|

市場調查報告書

商品編碼

1644296

銀行維護援助與服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Banking Maintenance Support & Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

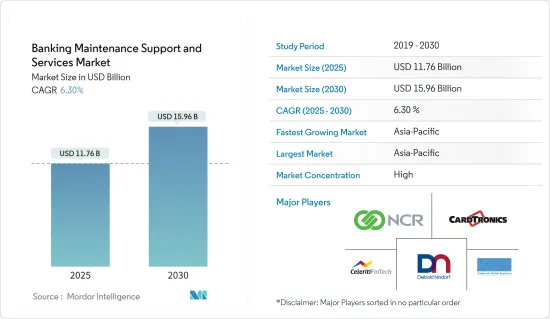

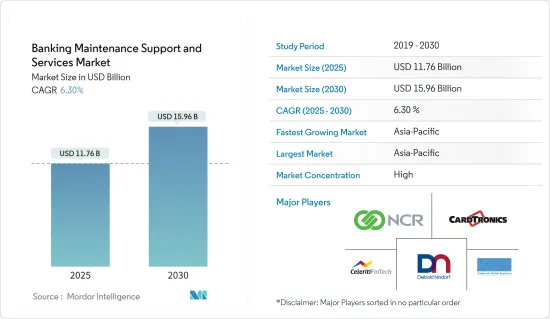

銀行維護援助和服務市場規模預計在 2025 年達到 117.6 億美元,預計到 2030 年將達到 159.6 億美元,預測期內(2025-2030 年)的複合年成長率為 6.3%。

新興經濟體的人口快速成長,使得企業更重視改善店內顧客的體驗。

主要亮點

- 銀行維護援助和服務大大減少了銀行的停機時間和營運成本。每家公司都提供全系列的產品和解決方案,以簡化現金管理流程。這些產品和服務實現了現金處理和加工的自動化,提高了生產效率,降低了開支,並且使銀行能夠透過專注於提高客戶滿意度和其他關鍵業務來更好地利用員工。因此,銀行業對幫助台支援、軟體支援和硬體維護服務的需求日益增加。

- 此外,銀行自助服務設備(如 ATM、自動提款機、銀行亭和數位指示牌系統)的使用預計將增加對維護和支援服務的需求。預計這些也將對預測期內的收益產生重大影響。

- 為了擴大其國際服務並幫助這些金融機構改善客戶體驗,該服務提供者與全球眾多銀行機構建立了合作關係。因此,預計未來幾年銀行硬體維護、軟體支援和幫助台支援服務市場將快速成長。高昂的研發成本也豐富了市場拓展的潛力。

- 由於現有參與者之間的競爭以及新競爭對手進入市場的威脅,市場成長率可能會放緩。由於新參與企業和現有企業的激烈競爭,銀行硬體維護、軟體支援和幫助台支援服務市場預計在未來幾年將面臨許多挑戰。

- 在新冠肺炎疫情期間,世界各地實施了封鎖和隔離規則,迫使許多企業和組織暫停業務一段時間。但銀行業仍在運作。這意味著分店仍然需要維護服務以確保員工的健康和安全並阻止病毒進入銀行。

- 例如,維護服務 BS/2 負責所有銀行設備的維護,即使在實施檢疫規則的情況下也是如此。俄羅斯和烏克蘭之間的戰爭也帶來了整個包裝生態系統的變化。

銀行維護援助和服務市場趨勢

硬體支援可望主導市場佔有率

- BFSI 行業面臨的最大挑戰是改善銀行分店的客戶體驗並減少排隊時間。為此,一些銀行正在努力透過引入自助服務設備(如 ATM、自動提款機、銀行亭和數位指示牌系統)來實現某些任務的自動化。

- 這些設備可以輕鬆執行多種銀行業務,例如餘額查詢、轉帳、存入支票和提取現金。這些設備使銀行工作人員能夠消除長隊現象並減少分店的等待時間,同時提高客戶服務的效率。

- 例如,CashLink World Systems 的 ATM 服務業務為客戶提供廣泛的服務,包括 ATM 安裝/拆除、搬遷、運輸、搬運、測試、試運行、操作培訓和 SLM。

亞太地區可望實現強勁成長

- 預計預測期內亞太地區將實現高速成長。這是因為銀行和其他金融服務機構正在增加使用自助服務技術來提高其市場佔有率。該地區的多家銀行機構正在增加對其組織維護、維修和支援服務的招聘,以增強其提升客戶體驗的能力。

- 與歐洲、中東和非洲地區以及美洲地區相比,亞太地區對 BaaS 服務的需求更高。在歐洲、中東和非洲以及美洲地區,只有 80% 的高階主管使用或計劃使用 BaaS 解決方案,而亞太地區的比例為 88%。其中包括銀行、醫療保健、零售和科技。

- BaaS 生態系統中的主要企業(分銷商、推動者和提供者)渴望增加對 BaaS 的投資和連接,因為預計未來五年該行業每年的成長率將超過 50%。隨著終端用戶擴大採用易於使用且有助於降低銀行和其他服務提供者成本的尖端數位銀行解決方案,市場正在不斷擴大。其背景是銀行和金融服務業法規環境的變化。

銀行維護援助和服務業概覽

隨著全球範圍內幾家領先服務提供者的存在,銀行維護援助和服務市場的競爭格局得到鞏固。服務提供者與世界各地的銀行合作,擴展他們的服務並幫助銀行改善客戶體驗。

2022 年 3 月,總部位於東京的行動金融軟體公司 Kyash 在 D 輪資金籌措中籌集了 4,120 萬美元(49 億日圓)。日本郵政、Block(原 Square)、Greyhound Capital、三井住友證券、Altos Ventures、Goodwater Capital、StepStone Group、JAFCO Group 和三井住友保險資本也參與了此輪融資。

2022年1月,主要企業的金融機構科技即服務平台金融壹帳通宣布與中國人民銀行推出的金融科技公司誠方金融科技建立策略夥伴關係。透過此次合作,金融壹帳通與誠方金科將共同探索資料隱私技術在銀行監控系統中的新應用,推動新資料標準的引進與共用,並尋找企業所需的金融資料協作與分發模型,滿足安全雲端運算的要求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提和市場研究

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 更重視改善 BFSI 產業的店內顧客體驗

- 自助機器的普及率不斷提高

- 市場限制

- 數位銀行解決方案的採用率不斷提高

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場區隔

- 按組件

- 硬體維護支援與服務

- 軟體維護支援與服務

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- CeleritiFinTech

- Diebold Nixdorf, Inc.

- CashLink Global Systems Pvt. Ltd.

- NCR Corporation

- Cardtronics Inc.

- Glory Global Solutions(International)Limited

第7章投資分析

第8章 市場機會與未來趨勢

The Banking Maintenance Support & Services Market size is estimated at USD 11.76 billion in 2025, and is expected to reach USD 15.96 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

The number of people living in emerging economies is growing very quickly, and more and more attention is being paid to improving the in-branch experience for customers.

Key Highlights

- Banking maintenance support and services significantly lower banks' downtime and operating costs. Businesses offer products and solutions that simplify cash management processes across the board. These goods and services automate the handling and processing of cash, which boosts output, reduces expenses, and allows the bank to make better use of its employees by putting more emphasis on enhancing customer satisfaction and other vital tasks. As a result, there is a high demand for helpdesk support, software support, and hardware maintenance services in the banking industry.

- The fast growth of populations in developing countries and the focus on improving the in-branch experiences of customers have greatly increased the need for banking hardware maintenance, software support, and helpdesk support services.Also, it is expected that the use of self-service equipment in banks, like ATMs, cash deposit machines, banking kiosks, and digital signage systems, will increase the need for maintenance and support services. Also, it is expected that these things will make a big difference in revenue during the forecast period.

- In order to expand their services internationally and help these institutions improve their customer experiences, the service providers have teamed up with a number of banking institutions on a global scale. This will make the market for hardware maintenance, software support, and helpdesk support services for banks grow faster over the next few years. High research and development expenditures also present a wealth of market expansion potential.

- The growth rate of the market could be slowed down by competition between current players and threats from new competitors who are just starting out. Due to the fierce competition between new entrants and established firms, the market for banking hardware maintenance, software support, and helpdesk support services is expected to face a lot of problems over the next few years.

- During the COVID-19 pandemic, many businesses and organizations had to stop working for a while because of lockdown and quarantine rules that were put in place all over the world. But the banking industry was still running, which meant that maintenance services were still needed in the branches to keep employees healthy and safe and stop viruses from getting into the banks.

- For example, BS/2, which is a maintenance service, took care of all the maintenance for banking equipment even when quarantine rules were in place. The war between Russia and Ukraine has also changed the packaging ecosystem as a whole.

Banking Maintenance Support & Services Market Trends

Hardware Support Expected to Exhibit Significant Market Share

- The BFSI sector's biggest challenge is to improve the customer experience at bank branches and reduce the amount of time spent waiting in lines.For this reason, several banks are making efforts to automate several tasks by deploying self-service devices such as ATMs, cash deposit machines, banking kiosks, digital signage systems, and many more.

- Such devices foster ease in performing several banking activities, such as balance inquiries, money transfers, check deposits, cash withdrawals, and many more. These devices allow the bankers to eliminate long queues at the branches, reducing wait times while increasing their efficiency in managing their customers.

- For example, CashLink Global Systems' ATM Service business offers a number of services to its customers, such as ATM installation and removal, relocation, transportation, handling, testing, commissioning, operational training, and SLM.

Asia-Pacific Expected to Grow Significantly

- During the forecast period, the Asia-Pacific region is expected to grow at a high rate. This is because banks and other financial service organizations are using self-service technologies more and more to improve their market presence.Several banking institutions in the region are increasingly adopting maintenance, repair, and support services for their organizations to augment their ability to enhance the customer experience.

- In comparison to EMEA and the Americas, the demand for BaaS services is higher in APAC. Compared to EMEA and the Americas, where only 80% of senior executives use or plan to use BaaS solutions, 88% of senior executives in APAC do so or plan to do so. This includes banking, healthcare, retail, and technology.

- The main players in the BaaS ecosystem (distributors, enablers, and providers) want to increase their BaaS investments and connections because they predict that the BaaS industry will grow at a rate of more than 50% annually over the next five years. The market is growing because more and more end users are using cutting-edge digital banking solutions that are easy to use and help banks and other service providers save money. This is due to the banking and financial services industry's shifting regulatory environment.

Banking Maintenance Support & Services Industry Overview

The competitive landscape of the banking maintenance, support, and service market is consolidated due to the presence of a few major service providers worldwide. The service providers are partnering with several banking institutions globally to expand their services and help these institutions enhance their customer experiences.

In March 2022, Kyash, a Tokyo-based mobile finance software company, raised USD 41.2 million in Series D fundraising (4.9 billion yen). Japan Post Investment Corporation, Block (previously known as Square), Greyhound Capital, SMBC Nikko Securities, Altos Ventures, Goodwater Capital, StepStone Group, JAFCO Group, Mitsui Sumitomo Insurance Capital, and other investors participated in the round.

In January 2022, OneConnect Financial Technology Co., Ltd., a leading technology-as-a-service platform for financial institutions, announced that it had formed a strategic alliance with Chengfang Financial Technology Co., Ltd., a financial technology company started by the People's Bank of China. Under the terms of the agreement, OneConnect and Chengfang Financial Technology will work together to find new uses for data privacy technology in bank surveillance systems, promote the introduction and sharing of new data standards, and find the financial data collaboration and circulation models that businesses need to meet the requirements for secure cloud computing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Study

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Focus on Providing Enhanced In-Branch Customer Experience in the BFSI Industry

- 4.2.2 Increasing Adoption of Self-service Machines

- 4.3 Market Restraints

- 4.3.1 Increasing Adoption of Digital Banking Solutions

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware Maintenance Support and Services

- 5.1.2 Software Maintenance Support and Services

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle-East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 CeleritiFinTech

- 6.1.2 Diebold Nixdorf, Inc.

- 6.1.3 CashLink Global Systems Pvt. Ltd.

- 6.1.4 NCR Corporation

- 6.1.5 Cardtronics Inc.

- 6.1.6 Glory Global Solutions (International) Limited