|

市場調查報告書

商品編碼

1644308

認知操作:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Cognitive Operations - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

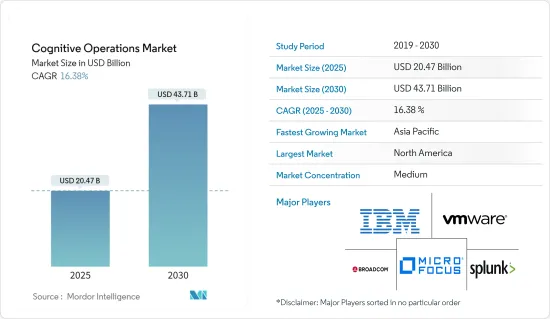

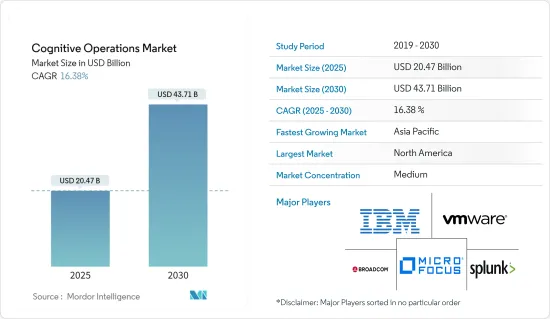

認知營運市場規模預計在 2025 年為 204.7 億美元,預計到 2030 年將達到 437.1 億美元,預測期內(2025-2030 年)的複合年成長率為 16.38%。

主要亮點

- 企業正在將其關鍵任務業務應用程式遷移到雲端,因為擴充性、低成本且易於部署。透過利用雲端基礎的技術,預測分析技能可以快速整合到各種企業應用程式中。這些優勢可能會推動雲端基礎的認知操作解決方案的需求。

- 隨著技術達到新的水平,機器人流程自動化 (RPA) 將與認知操作結合。認知 RPA 使用自然語言處理 (NLP)、光學字元辨識 (OCR) 和機器學習來理解大量資料,從而提高生產力、可擴展性和效率。透過將認知過程與 RPA 結合,聊天機器人可以使用企業資料並導航傳統企業系統,以更好地管理來自客戶和員工的複雜即時請求。

- 新冠肺炎疫情為社區和企業的生活帶來了重大變化。不斷變化的客戶購物行為和需求促使企業實施自動化流程以保持競爭力。認知運算在電子商務行業的應用使公司能夠監控買家的購物行為,包括品牌偏好、線上購買頻率和店內導航模式。同樣,認知解決方案可以根據您的行業進行客製化,以幫助擴大您的業務並產生收入。

- 認知業務的初始投資很高。為這些系統創建軟體需要很長時間,並且需要高技能的開發團隊。系統需要利用大量資料集進行廣泛而徹底的訓練才能理解特定的業務和程序。由於這些因素,企業很難說服其他人採用認知操作,因此市場成長緩慢。

認知操作市場趨勢

IT 和通訊領域強勁成長

- 認知服務有助於將您的通訊後勤部門轉變為專業的客戶服務團隊。此外,通訊業可以透過為顧客關懷機器人實現自然語言解釋和文字翻譯的自動化來改善基本業務運作。智慧網路營運,即認知網路營運中心,使用人工智慧 (AI)、機器學習 (ML) 和高級分析來支援自我修復、自我最佳化和自主傳輸網路。

- IT 和通訊業的認知操作解決方案可以幫助從使用者和網路產生的大量資料中提取有價值的見解。這提高了客戶體驗。認知服務將透過自動協助機器人理解自然語言和翻譯文本,使電訊業能夠更好地執行基本業務功能。

- 領先的對話式 AI 公司之一 Jio Haptik 正在利用 Microsoft Azure 認知服務來提高其現有印地語對話式 AI 模型的準確性和效率。這項業界領先的人工智慧翻譯技術是印地語、英語甚至印式英語端到端互動的關鍵推動因素,使用戶可以與 Jio Mobility 的智慧虛擬助理聊天。

- 隨著網路攻擊的增加以及知識淵博的網路安全負責人的短缺,公司需要認知運算等現代技術來對抗因資料量不斷成長而產生的網路風險。認知演算法可以提供識別虛假資訊和欺騙性資料的技術手段,有助於防止網路攻擊。因此,客戶不太容易受到操縱。

- 《富比士》聲稱,每年的資料量成長速度比以往任何時候都快。到2025年,預計每人每秒將產生3.2GB的資訊。光是一年時間,全球資料總量就將達到64兆GB。透過採用認知操作,組織可以獲得正確的知識,從而做出更快、更準確的業務決策。

亞太地區將迎來顯著成長

- 由於新加坡、澳洲、中國和印度等國家在技術方面的支出不斷增加,亞太地區預計將成為資料管治成長最快的地區。中小型企業需要經濟實惠的資料管理和管治解決方案和服務。這推動了該地區對認知營運市場的需求。

- 該地區對智慧製造和數位化的投資不斷增加,推動了對認知操作的需求。認知製造可幫助公司在產品開發的所有階段(從設計到生產再到保固服務)始終關注品質。

- 根據 IBM 商業價值研究院的一項研究,財富 500 強公司可能會因庫存放錯或製造錯誤的 SKU 和通路組合而損失 2% 至 5% 的收益。透過開發數位孿生、規範和認知能力,企業可以將供應鏈生產力提高 10% 至 15%,將非增值工作減少 50% 至 60%,並將中斷的回應時間從幾天縮短到幾小時或幾分鐘。

認知操作產業概覽

認知操作市場競爭相對不激烈,只有少數參與者利用其產品。然而,在研究期間仍有巨大的成長潛力。這些認知營運提供者正在發布整合人工智慧技術的改進產品,以降低成本、提高客戶滿意度並提高使用非結構化資料的複雜業務流程的準確性。隨著企業向數位技術轉變,其擴張範圍也不斷擴大。在該領域提供服務的一些重要公司包括 Micro Focus International Plc、Broadcom Corporation、IBM Corporation 和 VMware, Inc.

- 2023 年 3 月 - 保險科技新興企業i3systems 與 Microsoft Azure 合作,為關鍵的 BFSI 流程帶來業界領先的文件和資料智慧準確性。 i3systems 的特定領域 AI 模型由 Microsoft Azure Cognitive Vision 提供支援,可為健康和人壽保險公司提供協助。 i3systems 用戶注意到客戶 NPS 顯著改善,處理時間和成本減少了 70%。

- 2022 年 10 月-塔塔諮詢服務公司推出認知業務營運解決方案 TCS Cognix。它是一個預先建立的、人工智慧主導的人機協作套件,將業務流程管理、IT 應用程式或軟體、資料中心和伺服器整合在一個產品中。 COGNIZ 為財務長提供現金流量指揮中心,提供有關公司將收到多少錢的資料以及預測,包括哪些客戶遇到付款困難。

- 2022 年 8 月 – Operaize 加入 SAP PartnerEdge 製造業計劃,以加速基於 AI 的雲端生產計畫和調度創新。 Operaize 將把其基於 AI 的生產計畫和調度解決方案 Cognitive Operations 與 SAP ERP Central Component (SAP ECC) 和 SAP S/4HANA 中的生產計畫元件結合。該解決方案利用人工智慧來推動客戶價值、實現速度和準確性,同時管理複雜性。該解決方案使客戶能夠將卓越營運提升到新的高度。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 越來越注重選擇雲端基礎的認知 IT 營運解決方案

- 監控複雜 IT 環境的需求不斷增加

- 市場限制

- 將認知操作能力與目前系統結合

- 缺乏技能和專業知識

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場區隔

- 按組件

- 解決方案

- 按服務

- 依部署方式

- 雲

- 本地

- 按公司規模

- 大型企業

- 中小型企業

- 按應用

- IT 營運分析

- 應用程式效能管理

- 網路分析

- 安全分析

- 基礎設施管理

- 其他用途

- 按行業

- BFSI

- 醫療保健與生命科學

- 資訊科技和電信

- 零售與電子商務

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭格局

- 公司簡介

- Broadcom Inc.

- IBM Corporation

- VMware, Inc.

- Micro Focus International Plc

- Splunk Inc.

- HCL Technologies Limited

- BMC Software, Inc.

- New Relic, Inc.

- CloudFabrix Software Inc.

- Servicenow Inc.

- Loom Systems Inc.

- Dynatrace LLC

- Interlink Software Services Ltd

- DEVO Technology Inc.

- Correlata Solutions Inc

- ScienceLogic Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Cognitive Operations Market size is estimated at USD 20.47 billion in 2025, and is expected to reach USD 43.71 billion by 2030, at a CAGR of 16.38% during the forecast period (2025-2030).

Key Highlights

- Organizations are moving their essential business apps to the cloud because of its scalability, lower cost, and ease of deployment. Predictive analytics skills can be swiftly integrated into a variety of corporate applications with the use of cloud-based technologies. These advantages likely increase demand for cloud-based cognitive operations solutions.

- As the technology reaches the next level, Robotic Process Automation (RPA) integrates with Cognitive Operations. Cognitive RPA is utilized to produce higher productivity, scalability, and enhanced efficiency since it can use Natural Language Processing (NLP), Optical Character Recognition (OCR), and Machine Learning to make sense of masses of data. Integrating cognitive processes with RPA helps Chatbots better manage complicated, real-time requests from customers and employees by using company data and navigating legacy enterprise systems.

- The Covid-19 outbreak brought a significant transformation in the lives of communities and businesses. Customer shopping behavior and demand changes urged companies to adopt automated processes to remain competitive. By using Cognitive Computing in the e-commerce industry, companies can monitor the shopping behavior of the buyers, like their brand preference, online purchase frequency, navigation pattern in the store, and so on. Similarly, based on the industry, cognitive solutions can be customized and help businesses expand and generate revenue.

- The initial investment in cognitive operations is high. It takes a long time and requires skilled development teams to create the software for these systems. The systems need extensive, in-depth training with large data sets to understand specific jobs and procedures. Due to these factors, the companies are not easily convinced to adopt these cognitive operations, and thus, there is slow growth in the market.

Cognitive Operations Market Trends

IT and Telecommunication Segment to Grow Significantly

- Cognitive services help to transform the telecom back offices into an expert customer care team. Further, the telecommunications sector can improve its essential business operations by automating customer care bots' interpretation of natural language and text translation. Intelligent network operations, often called a cognitive network operations center, use artificial intelligence (AI), machine learning (ML), and advanced analytics to support self-healing, self-optimized, and autonomous transport networks.

- The IT and telecom vertical leverages cognitive operations solutions to extract valuable insights from the massive amounts of data user networks create. It thereby improves customer experience. Cognitive services enable the telecoms sector to perform its essential business functions better by automating assisting robots by understanding natural language and translating text.

- One of the top conversational AI firms, Jio Haptik, is enhancing the accuracy and efficiency of its existing Hindi conversational AI models by leveraging Microsoft Azure Cognitive Services. This industry-leading AI translation technology enables end-to-end dialogues in Hindi, English, and even Hinglish and is a crucial component allowing users to chat with the Intelligent Virtual Assistants at Jio Mobility.

- Due to the rise in cyberattacks, and the shortage of knowledgeable cybersecurity personnel, companies need contemporary techniques like cognitive computing to battle these cyber risks due to the growth in data volume. Cognitive algorithms will help prevent cyberattacks by offering a technical means of spotting false information and deceptive data. Hence customers will be less vulnerable to manipulation.

- Forbes claims that annual data production is increasing more quickly than ever. Every person will generate 3.2 GB of information every second by 2025. The total data worldwide will reach 64 trillion GB in just one year. The organization will include proper knowledge to make business decisions more quickly and accurately after adopting cognitive operations.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific is projected to be the fastest-growing data governance region because of the rising spending on technology in countries like Singapore, Australia, China, and India. Small and medium-sized organizations (SMEs) need affordable data management and governance solutions and services. It drives the region's cognitive operations market need.

- The region is further investing in smart manufacturing and digitization, driving the need for cognitive operations. With the help of cognitive manufacturing, businesses can maintain a laser-like focus on quality across all stages of a product's development, from design to production and warranty service.

- According to research from the IBM Institute for Business Value, Fortune 500 businesses can lose between 2% and 5% of revenue due to misplacing inventory or manufacturing the wrong SKU and channel mix. Companies can increase supply chain productivity by 10% to 15%, decrease non-value-added work by 50% to 60%, and reduce their response time to disruptions from days to hours or minutes as they develop their digital twin, prescriptive and cognitive capabilities.

Cognitive Operations Industry Overview

Since only some players leverage their offerings in Cognitive Operations Market, there is moderate competition. However, there is vast potential for growth during the studied period. These Cognitive Operation providers release improved products with AI technology integrated, resulting in cost savings, more client satisfaction, and improved accuracy in complex business processes using unstructured data. As businesses shift to digital technologies, they include a wider scope of expansion. Some significant companies offering their services in this sector include Micro Focus International Plc, Broadcom Corporation, IBM Corporation, and VMware, Inc., among others.

- March 2023- i3systems, an insurtech startup, partnered with Microsoft Azure to provide industry-leading document and data intelligence accuracy for critical BFSI processes. i3systems' domain-specific AI models backed by Microsoft Azure Cognitive Vision are helping health and life insurance companies. Users of i3systems noticed a considerable improvement in customer NPS and a 70% reduction in processing time and cost.

- October 2022- Tata Consultancy Services launched TCS Cognix, the cognitive business operation solution. It is an AI-driven, pre-built human-machine collaboration suite that combines business process management, IT applications or software, data centers, and servers into a single offering. COGNIZ cash flow command center for CFO will provide data on how much money their firm will receive and a forecast of which customers they include payment troubles with.

- August 2022- Operaize joins the SAP PartnerEdge program in the manufacturing industry to accelerate innovation for AI-based production planning and scheduling in the cloud. Operaize integrates its AI-based production planning and scheduling solution Cognitive Operations with the production planning component within SAP ERP Central Component (SAP ECC) and SAP S/4HANA. The solution drives customer value using artificial intelligence to achieve speed and accuracy while managing complexity at the same time. It helps customers to take their operational excellence to new heights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Focus Toward Selection of Cloud-Based Cognitive IT Operations Solutions

- 4.2.2 Rising Demand for Monitoring the Complex IT Environment

- 4.3 Market Restraints

- 4.3.1 Integration of Cognitive Operations Capabilities With the Present Systems

- 4.3.2 Dearth of Skills and Expertise

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-Premises

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-Sized Enterprises

- 5.4 By Application

- 5.4.1 IT Operations Analytics

- 5.4.2 Application Performance Management

- 5.4.3 Network Analytics

- 5.4.4 Security Analytics

- 5.4.5 Infrastructure Management

- 5.4.6 Other Applications

- 5.5 By Industry Vertical

- 5.5.1 BFSI

- 5.5.2 Healthcare & Life Sciences

- 5.5.3 IT & Telecom

- 5.5.4 Retail & E-commerce

- 5.5.5 Other Industry Verticals

- 5.6 Geography

- 5.6.1 North America

- 5.6.2 Europe

- 5.6.3 Asia-Pacific

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Broadcom Inc.

- 6.1.2 IBM Corporation

- 6.1.3 VMware, Inc.

- 6.1.4 Micro Focus International Plc

- 6.1.5 Splunk Inc.

- 6.1.6 HCL Technologies Limited

- 6.1.7 BMC Software, Inc.

- 6.1.8 New Relic, Inc.

- 6.1.9 CloudFabrix Software Inc.

- 6.1.10 Servicenow Inc.

- 6.1.11 Loom Systems Inc.

- 6.1.12 Dynatrace LLC

- 6.1.13 Interlink Software Services Ltd

- 6.1.14 DEVO Technology Inc.

- 6.1.15 Correlata Solutions Inc

- 6.1.16 ScienceLogic Inc.