|

市場調查報告書

商品編碼

1643157

亞洲工業 4.0:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Industry 4.0 - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

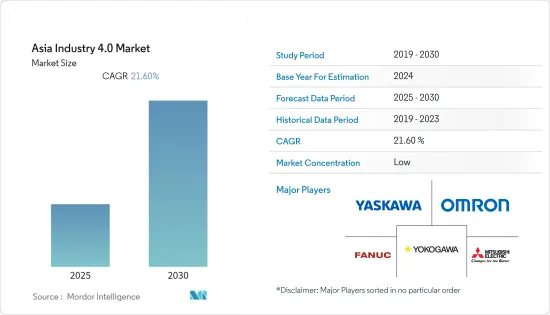

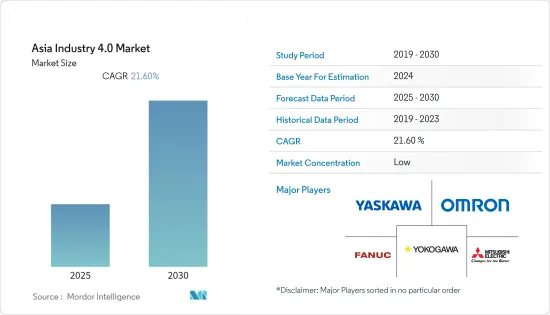

預計預測期內亞洲工業 4.0 市場複合年成長率將達到 21.6%。

主要亮點

- 亞洲是最早採用科技進步的地區之一。這些新興市場在工業自動化應用方面具有關鍵優勢,因為它們沒有重建傳統自動化系統或投資機械的負擔。

- 機器人技術對於中國的智慧製造目標和綜合產業政策至關重要。雖然政府機構的組成略有不同(工信部再次掌舵),但《智慧製造發展規劃》的發布包括在2022年發布機器人產業相關的五年發展規劃。以5G為代表的工業革命4.0已快速啟動,中國已取得良好開端。

- 華為表示,其工業級基於無線專網的關鍵通訊解決方案為工業 4.0使用案例提供了難以想像的可能性,從機器遠程操作到雲機器人、流程自動化、預測性資產維護、輔助/自動駕駛汽車、CCTV監控以及任務關鍵型一鍵通話和一鍵影片,全部通過單一網路基礎設施實現。

- 過去十年的技術變革徹底改變了工業生產的組織方式,影響了生產流程和供應鏈。工業4.0(以下簡稱工業4.0)將人工智慧、物聯網、機器學習、雲端運算、分析等新技術融入製造業生產營運與流程,推動智慧製造新時代的到來。製造業的數位技術將推動自動化和自我最佳化,使該地區整個價值鏈的運作更加高效。

- 工業革命 4.0 將由四個關鍵因素推動:超高效處理技術(晶片)、廣泛的網路應用、機器學習和人工智慧。上一次工業革命所伴隨的自動化浪潮普及了大規模同質生產系統,而工業 4.0 則推動了更客製化的工業生產。隨著工業 4.0 的出現,一種新的生產模式正在出現,其中 3D 列印機、自動化系統、機器人、資料交換和資料傳輸在智慧工廠環境中得到有效利用。這使得生產過程精益而靈活,並確保資源的最佳利用。

- 由於新興國家疫情期間亞洲國家實施了嚴格的停工措施,工業4.0的發展受到了長達六到八個月的影響。工廠關閉和投資轉移是主要因素。多家工廠自動化解決方案供應商已關閉其工廠,以遏制病毒傳播。人工智慧、大規模自動化、工業通訊、巨量資料、機器人和3D列印等顛覆性技術正在重塑該地區疫情後的製造業格局。

亞洲工業 4.0 市場趨勢

製造業佔很大市場佔有率

- 製造業是亞太地區經濟的主要貢獻者,目前正在經歷快速的技術和數位轉型。由於可以獲得廉價勞動力,製造公司擴大將業務遷往東南亞以削減成本。

- 工業IoT(IIoT) 正在整個製造業中廣泛應用。此外,雲端處理、行動行動運算等電腦和網路技術也被引入這些系統,預計將推動該國採用先進技術。

- 根據 MOSPI,2022 年 1 月,21 會計年度全印度製造業工業生產指數為 116.9。在印度,製造業已逐漸成為高成長產業之一。 「印度製造」計畫使印度成為全球製造業中心,並獲得了國際社會對印度經濟的認可。此外,通用電氣、西門子、HTC、東芝和波音等製造業巨頭都已在印度建立或正在建立製造廠。這些趨勢預計將推動未來工廠採用工業 4.0。

- 三菱公司投資超過300億日圓增加工廠自動化系統產品的產量以滿足日益成長的需求,也推動了這一趨勢。此外,為提高產能,該公司計劃在愛知縣現有工廠附近建立新工廠,取代名古屋現有的工廠。預計類似的措施將推動該地區製造業對工業 4.0 技術的應用。

日本取得顯著成長

- 日本是亞太地區轉型為自動化工業經濟和採用工業4.0成長最快的經濟體之一。日本正成為向亞太地區區域市場供應自動化產品的製造地。

- 眾多汽車製造商、食品工業和電子製造業的存在使日本成為該地區的重要市場。憑藉高度發展的自動化和機器人產業,該國可被視為生產過程自動化和機器人技術採用的全球領導者。

- 日本製造業貢獻了日本名目國內生產總值(GDP)的約20%。據國際貨幣基金組織(IMF)稱,日本的製造業自綜合稅(ITC)訂定以來取得了長足的發展。日本的工業4.0帶動了協作機器人、人工智慧機器人等尖端技術的發展。透過在各個流程中實施這些措施,公司能夠提高效率並減少錯誤。預計職場安全法規的不斷加強和生產能力的不斷提高將推動對機器人系統的需求。

- 該國日益增多的數位化舉措和工業 4.0 的興起預計將為市場提供良好的機會。儘管影響該國經濟的因素多種多樣,但該國經濟仍保持穩定成長。此外,電子和汽車產業是日本生產率最高的製造業產業,日常工作嚴重依賴自動化。這一因素可能會推動各種商品製造過程的數位轉型和自動化。

亞洲工業 4.0 產業概況

亞洲工業4.0市場競爭激烈。由於大大小小的參與者眾多,市場集中度很高。市場的主要參與者包括三菱電機、OMRON、橫河電機、FANUC、安川電機、羅伯特博世有限公司和通用電氣公司。

2022 年 2 月,三菱電機亞洲工廠自動化與工業部門以二級成員身分加入新加坡 ARTC。為響應新加坡智慧工業就緒指數,先進再製造技術中心(ARTC)是一個透過強大的官民合作關係關係建立的現代化平台,它正在擴大其在工業物聯網(IIoT)服務領域的立足點,為製造業開發整合解決方案,以加速其數位轉型並增加對工業4.0技術的採用。

2022 年 2 月,日本製造集團三菱電機攜手同國 NTT Docomo 加入其在泰國的新工業 4.0 聯盟,提供私人 5G 以及其他合作夥伴的智慧製造解決方案。三菱電機稱這案例泰國首次採用日本製造的5G設備。兩家公司計劃於夏季末在泰國建設一個新的私人 5G 設施,作為政府泰國 4.0計劃的戰略定位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 該地區積極的政府措施和相關人員的合作

- 工業機器人需求不斷成長

- 中小企業如何因應數位轉型

- 市場挑戰

- 採用工業 4.0 的投資報酬率缺乏認知

- 需要大量投資才能實現利潤

- 勞動力和標準化挑戰

第6章 市場細分

- 依技術類型

- 工業機器人

- IIoT

- 人工智慧和機器學習

- 區塊鏈

- 擴增實境

- 數位雙胞胎

- 3D 列印

- 其他技術

- 按最終用戶產業

- 製造業

- 車

- 石油和天然氣

- 能源與公共產業

- 電子/鑄造廠

- 飲食

- 航太和國防

- 其他最終用戶產業

- 按國家

- 中國

- 韓國

- 日本

- 印度

- 印尼

- 亞洲其他地區

第7章 競爭格局

- 公司簡介

- Mitsubishi Electric

- Omron Corporation

- Yokogawa Electric Corporation

- Fanuc Corporation

- Yaskawa Electric Corporation

- Robert Bosch GmbH

- General Electric Company

- ABB Ltd

- Cisco Systems Inc.

- Intel Corporation

- IBM Corporation

- Denso Corporation

第8章投資分析

第9章:市場的未來

The Asia Industry 4.0 Market is expected to register a CAGR of 21.6% during the forecast period.

Key Highlights

- Asia has been an early adopter of technological advancements. The market in these developing economies poses a key advantage in implementing industrial automation since they are not tormented by rebuilding legacy automation systems and machine investments.

- Robotics is crucial to China's smart manufacturing ambitions and comprehensive industrial policy. A slightly different variation in the configuration of the government agencies (with MIIT again at the helm) announced a related 5-year development plan for the robotics industry in 2022 as the release of the smart manufacturing development plan. The fast pace toward the 5G-powered industry revolution 4.0 is on, and China has a strong head start.

- According to Huawei, critical communications solutions based on industrial-grade private wireless offer unimaginable possibilities to the power Industry 4.0 use cases, from machine remote control to cloud robotics, process automation, predictive asset maintenance, assisted/autonomous vehicles, CCTV monitoring, and mission-critical push-to-talk and push-to-video, all on a single network infrastructure.

- Technological changes in the last decade revolutionized the organization of industrial production, influencing production processes and supply chains. Industry 4.0, hereafter, has integrated new technologies such as AI, IoT, ML, cloud computing, and analytics into manufacturing production operations and processes, propelling a new era of smart manufacturing. Digital technologies in manufacturing promote automation and self-optimization, leading to the efficiency of operations across the value chain in the region.

- Industry revolution 4.0 is fuelled by four significant components: hyper-efficient processing technology (chips), widespread internet penetration, machine learning, and artificial intelligence. While the waves of automation due to past industrial revolutions popularised the mass-homogeneous production systems, Industry 4.0 brings more customized industrial production to the fore. With Industry 4.0, new production models are emerging where 3-D printers, automated systems, robots, data exchanges, and data exchanges are used effectively in an environment of smart factories. This will make the production processes lean and flexible, enabling optimum resource utilization.

- As Asian countries experienced strict lockdowns during the COVID-19 pandemic, the developments concerning Industry 4.0 were impacted for 6-8 months. Factory closures and shifts in investments were primary factors for the same. Multiple vendors of factory automation solutions shut their facilities in the wake of curbing the spread of the virus. Innovative technologies, such as artificial intelligence (AI), mass automation, industrial communications, big data, robotics, and 3D printing, are transforming the regional manufacturing landscape post-pandemic.

Asia Industry 4.0 Market Trends

Manufacturing Industry to Hold Significant Market Share

- The manufacturing industry is a key contributor to the economy of the Asia-Pacific region and is presently undergoing a rapid technological digital transformation. Manufacturing firms are increasingly moving their operations to Southeast Asia to cut costs due to inexpensive workforce availability.

- Industrial IoT (IIoT) is being adopted significantly in the region of the manufacturing industry. Further, computer and network technologies, such as cloud computing and mobile computing, are also being implemented in these systems, which is expected to boost the adoption of advanced technologies in the country.

- According to MOSPI, in January 2022, the index of industrial production for the manufacturing sector across India in the financial year of 2021 stood at 116.9. In India, the manufacturing industry has gradually emerged as one of the high-growth sectors. The 'Make in India' program places India on the global map as the manufacturing hub provides international recognition to the Indian economy. Moreover, manufacturing giants such as GE, Siemens, HTC, Toshiba, and Boeing, have either set up or are setting up manufacturing plants in India. These trends are expected to boost the adoption of Industry 4.0 in their plants in the future.

- The trend is also augmented by Mitsubishi's investment of more than JPY 30 billion to increase the output of its factory automation system products to meet growing demand. Further, the company plans to establish a new plant near its existing facility in Aichi Prefecture and rebuild an existing plant in Nagoya to bolster production capacity. Similar initiatives are expected to boost the adoption of Industry 4.0 technologies across the region's manufacturing industry.

Japan to Witness Significant Growth

- Japan has been transforming into an automated industrial economy and adopting Industry 4.0 faster in the Asia-Pacific region. The government of Japan has been emerging as a manufacturing hub for automation products and supplies to the regional markets in the Asia-Pacific region.

- The presence of multiple automobile manufacturers, the food processing industry, and the electronic product manufacturing industry makes Japan an essential market in the region. The country with highly-developed automation technologies and a robotic sector can be regarded as the global leader in the automation of production processes and employment of robotics.

- The manufacturing industry in Japan contributes around 20% to the country's nominal Gross Domestic Product (GDP). According to the International Monetary Fund, the country's manufacturing sector gained significant ground by implementing the Integrated Manufacturing Tax (ITC). Industry 4.0 in Japan has led to the development of advanced technologies, such as collaborative and AI-enabled robots. These have allowed companies to improve their efficiency and reduce errors by implementing them in various processes. Increasing workplace safety regulations and improving production capabilities are expected to drive demand for robotic systems.

- The increasing number of digitization initiatives in the country and the emergence of Industry 4.0 are expected to provide promising opportunities for the market. Even with the presence of various factors that have affected the country's economy, it has still managed to grow steadily. Moreover, the electronics and automotive sectors are Japan's most productive manufacturing sectors, which rely heavily on automation daily. This factor is likely to drive digital transformation and automation in the manufacturing processes of various goods.

Asia Industry 4.0 Industry Overview

The Asian Industry 4.0 market is very competitive. The market is highly concentrated due to the presence of various small and large players. Some of the significant players in the market are Mitsubishi Electric, Omron Corporation, Yokogawa Electric Corporation, Fanuc Corporation, Yaskawa Electric Corporation, Robert Bosch GmbH General Electric Company, and many more.

In February 2022, Mitsubishi Electric Asia's Factory Automation & Industrial Division joined Singapore's ARTC as a Tier 2 Member. The Advanced Remanufacturing and Technology Centre (ARTC), a contemporary platform built upon solid public-private partnerships company, is expanding its foothold around the Industrial Internet of Things (IIoT) services by developing integrated solutions for manufacturing companies to accelerate digital transformation and scaling up its adoption of Industry 4.0 technologies in response to Singapore's Smart Industry Readiness Index.

In February 2022, the Japanese manufacturing group Mitsubishi Electric inducted the country mate NTT Docomo into its new Industry 4.0 alliance in Thailand to offer private 5G with smart manufacturing solutions from other partners. Mitsubishi Electric called it the first case of 5G with Japanese equipment in Thailand. The companies will build a new private 5G set up in the country by the end of the summer, strategically located for the government's Thailand 4.0 project.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region

- 5.1.2 Growth in Demand for Industrial Robotics

- 5.1.3 Digital Transformation Initiatives Undertaken by SMEs

- 5.2 Market Challenges

- 5.2.1 Relative Lack of Awareness on the ROI Related to Adoption of Industry 4.0

- 5.2.2 Need For Significant Investments to Realize Benefits

- 5.2.3 Workforce and Standardization Related Challenges

6 MARKET SEGMENTATION

- 6.1 By Technology Type

- 6.1.1 Industrial Robotics

- 6.1.2 IIoT

- 6.1.3 AI and ML

- 6.1.4 Blockchain

- 6.1.5 Extended Reality

- 6.1.6 Digital Twin

- 6.1.7 3D Printing

- 6.1.8 Other Technology Types

- 6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Automotive

- 6.2.3 Oil and Gas

- 6.2.4 Energy and Utilities

- 6.2.5 Electronics and Foundry

- 6.2.6 Food and Beverage

- 6.2.7 Aerospace and Defense

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 South Korea

- 6.3.3 Japan

- 6.3.4 India

- 6.3.5 Indonesia

- 6.3.6 Rest of Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mitsubishi Electric

- 7.1.2 Omron Corporation

- 7.1.3 Yokogawa Electric Corporation

- 7.1.4 Fanuc Corporation

- 7.1.5 Yaskawa Electric Corporation

- 7.1.6 Robert Bosch GmbH

- 7.1.7 General Electric Company

- 7.1.8 ABB Ltd

- 7.1.9 Cisco Systems Inc.

- 7.1.10 Intel Corporation

- 7.1.11 IBM Corporation

- 7.1.12 Denso Corporation