|

市場調查報告書

商品編碼

1643186

亞太地區小型蜂窩塔:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)APAC Small Cell Tower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

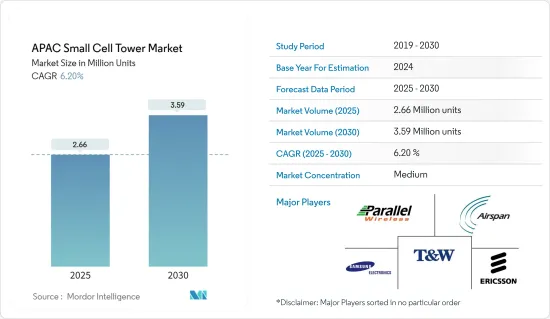

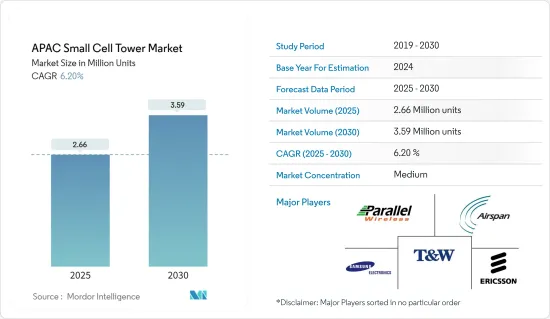

亞太地區小型蜂巢塔市場規模預計在 2025 年達到 266 萬台,預計到 2030 年將達到 359 萬台,預測期內(2025-2030 年)的複合年成長率為 6.2%。

小型基地台是低功率蜂窩無線存取節點,範圍從幾百公尺到幾公里。這些基地台消耗的能量更少,價格更便宜,而且可以透過緊密放置來提供高資料速率,從而最大限度地提高空間頻譜效率。

關鍵亮點

- 大多數 5G 網路可能由小型基地台組成。小型基地台對於 5G 網路的運作至關重要,因為它們可以提供 5G 所需的更大資料容量。它還有望透過消除昂貴的屋頂系統和安裝成本來幫助供應商降低成本,並有助於提高行動裝置的性能和電池壽命。

- 除了網路技術和連網設備的進步之外,全球對行動裝置日益成長的需求也推動了市場的發展。這種需求正在推動IT服務交付方式的轉變,為市場參與企業擴大在亞太地區的影響力提供了巨大的機會。

- 此外,小型基地台對於當今互聯設備和物聯網 (IoT) 應用的興起至關重要。安裝較低頻段的微蜂窩塔也是 5G通訊業者致力於為消費者增加頻寬選擇的領域。

- 小型蜂窩雖然能夠以較低的成本保證更好的網路覆蓋,但也帶來了新的挑戰,例如小型蜂窩網路回程傳輸的開發。

- 由於許多國家實施封鎖,人們被限制整天待在家裡,迫使他們在家工作、遠端與同事聯繫,並使用網路服務進行工作和娛樂,因此 COVID-19 疫情增加了對無線網路的需求。這導致線上流量激增,並成為推動易於部署且具有成本效益的小型蜂窩網路成長的關鍵因素。

亞太地區小型蜂窩塔市場趨勢

預計室內應用將佔據主要的市場佔有率。

- 室內場景本質上比室外場景更複雜。室內場景通常包括大中型公共設施、中小型企業、家庭等,入網需求多樣化,需要多樣化的解決方案來滿足這些需求。

- 小型基地台對於網路至關重要,因為它們能夠以快速、經濟且高效能的方式提供巨集網路以外的覆蓋和容量,甚至可用於室內。例如,愛立信的室內小型基地台滿足了室內語音和資料通訊增強覆蓋範圍和容量的要求。

- 室內小型基地台可在大學、熱門旅遊目的地、體育場、音樂場所、會議中心、飯店環境和各種大型會議空間等流量大、容量有限的區域提供擴大覆蓋範圍。這將使公民無論身在何處都能有效地使用各種設備。

- 例如,為了滿足校園、產業和場館對私有5G企業連接日益成長的需求,2022年3月,市場領先的數位網路整合商之一STL宣布與ASOCS和VMWare合作推出首端對5G企業解決方案。這些面向未來的 5G 網路採用開放的、基於標準的設計,能夠支援無縫室內覆蓋所需的高密度環境。

中國正在關注成長

- 這些國家迅速採用 5G 技術和行動連線,促進了整個地區的市場成長。

- 中國在亞太地區5G部署方面處於領先地位。根據新華社報道,中國預計將在2022年5月安裝81.9萬個5G基地台(佔全球整體的70%以上),在5G發展方面處於主導。中國預計,到2023年終,5G用戶數將達到近5.6億美元,佔全球消費者總數的35%。官員還表示,10,000 名中國人將可以使用超過 18 個 5G基地台。

- 此外,各全球公司紛紛進入中國,透過創造具有所需速度、容量和低延遲的密集室內覆蓋環境,為消費者提供 5G 體驗。

- 小型蜂窩網路有可能為零售商提供更快的行動連線,擴展和解鎖新的體驗,並為客戶和零售商提供新的購物和經營方式。此外,物聯網設備在這一領域的滲透正變得越來越廣泛。

- 此外,隨著 5G 網路在全國範圍內的推廣,預計未來幾年小型蜂窩網路的採用將大幅增加。近年來,小型蜂窩網路已成為任何希望改善室內和室外行動覆蓋範圍和容量的零售企業的可行選擇。

- 根據GSMA《2022年中國移動經濟研究》顯示,到2025年,4G連線數預計將降至8.4億美元,普及率為48%,而5G連線數預計將成長至8.92億美元,普及率為52%。

亞太地區小型蜂窩塔產業概覽

亞太地區小型蜂巢塔市場的競爭處於半靜態狀態。為了推出新產品,市場上的公司正在進行併購、策略聯盟和產品開發。主要參與企業包括三星電子、Parallel Wireless和Airspan Networks。

- 2023 年 2 月 - Airspan Networks Inc 宣布將把其 5G 創新實驗室舉措擴展到東京,以滿足亞太地區加速的網路部署和擴展。同時,隨著 5G 技術不斷拓展新的使用案例,Airspan Japan 的東京辦事處正帶頭努力滿足對關鍵互通性測試和公共和私人網路中簡化整合日益成長的需求。

- 2023 年 2 月 - Telefonaktiebolaget LM Ericsson 在其室內行動連線產品線中增加了三種新解決方案,包括名為 IRU 8850 的無線電單元、愛立信室內融合單元和用於室內網路的新軟體功能 5G 精確定位,可以快速且低成本地部署,為任何職場環境提供 5G 功能和規模和複雜程度,無論如何的設施或複雜程度。愛立信無線點系統產品組合新增解決方案,增強市場領先產品的彈性

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 該地區行動資料流量快速成長

- 透過更換較小的手機訊號塔,更加重視營運效率和減少資本支出

- 中國和韓國等成熟市場的現有營運商的安裝量穩步成長

- 市場問題

- 對 5G 網路部署相關的國家法規和營運挑戰的擔憂

- 行業標準和法規

- COVID-19 對小型基地台部署和連接的影響

- 小型蜂窩塔部署的關鍵影響和技術考慮

- 當前所有權模式和新興小型基地台租賃/共享機制

- 亞太地區連結技術現況(3G、4G、5G)

第6章 亞太地區 5G藍圖分析(中國、韓國、新加坡、日本)

7. 亞太地區小型蜂窩網路按類型細分

- 按應用

- 戶外的

- 室內的

- 按國家

- 中國

- 韓國

- 日本

- 印度

- 菲律賓

- 其他亞太地區

第8章 競爭格局

- 公司簡介

- Parallel Wireless Inc.

- Airspan Networks Inc.

- T&W Electronics Co Ltd

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Baicells Technologies Co., Ltd.

- NEC Corporation

- Nokia Corporation

第9章 投資分析及市場展望

The APAC Small Cell Tower Market size is estimated at 2.66 million units in 2025, and is expected to reach 3.59 million units by 2030, at a CAGR of 6.2% during the forecast period (2025-2030).

Small cells are low-power cellular radio access nodes ranging from a few hundred meters to several kilometers. These base stations use little energy, are inexpensive, and may deliver high data rates by being placed close together to maximize spatial spectrum efficiency.

Key Highlights

- Most of the 5G networks will likely be composed of small cells. Small cells are vital to the functionality of 5G networks because they provide the increased data capacity that 5G demands. They also help providers reduce costs by eliminating expensive rooftop systems and installation costs, and they are expected to help improve the performance and battery life of mobile handsets.

- In addition to the evolution of network technology and connectivity devices, the market is also driven due to the growth of demand for mobile devices worldwide. Such demand has been driving the shift in how IT services are delivered and has been providing the players in the market with significant opportunities for enhancing their presence across the Asia-Pacific region.

- Moreover, Small cells are essential today for the increasing number of linked devices and Internet of Things (IoT) applications. Installing microcell towers in the low-frequency spectrum is another area of focus for 5G telecom providers as they work to increase bandwidth options for their consumers.

- While small cells can ensure improved network coverage at a low cost, the deployment has brought in new challenges, such as the backhaul development of small cell networks.

- The COVID-19 pandemic has increased demand for wireless internet as people were restricted at home all day (due to lockdowns in many countries) and forced to work from home, connect remotely with their peers, and use the internet services for both work and entertainment. This has led to a surge in online traffic, which acted as a key factor driving the growth of small cell networks, which are easy to install and cost-effective.

APAC Small Cell Tower Market Trends

Indoor applications are Expected to Have a Major Market Share.

- Indoor scenarios are inherently more complex in comparison to outdoor ones. Indoor scenarios typically include large and medium public locations, small and medium enterprises, and homes, which vary in-service requirements and need diverse solutions to cater to these requirements.

- Small cells are essential to networks because they provide coverage and capacity outside of the macro network in a quick, affordable, and high-performing manner that allows for interior use. For instance, Ericsson's indoor small cells meet the requirement for enhanced indoor voice and data coverage and capacity.

- Small indoor cells provide coverage expansion in areas with heavy traffic and limited capacity, such as universities, well-known tourist destinations, stadiums, music halls, convention centers, hospitality settings, and various large meeting spaces. This makes it possible for the general public to utilize their various devices effectively wherever they are.

- To meet the rising demand for private 5G enterprise connectivity for campus, industrial, and venue applications, for instance, in March 2022, STL, one of the leading digital network integrators in the market, announced the launch of the first end-to-end 5G Enterprise solution is in partnership with ASOCS and VMWare. These future-ready 5G networks, which can handle dense environments required for seamless interior coverage, will be made possible by open standards-based designs.

China to Witness the Growth

- The rapid development of 5G technology and mobile connectivity in such countries collectively contributes to the growth of the market in the region.

- China is at the forefront of 5G adoption in the Asia Pacific. China reportedly took the lead in 5G development in May 2022, with 819,000 5G base stations, or more than 70% of the total number installed globally, according to Xinhua. By the end of 2023, China projects that the number of 5G users will be close to 560 USD million, or 35% of the total number of consumers worldwide. Also, every 10,000 Chinese would have access to more than 18 5G base stations, according to the official release.

- In addition, various global companies are stepping into the country to drive 5G experiences for consumers by creating a dense environment for indoor coverage with the required speed, capacity, and low latency.

- A small cell network enables retailers a higher rapid mobile connectivity, which can scale and unlock new experiences and may offer customers and retailers new ways to shop and run their businesses. Furthermore, the growing adoption of IoT devices in the sector further expands the scope.

- Moreover, With the nationwide rollout of the 5G network, small-cell networks will see a significant increase in adoption over the coming years. In recent years, small cell networks have established themselves as a viable option for all retail businesses seeking improved mobile coverage and capacity indoors and outdoors.

- According to the GSMA 2022 Study on the mobile economy in China, it is predicted that in 2025, the number of 4G connections will decline to 840 USD million with a 48% adoption rate, while the number of 5G connections is predicted to increase to 892 USD million with a 52% adoption rate.

APAC Small Cell Tower Industry Overview

The competition in the Asia-Pacific Small Cell Tower Market is semi-consolidated. To launch new items, organizations in the market are implementing mergers and acquisitions, strategic collaborations, and product development. The major players are Samsung Electronics Co., Ltd., Parallel Wireless Inc., and Airspan Networks Inc.

- February 2023 - Airspan Networks Inc has announced to expand of its 5G Innovation Lab initiative in Tokyo to accommodate accelerating network adoption and scaling in the Asia-Pacific region. In contrast, Airspan Japan's Tokyo office will spearhead the effort to meet the growing demand for critical interoperability testing and integration simplicity in public and private networks as technology continue to reach new 5G use cases.

- February 2023 - Telefonaktiebolaget LM Ericsson has announced the addition of three new low-cost, quick-to-deploy solutions such as a radio unit called IRU 8850, Ericsson Indoor Fusion Unit, and a new software feature for indoor networks 5G Precise Positioning to its indoor mobile connectivity lineup to bring 5G capabilities and coverage to any workplace setting, regardless of the size or complexity of the facility. Adding additional solutions to the Ericsson Radio Dot System range increases the flexibility of this market-leading offering.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Increase in Mobile Data Traffic in the Region

- 5.1.2 Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers

- 5.1.3 Steady Growth in Installations by Market Incumbents in Mature Markets such as China and South Korea

- 5.2 Market Challenges

- 5.2.1 Concerns with State Regulations and Operational Challenges Related to Deployment in 5G Networks

- 5.3 Industry Standards & Regulations

- 5.4 Impact of COVID-19 on the Small Cell Deployments and Connectivity

- 5.5 Major Implications and Technical Considerations Related to Installation of Small Cell Towers

- 5.6 Current Ownership Models and Emergence of Small Cell Leasing/Sharing Mechanism

- 5.7 Current Breakdown of the Connectivity Technology in Asia Pacific (3G, 4G & 5G)

6 ANALYSIS OF 5G ROADMAP IN ASIA PACIFIC (CHINA, SOUTH KOREA, SINGAPORE, JAPAN)

7 ASIA PACIFIC SMALL CELL NETWORK SEGMENTATION BY TYPE

- 7.1 By Application

- 7.1.1 Outdoor

- 7.1.2 Indoor

- 7.2 By Country

- 7.2.1 China

- 7.2.2 South Korea

- 7.2.3 Japan

- 7.2.4 India

- 7.2.5 Philippines

- 7.2.6 Rest of Asia Pacific

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Parallel Wireless Inc.

- 8.1.2 Airspan Networks Inc.

- 8.1.3 T&W Electronics Co Ltd

- 8.1.4 Samsung Electronics Co., Ltd.

- 8.1.5 Telefonaktiebolaget LM Ericsson

- 8.1.6 Huawei Technologies Co., Ltd.

- 8.1.7 ZTE Corporation

- 8.1.8 Baicells Technologies Co., Ltd.

- 8.1.9 NEC Corporation

- 8.1.10 Nokia Corporation