|

市場調查報告書

商品編碼

1644285

終端用戶計算 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)End User Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

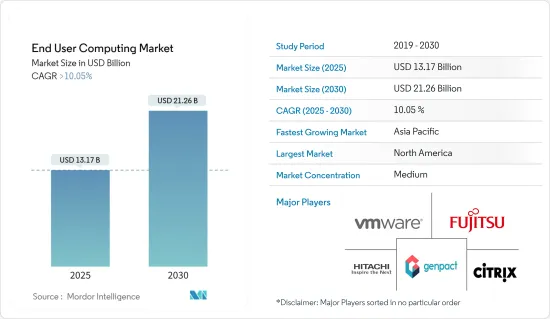

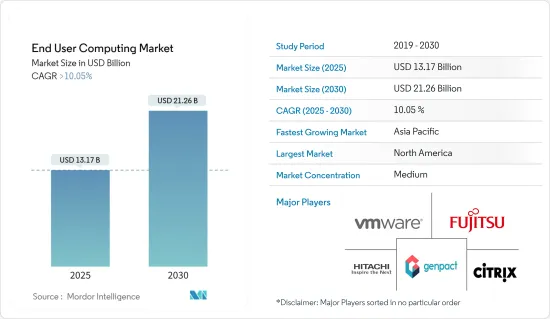

終端用戶計算市場規模預計在 2025 年為 131.7 億美元,預計到 2030 年將達到 212.6 億美元,預測期內(2025-2030 年)的複合年成長率將超過 10.05%。

終端用戶運算市場的成長得益於快速發展的技術和軟體更新、BYOD(自帶設備)設備的日益成長的趨勢、對員工生產力的日益關注以及在現代化工作空間的同時降低IT基礎設施成本的努力。

關鍵亮點

- 即時複製、使用者環境管理和應用程式磁碟區等創新使企業能夠簡化桌面和應用程式管理,並為員工提供乾淨、無狀態的桌面。這使企業能夠降低成本、提高安全性並為員工提供個人化的桌面體驗。

- 隨著許多工作場所轉向在家工作以保持業務連續性並確保員工安全,對終端用戶運算解決方案的需求激增。為了因應這種情況,各公司紛紛推出針對不同業務規模和IT資源量身訂做的解決方案和服務。

- 此外,2023 年 7 月,genpact 宣布與主要企業人工智慧 (AI) 軟體平台供應商 o9 Solutions 擴大合作夥伴關係,旨在轉變規劃和決策,透過利用生成性 AI 幫助企業應對持續的供應鏈中斷。

- 對於 IT 資源有限的中小型企業,終端使用者運算供應商提供低成本的入門版本或市場領先解決方案的免費試用版。然而,越來越多的人遠端存取資料和文件,給伺服器和網路基礎設施等實體資源帶來壓力,從而導致長期成本增加。

- COVID-19 疫情對終端用戶計算產業產生了負面影響。社交距離措施和限制的實施導致關鍵核心組裝地點的業務停止,並擾亂了供應鏈和製造業務。這對該行業產生了短期和長期的影響,亞太和歐洲的許多公司由於勞動力和活動減少而被迫暫停營運。

終端用戶計算市場趨勢

雲端運算使用量的增加預計將推動終端用戶運算市場的成長

- 終端用戶運算提供者提供許可和基於訂閱的解決方案,使企業能夠使用雲端服務並僅為其暫時需要的資源付費。這有助於企業消除購買、編程和維護長期閒置的額外資源和設備的需要,降低非收益成本,並有助於發展雲端基礎的終端用戶運算市場。

- 為了滿足最終用戶的多樣化需求,企業可以透過本地、雲端或兩者結合的混合方式提供最終用戶運算解決方案。這種方法為企業提供了一條從內部部署服務轉向完全雲端託管或混合雲端管理服務的低風險途徑。

- 借助內部可託管的雲端基礎的管理、桌面和基礎設施、先進的虛擬以及 Nvidia Grid 和全新 Blast Extreme通訊協定等技術,企業可以提供具有最終用戶期望的所有功能的卓越用戶體驗,即使對於最苛刻的圖形密集型工作負載也是如此。

- 例如,VMware 與 Microsoft 合作開發了名為 VMware Workspace ONE for Microsoft Endpoint Manager 的新解決方案。此解決方案支援對 Windows 10 裝置進行現代化管理,並允許企業從 Workspace One主機內部管理 Windows 10 裝置。 VMware 還將透過 Workspace ONE 提供對 Microsoft 365 應用程式和服務的訪問,並在整個 BYoD(自帶設備)過程中與 Microsoft Endpoint Manager 和 Azure Active Directory Premium 整合。

預計北美將佔據較大的市場佔有率

- 由於多種因素,北美在終端用戶運算市場中佔據關鍵地位。該地區正經歷網路技術、先進行動平台的可用性和 SaaS 的靈活性的快速發展。由此產生的勞動力流動性正在推動終端用戶運算的成長。此外,隨著5G網路的出現,終端用戶運算供應商將能夠在不久的將來享受更大的頻寬和更快的網路速度,使他們能夠開發更先進的服務。

- 北美也因開創自帶設備 (BYOD) 文化而聞名,這種文化推動了終端用戶運算的廣泛採用。該地區的許多公司並沒有堅持使用公共雲端,而是採用了結合公共雲端、私有雲端和傳統 IT 的混合 IT 方法。這種方法使員工可以隨時隨地存取公司資料和應用程式。雲端基礎的解決方案和服務的採用和開發進一步推動了終端用戶運算市場的成長。

- 此外,資料中心的採用正在加速專業雲端服務市場的成長。 2022 年,北維吉尼亞的資料中心淨吸收量在美國主要資料中心市場最高,達到 303.3 兆瓦。隨著越來越多的企業採用雲端基礎的解決方案和服務來滿足其運算需求,預計這一趨勢將會持續下去。總體而言,由於北美的技術進步、BYOD文化的採用以及雲端基礎的解決方案和服務的成長,北美在終端用戶運算市場的主導地位預計將持續下去。

終端用戶計算行業概況

預計終端用戶運算市場將保持半固體,區域和參與企業將憑藉其技術專長參與企業市場。許多企業採取策略夥伴關係來獲得通用利益並加強其市場地位。

- 2023 年 4 月-IGEL 宣布推出其新的 COSMOS 端點平台。該平台允許員工從任何設備到任何雲端存取任何數位工作區,從而實現出色的工作區體驗,同時透過新的作業系統、更新的管理主機和一系列新的雲端服務為 EUC 管理員提供更高的安全性、管理和控制。

- 2022 年 11 月 - XenTegra 和 Mindcentric 推出 XenTegra ONE,這是一家將利用 XenTegra 豐富的技術知識的新公司。這將為企業客戶提供改進的終端用戶運算、雲端運算和資料中心基礎設施解決方案。 Mindcentric 仍將作為獨立企業,但將代表 XenTegra 作為公司的 SMB 銷售和支援部門。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 透過科技提高員工生產力

- 增加雲端使用量

- 市場限制

- 組織流程轉型與整合的問題

- 評估新冠肺炎對各行業的影響

第5章 市場區隔

- 類型

- 解決方案

- 虛擬桌面基礎架構

- 設備管理

- 其他解決方案(整合通訊、軟體資產管理)

- 服務詳情

- 解決方案

- 組織規模

- 大型企業

- 中小型企業

- 實施形式

- 本地

- 雲

- 最終用戶產業

- 資訊科技和電訊

- 銀行、金融服務和保險

- 醫療

- 零售

- 其他終端使用者產業(媒體和娛樂、政府、教育、運輸和物流)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Nutanix, Inc.

- Fujitsu Ltd.

- Genpact

- HCL Infosystems Limited

- IGEL Technology

- Infosys Limited

- Mindtree Limited

- NetApp, Inc.

- Nucleus Software Exports Limited

- Citrix Systems, Inc.

- Tech Mahindra Limited

- Vmware, Inc.

- Hitachi Systems Micro Clinic

- Dell Technologies

- Amazon Web Services

第7章投資分析

第8章 市場機會與未來趨勢

The End User Computing Market size is estimated at USD 13.17 billion in 2025, and is expected to reach USD 21.26 billion by 2030, at a CAGR of greater than 10.05% during the forecast period (2025-2030).

The growth of the end-user computing market is fueled by rapidly advancing technology and software updates, a rising trend of BYOD (bring your device) devices, an increased focus on employee productivity, and efforts to lower IT infrastructure costs while modernizing workspaces.

Key Highlights

- Innovative technologies such as instant clones, user environment management, and app volumes are helping organizations streamline desktop and application management, providing employees with clear and stateless desktops that can be easily destroyed or delivered as needed. This allows organizations to reduce costs, improve security, and provide personalized desktop experiences for their employees.

- The demand for end-user computing solutions has skyrocketed as many workspaces have shifted to work-from-home setups to maintain business continuity and ensure employee safety. In response, companies offer solutions and services tailored to different business sizes and IT resources.

- Furthermore, in July 2023, genpact has announced it is expanding its partnership with o9 Solutions, a leading enterprise artificial intelligence (AI) software platform provider for transforming planning and decision-making, to help companies navigate ongoing supply chain disruptions by leveraging generative AI.

- For small to medium-sized organizations with limited IT resources, end-user computing providers offer low-cost entry-level versions and free trials of their market-leading solutions. However, the growing number of people accessing data and files remotely is straining physical resources such as servers and network infrastructure, which may increase costs in the long run.

- The COVID-19 pandemic negatively impacted the end-user computing sector. Implementing social distancing measures and restrictions halted duties at critical core assembly sites, leading to disruptions in the supply chain and manufacturing operations. This had short-term and long-term effects on the industry, with numerous companies in Asia-Pacific and Europe having to shut down operations due to reduced employees and activity.

End User Computing Market Trends

Increasing Use of Cloud is Expected to Drive the End User Computing Market Growth

- End-user computing providers offer licensing and subscription-based solutions that allow companies to use cloud services and pay only for the resources they temporarily require. This eliminates the need for companies to purchase, program, and maintain additional resources and equipment that remain idle for extended periods of time, thus reducing costs that do not generate revenue and promoting market growth in the cloud-based end-user computing market.

- To meet the diverse requirements of end-users, companies can deliver end-user computing solutions from on-premises, in the cloud, or through a hybrid approach that combines both. This approach provides businesses a low-risk way to move from an on-premises service to a fully cloud-hosted or hybrid cloud-managed service.

- With cloud-based management, desktops, and infrastructure that can be hosted on-premises, advanced virtual c, technologies such as Nvidia Grid, and brand new blast extreme protocol, companies can deliver great user experiences with all the features end-users expect, even for the most demanding graphic-intensive workloads.

- For example, VMware partnered with Microsoft to develop a new solution named VMware Workspace ONE for Microsoft Endpoint Manager. This solution enables modern management for Windows 10 devices and allows enterprises to manage their Windows 10 devices from their Workspace One console. VMware will also provide access to Microsoft 365 apps and services via Workspace ONE and integration with Microsoft endpoint manager and Azure active directory premium across bring-your-own-devices (BYoDs).

North America is Expected to Hold Significant Market Share

- North America is a significant player in the end-user computing market due to various factors. The region has witnessed rapid growth in network technologies, the availability of advanced mobile platforms, and the flexibility of SaaS. This has resulted in increased workforce mobility, driving the growth of end-user computing. Additionally, with the onset of 5G networks, end-user computing providers can utilize more bandwidth and faster internet speeds to develop more advanced services in the near future.

- North America is also known for being a pioneer in the bring-your-own-device (BYOD) culture, which has led to the widespread incorporation of end-user computing. Many companies in the region are moving beyond the public cloud and adopting a hybrid IT approach that combines public cloud, private cloud, and traditional IT. This approach allows employees to access corporate data and applications from anywhere and anytime. The adoption and development of cloud-based solutions and services are further fueling the growth of the end-user computing market.

- Moreover, the adoption of data centers is accelerating the growth of the professional cloud services market. Northern Virginia had the highest data center net absorption among the leading data center markets in the United States in 2022, amounting to 303.3 megawatts. This trend will continue as more companies adopt cloud-based solutions and services to meet their computing needs. Overall, North America's dominance in the end-user computing market is expected to continue due to its technological advancements, adoption of BYOD culture, and growth in cloud-based solutions and services.

End User Computing Industry Overview

The end-user computing market is expected to be semi-consolidated, with both regional and global players dominating the market with their technological expertise. Many companies are adopting strategic partnerships to gain shared benefits and strengthen their position in the market.

- April 2023 - IGEL has announced the launch of the new COSMOS endpoint platform, which allows employees to have an incredible workspace experience by enabling them to access any digital workspace from any device into any cloud and gives EUC administrators the ability to provide greater security, management, and control through its new Operating System, updated administrative console and a number of new cloud services.

- November 2022 - XenTegra and Mindcentric formed a new company called XenTegra ONE, which leverages XenTegra's extensive technological know-how. This has provided enterprise clients with improved end-user computing, cloud computing, and data center infrastructure solutions. While Mindcentric will remain a separate business, it will represent XenTegra as its SMB sales and support division.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Drive to Increase the Productivity of Employees with Technology

- 4.4.2 Increasing Use of Cloud

- 4.5 Market Restraints

- 4.5.1 Issues Associated with Transformation and Integration of Processes By Organizations

- 4.6 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solution

- 5.1.1.1 Virtual Desktop Infrastructure

- 5.1.1.2 Device Management

- 5.1.1.3 Other Solutions (Unified Communication, Software Asset Management)

- 5.1.2 Services

- 5.1.1 Solution

- 5.2 Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small & Medium Enterprises

- 5.3 Deployment Mode

- 5.3.1 On Premise

- 5.3.2 Cloud

- 5.4 End user Industry

- 5.4.1 IT and Telecom

- 5.4.2 Banking, Financial Services, and Insurance

- 5.4.3 Healthcare

- 5.4.4 Retail

- 5.4.5 Other End user Industries (Media & Entertainment, Government, Education, Transportation and Logistics)

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nutanix, Inc.

- 6.1.2 Fujitsu Ltd.

- 6.1.3 Genpact

- 6.1.4 HCL Infosystems Limited

- 6.1.5 IGEL Technology

- 6.1.6 Infosys Limited

- 6.1.7 Mindtree Limited

- 6.1.8 NetApp, Inc.

- 6.1.9 Nucleus Software Exports Limited

- 6.1.10 Citrix Systems, Inc.

- 6.1.11 Tech Mahindra Limited

- 6.1.12 Vmware, Inc.

- 6.1.13 Hitachi Systems Micro Clinic

- 6.1.14 Dell Technologies

- 6.1.15 Amazon Web Services