|

市場調查報告書

商品編碼

1644321

中東太陽能光電:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Middle-East Solar Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

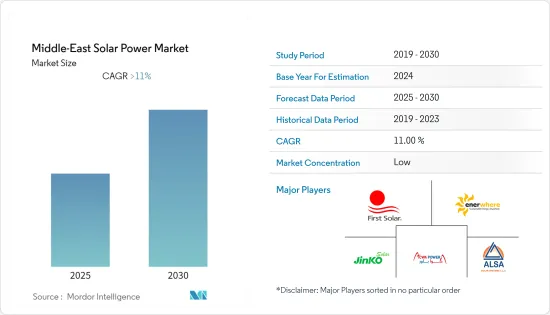

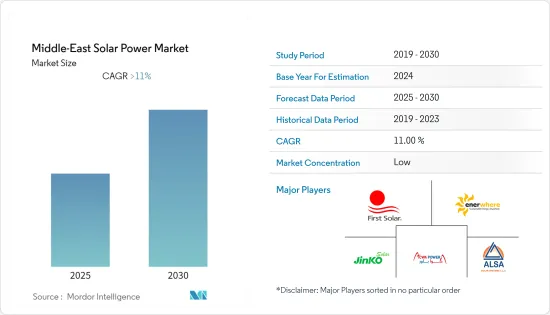

預測期內,中東太陽能市場預計將以超過 11% 的複合年成長率成長。

2020年第一季的新冠疫情對中東太陽能光電市場造成了一定影響。由於太陽能板出貨延遲,沙烏地阿拉伯、科威特和卡達等一些國家的 2020 年新增安裝量大幅下降。 2021年,市場復甦。

關鍵亮點

- 政府的支持性政策、加強利用再生能源來源滿足電力需求的力度以及減少對石化燃料的依賴等因素預計將成為推動市場發展的主要因素。此外,許多雄心勃勃的太陽能發電工程計畫在預測期內實施,預計將在未來幾年推動太陽能發電市場的發展。

- 然而,大型太陽能發電工程推遲以及對替代能源的日益關注等因素預計將阻礙市場成長。

- 即將在該地區實施的太陽能發電工程以及混合電力解決方案的利用很可能在不久的將來為太陽能市場創造巨大的機會。

- 由於預測期內大量正在進行和即將開展的計劃,預計沙烏地阿拉伯的需求將大幅增加。

中東太陽能發電市場趨勢

光伏(PV)計劃推動市場

- 光伏 (PV) 電池是包含光伏材料的電池陣列,可將來自太陽的輻射或能量轉換為直流電。 2022 年,光伏 (PV) 太陽能板佔中東地區太陽能組裝機量的 96.57% 以上。

- 中東地區太陽能發電裝置容量預計將從 2021 年的 923.9 萬千瓦增加到 2022 年的 1,244 萬千瓦。預計即將實施的計劃將在預測期內進一步增加產能。

- 2022 年 10 月,水務採購公司(OPWP)和阿曼電力公司在阿曼西北部伊布里啟動第二個大型太陽能光伏(PV)計劃的競標。新的伊布里三期太陽能獨立發電工程(IPP)的太陽能發電能力將達到 500MW。新工廠預計將於 2026 年第四季開始商業運作。

- 2023年2月,穆巴拉克鋼鐵公司預計將為伊斯法罕省庫赫帕耶縣的一座600兆瓦太陽能發電廠提供資金。該計劃預計投資5億美元。第一階段預計將在2023年7月為國家電網增加近100兆瓦的發電量。

- 隨著沙烏地阿拉伯和阿拉伯聯合大公國等國家有多個計劃在建或處於競標階段,預計預測期內太陽能發電量將大幅成長,推動中東地區太陽能市場的發展。

沙烏地阿拉伯主導市場

- 在沙烏地阿拉伯,裝置容量的成長是由國家可再生能源計畫推動的,該計畫的目標是到 2030 年實現 35 個可再生計劃和 58.7 吉瓦的裝置容量。

- 沙烏地阿拉伯2022年的太陽能光電裝置容量為440兆瓦,預計未來幾年還會成長。此外,沙烏地阿拉伯的太陽能光電裝置容量預計將從 2020 年的 59 兆瓦增加到 2022 年的 390 兆瓦。

- 2022年11月,ACWA Power與水力發電控股公司(Badeel)簽署協議,在麥加省的Al Shuaibah 開發世界上最大的單站點太陽能發電廠。該太陽能發電廠的發電容量為 2,060 兆瓦,計劃於 2025年終投入營運。

- 此外,據工業和礦產資源部稱,沙烏地阿拉伯於 2022 年 3 月啟動了一項新計劃,以支持綠色能源努力並減少對原油的依賴。該部還計劃為可再生能源企業提供稅收減免和其他激勵措施。

- 因此,基於上述事實,預計預測期內沙烏地阿拉伯將在中東地區太陽能市場出現巨大需求。

中東太陽能產業概況

中東太陽能光電市場中等程度細分。該市場的主要企業包括晶科能源控股、First Solar Inc.、Enerwhere Sustainable Energy DMCC、ACWA POWER BARKA SAOG 和 Alsa Solar Systems LLC(不分先後順序)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2028 年裝置容量及預測(單位:吉瓦)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 技術板塊

- 光伏 (PV)

- 聚光型太陽光電(CSP)

- 地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 阿曼

- 其他中東地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- JinkoSolar Holding Co. Ltd.

- First Solar Inc

- Enerwhere Sustainable Energy DMCC

- ACWA POWER BARKA SAOG

- Alsa Solar Systems LLC

- Enviromena Power Systems

- Trina Solar Ltd.

- JA SOLAR Co. Ltd.

- Sungrow Power Supply Co. Ltd.

- Hitachi Energy Ltd.

- Canadian Solar Inc.

第7章 市場機會與未來趨勢

The Middle-East Solar Power Market is expected to register a CAGR of greater than 11% during the forecast period.

With the COVID-19 outbreak in Q1 2020, the Middle Eastern solar power market was moderately impacted. Few countries like Saudi Arabia, Kuwait, and Qatar had significantly less number of new installations in 2020 due to delays in the shipping of solar modules. The market rebounded in 2021.

Key Highlights

- Factors such as supportive government policies and increasing efforts to meet power demand using renewable energy sources, and decreased dependency on fossils are expected to be significant contributors to driving the market. Besides, many ambitious photovoltaic projects are lined up in the forecast period and are expected to drive the solar market in the coming years.

- However, factors such as delays in large-scale solar projects and increasing focus on alternative energy sources are expected to hinder the market's growth.

- The upcoming solar power projects, along with the use of hybrid power solutions in this region, can create immense opportunities for the solar power market in the near future.

- Saudi Arabia is expected to witness significant demand due to the number of ongoing and upcoming projects over the forecast period.

Middle East Solar Power Market Trends

Solar Photovoltaic (PV) Projects to Drive the Market

- Photovoltaic (PV) cells are arrays of cells containing a solar photovoltaic material that converts solar radiation or energy from the sun into direct current electricity. Photovoltaic (PV) solar panels held a share of more than 96.57% of the total Middle Eastern solar energy installed in 2022.

- The solar PV installed capacity of the Middle East grew to 12.440 GW in 2022, which is higher compared to the 9.239 GW installed in 2021. Upcoming projects are expected to increase capacity during the forecast period even further.

- In October 2022, the Water Procurement Company (OPWP) and Oman Power initiated bidding for the second large-scale solar photovoltaic (PV) project at Ibri in northwest Oman. The new Ibri III Solar Independent Power Project (IPP) has a solar PV capacity of 500 MW. The new facility is anticipated to begin commercial operations in the fourth quarter of 2026.

- In February 2023, Mobarakeh Steel Company was anticipated to finance the solar photovoltaic power plant in Kouhpayeh County, Isfahan Province, with a capacity of 600 MW. The project is expected to receive an investment of USD 500 million. The first phase will likely add nearly 100 MW to the nation's power grid by July 2023.

- With several projects under construction or in the tender phase in countries like Saudi Arabia and the United Arab Emirates, considerable growth in solar PV is expected to drive the solar power market in the Middle Eastern region over the forecast period.

Saudi Arabia to Dominate the Market

- In Saudi Arabia, the solar energy installed capacity growth can be attributed to the National Renewable Energy Program, which had a target of installing 35 renewable projects with 58.7 GW of installed capacity by 2030.

- The installed solar power capacity for Saudi Arabia in 2022 was 440 MW, which is expected to increase in the coming years. Also, the solar PV installed capacity for Saudi Arabia increased to 390 MW in 2022, which was higher compared to 59 MW in 2020.

- In November 2022, ACWA Power signed an agreement with Water and Electricity Holding Company (Badeel) to develop the world's largest single-site solar-power plant in Al Shuaibah, Mecca province. With a 2,060 MW generation capability, the solar power plant is anticipated to begin operations by the end of 2025.

- Moreover, in March 2022, according to the Ministry of Industry and Mineral Resources, Saudi Arabia launched a new plan to support green energy initiatives and reduce its reliance on crude oil. Additionally, the ministry would provide tax breaks and other benefits to businesses that generate renewable energy.

- Therefore, based on the aforementioned facts, Saudi Arabia is expected to witness significant demand for the solar power market in the Middle Eastern region over the forecast period.

Middle East Solar Power Industry Overview

The Middle Eastern solar power market is moderately fragmented. Some of the key players in this market include (not in particular order) JinkoSolar Holding Co. Ltd, First Solar Inc., Enerwhere Sustainable Energy DMCC, ACWA POWER BARKA SAOG, and Alsa Solar Systems LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 Geography

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Oman

- 5.2.4 Rest of the Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 JinkoSolar Holding Co. Ltd.

- 6.3.2 First Solar Inc

- 6.3.3 Enerwhere Sustainable Energy DMCC

- 6.3.4 ACWA POWER BARKA SAOG

- 6.3.5 Alsa Solar Systems LLC

- 6.3.6 Enviromena Power Systems

- 6.3.7 Trina Solar Ltd.

- 6.3.8 JA SOLAR Co. Ltd.

- 6.3.9 Sungrow Power Supply Co. Ltd.

- 6.3.10 Hitachi Energy Ltd.

- 6.3.11 Canadian Solar Inc.