|

市場調查報告書

商品編碼

1644306

加密資產管理 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Crypto Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

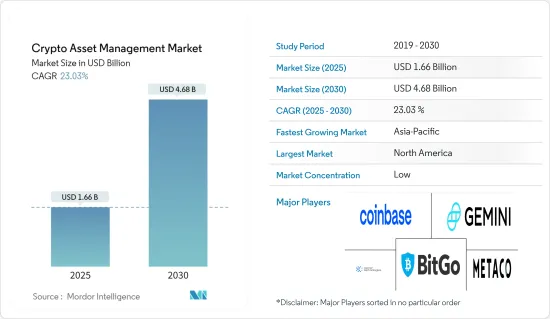

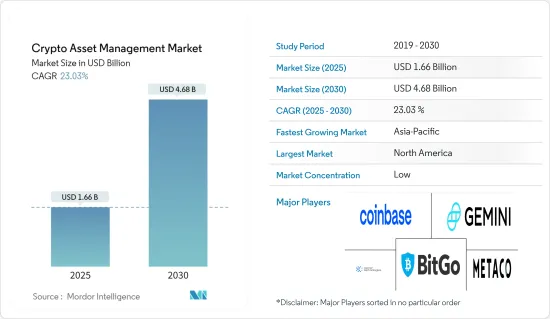

加密貨幣管理市場規模預計在 2025 年為 16.6 億美元,預計到 2030 年將達到 46.8 億美元,預測期內(2025-2030 年)的複合年成長率為 23.03%。

資產管理產業的發展,加上加密基金投資的增加,預計將影響未來幾年加密資產管理市場的成長。

關鍵亮點

- 近年來,由於區塊鏈技術的進步,加密貨幣引起了人們的極大興趣。隨著加密貨幣的發展勢頭強勁,加密貨幣市場對可靠投資選擇的需求也日益成長。此外,新興的區塊鏈技術有可能擴展數位資產大規模成長的服務,並為多個終端用戶產業提供多功能業務應用程式。這將在預測期內極大地推動對加密資產管理的需求。

- 此外,越來越多的機構投資者和財富管理師開始投資加密貨幣,消費者和各種終端用戶機構(如 BFSI 和零售商)也擴大採用加密貨幣。在預測期內,加密貨幣、數位資產和區塊鏈技術的現有和未來發展將進一步推動加密資產管理平台的採用。

- 此外,許多資產管理平台利用 AI/ML 程式根據用戶的投資目標創建投資組合。它還可以幫助您追蹤和管理大量資產。這些因素,加上加密產業和新數位資產的日益普及,將進一步推動對加密資產管理平台的需求。

- 然而,缺乏對加密貨幣的認知和技術理解,以及安全問題和各國嚴格的監管環境,可能會限制預測期內加密資產管理市場的成長。

- 新冠疫情嚴重擾亂了傳統的投資場景。這使得數位加密貨幣市場變得更具吸引力。疫情引發了全球經濟危機,而加密貨幣由於其硬性和通貨緊縮性,成為應對經濟動盪的一個有吸引力的選擇。此外,疫情爆發也刺激了雲端基礎的加密資產管理的需求,並推動了更深層的數位化,對市場成長產生了積極影響。

加密貨幣管理市場的趨勢

BFSI 產業預計將佔據主要市場佔有率

- 該領域對區塊鏈或分散式帳本技術的日益廣泛採用預計將導致 BFSI 領域對加密貨幣的投資增加。例如,透過建立分散式付款帳本(如比特幣),銀行解決方案可以實現比傳統系統更快的付款和更低的費用。

- 近年來,隨著向行動銀行等數位化主導的經營模式的轉變,區塊鏈技術的採用迅速在世界各地的銀行和金融機構中獲得了顯著的關注。此外,加密交易的成長也推動了銀行業對財富管理平台的需求。例如,根據 BitInfoCharts 的資料, 2022 年 9 月,區塊鏈上比特幣的每日交易數量達到 286,500 筆,而 2021 年 12 月為 269,390 筆。

- 全球越來越多的金融機構參與加密貨幣和區塊鏈。例如,2022 年 9 月,法國市值第三大銀行法國興業銀行 (GLE) 為其資產管理客戶推出了新服務,以滿足投資者對加密貨幣日益成長的需求。新推出的服務使資產管理者能夠在歐洲監管框架內以簡單、合規的方式提供加密基金。此類舉措和案例有望推動加密資產管理解決方案在 BFSI 行業中的採用。

- 此外,加密貨幣的日益普及導致銀行業廣泛採用加密資產管理平台來有效地服務機構投資者。例如,2023 年 2 月,德國資產規模第二大銀行 DZ Bank 宣布與數位資產公司 Metaco 合作,將數位貨幣完全整合到其資產管理服務中。該銀行已選擇數位資產公司 Metaco 的託管平台 Harmonize 為其機構客戶列出數位貨幣。

北美可望主導市場

- 由於美國和加拿大廣泛採用比特幣和加密貨幣,北美預計將在全球加密資產管理市場中佔據主導地位。此外,美國是加密貨幣交易的主要市場之一,因此資產管理解決方案的採用迅速。

- 此外,北美在終端用戶產業中已經明顯採用區塊鏈,並且已經迅速適應了這項技術。此外,知名市場供應商的存在也是市場的主要動力。早期採用先進技術和數位化預計將推動該地區加密資產託管市場的成長。

- 此外,預計在預測期內,美國各個終端使用者群體的採用率將持續提高,進而推動該國財富管理平台市場的發展。例如,2022年10月,美國銀行紐約梅隆銀行宣布其數位資產託管平台在美國運作,允許部分客戶發送和持有比特幣和以太幣。此項服務強化了紐約梅隆銀行致力於滿足客戶對值得信賴的傳統和數位資產定序提供者的需求的承諾。

- 此外,越來越多的美國企業使用加密貨幣和其他數位資產進行管理、投資和交易,為未來幾年資產管理市場供應商創造龐大的商機。

加密貨幣管理行業概覽

由於加密貨幣在世界各地日益普及,加密資產管理市場的競爭格局預計將變得越來越分散。此外,一些中小型全球參與企業的出現也有望推動市場成長。現有的市場參與企業正在不斷推出新產品並做出多項創新以擴大其市場佔有率。

2022 年 10 月,專注於加密貨幣的資產管理公司 BlockTower推出了其創業投資部門,籌集了一隻 1.5 億美元的新基金,用於支持去中心化金融 (DeFi) 和區塊鏈基礎設施計劃。

2022 年 5 月,針對散戶和機構投資者的加密貨幣平台 Blockchain.com 宣布將與澤西島投資經理 Altis Partners 合作推出一個新的加密資產管理平台。新平台名為 Blockchain.com Asset Management(BCAM),列出了針對家族辦公室、機構和高淨值人士的受監管的投資產品。 Altis Partners 管理投資,Blockchain.com 提供加密交易基礎設施、安全性、研究和軟體服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 終端用戶產業擴大採用區塊鏈技術

- 加密貨幣資產安全受到越來越多的關注

- 擴大採用加密貨幣進行匯款和交易

- 市場限制

- 缺乏集中法規結構

- 缺乏技術知識和意識

第6章 市場細分

- 按類型

- 解決方案

- 託管解決方案

- 代幣化解決方案

- 匯款解決方案

- 交易解決方案

- 服務

- 解決方案

- 依部署方式

- 雲

- 本地

- 按最終用戶產業

- BFSI

- 零售與電子商務

- 媒體與娛樂

- 其他終端使用者產業(醫療保健、旅遊、旅館業)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- BitGo, Inc.

- Coinbase, Inc.

- Gemini Trust Company, LLC

- Cipher Technologies Management LP

- Metaco SA

- Amberdata Inc.

- Paxos Trust Company, LLC

- Crypto Finance Group

- Bakkt

- ICONOMI Limited

第8章投資分析

第9章 市場機會與未來趨勢

The Crypto Asset Management Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 4.68 billion by 2030, at a CAGR of 23.03% during the forecast period (2025-2030).

The evolution of the asset management industry, coupled with increasing investments in crypto funds, is analyzed to influence the crypto asset management market growth in the coming years.

Key Highlights

- Blockchain technology advances have generated significant interest in cryptocurrencies over the past few years. As crypto gains momentum, there is a growing demand for reliable investment options in the crypto market. In addition, emerging blockchain technology has the potential to offer multipurpose business applications across several end-user industries, extending its services across the enormous growth of digital assets. Thus significantly driving the demand for crypto asset management over the forecast period.

- Further, an increasing number of institutional investors and wealth managers started investing in cryptocurrencies, coupled with growth in cryptocurrency adoption by consumers and various end-user institutions such as BFSI and retail. The adoption of a crypto asset management platform will be further fostered during the forecast period by the existing and future developments in cryptocurrencies, digital assets, and blockchain technology.

- Moreover, many asset management platforms utilize AI/ML programs that create portfolios according to the investment goals of the users. They also help to track and manage a large number of assets. Such factors further boost the demand for crypto asset management platforms with the increasing popularity of the crypto industry and new digital assets.

- However, a lack of awareness and technical understanding regarding cryptocurrency coupled with security issues and a stringent regulatory landscape in various countries may limit the growth of the crypto asset management market over the forecast period.

- The COVID-19 pandemic largely disrupted the traditional investment scenario. This further made the digital cryptocurrency space increasingly attractive. The pandemic led to a global economic crisis, which made crypto an attractive option to combat economic disruption due to its hard, deflationary nature. Additionally, the outbreak fostered the demand for cloud-based crypto asset management and pushed the drive toward deeper digitalization, thus positively impacting the market growth.

Crypto Asset Management Market Trends

BFSI Industry Expected to Hold Significant Market Share

- The growing adoption of blockchain or distributed ledger technologies in the sector is expected to increase investment by the BFSI sector in cryptocurrency. For instance, by establishing a decentralized payment ledger (e.g., Bitcoin), banking solutions could facilitate faster payments at lower fees than traditional systems.

- In recent years, the adoption of blockchain technology is rapidly gaining significant traction in banking and institutions across the globe owing to the move towards digitalization-driven business models like mobile banking. Further, the growth in crypto transactions is also enhancing the demand for asset management platforms in the banking sector. For instance, according to the data from BitInfoCharts, the number of Bitcoin transactions per day on blockchain reached 286.5 thousand in September 2022 compared to 269.39 thousand in December 2021.

- More and more financial institutions worldwide are getting involved in crypto assets and blockchain. For instance, in September 2022, Societe Generale (GLE), the third-largest French bank by market cap, introduced new services for asset manager clients looking to respond to the increased demand from investors for cryptocurrencies. The newly launched services will enable asset managers to offer crypto funds in a simple and adapted way within a framework compliant with European regulations. Such initiatives and instances are expected to boost crypto asset management solutions adoption in the BFSI industry.

- Further, the rising popularity of cryptocurrency led to the high adoption of crypto asset management platforms in the banking sector to effectively serve institutional investors. For instance, in February 2023, DZ Bank, Germany's second-largest bank regarding asset size, announced to fully integrate of digital currencies into its asset management services in partnership with the digital asset firm Metaco. The bank selected the digital asset firm Metaco's custody platform Harmonize to provide digital currencies to its institutional clients.

North America Expected to Dominate the Market

- North America is expected to dominate the crypto asset management market globally, owing to the dominance of the United States and Canada in adopting Bitcoin or Cryptocurrencies. In addition, the US is one of the prominent markets for crypto trading and transactions, thus driving the adoption of asset management solutions rapidly.

- Also, North America is an early technological adaptor with significant blockchain adoption in end-user industries. In addition, the presence of prominent market vendors also drives the market at a significant pace. The early adoption of advanced technologies and digitization is expected to fuel the growth of the crypto asset management market in the region.

- Moreover, the growing adoption in various end-user segments across the United States is expected to drive the asset management platform market in the country over the forecast period. For instance, in October 2022, American Bank, BNY Mellon, announced that its Digital Asset Custody Platform is live in the United States, With select clients now able to transfer and hold bitcoin and ether. This offering reinforces BNY Mellon's commitment to supporting its client demand for a trusted traditional and digital asset servicing provider.

- Moreover, an increasing number of businesses in the United States are using cryptocurrencies and other digital assets for a host of operational, investment, and transactional purposes, thus creating significant opportunities for asset management market vendors in the coming years.

Crypto Asset Management Industry Overview

The competitive landscape of the Crypto Asset Management Market is expected to gradually move towards fragmentation, owing to the increasing adoption of cryptocurrency across the globe. Also, the emergence of several small and medium-sized global players is expected to help the market grow. The existing market players are increasingly making new product launches or several innovations to boost their market presence.

In October 2022, Crypto-focused asset-management company BlockTower launched a venture capital arm with a new USD 150 million fund to back decentralized finance (DeFi) and blockchain-infrastructure projects.

In May 2022, Blockchain.com, a cryptocurrency platform for individuals and institutions, announced the launch of a new crypto asset management platform with Altis Partners, a Jersey-based investment Manager. The new platform is called Blockchain.com Asset Management (BCAM) and offers regulated investment products for family offices, institutional investors, and high-net-worth individuals. Altis Partners will manage the investments, and Blockchain.com will provide the crypto trading infrastructure, security, research, and software services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Blockchain Technology Across End-user Industries

- 5.1.2 Increasing Focus on the Security of Cryptocurrency Assets

- 5.1.3 Growing Adoption of Cryptocurrency for Remittances and Trading Purposes

- 5.2 Market Restraints

- 5.2.1 Lack of a Centralized Regulatory Framework

- 5.2.2 Lack of Technical Knowledge and Awareness of the Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions**

- 6.1.1.1 Custody Solutions

- 6.1.1.2 Tokenization Solutions

- 6.1.1.3 Transfer & Remittance Solutions

- 6.1.1.4 Trading Solutions

- 6.1.2 Services

- 6.1.1 Solutions**

- 6.2 By Deployment Mode

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Retail & E-commerce

- 6.3.3 Media & Entertainment

- 6.3.4 Other End-user Industries (Healthcare, Travel & Hospitality)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BitGo, Inc.

- 7.1.2 Coinbase, Inc.

- 7.1.3 Gemini Trust Company, LLC

- 7.1.4 Cipher Technologies Management LP

- 7.1.5 Metaco SA

- 7.1.6 Amberdata Inc.

- 7.1.7 Paxos Trust Company, LLC

- 7.1.8 Crypto Finance Group

- 7.1.9 Bakkt

- 7.1.10 ICONOMI Limited