|

市場調查報告書

商品編碼

1643220

北歐可再生能源 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North Europe Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

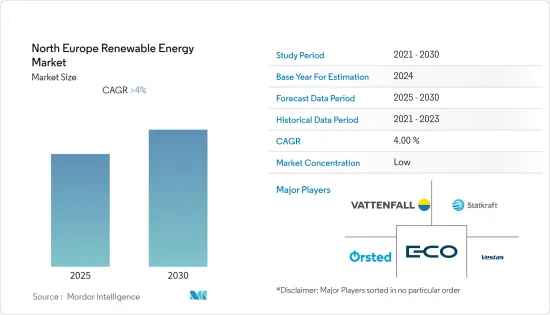

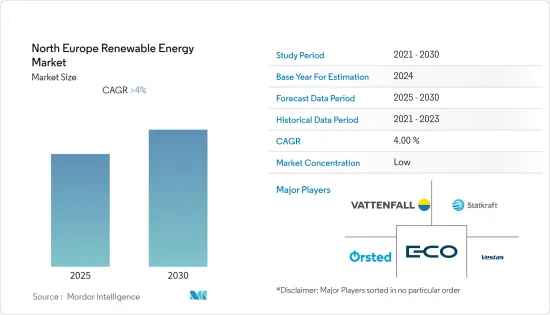

預計預測期內北歐可再生能源市場的複合年成長率將超過 4%。

2020 年,新冠疫情對市場產生了負面影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從中期來看,日益成長的環境問題、政府為可再生計劃開發提供的激勵和稅收優惠措施、以及擴大電網的高成本等因素預計將推動市場的發展。此外,降低可再生能源技術製造成本和提高發電效率的技術進步也為北歐可再生能源發電市場的成長做出了重大貢獻。

- 同時,高昂的初始資本支出可能在未來幾年抑制北歐可再生能源市場的成長。

- 然而,人們對清潔能源生產的日益關注以及能源生產從煤炭和天然氣等傳統能源來源向清潔能源的逐步轉變,預計將為該地區的可再生能源營運商創造令人興奮的機會。

- 挪威憑藉政府的支持措施在該地區可再生能源市場佔據主導地位。

北歐可再生能源市場的趨勢

水電佔據市場主導地位

- 預計水電將主導該地區的可再生能源市場。預計這一領域將由挪威和瑞典等國家引領,這兩個國家的水力發電裝置容量在 2021 年將達到 38.81 吉瓦和 16.40 吉瓦。

- 截至 2021 年,北歐水電裝置容量為 56.9 吉瓦,約佔該地區水電總裝置容量的 25%。水力發電還佔該地區可再生能源容量的63%以上。

- 水力發電廣泛使用的主要原因是其電力供應具有成本效益、不受動盪的批發電力市場價格飆升的影響以及供應安全。

- 水力發電產業透過提供靈活、可靠的電力供應(可在需要時調用)增強了各國和消費者的信心。

- 因此,預計上述因素將在預測期內支撐市場主導地位。

挪威主導市場成長

- 近年來,挪威一直主導該地區的可再生能源市場,預計在預測期內仍將保持這一地位。該國擁有綠能生產系統之一,97%以上的電力來自可再生能源。

- 挪威的可再生能源開發早在 19 世紀就開始了,當時該國利用河流進行水力發電。

- 可再生能源發電的大部分來自水力發電。截至 2021 年,挪威的水力發電容量為 38.81 吉瓦,可再生能源總容量為 39.77 吉瓦。挪威是該地區和歐洲第二大水力發電國,也是世界第七大水力發電國。

- 除水力發電外,該公司也活躍於風力發電領域,在陸上和海上業務規模龐大。 2022年11月,全球最大的浮體式海上風電場將在挪威海岸86英里處投入運作。該風電場將於2023年全面運作,總發電量為88兆瓦。

- 由於挪威的優惠政策和擴大可再生的意願,預計預測期內挪威將在該地區保持領先地位。

北歐可再生能源產業概況

北歐可再生能源市場比較分散。該市場的主要企業包括(不分先後順序)Orsted AS、Vestas Wind Systems AS、Statkraft AS、E-CO Energi Holding As 和 Vattenfall AB。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2027年裝置容量及預測(單位:MW)

- 2021 年各國可再生能源總總設備容量(MW)

- 最新趨勢和發展

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 市場類型

- 風

- 水力發電

- 太陽的

- 其他

- 地區

- 瑞典

- 挪威

- 英國

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Orsted AS

- Vestas Wind Systems AS

- E.ON SE

- Statkraft AS

- E-CO Energi

- Vattenfall AB

- Nordex SE

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 70286

The North Europe Renewable Energy Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as rising environmental concerns, government policies for incentives and tax benefits for renewable project development, and the high cost of grid expansion are expected to drive the market. Also, advancement in technology, leading to renewable energy technology manufacturing cost reduction and an increase in power generation efficiency, is a significant factor in the growth of the North Europe renewable energy market.

- On the other hand, high initial CAPEX is likely to restrain the growth of the North Europe renewable energy market in the coming years.

- However, the increasing focus on producing clean energy and the gradual shift from energy generation from conventional sources such as coal and natural gas to clean energy is expected to create an excellent opportunity for the renewable energy players in the region.

- Norway has dominated the renewable energy market in the region due to supportive government policies.

North Europe Renewable Energy Market Trends

Hydro Power to Dominate the Market

- Hydropower is expected to dominate the renewable energy market in the region. The sector is expected to be led by countries like Norway and Sweden having a capacity of 38.81 GW and 16.4 GW of hydropower capacity in 2021, respectively.

- North Europe holds around 25% share of the region's hydropower capacity at 56.9 GW as of 2021. Hydropower also makes up over 63% share of the region's renewable energy capacity.

- The main reasons behind such extensive usage of hydropower are the cost-efficient supply of electricity, independence from price spikes in volatile wholesale electricity markets, and security of supply.

- The hydropower sector provides a sense of reliability to countries and consumers by providing a flexible and reliable capacity that can be called upon when needed.

- Therefore, the factors above are expected to help the market dominate in the forecast period.

Norway to Dominate the Market Growth

- Norway has dominated the renewable energy market in the region in recent years and is expected to continue to do so in the forecast period too. The country has one of the cleanest electricity production systems in place, with over 97% of its electricity generated from renewable energy.

- Renewable energy development in Norway started as early as the 1800s, with the harvest of hydropower from the rivers cascading through the country.

- The majority of the electricity generation from renewable resources comes from hydropower. As of 2021, the hydropower capacity of Norway stood at 38.81 GW, and the total renewable energy capacity stood at 39.77 GW. Norway is the second-largest hydropower producer in the region and Europe and the seventh-largest producer in the world.

- Apart from hydropower, the country has been very active in the wind power sector, with a number of utility sizes in both its onshore and offshore regions. In November 2022, the world's largest floating offshore wind farm went online 86 miles off the coast of Norway. The wind farm will be fully operational in 2023 with a total capacity of 88 MW.

- The country is likely to maintain its dominance in the region during the forecast period, supported by its favorable policies and awareness for more and more usage of renewable energy.

North Europe Renewable Energy Industry Overview

The North Europe Renewable Energy Market is fragmented. Some of the key players in this market include (not in particular order) Orsted AS, Vestas Wind Systems AS, Statkraft AS, E-CO Energi Holding As, and Vattenfall AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in MW, till 2027

- 4.3 Installed Total Renewable Energy Capacity, in MW, by Country, 2021

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Wind

- 5.1.2 Hydro

- 5.1.3 Solar

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 Sweden

- 5.2.2 Norway

- 5.2.3 United Kingdom

- 5.2.4 Rest of North Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Gamesa Renewable Energy SA

- 6.3.2 General Electric Company

- 6.3.3 Orsted AS

- 6.3.4 Vestas Wind Systems AS

- 6.3.5 E.ON SE

- 6.3.6 Statkraft AS

- 6.3.7 E-CO Energi

- 6.3.8 Vattenfall AB

- 6.3.9 Nordex SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219