|

市場調查報告書

商品編碼

1643201

轉葉真空幫浦:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Rotary Vane Vacuum Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

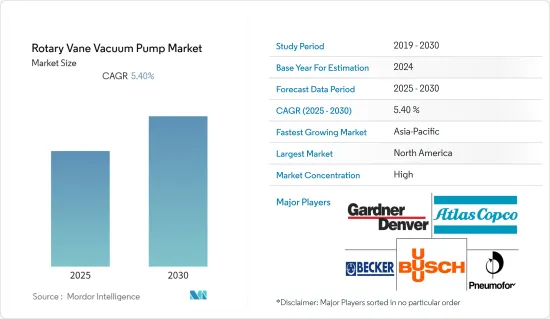

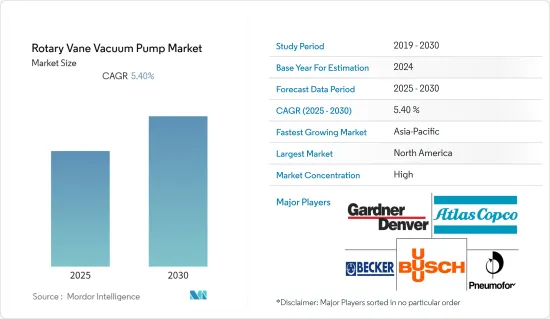

預測期內,轉葉真空幫浦市場預期複合年成長率為 5.4%。

各終端用戶垂直領域對真空幫浦的需求都很高。這些行業經常暴露在惡劣的環境中,這使它們極易受到腐蝕,因此更需要符合各種行業法規的真空幫浦。

關鍵亮點

- 轉葉真空幫浦是油封旋轉容積幫浦。該系統通常由一個外殼、一個偏心安裝的轉子、在彈簧力下徑向移動的葉片、一個入口和一個出口組成。出口閥一般採用油封式。

- 電子和半導體產業的快速成長歸因於智慧型手機、筆記型電腦和其他相關設備等消費性電子產品的日益普及。這些是推動旋轉葉片泵市場成長的關鍵因素。

- 各公司即將開展的半導體製造計劃可能會進一步推動對轉葉真空幫浦的需求。例如,World Foundry在2021年3月宣布打算投資14億美元建立全球製造能力。該公司每年投資數億美元來提高生產能力。

- COVID-19 疫情對乾式真空幫浦市場產生了不利影響。由於封鎖和社交距離規定,一些地區的主要企業已經停止營運。由於都市化加快和對有效利用可用空間的需求,預計疫情過後該領域的需求和供應將大幅增加。

- 幾十年來,油潤滑轉葉真空幫浦已在許多領域得到應用。目前,它是應用最廣泛的機械真空幫浦。然而,無油真空幫浦的進入市場成為轉葉真空幫浦普及的限制因素。

- 例如,2021 年 8 月,普發真空推出了 HiPace 80 Neo 渦輪幫浦。這些優勢是透過為渦輪泵轉子開發的新型先進雷射平衡方法實現的。

轉葉真空幫浦的市場趨勢

半導體產業預計將佔很大佔有率

- 半導體產業是重點地區經濟實力、國際競爭和技術領先地位的關鍵驅動力,特別是對於微處理器而言,對葉片真空幫浦的需求龐大。

- 半導體技術進步迅速,已開發出多代半導體裝置。目前,半導體設備的製造和使用涉及多種化學元素等許多高新技術,技術整體性很強。

- 半導體設備技術正逐步將技術模組化融入設備之中,使其高度自動化、智慧化,並影響變化的材料和製程的自然分離。半導體製造流程出現了新的真空應用,主要受到智慧型手機、高亮度 LED 照明、光伏太陽能板和鋰離子電池生產的推動。

- 例如,根據WSTS的數據,2021年半導體銷售額為5,558.9億美元。預計到 2022 年將達到 6,135.2 億美元,高於全球整體的 4,403.9 億美元。半導體銷量的成長預計將推動轉葉真空幫浦市場的發展。

- 半導體製程真空用於沉積、沉澱、PECVD 、真空乾蝕刻、真空吸附、檢查設備、真空清洗和其他鍵結製程。半導體製造過程會產生易燃、易爆和有毒氣體,因此真空幫浦製造商必須遵守 CE、UL/CSA 等標準,以確保生產和人員安全。

- 例如乾式蝕刻一般是透過物理和化學相結合的方法去除薄膜,因此蝕刻具有異向性,可以從根本上改善濕式製程固有的橫向鑽孔侵蝕問題,滿足精細線路刻蝕的要求,轉葉真空技術就是其中一種。此外,光是真空幫浦就佔了半導體製造工廠總能耗的 25%。

預計北美將佔很大佔有率

- 阿特拉斯·科普柯已收購多家泵浦業務以增強其基礎。不過這些公司的收益與其國內收益接近。一些供應商正在北美、美國建立製造工廠,而其他海外供應商則在北美擴大其分銷網路。由於半導體、太陽能和製程工業等各個終端用戶產業的不斷發展,轉葉真空幫浦預計在美國將大幅成長。

- 2022 年 8 月,高通和 GlobalFoundries 宣佈建立新的合作夥伴關係,其中包括斥資 42 億美元擴建 GlobalFoundries 位於紐約州北部的工廠以生產晶片。全球領先的無晶圓廠半導體公司高通宣布,計劃在未來五年內將其美國半導體產量提高至50%。由於轉葉真空幫浦廣泛應用於半導體,新興市場的發展預計將對該地區的市場產生正面影響。

- 同樣,2022年9月,美國總統簽署了《晶片與科學法案》,授權政府為美國半導體生產和研究提供約520億美元的補貼,以及為晶片工廠提供核准價值240億美元的投資稅額扣抵。

- 各公司即將開展的半導體製造計劃預計將進一步推動對轉葉真空幫浦的需求。例如,2021年3月,英特爾宣布將投資200億美元在亞利桑那州錢德勒建造兩家新工廠,以推動亞利桑那州蓬勃發展的半導體製造地。

- 該地區對半導體生產和研究的補貼和投資預計將推動轉葉真空幫浦市場的發展。

轉葉幫浦產業概況

轉葉真空幫浦市場正在整合,少數參與企業佔據大部分市場。產品線的技術進步為企業提供了永續的競爭優勢,市場也正在經歷現有產品系列的升級。市場也出現了一系列併購活動。 Gardner Denver Inc.、Busch Holding GmbH、Atlas Copco Group、Gebr. Becker GmbH 和 Pneumofore SPA 是轉葉真空幫浦市場的主要企業。

2021 年 10 月,HHV Pumps Pvt. Ltd 同意被阿特拉斯科普柯收購。該公司為各種行業設計和製造真空幫浦和真空系統。 HHV Pumps 總部位於印度班加羅爾,成立於 2009 年,擁有 151 名員工。 2020年公司收益約600萬美元。

2021 年 8 月,普發真空推出了 HiPace 80 Neo 渦輪泵,該泵的使用壽命更長,振動和噪音更小。這些優勢是透過為渦輪泵轉子開發的新型先進雷射平衡方法實現的。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 工業物聯網數位化推動電子產業成長

- 節能真空幫浦的需求

- 市場限制

- 市場參與企業整合

第6章 市場細分

- 按最終用戶產業

- 製程工業

- 半導體

- 太陽能電池

- 測量儀器

- 其他

- 按地區

- 美洲

- 中國

- 日本

- 韓國

- 亞洲其他地區

- 歐洲、中東和非洲

第7章 競爭格局

- 公司簡介

- Gardner Denver Inc.

- Busch Holding GmbH

- Tuthill Corporation

- Gast Manufacturing Inc.(Idex Corporation)

- Atlas Copco Group

- ULVAC Technologies Inc.

- Pneumofore SpA

- Gebr. Becker GmbH

- The Kurt J. Lesker Company

第8章投資分析

第9章:市場的未來

The Rotary Vane Vacuum Pump Market is expected to register a CAGR of 5.4% during the forecast period.

Vacuum pumps have experienced a substantial demand from various end-user verticals. The operations in these verticals are extremely susceptible to corrosion due to constant exposure to harsh environments, emphasizing the need for vacuum pumps to comply with various industrial regulations.

Key Highlights

- The rotary vane vacuum pump is an oil-sealed rotary displacement pump. The system usually comprises a housing, an eccentrically installed rotor, vanes that move radially under spring force, and the inlet and outlet. The outlet valve is generally oil-sealed.

- The rapid growth of the electronics and semiconductor industries can be attributed to the increasing proliferation of consumer electronics like smartphones, laptops, and other relevant gadgets. It is a significant factor driving the rotary vane pump market growth.

- The upcoming semiconductor fabrication projects by different companies are likely to boost the rotary vane vacuum pump demand further. For instance, Global Foundries announced its intentions to invest USD 1.4 billion in its global manufacturing capacity in March 2021. The company invests hundreds of millions of dollars yearly to improve its production capacity.

- The COVID-19 pandemic had a detrimental impact on the Dry Vacuum Pumps Market. Due to the lockdown and social distancing norms, significant corporations halted operations in several areas. The sector anticipated a high level of demand and supply following the epidemic due to increased urbanization and the growing need for efficient use of available space.

- Oil-lubricated rotary vane vacuum pumps have been deployed across many fields for decades. Currently, they represent the most widely used mechanical vacuum pumps. However, oil-free vacuum pumps have been introduced in the market, which acts as a restraint towards adopting rotary vane vacuums.

- For instance, in August 2021, Pfeiffer Vacuum introduced the HiPace 80 Neo turbopump, which has a longer service life and lowers vibration and noise emissions. The novel, advanced Laser Balancing method developed for turbopump rotors enables these advantages.

Rotary Vane Vacuum Pump Market Trends

Semiconductor Industry is Expected to Hold Significant Share

- With the semiconductor industry being a key driver of the significant region's economic strength, global competitiveness, and technology leadership, especially in microprocessors, the demand for vane vacuum pumps has been substantial.

- Semiconductor technology has rapidly evolved, leading to the development of semiconductor devices over generations. Currently, the manufacture and use of semiconductor equipment involves many high and new techniques, such as various chemical elements, and has a robust technical comprehensiveness.

- Semiconductor equipment technology has gradually integrated technology modularization into equipment, making it highly automated and intelligent, affecting the natural separation of material and the process to change. New vacuum applications in the semiconductor manufacturing process have emerged, mainly fueled by the production of smartphones, high-brightness LED lighting, photovoltaic solar panels, and Li-ion batteries.

- For instance, according to WSTS, semiconductor sales in 2021 were USD 555.89 billion. It increased from USD 440.39 billion globally and was forecasted to rise to USD 613.52 billion in 2022. The increase in semiconductors sales will drive the rotary vane vacuum pump market.

- Semiconductor process vacuum is used across evaporation, sputtering, PECVD, vacuum dry etching, vacuum adsorption, testing equipment, vacuum cleaning, and other bonding processes. The flammable, explosive, and toxic substance gases in the manufacturing process of semiconductor, leads the manufacturer of vacuum pumps to adhere to compliances such as CE and UL/CSA standards for production and personnel safety.

- Dry etching, for instance, is generally used to remove the etched thin film through a combination of physical and chemical methods, so the etching has anisotropy, which can fundamentally improve the inherent problem of horizontal drilling erosion of wet process, to meet the requirements of fine line etching, rotary vane vacuum technology is one of them. Also, vacuum pumps alone represent up to 25% of the total energy consumed by a semiconductor manufacturing facility.

North America is Expected to Hold Significant Share

- Traditionally, European vendors dominated the rotary vane vacuum pump market, such as Atlas Copco, which acquired various pump businesses to increase its foothold. However, these companies reported revenues closer to their domestic revenues. While several vendors have established their manufacturing facilities in North America, in the United States, the other international vendors have increased their distributor networks in North America. The rotary vane vacuum pump is expected to grow significantly in the United States owing to the several developments taking place in various end-user industries, such as semiconductors, solar, and process industries.

- In August 2022, Qualcomm and GlobalFoundries announced a new partnership that included USD 4.2 billion to manufacture chips in an expansion of GlobalFoundries' upstate New York facility. Qualcomm, the leading fabless semiconductor company in the world, announced plans to increase semiconductor production in the US by up to 50% over the next five years. With the rotary vane vacuum pump significantly used in semiconductors, the developments are expected to impact the region's market positively.

- Similarly, in September 2022, the US President signed into law the Chips and Science Act, which authorized about USD 52 billion in government subsidies for US semiconductor production and research, as well as an investment tax credit for chip plants estimated to be worth USD 24 billion.

- The upcoming semiconductor fabrication projects by different companies will further boost the rotary vane vacuum pump demand. For instance, in March 2021, Intel stated that it would invest USD 20 billion in two new fabs in Chandler, Arizona, adding to Arizona's burgeoning semiconductor manufacturing base.

- Such subsidies and investments in semiconductor production and research in this region will drive the market for rotary vane vacuum pumps.

Rotary Vane Vacuum Pump Industry Overview

The rotary vane vacuum pump market is consolidated, with most of the market occupied by a few players. Technological advancements in their product line are bringing sustainable competitive advantage to the companies, and the market is also witnessing the upgradation of the existing product portfolio. The market is also witnessing various mergers and acquisitions. Gardner Denver Inc., Gardner Denver Inc., Busch Holding GmbH, Atlas Copco Group, Gebr. Becker GmbH, and Pneumofore SPA are the major players in the rotary vane vacuum pump market.

In October 2021, HHV Pumps Pvt. Ltd agreed to be acquired by Atlas Copco. Vacuum pumps and systems are designed and manufactured by the company for various industries. HHV Pumps, based in Bengaluru, India, was started in 2009 and employs 151 people. The company generated around USD 6 million in revenue in 2020.

In August 2021, Pfeiffer Vacuum introduced the HiPace 80 Neo turbopump, which has a longer service life, and lowers vibration and noise emissions. The novel, advanced Laser Balancing method developed for turbopump rotors enables these advantages.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Electronics Industry Driven by IIoT and Digitalization

- 5.1.2 Demand for Energy-Efficient Vacuum Pumps

- 5.2 Market Restraints

- 5.2.1 Consolidation of Market Participants

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Process Industry

- 6.1.2 Semiconductor

- 6.1.3 Solar

- 6.1.4 Instrumentation

- 6.1.5 Other End-user Industries

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 China

- 6.2.3 Japan

- 6.2.4 South Korea

- 6.2.5 Rest of Asia

- 6.2.6 Europe, Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gardner Denver Inc.

- 7.1.2 Busch Holding GmbH

- 7.1.3 Tuthill Corporation

- 7.1.4 Gast Manufacturing Inc. (Idex Corporation)

- 7.1.5 Atlas Copco Group

- 7.1.6 ULVAC Technologies Inc.

- 7.1.7 Pneumofore SpA

- 7.1.8 Gebr. Becker GmbH

- 7.1.9 The Kurt J. Lesker Company