|

市場調查報告書

商品編碼

1643143

亞太地區遠端資訊處理 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)APAC Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

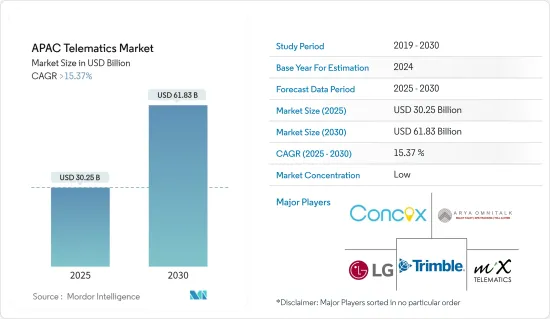

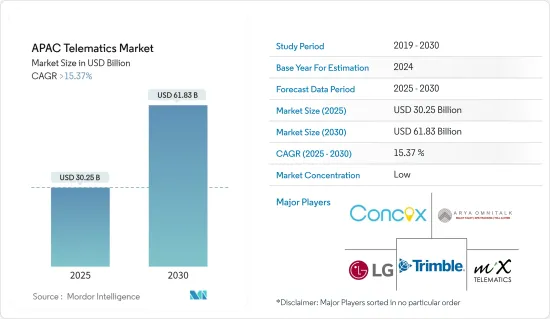

亞太地區遠端資訊處理市場規模預計在 2025 年為 302.5 億美元,預計到 2030 年將達到 618.3 億美元,預測期內(2025-2030 年)的複合年成長率將超過 15.37%。

遠端資訊處理透過向車隊管理公司和汽車保險公司提供資訊來監控車輛的位置和行為,從而有助於基於使用情況的保險 (UBI)。政府透過商用車和智慧型運輸系統(ITS) 強制導航來保障道路安全,對電動車的需求不斷成長,以及透過價格實惠的感測器不斷上升的連接趨勢,主要推動了亞太地區遠端資訊處理市場的成長。中國、日本、韓國等國家5G基礎設施的發展也將推動亞太地區車聯網產業的發展。

關鍵亮點

- 高通技術公司宣布推出“連接即服務”,這是其驍龍車到雲端服務的一項功能。它匯集了支援雲端和設備開發環境的新技術合作,旨在向世界提供開箱即用的連接、整合分析、新技術功能、內容和服務。 Cognizant 正在與 Qualcomm Technologies Inc. 合作,為汽車製造商整合和客製化 Snapdragon 車到雲端服務。目標是提供豐富、身臨其境和個性化的車載體驗、新的連接解決方案和更好的按需服務。

- 隨著聯網汽車服務的日益普及推動市場的發展,各家公司正在建立策略夥伴關係,將服務送到您家門口。印度汽車科技新興企業ReadyAssist 宣布與 iTriangle Infotech 建立策略合作夥伴關係,後者是一家為遠端資訊處理解決方案提供車輛追蹤和車隊管理的技術提供商。該合作夥伴關係將利用每家公司現有的遠端資訊處理和服務網路功能,實現在客戶家門口安裝、維修和保固更換物聯網設備。

- 由於都市化、生活水準提高和經濟成長,亞太地區的汽車持有正在大幅增加。隨著越來越多的車輛上路,對高效能車隊管理和維護解決方案的需求也隨之增加。根據國際能源總署預測,2022年中國將成為亞太地區電動車銷量最大的國家,銷量約600萬輛。遠端資訊處理在管理和監控電動車性能以最佳化駕駛體驗和提高效率方面發揮關鍵作用。

- 然而,遠端資訊處理系統成本高、產品標準化缺乏以及日益嚴重的網路安全威脅是限制該市場成長的主要因素。此外,個人商用/乘用車和小型車隊營運商的認知度較低也對研究市場的成長構成了挑戰。

亞太地區車聯網市場趨勢

乘用車市場預計將佔據主要市場佔有率

- 由於汽車銷售量高,乘用車領域預計將引領亞洲的遠端資訊處理市場。對安全、便利的遠端資訊處理服務的需求不斷成長,刺激了乘用車市場的發展。由於過去十年的重大技術發展,聯網汽車已經推出,並有望進一步發展。中國、印度、澳洲和日本等國家擁有主要的乘用車市場,這些國家的更嚴格的車輛安全法規推動了對高階遠端資訊處理服務和連接解決方案的需求。

- 2000 年 4 月至 2022 年 9 月期間,印度汽車產業獲得股權外國直接投資流入約 337.7 億美元。印度政府預計到2023年汽車業將吸引80億至100億美元的國內外投資。

- OICA預計,2023年中國將主導亞太乘用車市場,銷售超過2,600萬輛。印度位居第二,銷量接近 410 萬台。預計乘用車產銷量的成長將推動該地區市場的發展。

- 中國是亞太地區遠端資訊處理市場成長的主要貢獻者。一些中國較新的汽車新興企業,如蔚來汽車、飛馳汽車、雷霆動力和觀致汽車,在其最新的產品組合中都包含導航和即時交通資訊系統。中國的車輛失竊案日益增多,推動了被盜車輛追蹤 (SVT) 技術的需求穩定成長。

- 高階駕駛輔助系統(ADAS)也是推動亞太地區遠距資訊處理市場發展的因素之一。日本是最早發明和實施大多數汽車ADAS的國家之一。這家日本汽車公司正在開發用於遠端資訊處理和車輛連接技術的先進設備。

預計中國市場將大幅成長

- 中國的遠端資訊處理市場正在經歷顯著的成長,該國的汽車產業正在迅速採用遠端資訊處理技術,導致道路上出現大量聯網汽車。聯網汽車支援多種服務,例如導航、遠距離診斷、資訊娛樂和安全功能。

- 中國政府在推動遠端資訊處理方面發揮關鍵作用。 2022 年 1 月,中國政府定期修改法規,以規範自動駕駛的採用和適應。配備 ADAS 和其他聯網汽車功能的汽車必須配備一個類似飛機的裝置,該裝置帶有一個後箱,可以記錄指揮自動駕駛系統的所有變數。中國在汽車微控制器和微處理器領域的全球主導地位,使其在遠端資訊處理控制單元 (TCU) 製造方面具有優勢。此外,最近對 5G 基礎設施市場的投資(作為從 COVID-19 疫情中恢復的措施)將進一步推動 5G TCU 的本地生產。

- 物聯網(IoT)的普及和中國5G網路的推出大大提高了遠端資訊處理系統的功能。更快、更可靠的連接可實現即時資料傳輸,從而實現先進的遠端資訊處理服務,例如遠端監控、無線更新和車對車 (V2X)通訊。

- 中國基地台數量的增加將推動市場發展,實現更快、更可靠的資料通訊,擴大應用範圍,並刺激汽車和運輸業的創新。據工信部預計,到2023年終,我國5G基地台數量將達338萬個左右。由於大規模的基礎設施投資和雄心勃勃的推廣計劃,中國正在實現 5G 的廣泛應用。預計到2024年基地台數量將達到約600萬個。

- 遠端資訊處理提供的車隊管理解決方案在中國需求旺盛,尤其是在物流、運輸和電子商務領域。這些解決方案可協助公司最佳化車隊、降低營運成本、提高燃油效率並增強駕駛員安全性。

亞太地區車聯網產業概況

亞太地區遠端資訊處理市場高度細分,主要參與者包括 LG Corporation、MiX Telematics Ltd、Concox Information Technology、Trimble Inc. 和 Arya Omnitalk Wireless Solutions Private Limited。市場參與企業正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2022 年 12 月 - OCTO Telematics 宣佈在日本東京開設辦事處,加強其在技術、機器人和自動化戰略中心的地位。 OCTO 的日本子公司將進一步協助發展日本和鄰國的連網行動市場,為合作夥伴提供技術和銷售支援。

- 2022 年 10 月 - Asia Mobiliti 與 Truck It 合作,列出全面的遠程資訊處理和地理映射技術,使廣告購買者能夠定位並提供每輛卡車、路線的即時追蹤資訊,並顯示適合他們選擇的卡車類型。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

- 技術簡介

第5章 市場動態

- 市場促進因素

- 聯網汽車服務的使用增加

- 對便利車輛診斷的需求日益增加

- 市場限制

- 資料駭客對資料安全的威脅

第6章 市場細分

- 按車型

- 商用車(卡車)LCV 與 M/HCV

- 搭乘用車

- 按頻道

- OEM

- 報紙

- 售後市場

- 按國家

- 中國

- 日本

- 韓國

- 東南亞

第7章 競爭格局

- 公司簡介

- LG Corporation

- MiX Telematics Ltd

- Concox Information Technology Co. Ltd

- Trimble Inc.

- Arya Omnitalk Wireless Solutions Private Limited

- iData Kft(iTrack)

- Bright Box Hungary Kft

- Tata Consultancy Services Ltd

- Efkon India Pvt Ltd

- Tech Mahindra Limited

- Meitrack Group

- Octo Group SpA

- Asia Mobility Technologies Sdn Bhd

第8章投資分析

第9章:市場的未來

The APAC Telematics Market size is estimated at USD 30.25 billion in 2025, and is expected to reach USD 61.83 billion by 2030, at a CAGR of greater than 15.37% during the forecast period (2025-2030).

Telematics helps in usage-based insurance (UBI) by providing information to fleet management companies and automobile insurance companies to monitor the location and behavior of vehicles. Government initiatives towards road safety with mandatory navigation for commercial vehicles and Intelligent Transport System (ITS), rising demand for EVs, and increasing trend of connectivity with affordable sensor prices are mainly driving the growth in the Asia-Pacific telematics market. The development of 5G infrastructure in countries such as China, Japan, and South Korea will also boost the telematics industry in the Asia Pacific.

Key Highlights

- Qualcomm Technologies introduced a feature for Snapdragon Car-to-Cloud Services - Connectivity-as-a-Service - that brings new technology collaborations to support out-of-the-box connectivity, integrated analytics, and a cloud and device developer environment aimed to deliver new technology features, content, and services globally. Cognizant will work with Qualcomm Technologies to integrate and tailor Snapdragon Car-to-Cloud Services for automakers, with the goal of delivering rich, immersive, personalized in-vehicle experiences, new connected solutions, and better on-demand services.

- With the increase in usage of connected car services driving the market, companies are making strategic partnerships to offer services at the doorstep. Indian AutoTech startup ReadyAssist announced its strategic partnership with iTriangle Infotech, a technology provider for vehicle tracking and fleet management for telematics solutions. The partnership will cross-leverage the companies' existing capabilities of telematics and service networks to bring installation, service, and warranty replacements of IoT devices to their customers at the doorstep.

- The Asia Pacific region has witnessed a substantial increase in vehicle ownership due to urbanization, improved living standards, and economic growth. With more vehicles on the road, there is a growing need for efficient vehicle management and maintenance solutions. According to IEA, in 2022, China witnessed the highest number of electric car sales across the Asia Pacific region, with around six million electric car sales, and nearly 28,000 electric cars were sold in 2022 in New Zealand. The growth in EVs is anticipated to drive the telematics market, as these advanced systems play a crucial role in managing and monitoring EV performance, enhancing optimization and efficiency of the driving experience.

- However, the higher cost of telematics systems, lack of standardization of products, and increasing cybersecurity threats are among the major factors restraining the growth of the market studied. Additionally, a lower awareness among individual commercial/passenger vehicles and small vehicle fleet operators also challenges the growth of the market studied.

APAC Telematics Market Trends

Passenger Type of Vehicles Segment is Expected to Hold Significant Market Share

- The passenger car segment is expected to drive the Asian telematics market owing to a high sales rate. Increased demand for safety and convenience telematics services is fueling the passenger car segment. Significant technological developments over the last decade have resulted in the launch of connected cars, which are expected to evolve further. Countries like China, India, Australia, and Japan have major passenger vehicle markets, and the safety regulations for these vehicles are more stringent in these countries, leading to the demand for high-end telematics services and connectivity solutions.

- The automobile sector in India got a cumulative equity FDI inflow of around USD 33.77 billion between April 2000 and September 2022. The Indian government expects the automobile industry to attract USD 8-10 billion in foreign and local investments by 2023.

- According to OICA, in 2023, China dominated the Asia-Pacific passenger car market, selling over 26 million units. India followed as the second-largest market, with sales nearing 4.1 million units.. The growing production and sale of passenger vehicles are expected to drive the market in the region.

- China is a major contributor to the growth of the APAC telematics market. Some of the new automotive start-ups in China, like Nio, FutureMove, ThunderPower, and Qoros, use navigation and real-time traffic information systems in their latest portfolios. There is a steady increase in the demand for Stolen Vehicle Tracking (SVT) technology as vehicle thefts rise in China.

- The Advanced Driver Assistance System (ADAS) is another factor driving the APAC telematics market. Japan was one of the first countries to invent and implement most car ADAS. Japanese automotive companies are developing advanced devices for telematics and vehicle connectivity technologies.

China Expected to Witness Significant Growth in the Market

- The telematics market in China is significantly growing, and the country's automotive industry has quickly adopted telematics technology, resulting in a substantial number of connected vehicles on the road. Connected cars enable various services such as navigation, remote diagnostics, infotainment, and safety features.

- The Chinese government has played a crucial role in promoting telematics adoption. In January 2022, the Chinese government changed the rules regularly to shape the country's introduction and adaptation of autonomous driving. The cars with ADAS and other connected car features must be fitted with devices similar to aircraft having back boxes, recording all the variables directing the autonomous driving systems. China's dominance in global automotive microcontrollers and microprocessors also gives them the upper hand in manufacturing telematics control units (TCU). Also, the country's recent investment in the 5G infrastructure market (as a recovery step from the COVID-19 outbreak) further promotes the local production of 5G TCUs.

- The proliferation of the Internet of Things (IoT) and the deployment of 5G networks in China have significantly enhanced the capabilities of telematics systems. Faster and more reliable connectivity allows for real-time data transmission, enabling advanced telematics services such as remote monitoring, over-the-air updates, and vehicle-to-everything (V2X) communication.

- The increasing number of base stations in China drives the market, enabling faster and more reliable data communication, expanding the range of possible applications, and fostering innovation in the automotive and transportation industries. According to MIIT, by the end of 2023, the number of 5G base stations in China is approximately 3.38 million. With extensive infrastructure investments and ambitious rollout plans, China has achieved significant 5G coverage. The forecasted number of base stations was projected to reach about six million by 2024.

- Fleet management solutions offered by telematics are in high demand in China, particularly in the logistics, transportation, and e-commerce sectors. These solutions help companies optimize their fleets, reduce operating costs, improve fuel efficiency, and enhance driver safety.

APAC Telematics Industry Overview

The Asia Pacific Telematics market is highly fragmented, with the presence of major players like LG Corporation, MiX Telematics Ltd, Concox Information Technology Co. Ltd, Trimble Inc., and Arya Omnitalk Wireless Solutions Private Limited. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - OCTO Telematics announced an opening in Tokyo, Japan, to strengthen its presence in a strategic hub for technology, robotics, and automation. The Japanese subsidiary of OCTO will further help the development of the connected mobility market throughout Japan and surrounding countries, providing technical and sales support to partners.

- October 2022 - Asia Mobiliti collaborated with Truck It to provide comprehensive telematics and geo-mapping technologies that would offer advertisement buyers the capability to target their customers, offer them real-time tracking information of all trucks, routes, and display the type of truck that suits their choice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Connected Cars Services

- 5.1.2 Growing Demand for Easy Vehicle Diagnostics

- 5.2 Market Restraints

- 5.2.1 Threats to Data Security in the form of Data Hacking

6 MARKET SEGMENTATION

- 6.1 By Type of Vehicle

- 6.1.1 Commercial (Truck) LCV Vs. M/HCV

- 6.1.2 Passenger (Car)

- 6.2 By Channel

- 6.2.1 OEM

- 6.2.2 Newsprint

- 6.2.3 Aftermarket

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 South Korea

- 6.3.4 South East Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LG Corporation

- 7.1.2 MiX Telematics Ltd

- 7.1.3 Concox Information Technology Co. Ltd

- 7.1.4 Trimble Inc.

- 7.1.5 Arya Omnitalk Wireless Solutions Private Limited

- 7.1.6 iData Kft (iTrack)

- 7.1.7 Bright Box Hungary Kft

- 7.1.8 Tata Consultancy Services Ltd

- 7.1.9 Efkon India Pvt Ltd

- 7.1.10 Tech Mahindra Limited

- 7.1.11 Meitrack Group

- 7.1.12 Octo Group S.p.A

- 7.1.13 Asia Mobility Technologies Sdn Bhd