|

市場調查報告書

商品編碼

1644358

巨量資料工程服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Big Data Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

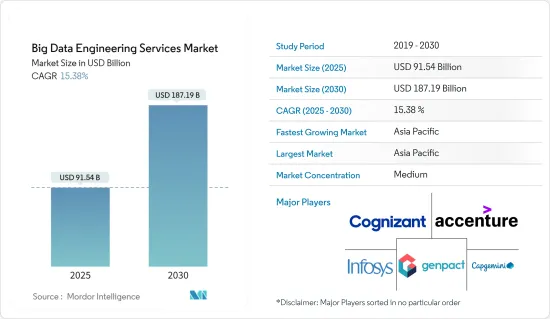

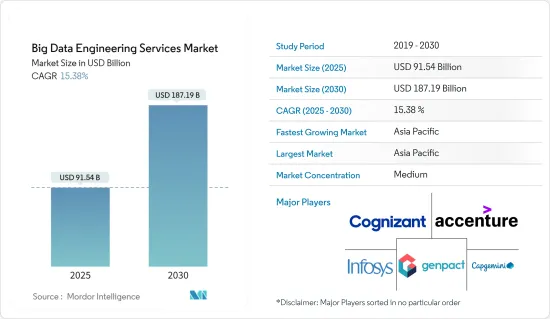

巨量資料工程服務市場規模預計在 2025 年為 915.4 億美元,預計到 2030 年將達到 1871.9 億美元,預測期內(2025-2030 年)的複合年成長率為 15.38%。

資料整合和工程需要應用程式介面。資料工程師使用專門的工具、程序和設備來準備和分析資料以供後續分析。

主要亮點

- 巨量資料工程服務市場的成長受到幾個關鍵因素的推動。首先,數位技術的廣泛應用導致各行各業產生的資料量迅速增加,迫切需要先進的資料管理和處理解決方案。隨著企業尋求挖掘資料的潛力,他們擴大轉向巨量資料工程服務來最佳化其儲存、處理和分析能力。

- 金融業正在迅速變化,提供新的消費產品和服務。銀行業預計將對資料工程市場產生重大影響。例如,澳洲國民銀行與亞馬遜網路服務的合作正在擴大。該銀行表示,目前其 70% 的程式都已遷移到雲端,並且剛剛成為第一家轉型其線上商業銀行平台的澳洲大型銀行。

- 醫療保健領域使用的資料量正在迅速成長。電子健康記錄是醫療保健產業最普遍、最重要的資料來源。以前,這些資訊都以手寫文件的形式保存。借助 EHR 產生的大量資料和機器學習等強大的分析技術,醫學研究人員現在可以創建預測模型。

- 此外,機器學習和人工智慧的進步為從海量資料獲取有價值的見解開闢了新的可能性,促使組織投資資料工程服務以支援他們的人工智慧舉措。此外,有關資料隱私和安全的監管要求迫使公司採用更強大的資料管理實踐,增加了對巨量資料工程專業知識的需求。

- 不了解特定用戶群的需求會使資料工程計劃變得困難。處理無止盡的資料湧入和錯置的價值很快就會變得難以承受。透過資料管治計畫制定全面的資料管理策略是應對此資料工程挑戰的潛在方法之一。

巨量資料工程服務的市場趨勢

銀行巨量資料分析預計將大幅成長

- 銀行業正在經歷巨量資料分析和工程應用的激增。這主要是因為巨量資料分析在提高業務效率、客戶體驗和風險管理方面具有巨大的價值。摩根大通和富國銀行等公司正在大力投資巨量資料計劃,以利用業務中產生的大量資料。

- 此外,巨量資料工程有助於處理、儲存和分析龐大的資料集,使銀行能夠有效地處理資料的速度、種類和數量。 Hadoop 和 Spark 等技術使銀行能夠大規模儲存和處理資料,從而實現更快的決策並改善客戶服務。

- 此外,數位銀行的成長和線上交易的普及進一步增加了銀行業對巨量資料解決方案的需求。透過利用先進的分析和機器學習演算法,銀行可以提供個人化提案,簡化業務並有效降低風險。

- 2023 年 12 月,印度聯合銀行與Accenture合作,建構可擴展且安全的企業資料湖平台。該計劃旨在提高業務效率、提供以客戶為中心的銀行服務並改善風險管理。該平台利用預測分析、機器學習和人工智慧資料。此外,跨職能的強大資料視覺化和報告功能增強了員工的能力。

亞太地區佔主要市場佔有率

- 亞太地區(包括中國、新加坡、印度和馬來西亞)的巨量資料工程市場近年來取得了顯著成長,這歸因於數位技術的日益普及、資料主導決策的需求不斷成長以及網際網路連接設備的廣泛使用等因素。這些地區的企業正在意識到利用大量資料來獲取洞察力並在全球市場保持競爭力的價值。

- 阿里巴巴、騰訊等主要企業處於巨量資料創新的前沿,利用其廣泛的用戶群和先進的分析能力提供個人化服務並提高業務效率。例如,阿里巴巴的雲端處理部門阿里雲提供一系列大巨量資料解決方案,包括資料倉儲、分析和人工智慧服務,為各行各業的企業提供服務。

- 此外,東南亞領先的超級應用程式 Grab 等公司嚴重依賴巨量資料工程來最佳化其叫車、外送和金融服務平台。 Grab 使用資料分析來改善用戶體驗、最佳化司機分配並開發新產品和服務以滿足客戶偏好,從而促進公司快速擴張和佔據市場主導地位。

- 同時,在馬來西亞,亞航等公司正在利用巨量資料工程來改變航空業,提供個人化的旅行體驗,並透過預測分析和機器學習演算法最佳化營運。亞航的資料主導方法使其能夠簡化流程、降低成本並在高度活躍的航空市場中保持競爭力。

- 總體而言,亞太國家巨量資料工程市場的成長反映了數位轉型和創新的更廣泛趨勢,各行業的公司都在利用資料的力量推動業務成功,在日益激烈的競爭中釋放新的成長和差異化機會。

巨量資料工程服務業概覽

隨著差異化和附加價值服務的新機會出現,適度分散的巨量資料工程服務市場有可能改變競爭格局。此外,許多行業都在大力投資人工智慧,對巨量資料工程技能和能力的需求很高。為了獲得市場佔有率並擴大其在情報領域的影響力,埃森哲公司和凱捷公司等知名供應商正在進行收購和投資新公司和新技術。

- 2023 年 10 月,Google Cloud 合作夥伴 Onyx 收購資料 ,這是一家 IP主導的顧問公司,專門從事資料遷移、現代化和 BI/分析。 Datametica 獨特的產品組合可自動將資料倉儲、資料庫、ETL 流程和分析工作負載遷移到 Google Cloud 並實現現代化,為客戶提供快速的結果和有保障的結果。這項策略性舉措增強了 Onix 的資料和 AI 能力,並使其成為雲端轉換和資料管理 IP主導解決方案的領導者。

- 2023 年 2 月 Alteryx 宣佈在 Alteryx Analytics Cloud 平台上增強自助服務和企業級功能。重新設計的 Alteryx Designer Cloud 介面使現代資料工作者能夠以互動和協作的方式分析、準備和傳輸資料。分析師和資料工程師現在可以輕鬆建立互動式報告,而Alteryx Auto Insights 利用機器學習來揭示解釋值和關鍵促進因素,以便做出更好的決策。該平台的可擴展性和安全性使組織能夠在保持資料管治標準的同時做出更快、更明智的決策。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 互聯設備和社群媒體的快速成長正在產生越來越多的非結構化資料

- 資訊服務公司提供經濟高效的服務和尖端專業知識

- 市場限制

- 服務供應商未能提供即時洞察

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估宏觀經濟因素對市場的影響

第5章 新興科技趨勢

第6章 市場細分

- 按類型

- 資料建模

- 資料整合

- 資料品質

- 分析

- 按業務功能

- 行銷和銷售

- 金融

- 手術

- 人力資源

- 按組織規模

- 中小型企業

- 大型企業

- 依實施類型

- 雲

- 本地

- 按最終用戶產業

- BFSI

- 政府

- 媒體與通訊

- 零售

- 製造業

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Accenture PLC

- Genpact Inc.

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Capgemini SE

- NTT Data Inc.

- Mphasis Limited

- L&T Technology Services

- Hexaware Technologies Inc.

- KPMG LLP

- Ernst & Young LLP

- Latentview Analytics Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Big Data Engineering Services Market size is estimated at USD 91.54 billion in 2025, and is expected to reach USD 187.19 billion by 2030, at a CAGR of 15.38% during the forecast period (2025-2030).

Application programming interfaces are necessary for data integration and engineering. Data engineers use specialized tools, procedures, and equipment to prepare and analyze data for later analysis.

Key Highlights

- The growth of the big data engineering services market has been driven by several key factors. Firstly, the exponential increase in data generation across various industries, fueled by the proliferation of digital technologies, has created a pressing need for advanced data management and processing solutions. As organizations seek to harness the potential of their data, they increasingly turn to big data engineering services to optimize storage, processing, and analysis capabilities.

- The financial industry is quickly changing and providing new consumer products and services. The banking industry is expected to significantly impact the data engineering market. For instance, the partnership between the National Australia Bank and Amazon Web Services has grown. According to the bank, 70% of its programs have now been migrated to the cloud, and it just became the first significant Australian bank to convert its online business banking platform.

- The amount of data used in healthcare is growing quickly. Electronic health records are the most prevalent significant data source in the healthcare industry. Earlier, this information was stored in handwritten files. Medical researchers can now create prediction models thanks to the enormous data created by EHRs and powerful analytics techniques like machine learning.

- Furthermore, advancements in machine learning and artificial intelligence have opened up new possibilities for extracting valuable insights from large datasets, prompting organizations to invest in data engineering services to support their AI initiatives. Additionally, regulatory requirements around data privacy and security have compelled companies to adopt more robust data management practices, leading to increased demand for specialized big data engineering expertise.

- Not comprehending the needs of a specific user group is difficult for a data engineering project. The endless influx of data and dealing with value inconsistencies can quickly become overwhelming. Establishing a thorough data management strategy with a data governance plan is one potential response to this data engineering challenge.

Big Data Engineering Services Market Trends

Big Data Analytics in Banking is Expected to Grow Significantly

- The banking industry has witnessed a significant surge in the adoption of big data analytics and engineering, primarily due to the immense value they offer in enhancing operational efficiency, customer experience, and risk management. Companies like JPMorgan Chase and Wells Fargo have invested heavily in big data initiatives to harness the vast amounts of data generated within their operations.

- Furthermore, big data engineering facilitates the processing, storage, and analysis of massive datasets, enabling banks to handle the velocity, variety, and volume of data efficiently. With technologies like Hadoop and Spark, banks can store and process data at scale, enabling faster decision-making and improved customer service.

- Moreover, the growth of digital banking and the proliferation of online transactions have further fueled the demand for big data solutions in the banking sector. By leveraging advanced analytics and machine learning algorithms, banks can offer personalized recommendations, streamline operations, and mitigate risks effectively.

- In December 2023, Union Bank of India partnered with Accenture to create a scalable and secure enterprise data lake platform. This initiative aims to enhance operational efficiency, provide customer-centric banking services, and improve risk management. The platform will leverage predictive analytics, machine learning, and artificial intelligence to generate valuable insights from structured and unstructured data. Additionally, it will empower employees with robust data visualization and reporting capabilities across various functions.

Asia-Pacific to Hold Major Market Share

- The big data engineering market in Asia-Pacific countries like China, Singapore, India, Malaysia, and others has experienced significant growth in recent years, driven by factors such as increasing adoption of digital technologies, rising demand for data-driven decision-making, and the proliferation of internet-connected devices. Companies in these regions are recognizing the value of harnessing vast amounts of data to gain insights and stay competitive in the global market.

- Key players like Alibaba and Tencent have been at the forefront of big data innovation, leveraging their extensive user bases and advanced analytics capabilities to offer personalized services and improve operational efficiency. For example, Alibaba's cloud computing arm, Alibaba Cloud, provides a range of big data solutions, including data warehousing, analytics, and artificial intelligence services, catering to businesses across various industries.

- Moreover, companies like Grab, a key super app in Southeast Asia, rely heavily on big data engineering to optimize their ride-hailing, food delivery, and financial services platforms. Grab utilizes data analytics to enhance user experiences, optimize driver allocation, and develop new products and services tailored to customer preferences, contributing to its rapid expansion and market dominance.

- Meanwhile, in Malaysia, companies like AirAsia are leveraging big data engineering to transform the aviation industry, offering personalized travel experiences and optimizing flight operations through predictive analytics and machine learning algorithms. AirAsia's data-driven approach has enabled it to streamline processes, reduce costs, and maintain a competitive edge in the highly dynamic airline market.

- Overall, the growth of the big data engineering market in Asia-Pacific countries reflects a broader trend toward digital transformation and innovation, with companies across various sectors harnessing the power of data to drive business success and unlock new opportunities for growth and differentiation in an increasingly competitive landscape.

Big Data Engineering Services Industry Overview

With new opportunities for differentiation and value-added services, the moderately fragmented big data engineering services market has the potential to change the competitive landscape. Moreover, many sectors are investing extensively in artificial intelligence, and there is a high demand for big data engineering technology and capabilities. In order to gain market share in the intelligence sector and expand the scope of their service offerings, well-known vendors, such as Accenture PLC and Capgemini SE, are making acquisitions and investments in new companies and technologies.

- October 2023: Onix, a Google Cloud partner, acquired Datametica, an IP-driven consulting firm specializing in data migration, modernization, and BI/analytics. Datametica's suite of proprietary products automates the migration and modernization of data warehouses, databases, ETL processes, and analytical workloads to Google Cloud, delivering faster results and guaranteed outcomes for customers. This strategic move enhances Onix's data and AI capabilities, positioning them as a leader in IP-driven solutions for cloud transformation and data management.

- February 2023: Alteryx introduced enhanced self-service and enterprise-grade features in its Alteryx Analytics Cloud Platform. The reimagined Alteryx Designer Cloud interface empowers modern data workers to profile, prepare, and pipeline their data interactively and collaboratively. Analysts and data engineers can now build interactive reports with ease, and Alteryx Auto Insights leverages machine learning to surface explanatory values and key drivers for better decision-making. The platform's scalability and security ensure that organizations can make faster and more informed decisions while maintaining data governance standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Volume of Unstructured Data due to the Phenomenal Growth of Interconnected Devices and Social Media

- 4.2.2 Cost-effective Services and Cutting-edge Expertise Rendered by Data Servicing Companies

- 4.3 Market Restraints

- 4.3.1 Inability of Service Providers to Provide Real-time Insights

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of Macroeconomic Factors on the Market

5 EMERGING TECHNOLOGY TRENDS

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Data Modelling

- 6.1.2 Data Integration

- 6.1.3 Data Quality

- 6.1.4 Analytics

- 6.2 By Business Function

- 6.2.1 Marketing and Sales

- 6.2.2 Finance

- 6.2.3 Operations

- 6.2.4 Human Resource

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprizes

- 6.3.2 Large Enterprises

- 6.4 By Deployement Type

- 6.4.1 Cloud

- 6.4.2 On-premise

- 6.5 By End-user Industry

- 6.5.1 BFSI

- 6.5.2 Government

- 6.5.3 Media and Telecommunication

- 6.5.4 Retail

- 6.5.5 Manufacturing

- 6.5.6 Healthcare

- 6.5.7 Other End-user Verticals

- 6.6 Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Genpact Inc.

- 7.1.3 Cognizant Technology Solutions Corporation

- 7.1.4 Infosys Limited

- 7.1.5 Capgemini SE

- 7.1.6 NTT Data Inc.

- 7.1.7 Mphasis Limited

- 7.1.8 L&T Technology Services

- 7.1.9 Hexaware Technologies Inc.

- 7.1.10 KPMG LLP

- 7.1.11 Ernst & Young LLP

- 7.1.12 Latentview Analytics Corporation