|

市場調查報告書

商品編碼

1644301

整合平台即服務 (iPaaS):市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Integration Platform-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

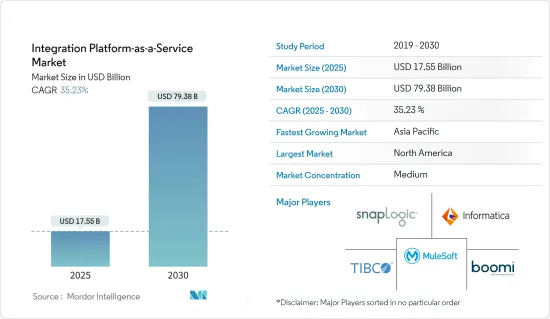

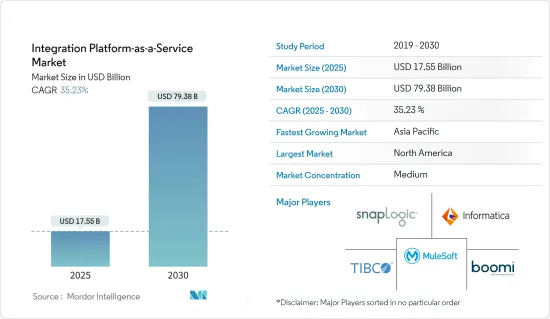

iPaaS(整合平台即服務)市場規模預計在 2025 年為 175.5 億美元,預計到 2030 年將達到 793.8 億美元,預測期內(2025-2030 年)的複合年成長率為 35.23%。

推動市場發展的是全球對先進系統的需求迅速成長,以改善企業應用程式開發、管理和部署的整個過程。

主要亮點

- 此外,組織流程中巨量資料、雲端運算和物聯網的最新進展也在推動 iPaaS 解決方案的擴展。根據英國廣播公司通報,微軟、亞馬遜網路服務、阿里雲和谷歌雲端平台等雲端供應商的收益成長率介於25%至100%之間。這種成長體現了變革的成果:效率和創新推動著規模和速度的持久業務轉型。

- 市場領域的強大參與者正在不斷增強他們的平台,其中包括被認為是下一代整合技術的技術,例如 API 管理、資料中心、B2B 整合和工作流程自動化。 iPaaS 供應商旨在將自己定位在企業應用程式架構中。

- 此外,由於資料中心、物聯網特定整合、即時同步和行動性等關鍵因素正變得越來越重要,因此雲端基礎的整合也已內建。現今的企業擴大將其客戶服務系統與 CRM 系統結合。然而,這些 CRM 系統與 ERP 和 BI/Analytics 的整合仍然存在差距。 IPaaS 解決方案為公司提供 360 度客戶視圖,協助存取敏感資訊並實現業務流程自動化。

- 2022年11月,Qlik推出了新的雲端基礎的資料整合平台服務。 Qlik Cloud Data Integration 是一種企業整合平台即服務,主要為資料工程師使用而開發,他們負責準備和培育其組織的資料以進行資料驅動的決策。新的整合平台即服務將資料編目和準備功能整合到一個地方,使組織能夠即時準備資料以供分析。該平台還包含一組旨在形成資訊結構的服務,可用於使組織能夠整合資料來源以獲得對其資料的全新視圖。

- 然而,採用 IPaaS 解決方案需要大量投資,這可能會抑制整個預測期內的整體市場成長。

- 冠狀病毒大流行也影響了雲端運算產業,多家供應商對突然激增的需求和對雲端基礎設施日益成長的興趣做出了反應。此外,自新冠肺炎疫情爆發以來,各行各業的公司都意識到雲端運算的好處超出了新冠肺炎疫情造成的直接需求。這導致企業熱切地提供廣泛的雲端基礎的解決方案和服務。

iPaaS(整合平台即服務)市場趨勢

零售和電子商務將大幅成長

- 電子商務的快速發展涉及B2B和B2C平台,要求企業處理線上銷售、庫存管理和訂購等多個領域。 IPaaS 解決方案可提供無縫的電子商務整合解決方案,主要整合後端流程、ERP 系統和網站。此外,這些整合工具允許前端和後端系統之間資料的自由流動,同時顯著降低 IT 支出。此外,2022 年 11 月,Aditya Birla Fashion & Retail Ltd. 與老佛爺百貨建立策略夥伴關係關係,在印度開設奢侈品百貨公司和專門的電子商務平台。

- 此外,2022 年 1 月,沃爾瑪宣布已邀請多家印度供應商加入沃爾瑪市場,該市場在美國每月有超過 1.2 億人使用。該公司在印度擁有 Flipkart,並計劃到 2027 年在印度實現每年 100 億美元的出口額。此外,根據美國貿易代表辦公室的數據,2022 年 2 月,騰訊控股有限公司和阿里巴巴集團控股有限公司的電子商務網站被列入美國政府最新的「惡名市場」名單。電子商務行業的這種發展可能會進一步促進所研究市場的成長。

- 此外,這些創新的整合工具還使零售商能夠將其線上市場與 ERP 解決方案連接起來,並瀏覽行動和網路銷售門戶,而無需傳統的傳統整合工具。對於越來越需要改善內部資料管道,或即使是第一次建立內部資料管道的電子商務企業來說,IPaaS 技術都可以證明是一項極其強大的資產。

- 2022年11月,技術服務與顧問公司Wipro Limited推出了基於零售雲端Microsoft Cloud建構的新零售解決方案,作為加州的新零售創新體驗。虛擬、實體和混合體驗加深了 Wipro 和微軟的合作,並加強了新的解決方案產品,使零售商能夠發展和擴大業務並建立更牢固的客戶關係。

- 根據美國人口普查局統計,2023年1月至3月美國零售電商銷售額達約2,730億美元,較上一季成長。美國零售電子商務銷售額的成長可能會顯著促進市場成長。因此,預計整個預測期內它將面臨廣泛的成長機會。

北美可望實現強勁成長

- 預計預測期內北美將大幅成長。這主要是因為該地區擁有多個行業參與者,各個組織迅速採用了雲端基礎的服務。此外,預計有許多因素將推動對 IPaaS 解決方案的需求,包括對高階整合服務日益成長的需求以及工作負載向雲端環境的不斷轉移。

- 此外,根據思科最新的視覺網路指數報告,智慧家庭預計將成為未來幾年物聯網連接成長的主要驅動力之一。到2022年,預計約50%的設備連接將基於IoT/M2M(機器對機器)。

- 根據美國醫療補助服務中心的數據,從最近到 2026 年,美國的醫療保健和醫療保險支出預計每年將增加 5.5%。如果支出繼續以這種速度成長,預計到 2026 年醫療保健成本將達到 5.7 兆美元,這將加劇醫療保健提供者之間的競爭,並需要採用新技術以保持相關性。

- 此外,雲端處理和巨量資料分析的快速成長也推動了該地區對 IPaaS 解決方案的需求。此外,伺服器價格的下降也正在提高全部區域雲端運算業務的採用率,預計這將在預測期內推動對 IPaaS 解決方案的需求。

- 2022 年 12 月—美國通路管理平台和合作夥伴關係管理 (PRM) 供應商 Impartner 與 Syncari 和 Tray.io 等 iPaaS 供應商合作,以促進企業生態系統內的連接並消除不準確的合作夥伴資料。 Impartner 是 Microsoft Dynamics 365 和 Salesforce 的長期整合合作夥伴,但最新的整合彌合了公司額外的直銷系統與 Impartner PRM 之間的差距。

iPaaS(整合平台即服務)產業概覽

iPaaS(整合平台即服務)市場已經趨於固體,許多大大小小的供應商都進入該市場。市場流動性適中,領導企業採用產品創新和併購等策略來增加其解決方案組合併擴大其地理覆蓋範圍。該市場的主要企業包括 Dell Boomi, Inc.、Informatica Corporation 和 Mulesoft。

- 2022 年 8 月 - 行動優先庫存解決方案提供商 Cloud Inventory 和智慧連接和自動化供應商 Boomi 宣布正在擴大合作,為客戶提供更快、更輕鬆的整合。此次合作的重點是使使用任何 ERP 平台的企業能夠快速連接應用程式、資料、人員和設備。這最佳化了會計、訂單管理、庫存和採購等關鍵流程。

- 2022 年 7 月 - 企業資料供應商 TIBCO Software Inc. 宣布對其由 TIBCO Cloud 提供支援的 iPaaS TIBCO Cloud Integration 進行重大增強。這為跨不同混合環境的資料、應用程式和裝置的整合開闢了新的可能性,幫助客戶在動盪的商業世界中導航以改善業務成果。此外,TIBCO Cloud Integration 不僅可讓您整合公司的 IT 資產,還可以非常快速地實現任何業務流程的自動化。企業可以快速回應不斷變化的市場條件並簡化應用程式開發,從而為客戶提供優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 宏觀經濟趨勢對市場的影響

第5章 市場動態

- 市場促進因素

- 物聯網與人工智慧技術的融合

- 組織對簡化業務流程的需求不斷增加

- 市場挑戰

- 初期投資高

第6章 市場細分

- 按部署模型

- 公共雲端

- 私有雲端

- 混合雲端

- 按行業

- BFSI

- 零售與電子商務

- 醫療保健與生命科學

- 製造業

- 資訊科技/通訊

- 媒體與娛樂

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Dell Boomi, Inc.

- Informatica Corporation

- Mulesoft, Inc.

- Snaplogic, Inc.

- TIBCO Software Inc.

- IBM Corporation

- Jitterbit, Inc.

- Oracle Corporation

- Celigo, Inc.

- SAP SE

第8章投資分析

第9章:市場的未來

The Integration Platform-as-a-Service Market size is estimated at USD 17.55 billion in 2025, and is expected to reach USD 79.38 billion by 2030, at a CAGR of 35.23% during the forecast period (2025-2030).

The rapidly increasing requirement for advanced systems to improve the overall process of development, management, and deployment of enterprise applications across the globe has been driving the market.

Key Highlights

- Moreover, the recent advancements in big data, cloud computing, and the Internet of Things within organizational processes have also driven the expansion of iPaaS solutions. According to British Broadcasting Corporation, cloud providers such as Microsoft, Amazon Web Services, Alicloud, and Google Cloud Platform have grown their revenues between 25% and 100%. This growth has shown transformative results, including efficiencies and innovations that drive enduring business change at scale and speed.

- The robust players in the market landscape have continuously enhanced their platforms by including API management, data hubs, b2b integration, and workflow automation, among others believed to be the next-generation integration technologies. The iPaaS vendors aim to position themselves in the enterprise application architecture.

- Furthermore, with the increasing considerations of crucial elements such as data-centric and IoT-focused integrations, real-time synchronization, and mobility, cloud-based integration is incorporated. Enterprises today increasingly use CRM systems to integrate their customer service systems. However, there is still a gap in integrating these CRM systems with the ERP and BI/Analytics. The IPaaS solutions give enterprises a 360-degree view of their customers, help them access sensitive information, and automate their business processes.

- In November 2022, Qlik launched a cloud-based new data integration platform service that combines data from disparate sources in real-time. Qlik Cloud Data Integration is mainly an enterprise integration platform as a service developed for use by data engineers who prepare and cultivate their organization's data, especially for data-informed decision-making. The new integration platform as a service joins data cataloging and preparation capabilities in one place, allowing organizations to ready their data in real time for analysis. The Platform also comprises a set of services, which are primarily designed to form an information fabric and can be used by the organisation in order to make it possible to bring together data sources so that they can gain a complete new view of their data.

- However, the high investment involvement initially in deploying IPaaS solutions could restrain the overall market's growth throughout the forecast period.

- The coronavirus pandemic affected the cloud industry; hence, multiple providers responded to this sudden surge in demand and increased interest in cloud infrastructure. Furthermore, during the post-COVID-19, companies from various industries have realized the benefits of cloud computing beyond the immediate need generated by the COVID-19 pandemic. Hence, they are well-indulged in bringing out a broad spectrum of cloud-based solutions and services.

Integration Platform-as-a-Service Market Trends

Retail & E-commerce to Witness Significant Growth

- The rapid advancement of e-commerce that deals in B2B and B2C platforms has demanded that businesses handle multiple areas such as online selling, inventory management, and placing orders. The IPaaS solutions can provide a seamless e-commerce integration solution primarily to merge the back-end processes, ERP systems, and the website. Moreover, these integration tools also enable the free flow of data across front-end and back-end systems while significantly reducing IT outlays. Additionally, in November 2022, Aditya Birla Fashion and Retail Ltd. joined a strategic partnership with the Galeries Lafayette to open luxury department shops and a dedicated e-commerce platform in India.

- Further, in January 2022, Walmart announced that it had invited a few Indian vendors to join its Walmart Marketplace, which has over 120 million monthly visitors in the United States. The company owns Flipkart in India and aims to export USD 10 billion annually from India by 2027. Also, in February 2022, Tencent Holdings Ltd and Alibaba Group Holding Ltd.'s e-commerce sites were added to the US government's latest "notorious marketplaces" list, according to the US Trade Representative. Such developments in the e-commerce industries may further propel the studied market growth.

- Moreover, these innovative integration tools have also enabled retailers to navigate their online marketplace to be linked up with their ERP solutions to their mobile and web sales portals without using traditional legacy integration tools. For e-commerce organizations, an increasing need to improve their internal data conduits, or even if it is being established for the first time, IPaaS technology can prove to be an immensely powerful asset.

- In November 2022, Wipro Limited, a technology services and consulting company, declared new retail solutions created on the and Cloud for Retail, Microsoft Cloud a new Retail Innovation Experience in California. This virtual, physical, and hybrid Experience would deepen collaboration between Wipro and Microsoft to augment the delivery of new solutions, further allowing retailers to grow and expand their business and build stronger customer relationships.

- As per US Census Bureau, from January to March 2023, U.S. retail e-commerce sales amounted to nearly 273 billion U.S. dollars, marking an increase compared to the previous quarter. This increase in U.S. retail e-commerce sales will drive the market's growth rate significantly. Hence, it is expected to face a broad spectrum of growth opportunities throughout the forecast period.

North America is Expected to Witness Significant Growth

- The North American region is expected to have significant growth during the forecast period, primarily owing to the presence of multiple industry players and the rapid adoption of cloud-based services among various organizations in the region. Numerous factors, such as the increased need for advanced integration services and the increased shift of workloads to the cloud environment, are also expected to drive the demand for IPaaS solutions.

- Moreover, according to Cisco's latest Visual Networking Index report, smart homes are expected to be one of the key drivers of IoT connectivity growth during the next few years. In 2022 the company reached around 50% of the 28.5 billion device connections based on IoT/machine-to-machine (M2M).

- According to the US Centers for Medicaid Services, healthcare and Medicare spending acorss the United States is also projected to increase by 5.5% annually from recent through 2026. If the expenditure increases at this rate, by 2026, healthcare spending is projected to reach USD 5.7 trillion, which indicates stronger competition among healthcare providers, creating the need to embrace new technologies to sustain.

- Cloud computing and big data are rapidly growing analytics also drives the demand for IPaaS solutions in the region. Moreover, the declining prices of servers have also improved the adoption of cloud computing businesses across the North American region, which is expected to fuel the demand for IPaas solutions over the forecast period.

- In December 2022 - Impartner, headquartered in the United States, a channel management platform and partner relationship management (PRM) provider, partnered with iPaaS providers such as Syncari, Tray.io, and others to facilitate connections in a company's ecosystem and eliminate inaccurate partner data. While Impartner has been a longstanding integrated partner with Microsoft Dynamics 365 and Salesforce, the recent integrations bridge the gap between a corporation's additional direct sales systems and Impartner PRM.

Integration Platform-as-a-Service Industry Overview

The Integration Platform-as-a-Service Market is semi-consolidated owing to the presence of various small and large vendors working in the markets. The market is moderately Fragemented, with the influential players adopting strategies like product innovation and mergers and acquisitions to increase their solutions portfolio and extend their geographic reach. Some of the major players in the market are Dell Boomi, Inc., Informatica Corporation, and Mulesoft, among others.

- August 2022 - Cloud Inventory, a provider of mobile-first inventory solutions, and Boomi, an intelligent connectivity and automation player, announced an expanded collaboration to provide faster, easier integration for customers. The partnership mainly empowers companies using any ERP platform to quickly connect applications, data, people, and devices. This optimizes critical processes, including accounting, order management, inventory, and procurement.

- July 2022 - TIBCO Software Inc., a provider of enterprise data, TIBCO Cloud Integration, its industry recognized iPaaS offering, powered by TIBCO Cloud, has announced significant enhancements. This expands the overall potential for integrating data, applications, and devices across various hybrid environments, helping customers grapple with a volatile business world to enhance business outcomes. Also, a remarkably rapid automation of all business processes as well as the integration of IT assets within an enterprise is achieved through TIBCO Cloud Integration. Businesses can react to changing market conditions more quickly and provide their customers with an edge by simplifying the development of applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Convergence of IoT and AI Technologies

- 5.1.2 Increasing Demand From Organizations to Streamline Business Processes

- 5.2 Market Challenges

- 5.2.1 High Initial Investment

6 MARKET SEGMENTATION

- 6.1 By Deployment Model

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Retail & E-commerce

- 6.2.3 Healthcare and Life Science

- 6.2.4 Manufacturing

- 6.2.5 IT & Telecom

- 6.2.6 Media & Entertainment

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Boomi, Inc.

- 7.1.2 Informatica Corporation

- 7.1.3 Mulesoft, Inc.

- 7.1.4 Snaplogic, Inc.

- 7.1.5 TIBCO Software Inc.

- 7.1.6 IBM Corporation

- 7.1.7 Jitterbit, Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Celigo, Inc.

- 7.1.10 SAP SE