|

市場調查報告書

商品編碼

1643123

無塵室消耗品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Cleanroom Consumables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

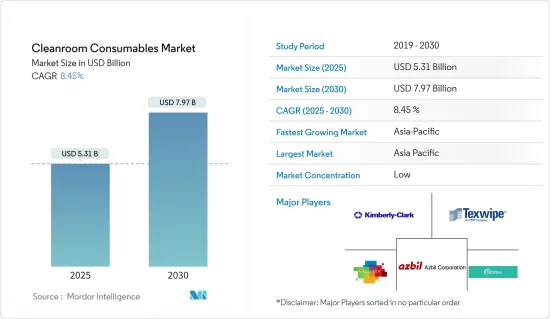

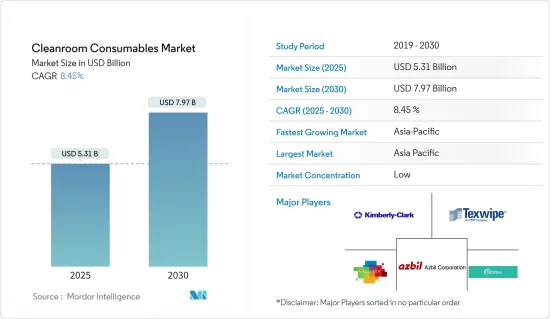

無塵室消耗品市場規模預計在 2025 年為 53.1 億美元,預計到 2030 年將達到 79.7 億美元,預測期內(2025-2030 年)的複合年成長率為 8.45%。

預計全球無塵室消耗品市場的成長將受到奈米技術的興起和模組化潔淨室系統需求不斷成長的推動。預測期內,各公司可能會簽訂交付協議以擴大其全球市場佔有率。由於新技術、併購,預計未來幾年市場將會成長。

關鍵亮點

- 由於產品的敏感性,無塵室設施對於半導體和微電子等各種應用至關重要。這些潔淨室還配備了蝕刻設備、光刻設備、摻雜設備、清洗設備、切割設備等昂貴且精密的設備。因此,任何偏離清潔度標準的現像都會影響整個生產過程。

- 市場上有許多買家,包括生技、電子、奈米技術和製藥領域的公司。潔淨室消耗品的重要性吸引了許多買家,導致對這些產品的需求不斷增加。市場上有許多原料供應商,例如生產橡膠、纖維素、酒精和聚合物的公司。這使得該行業很難進行價格談判。

- 對外科口罩、罩衣、手套和護目鏡等產品的需求不斷成長,正在成為全球無塵室消耗品行業市場參與企業的收益來源。由於冠狀病毒株不斷變異,醫學專家正在積極尋找抗病毒藥物和疫苗。潔淨室專業人員現在專注於保護自己免受環境污染。醫院、實驗室和製藥業的最終消費者依賴維持可靠供應鏈的供應商。

- 製藥和生物技術行業擴大採用無塵室消耗品來提高藥品品質。潔淨室消耗品市場也受到監管機構制定的嚴格法規的推動,以確保產品品質和檢驗。

- 2023 年 8 月,Thomas Scientific 收購了位於麻薩諸塞州的無塵室、包裝和工業產品供應商 Quintana Supply。同時,托馬斯科學公司企業發展,並增強了其為具有受控工業環境的先進技術和工業領域的公司提供服務的能力。

- 人工智慧技術的發展正在增加對電子設備的需求,從而推動這些消耗品的銷售。同樣,在醫療產業,新治療方法的發展也推動了這些消耗品的需求增加。生活方式的改變也推動了對保存期限更長、更清潔、使用更方便的包裝食品的需求。

- 然而,嚴格的監管要求和一次性潔淨室消耗品帶來的環境生物危害的複雜性可能會阻礙市場擴張。此外,使用和維護無塵室是一項艱鉅的任務,原料成本的上升也使市場難以成長。

- 全球醫療保健產業的工作流程受到了 COVID-19 疫情的影響。由於疫情,包括許多醫療保健行業在內的多個行業被迫暫時關閉業務。然而,COVID-19感染疾病帶來了正面影響,增加了對各種服務的需求,包括手套、連身工作服、鞋套和口罩等無塵室用品。此外,針對新冠疫苗的研發力道不斷加大,促使製藥和生物製藥公司大力投資這一市場,以維護無污染的環境。

無塵室耗材市場趨勢

對安全和高品質藥品的需求不斷成長預計將推動市場成長

- 潔淨室的重要性在於其在防止生產產品污染方面所扮演的角色。製藥無塵室規範經過精心規劃,以確保成功的產品能夠繼續進入市場。

- 無塵室對於製藥業至關重要,因為無塵室可以控制濕度、灰塵、氣壓、細菌甚至溫度。無塵室有助於確保人們購買的保健食品(無論是非處方食品還是醫生配製的食品)都是無害的。

- 久坐的生活方式是世界各地慢性病發病的主要原因。這導致了有助於診斷和治療慢性疾病的電子設備(例如糖尿病機器)、系統和藥物的誕生。

- 據報導,慢性病是美國最普遍且最昂貴的健康問題之一。幾乎一半的美國人(約45%,即1.33億人)患有至少一種慢性疾病,而且這個數字還在增加。最常見的慢性病是愛滋病毒、癌症、糖尿病、高血壓、中風、心臟病、呼吸道疾病、關節炎和肥胖症。根據美國疾病管制中心統計,慢性病佔醫療總費用的近75%,估計每人每年5,300美元。

- 根據歐洲製藥工業協會聯合會(EFPIA)的數據,2007年至2022年歐洲、中國和美國醫藥品研究開發費用的年增率如下: 2018-2022年期間,歐洲製藥業研發支出的年增率為4.6%。

- 製藥公司正在擴大研發能力,進行臨床試驗並開發治療慢性病的有效藥物。例如,根據歐盟委員會聯合調查委員會的數據,Ventyx Biosciences 在 2021 年實現了 819% 的驚人成長率。緊隨其後的是三葉草生物製藥,其研發支出增加了777%。這筆巨額支出很可能包括職場無塵室消耗品的成長。

亞太地區佔較大市場佔有率

- 預計亞太地區將出現顯著的市場成長,這主要是由於全球電子設備的普及率不斷提高以及人事費用和原料成本的下降,從而鼓勵企業增加建立製造工廠的投資。此外,製藥和生物技術行業的不斷發展以及醫療和研究領域對無塵室消耗品的不斷成長的需求對於保持所製造產品的品質至關重要。

- 亞洲國家擁有強大的基礎設施,可以以可負擔的成本進行研究和藥物開發。因此,大多數外國公司正在合作研發和量產治療方法。大約有六家印度公司——Serum Institute、Biological E、Bharat BIoTech、Indian Immunologicals 和 Mynvax——正在致力於研發一種 COVID-19 疫苗,加入全球尋找快速預防治療方法的努力,以對抗這種正在全球迅速蔓延的致命感染疾病。此外,西普拉(Cipla)、格蘭馬克(Glenmark)和印度製藥公司雷迪博士(Dr. Reddy's)將與吉利德科學合作,開始開發瑞德西韋(Remdesivir),這是一種實驗性藥物,最初是為治療伊波拉出血熱而開發的,但現在被推測是治療新冠肺炎的最佳選擇。

- 潔淨室對於航太和國防工業至關重要,可維持戰鬥機、直升機、搜救飛機和引擎所用零件的質量,以及開發符合國際要求和標準的產品和服務。亞太國家有許多理由升級軍隊並購買新的國防裝備。隨著大國崛起、新威脅、安全挑戰和軍事承諾,這個地區無疑是一個安全動態不斷變化的地區。這些需要新的無塵室產品功能,並正在推動該地區的軍事現代化。

- 由於食品和飲料、加工、製藥、生物技術和醫療設備產業的成長,亞太地區在研究期間佔據了全球無塵室消耗品市場的很大佔有率。在預測期內,亞太地區潔淨室消耗品市場預計將受到傳染病數量的增加和國內參與企業的崛起的推動。

無塵室耗材產業概況

無塵室消耗品市場細分為幾家大公司,例如金佰利公司、Texwipe、Nitritex 有限公司、Valuetek 公司和阿自倍爾公司。這些佔據了絕對市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。然而,隨著技術進步和產品創新,中小企業透過贏得新契約和探索新市場來擴大其市場佔有率。

歐洲大型鋼鐵公司英國鋼鐵公司已與 Micronclean 簽署契約,繼續為英國各地工地上的 4,000 多名工人提供專用服裝。

金佰利專業公司推出了 Kimtech Opal 丁腈手套,這種手套舒適度更高、手感更牢固,即使長時間佩戴也不會影響工人的安全。新手套適用於無菌藥品製造、研發設施和生命科學領域。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 對安全、高品質藥品的需求不斷增加

- 監理機關對藥品生產包裝的強制性規定

- 市場限制

- 原料和製造成本高

- 無塵室法規複雜多樣

第6章 市場細分

- 產品

- 安全產品

- 洋裝

- 靴套

- 鞋套

- 蓬鬆

- 褲子和口罩

- 其他

- 清潔用品

- 拖把

- 桶

- 墊圈

- 刮刀

- 檢驗拭子

- 其他

- 潔淨室耗材

- 紙製品

- 筆記

- 黏合墊片

- 粘合劑

- 剪貼簿

- 標籤

- 其他

- 安全產品

- 應用

- 電子產品

- 製藥和生物技術

- 飲食

- 航太和國防

- 大學研究

- 車

- 醫療設備

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Kimberly-Clark Corporation

- The Texwipe Company, LLC(Illinois Tool Works, Inc.)

- Nitritex Ltd.(Ansell Limited)

- Valutek Inc.

- DuPont de Nemours, Inc.

- Azbil Corporation

- Clean Air Products

- Micronova Manufacturing Inc.

- Micronclean Ltd.

- Contec Inc.

第8章投資分析

第9章:未來市場展望

The Cleanroom Consumables Market size is estimated at USD 5.31 billion in 2025, and is expected to reach USD 7.97 billion by 2030, at a CAGR of 8.45% during the forecast period (2025-2030).

Global cleanroom consumables market growth is expected to be fueled by the emergence of nanotechnology and increased demand for modular cleanroom systems. Various companies may establish delivery agreements to increase their market share globally during the predicted period. Over the next few years, the market is expected to grow because of new technologies, mergers, and acquisitions.

Key Highlights

- Clean room facilities are essential across various applications, such as semiconductor and microelectronic purposes, due to the sensitive nature of their products. These clean rooms also include expensive and precise equipment, including etching, photolithography, doping, cleaning, and dicing machines. Therefore, any departures from the cleanliness standards may affect the entire production process.

- There are a lot of purchasers in the market, including companies in the biotechnology, electronics, nanotechnology, and pharmaceutical sectors. The significance of cleanroom consumables attracts many buyers, contributing to the rising demand for these goods. There are a lot of raw material suppliers on the market, like companies that make rubber, cellulose, alcohol, and polymers. This makes it harder for the industry to negotiate prices.

- The increased demand for products like surgical masks, gowns, gloves, and goggles is converting into revenue streams for market participants in the worldwide cleanroom consumables industry. Medical specialists have been actively searching for antiviral medications and vaccinations since coronavirus strains are constantly changing. Professionals working in cleanrooms now focus on protecting themselves from environmental pollution. Hospitals, research labs, and the pharmaceutical industry's end consumers are served by suppliers who maintain reliable supply chains.

- The pharmaceutical and biotechnology industries are increasingly adopting cleanroom consumables for improved pharmaceutical drug quality. The cleanroom consumables market is also driven by strict rules put in place by regulatory authorities to ensure product quality and validation.

- In August 2023, Thomas Scientific acquired the Massachusetts-based cleanroom, packaging, and industrial products provider Quintana Supply. Thomas Scientific's national footprint while enhancing its ability to provide products and services to companies in advanced technology and industrial segments with controlled and industrial environments.

- There is an increase in demand for electronic devices due to the developments in artificial intelligence technology, which drives the sales of these consumables. Similarly, the need for these consumables in the healthcare industry has increased due to the development of new and improved treatments. People's changing lifestyles are also making them want packaged foods that last longer, are cleaner, and are easier to use.

- However, the complexity of stringent regulatory requirements and environmental biohazards brought on by disposable cleanroom consumables might hamper market expansion. Also, using and taking care of a cleanroom is hard, and rising raw material costs also make it hard for the market to grow.

- Workflows in the healthcare industry have been affected globally by the COVID-19 epidemic. Several sectors, including numerous branches of healthcare, have been forced to temporarily close their operations due to the pandemic. The prevalence of COVID-19 infectious disease has, however, had a positive effect and increased demand for a variety of services, including cleanroom supplies like gloves, coveralls, shoe covers, face masks, and others, as there is an increasing need to maintain a contamination-free environment while sampling, collecting, and testing suspected COVID-19 cases. Additionally, increasing R&D efforts to create vaccines against COVID-19 prompted pharmaceutical and biopharmaceutical firms to invest significantly in the market to maintain a contaminant-free environment.

Cleanroom Consumables Market Trends

Increasing Demand for Safe and Better-Quality Pharmaceutical Drugs is Expected to Drives the Market Growth

- The importance of cleanrooms may be attributed to their role in preventing contamination of produced goods. Cleanroom specifications for medicines are carefully planned so that a successful product can stay on the market.

- The capacity to manage humidity, dust, air pressure, germs, and even temperature makes cleanrooms essential in the pharmaceutical industry. This helps make sure that the health products people buy, whether they get them over-the-counter or from their doctor, won't hurt them.

- The adoption of a sedentary lifestyle is the main reason why there are so many chronic diseases around the world. This has led to the creation of electronic devices (like diabetes devices), systems, and medicines that can help diagnose and treat chronic diseases.

- According to a report, chronic disease is among the most prevalent and costly health conditions in the United States. Nearly half (approximately 45%, or 133 million) of all Americans suffer from at least one chronic disease, and the number is growing. The most common chronic diseases are HIV, cancer, diabetes, hypertension, stroke, heart disease, respiratory diseases, arthritis, and obesity. And as per the Centers for Disease Control in the United States, chronic disease accounts for nearly 75% of aggregate healthcare spending, or an estimated USD 5300 per person annually.

- According to EFPIA, The pharmaceutical research and development spending annual growth rate in Europe, China, and the United States in selected periods between 2007 and 2022. The European pharmaceutical industry's expenditure on R&D grew 4.6 percent annually between 2018 and 2022.

- Pharmaceutical companies are expanding their research and development capacity to conduct trials and develop effective drugs to treat chronic diseases. For instance, according to the Joint Research Commission of the EC, Ventyx Biosciences recorded a significant growth rate of 819 percent in 2021. This was followed by Clover Biopharmaceuticals, which recorded a 777% growth rate in R&D spending. Such significant expenditures would include the growth in cleanroom consumables in the workplace.

Asia-Pacific to Hold a Significant Market Share

- Asia-Pacific is anticipated to experience significant market growth, primarily driven by the high adoption of electronic gadgets across the world and companies' increased investment in setting up manufacturing plants due to lower labor and raw material costs. Also, the rising growth of the pharmaceutical and biotechnology industries and the growing need for cleanroom consumables in the healthcare and research fields will be very important for keeping the quality of the products that are made.

- Asian countries have better research and pharmaceutical infrastructure to conduct research and develop medicine at an affordable cost. So most foreign companies are working jointly to create and mass-produce the treatment. Around six Indian companies named Serum Institute, Biological E, Bharat Biotech, Indian Immunologicals, and Mynvax were working to develop COVID-19 vaccines and had joined the global efforts to find a quick preventive cure for the deadly infection spreading rapidly across the world. Further, Cipla, Glenmark, and Dr. Reddy's (India-based pharmaceutical companies) would start working with Gilead Sciences to develop Remdesivir, an experimental drug initially developed to cure Ebola but now being speculated as the best option against COVID-19.

- Cleanrooms are critical in the aerospace and defense industries for developing products and services that maintain the quality of components used in fighter jets, helicopters, search and rescue flying boats, engines, and so on, while meeting international requirements and standards. Asia-Pacific nations have many reasons to upgrade their militaries and buy new defense equipment. With emerging great powers, new threats, security difficulties, and military commitments, the area is undoubtedly one with continually changing security dynamics. These necessitate new cleanroom product capabilities, propelling regional military modernization.

- Asia-Pacific held a sizable portion of the global cleanroom consumables market during the study period due to growth in the food and beverage, processing, pharmaceutical, biotechnology, and medical device industries. During the forecast period, the cleanroom consumables market in Asia-Pacific is expected to be driven by a rise in the number of contagious diseases and the rise of domestic players.

Cleanroom Consumables Industry Overview

The cleanroom consumables market is fragmented and dominated by a few significant players like Kimberly-Clark Corporation, Texwipe, Nitritex Ltd., Valuetek Inc., and Azbil Corporation. These notable players, with a prominent share of the market, are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, midsize to smaller companies are growing their market presence by securing new contracts and tapping new markets.

British Steel, a big steel company in Europe, signed a contract with Micronclean to keep getting specialized clothing for more than 4,000 of its workers at sites all over the UK.

Kimberly-Clark Professional launched Kimtech Opal Nitrile Gloves for increased comfort during prolonged wear and solid tactile sensitivity without sacrificing worker safety. The new gloves are suitable for use in non-sterile medicine manufacturing, research and development facilities, and life sciences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Safe and Better-Quality Pharmaceutical Drugs

- 5.1.2 Compulsory Regulations by Regulatory Authorities for Production and Packaging of Medical Products

- 5.2 Market Restraints

- 5.2.1 High Raw Materials and Manufacturing Cost

- 5.2.2 Complicated and Variable Regulations of Cleanroom

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Safety Consumables

- 6.1.1.1 Frocks

- 6.1.1.2 Boot Covers

- 6.1.1.3 Shoe Covers

- 6.1.1.4 Bouffants

- 6.1.1.5 Pants and Face Masks

- 6.1.1.6 Other Safety Consumables

- 6.1.2 Cleaning Consumables

- 6.1.2.1 Mops

- 6.1.2.2 Buckets

- 6.1.2.3 Wringers

- 6.1.2.4 Squeegees

- 6.1.2.5 Validation Swabs

- 6.1.2.6 Other Cleaning Consumables

- 6.1.3 Cleanroom Stationery

- 6.1.3.1 Papers

- 6.1.3.2 Notebooks

- 6.1.3.3 Adhesive Pads

- 6.1.3.4 Binder

- 6.1.3.5 Clipboards

- 6.1.3.6 Labels

- 6.1.3.7 Other Cleanroom Stationeries

- 6.1.1 Safety Consumables

- 6.2 Application

- 6.2.1 Electronics

- 6.2.2 Pharmaceutical and Biotechnology

- 6.2.3 Food and Beverage

- 6.2.4 Aerospace and Defense

- 6.2.5 University Research

- 6.2.6 Automotive

- 6.2.7 Medical Device

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kimberly-Clark Corporation

- 7.1.2 The Texwipe Company, LLC (Illinois Tool Works, Inc.)

- 7.1.3 Nitritex Ltd. (Ansell Limited)

- 7.1.4 Valutek Inc.

- 7.1.5 DuPont de Nemours, Inc.

- 7.1.6 Azbil Corporation

- 7.1.7 Clean Air Products

- 7.1.8 Micronova Manufacturing Inc.

- 7.1.9 Micronclean Ltd.

- 7.1.10 Contec Inc.