尼韋爾的 HG1930 慣性測量單元 (IMU) 高出一個數量級以上。

- 此外,隨著 COVID-19 疫情的爆發,許多製造業停工,嚴重影響了基於 MEMS 的 IMU 市場。但由於新冠疫情,汽車製造商在全球範圍內面臨越來越大的關閉工廠的壓力。聯邦、州和地方政府已開始鼓勵人們盡可能待在家裡。這導致各行各業的供應鏈中斷。例如,福特和通用汽車在冠狀病毒爆發期間已暫停了其在北美各自製造工廠的生產。由於全球新冠病毒疫情導致汽車需求預計下降,本田北美公司和寶馬也關閉了美國和歐洲的工廠。

MEMS 慣性測量單元 (IMU) 市場趨勢

汽車領域佔據主要市場佔有率

- 最新一代 ADAS(高級駕駛輔助系統)和自動駕駛汽車需要精確的慣性測量單元來準確預測車輛運動並即時確定其確切位置,從而推動基於 MEMS 的慣性測量單元市場的成長。此外,自動駕駛的發展預計將使基於安全的應用的需求翻倍,從而為市場創造商機。

- 由於乘用車和商用車需求旺盛,生產工廠增加,以及經濟區快速擴張,預計將推動市場成長。

- 例如,2022 年 7 月,寶馬集團推出了一個新計劃,汽車將在無需駕駛員的情況下在生產區域內行駛。該工廠自動駕駛計劃將與兩家新興企業:韓國的Seoul Robotics和瑞士的Embotech。我們正在提高工廠和配送中心的新車物流效率。

- 此外,隨著第一波疫情的消退,Analog Devices, Inc. 宣布其高精度慣性測量單元 (IMU) 已被 CHC Navigation 採用用於其下一代即時動態 (RTK)探測車接收器。這款新一代 RTK探測車接收機結合了衛星定位和慣性定位,可在任何位置實現高精度、高效的定位和測量。

- 此外,2022 年 5 月,義法半導體將發布基於 MEM 的慣性測量單元 (IMU) ASM330LHHX,以機器學習 (ML) 核心實現智慧駕駛並支援汽車產業朝向更先進的自動化邁進。

北美佔有最大市場佔有率

- 由於穩定性控制、安全措施和碰撞偵測系統等應用的進步,汽車產業成為高階 IMU 的新興市場。隨著高階汽車製造商在未來幾年可能更接近 L5 自動駕駛,該市場可能為與加速度、雷射雷達和運動偵測系統相關的配備 IMU 的 MEMS 感測器提供重大機會。

- 在第二波疫情期間,固態LiDAR感測器開發商 Innoviz Technologies Ltd 籌集了約 1.7 億美元,用於支援寶馬配備LiDAR的汽車。

- 國際能源總署(IEA)數據顯示,2021年美國電動車市場強勢回歸,銷量成長一倍以上,達50萬多輛。美國整體汽車市場也有所改善,電動車的市場佔有率增加至4.5%。在美國,特斯拉繼續佔據電動車市場的主導地位。總體而言,該國的汽車產業持續成長,為該地區汽車產業的市場研究做出了貢獻。

- 2021年4月,Avita Health System 成為美國第一家植入基於 CardioMEMS 的 IMU 系統治療心臟衰竭患者的重症病人准入醫院。該設備允許醫生遠端監測心臟壓力並即時實施治療。該公司的第一台設備在俄亥俄州加利恩醫院植入。

- 此外,2021 年 4 月,Inertial Labs 宣布推出 IMU-NAV-100,這是 Inertial Labs 產品組合中的新型戰術級 MEMS IMU。這種新型感測器是一種完全整合的慣性解決方案,它利用最先進的 3 軸 MEMS加速計和陀螺儀來精確測量線性加速度、角速率和俯仰/滾轉。

基於 MEMS 的 IMU 行業概覽

基於 MEMS 的 IMU(慣性測量單元)市場比較分散。整體而言,現任者之間的競爭敵意較高。未來收購、與大公司的合作都將以技術創新為重點。市場的主要企業包括霍尼韋爾國際公司、Analog Devices Inc.、Bosch Sensortec GmbH 和意法半導體國際公司。

- 2022 年 1 月-TDK 公司宣布推出 InvenSense ICM-45xxx SmartMotion 超高性能 (UHP) 系列 6 軸 MEMS 運動感測器。它具有片上自校準功能、業界最低功耗以及世界上第一種 BalancedGyro (BG) 技術。

- 2021 年 4 月—霍尼韋爾推出一系列基於 MEMS 的微型慣性測量裝置,具有一流的精度和耐用性,可承受高衝擊環境。新型 HG1125 和 HG1126 慣性測量單元 (IMU) 大小大約與水瓶蓋相當,成本低廉,適用於商業和軍事應用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估新冠肺炎對各行業的影響

第5章 市場動態

- 市場促進因素

- 新興應用增加(物聯網設備、無人駕駛汽車等)

- 低成本 MEMS IMU 的採用日益增多

- 市場限制

- 滿足不斷變化的消費者需求

第6章 市場細分

- 最終用戶產業

- 消費者

- 車

- 醫療

- 航太和國防

- 工業的

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Honeywell International Inc.

- Analog Devices Inc.

- TDK Corporation

- Bosch Sensortec GmbH

- STMicroelectronics NV

- Xsens Technologies BV

- NXP Semiconductors NV

- Sensonor AS

- Northrop Grumman LITEF GmbH

- Silicon Sensing Systems Limited

- Murata Manufacturing Co. Ltd

- MEMSIC Inc.

第8章投資分析

第9章:市場的未來

The MEMS-Based IMU Market size is estimated at USD 1.21 billion in 2025, and is expected to reach USD 2.07 billion by 2030, at a CAGR of 11.31% during the forecast period (2025-2030).

The market's growth is primarily fueled by the increase in the number of applications, technological advancements, and the increasing demand in emerging countries globally. The MEMS technology played a significant role in expanding the application base for inertial measurement systems by scaling down these devices' size and power consumption without compromising on their performance metrics, thereby driving the market's growth.

Key Highlights

- The market studied is growing, as MEMS inertial sensors used in the unit offer highly robust, reliable, fast, and temperature-stable characteristics. They can detect even the most minor changes in position and acceleration. Furthermore, the growing development of IoT devices is driving the market's growth.

- The internal components of MEMS IMU need to be protected from harsh environments, such as heat, moisture, and corrosive chemicals. However, the high sensitivity to fabrication and environmental variations makes the packaging of IMU sensors, such as micromachined gyroscopes, a challenging task and increases the packaging cost, thereby hampering the market's growth. The market is facing heavy headwinds due to the outbreak of COVID-19 worldwide. Lockdowns enforced by the spread of COVID-19 worldwide affected the manufacturing of devices, dragged consumer demand across end-user industries, and influenced the prices. However, with the resurgence, the market demand will likely rise to the trend line.

- As global defense agencies become more dependent on precision weapons, the signal chain's performance, quality, and design are even more mission-critical. MEMS gyroscope strengthens the industry with three essential aspects of signal chain design.

- For instance, in December 2021, Honeywell announced the development of the next generation of MEMS-based inertial sensor technology with financing from the US Defense Advanced Research Projects Agency (DARPA), which will be used in both commercial and defense navigation applications. Honeywell lab studies recently revealed that the new sensors are more than an order of magnitude more precise than Honeywell's HG1930 inertial measurement unit (IMU), a tactical-grade device with more than 150,000 units in operation.

- Furthermore, the beginning of the COVID-19 pandemic has severely hit the market for MEMS-based IMU owing to the shutdown of several manufacturing industries. However, automakers globally have faced increased pressure to shut down their factories due to the COVID-19 pandemic. After the federal, state, and local governments started recommending people stay in their homes as much as possible. This has caused supply chain disruptions across various industries. For instance, Ford and General Motors suspended production at their respective manufacturing facilities in North America amid the coronavirus outbreak. Honda North America and BMW also closed their plants throughout the U.S. and Europe owing to an expected decline in car demand related to the global coronavirus outbreak.

MEMS Inertial Measurement Unit (IMU) Market Trends

Automotive Sector is to Hold Significant Market Share

- The latest generation of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles require an exact inertial measurement unit to accurately predict the motion of a vehicle to determine its precise position in real-time, thereby driving the growth of the MEMS-based inertial measurement unit market. Also, with the evolution towards autonomous driving, the demand for the market is expected to increase multiple-fold for safety-based applications and create opportunities in the market.

- The increase in the number of production plants for passenger and commercial vehicles due to the high demand for these vehicles and the presence of rapidly expanding economies are likely to boost the market's growth.

- For instance, in July 2022, The BMW Group launched a new project that will see cars manoeuvre around production without requiring a driver. The Automated Driving In-Plant project is being realized in collaboration with two startups - Seoul Robotics from South Korea and Embotech from Switzerland. It will enhance the efficiency of new-vehicle logistics in plants and distribution centers.

- Moreover, during the end of the first wave of the pandemic, Analog Devices, Inc. announced its high-precision inertial measurement unit (IMU) was selected by CHC Navigation to enable its next-generation, real-time kinematic (RTK) rover receiver, which can achieve high-precision and high-efficiency positioning and measurement at any position through the combination of satellite and inertial positioning.

- Further, in May 2022, STMicroelectronics announced MEMs-based inertial measurement unit (IMU) ASM330LHHX to enable smart driving and support the automotive industry's quest for higher levels of automation with its machine-learning (ML) core.

North America Accounts for the Largest Market Share

- The automotive sector is the emerging market for high-end IMUs, following advancements in applications, such as stability control, safety measures, and crash detection systems. As the premium automakers may approach L5 autonomous driving in the next few years, the market may provide a massive opportunity for IMU-powered MEMS sensors related to acceleration, LiDAR, and motion detection systems.

- During the second pandemic wave, Innoviz Technologies Ltd, a developer of solid-state LiDAR sensors, raised around USD 170 million to back BMW's LiDAR-equipped cars, which will be rolled out by the beginning of 2022.

- According to the International Energy Agency (IEA), in 2021, the United States made a strong comeback in the electric car market, with sales more than doubling to more than half a million units. The entire car market in the United States improved as well, but electric vehicles increased their market share to 4.5%. Tesla continues to dominate the electric car market in the United States. Overall, the automotive sector in the country has been growing, contributing to the market studied, especially in the automotive industry, in the region.

- In April 2021, Avita Health System became the first critical access hospital in the United States to implant the CardioMEMS- based IMU system for treating heart failure patients. The device enables doctors to monitor cardiac pressure remotely and provide real-time treatments. The first device offered by the company was implanted at Galion Hospital in Ohio.

- Further, in April 2021, Inertial Labs launched the IMU-NAV-100, a new tactical-grade MEMS IMU in Inertial Labs' portfolio. The new sensor is a fully integrated inertial solution that measures linear accelerations, angular rates, and pitch/roll with high accuracy, utilizing state-of-the-art three-axis MEMS accelerometers and gyroscopes.

MEMS Inertial Measurement Unit (IMU) Industry Overview

The MEMS-based Inertial Measurement Unit Market is fragmented. Overall, the competitive rivalry among existing competitors is high. Moving forward, acquisitions and partnerships of large companies are focused on innovation. Some of the key players in the market are Honeywell International Inc., Analog Devices Inc., Bosch Sensortec GmbH, and STMicroelectronics International N.V.

- January 2022 - TDK Corporation announced the availability of the InvenSense ICM-45xxx SmartMotion ultra-high-performance (UHP) family of 6-axis MEMS motion sensors. This introduces the on-chip self-calibration, the industry's lowest power consumption, and the world's first BalancedGyro (BG) technology.

- April 2021 - Honeywell launched a new series of MEMS-based miniature inertial measurement units that are ruggedized to offer best-in-class accuracy and durability to survive high-shock environments. Roughly the size of a water bottle cap, the new HG1125 and HG1126 inertial measurement units (IMUs) are low-cost and serve both commercial and military applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of the impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Emerging Applications (IoT Devices, Robotic Cars, etc.)

- 5.1.2 Increasing Adoption of Low-cost MEMS-based IMUs

- 5.2 Market Restraints

- 5.2.1 Keeping Pace with the Changing Consumer Demand

6 MARKET SEGMENTATION

- 6.1 End-user Industry

- 6.1.1 Consumer

- 6.1.2 Automotive

- 6.1.3 Medical

- 6.1.4 Aerospace & Defense

- 6.1.5 Industrial

- 6.1.6 Others End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Analog Devices Inc.

- 7.1.3 TDK Corporation

- 7.1.4 Bosch Sensortec GmbH

- 7.1.5 STMicroelectronics N.V.

- 7.1.6 Xsens Technologies B.V.

- 7.1.7 NXP Semiconductors N.V.

- 7.1.8 Sensonor AS

- 7.1.9 Northrop Grumman LITEF GmbH

- 7.1.10 Silicon Sensing Systems Limited

- 7.1.11 Murata Manufacturing Co. Ltd

- 7.1.12 MEMSIC Inc.