|

市場調查報告書

商品編碼

1644359

一次性塑膠包裝:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Single Use Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

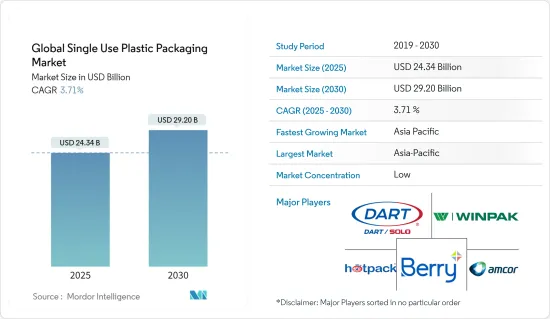

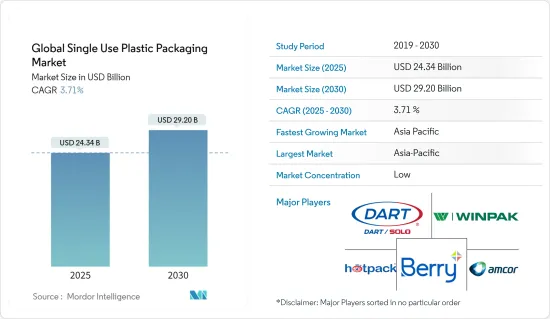

2025 年全球一次性塑膠包裝市場規模預估為 243.4 億美元,預計到 2030 年將達到 292 億美元,預測期內(2025-2030 年)的複合年成長率為 3.71%。

主要亮點

- 城鎮人口的不斷成長推動了對已調理食品的需求,極大地影響了餐飲業的包裝趨勢。預計這一趨勢將在預測期內增加對一次性塑膠包裝解決方案的需求。都市區消費者通常生活忙碌,沒有時間準備飯菜,因此越來越依賴需要高效包裝的簡便食品。

- 都市區宅配服務和外帶選擇的興起進一步推動了這種需求。在重點地區,都市化、生活方式的改變、對快節奏職場環境的適應以及對線上食品平台的日益依賴正在迅速改變餐飲業的動態,進一步推動對一次性塑膠包裝解決方案的需求。總的來說,這些因素推動了包裝市場的不斷成長,這種包裝市場優先考慮便利性、便攜性和食品保鮮性——這些特點通常與食品服務行業的一次性塑膠包裝有關。

- 越來越多的終端用戶(如快餐店、全方位服務餐廳、咖啡店、經銷店和機構)正在推動對便捷包裝解決方案的需求。預計這一趨勢將增加一次性包裝形式的產量。隨著消費者追求便利性並適應不斷變化的生活方式,尤其是家庭規模變小,從硬包裝到軟包裝的轉變正在加速。因此,一次性塑膠包裝在各種食品服務領域越來越受歡迎。

- 隨著人口結構、就業模式和生活方式的變化,速食專利權和速食店的快速擴張正推動市場成長。速食價格實惠、準備時間短,滿足了消費者對便利用餐選擇的需求。全球速食消費量的增加直接支持了餐飲業一次性塑膠包裝的成長。

- 消費者對便利性的需求不斷成長是推動一次性塑膠包裝市場發展的關鍵因素。製造商正在透過提供滿足不斷變化的需求的包裝解決方案來適應不斷變化的客戶偏好。忙碌的上班族的生活方式推動了對便利食品包裝選擇的需求。此外,生產商現在正在考慮使用後的處理,從而導致了易於處理的包裝物品的開發。

- 一次性塑膠的監管以及對紡織品和紙質產品等永續包裝替代品的日益偏好,都對市場成長構成了阻礙。這些法規旨在減少塑膠廢棄物並推廣環保包裝解決方案。向永續替代品的轉變受到消費者需求和政府政策的共同推動。

- 消費者對一次性塑膠和不永續做法對環境影響的認知不斷提高,這導致對更高發展標準的要求,從而帶來積極的生態學成果。這種意識導致許多消費者主動尋找具有環保包裝的產品,迫使企業調整其包裝策略。因此,各行各業的公司都在投資研發創新和永續的包裝解決方案,以滿足不斷變化的消費者期望並遵守監管要求。

一次性塑膠包裝市場的趨勢

速食店市場佔很大佔有率

- 速食店(QSR)提供平價的餐飲選擇,注重快速服務。快餐店與傳統餐廳的不同之處在於,它限制餐桌服務,並強調自助服務。快餐店通常提供精簡的菜單,其中包含易於準備的食品,例如漢堡、三明治和油炸食品,這些食品可以快速組裝和上桌。快餐店受到那些想要快速吃飯的人們的歡迎,因為他們高效的營運讓他們能夠快速地為大量顧客提供服務。

- 快餐店使用的大多數一次性塑膠食品服務由發泡聚苯乙烯 (EPS)、聚丙烯 (PP)、聚對苯二甲酸乙二醇酯 (PET) 和聚乳酸 (PLA) 製成。之所以選擇這些材料,是因為它們的耐用性、成本效益以及保持食物溫度的能力,有助於提高快餐服務的整體效率和客戶體驗。

- 快餐店(QSR)的菜單上的食物通常直接從包裝中取出食用。消費者選擇速食是因為其方便、準備快速、價值高且價格實惠。因此,包裝是食品的重要組成部分,必須符合消費者的速食動機和期望。包裝有多種用途,例如保持食品溫度、保鮮、方便食用。它還在品牌形象和客戶認知方面發揮著至關重要的作用。

- 隨著永續性成為日益受關注的問題,許多速食店正在探索環保包裝選擇,以滿足消費者對環境責任的需求,同時仍保持快餐顧客所期望的便利性和功能性。速食包裝的設計和材料必須平衡實用性、成本效益和環境影響,同時提升消費者的整體用餐體驗。

- 在當今快節奏的環境中,一次性塑膠包裝已成為快餐店(QSR)的必需品。由於需要更多時間在家做飯,消費者擴大選擇速食。消費行為的這種轉變推動了對便利、隨時用餐解決方案的需求。一次性塑膠包裝使快餐店能夠以高效、安全且經濟的方式包裝食品,從而滿足這一需求。這些包裝解決方案旨在承受各種溫度並在運輸過程中保持食品的品質。它們還具有不易洩漏、更易於處理等實際優勢,對於經常在通勤或職場途中吃飯的顧客來說至關重要。

- 餐廳越來越受歡迎,推動了速食店(QSR)市場的擴張。隨著主要 QSR 品牌開設更多門市,一次性塑膠包裝的需求也隨之增加。這種擴張發生在各個地區和菜系,反映了消費者對方便、實惠的餐飲選擇的偏好的改變。

- 這一趨勢在都市區和新興市場尤其明顯,快速的都市化和繁忙的生活方式導致 QSR 顧客數量的增加。例如,全球 QSR 品牌麥當勞正在穩步增加其在世界各地的餐廳數量,以滿足日益成長的快餐需求。該公司全球門市數量將從 2017 年的 37,241 家成長到 2023 年的 41,822 家,反映了這一趨勢。這種成長並不僅限於麥當勞,其他大型速食連鎖店也擴大了門市,進一步推動了一次性包裝的需求。

預計亞太地區將佔據主要市場佔有率

- 亞太地區擁有許多人口密集的國家,例如中國和印度,以及新興國家,因此外出用餐的需求很高。因此,一次性塑膠包裝的需求正在上升,並且這種趨勢在預測期內可能會持續下去。塑膠已成為包裝產業的關鍵組成部分,是消費者便利文化的核心。塑膠的多功能性和耐用性使其成為從外帶容器到飲料瓶等各種食品包裝應用的理想選擇。

- 由於塑膠包裝比其他材料更具成本績效,許多食品服務和包裝應用正在從紙板、玻璃和金屬等傳統包裝材料轉向塑膠。這種轉變在都市區尤其明顯,那裡的外賣和快餐店行業正在迅速擴張。由於塑膠包裝重量輕,它還有助於降低運輸成本和供應鏈中的碳排放,進一步支持其在亞洲各地餐飲業的採用。

- 該地區的家庭和非現場食品和飲料用包裝產品的產量預計將出現成長,因為這些產品的訂單通常為大批量。這一成長是由消費者習慣的改變和對方便、便攜食品的需求不斷成長所推動的。一次性塑膠包裝在該地區被廣泛使用,尤其是在速食店,用於各種用途,包括蛤殼、瓶子、托盤、杯子和蓋子。這些包裝解決方案的多功能性和成本效益使其成為餐飲公司的熱門選擇。然而,這一趨勢也引發了人們對環境永續性的擔憂,促使該地區關於替代包裝材料和回收工作的討論。

- 該地區擁有大量終端用戶產業,是一次性塑膠包裝的重要投資者和採用者。這種採用在食品飲料、醫療保健和消費品等多個領域都有所體現。有幾個因素推動了該地區的市場成長。首先,對包裝餐點的需求不斷增加,尤其是在高度重視便利性的都市區。其次,餐廳和超級市場的擴張推動了對保持食品新鮮和安全的包裝解決方案的需求。最後,隨著消費者偏好和生活習慣的改變,瓶裝水和飲料的消費量不斷增加,進一步推動了該地區對一次性塑膠包裝的需求。總的來說,這些趨勢正在促進該地區一次性塑膠包裝市場的持續成長和發展。

- 印度人口眾多,經濟正在崛起,其瓶裝水消費量大幅成長,成為該地區的強勁市場。印度鐵路餐飲和旅遊有限公司 (IRCTC) 推出了自己的瓶裝水品牌“Rail Neer”,主要在火車上和火車站銷售。隨著瓶裝水需求的不斷成長和鐵路部門的擴張,IRCTC 大幅增加了產量。預計2021年產量將達7,530萬瓶,2023年產量將增加至3.577億瓶。

- 近年來,印度和中國的包裝產業都經歷了顯著的成長。此次擴張歸因於多種因素,包括建立新的製造部門、採用環保材料和更注重研發。這些發展使得創新且外觀吸引的產品能夠以有競爭力的成本在當地生產。此外,印度的「印度製造」計畫等政府措施預計將加速包裝產業的進一步發展。

- 中國瓶裝水產量和消費量的增加對市場產生了正面影響。中國消費者越來越傾向於積極、健康的生活方式,這導致對瓶裝水的需求激增。人們對國家自來水污染問題的日益擔憂進一步加劇了這一趨勢。因此,中國各領域的瓶裝水需求均大幅成長。

- 消費者的健康意識不斷增強,他們尋求更安全、更方便的補水方式,瓶裝水因此成為有吸引力的選擇。根據東方財富網報道,這種消費行為的轉變也反映在中國瓶裝水零售的預測上。預計市場將經歷大幅成長,零售額將從 2020 年的 2,002 億元人民幣(281.2 億美元)成長至 2025 年的 3,536 億元人民幣(496.7 億美元)。這一成長軌跡凸顯了中國消費者對瓶裝水產品的市場潛力不斷擴大和偏好不斷改變。

一次性塑膠包裝行業概況

一次性塑膠包裝市場比較分散。包括 Berry Global Inc.、Amcor Group GmbH、Huhtamaki Oyj 和 Hotpack Packaging Industries LLC 在內的多家全球和地區參與者正在爭奪這個競爭激烈的市場的關注。該市場的特點是產品差異化程度低、產品滲透率高、競爭激烈。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 快餐店和小餐館的興起推動了市場需求

- 市場限制

- 有關包裝中使用塑膠的環境問題和政府法規

第6章 市場細分

- 按材質

- 聚乳酸(PLA)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚乙烯 (PE)

- 其他材料類型

- 依產品類型

- 瓶子

- 包包和小袋

- 翻蓋

- 托盤、杯子、蓋子

- 其他產品類型

- 按最終用戶

- 速食店

- 全方位服務餐廳

- 機構

- 零售

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 哥倫比亞

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Novolex

- Pactiv LLC

- Dart Container Corporation

- Winpak Ltd

- Berry Global Inc.

- Amcor Group

- Huhtamaki Oyj

- Hotpack Packaging Industries LLC

- Graphic Packaging International LLC

- Pactiv Evergreen Inc.

第8章投資分析

第9章:市場的未來

The Global Single Use Plastic Packaging Market size is estimated at USD 24.34 billion in 2025, and is expected to reach USD 29.20 billion by 2030, at a CAGR of 3.71% during the forecast period (2025-2030).

Key Highlights

- The expanding urban population drives the demand for prepared and ready-to-eat food products, significantly influencing food service packaging trends. This trend is expected to increase the demand for single-use plastic packaging solutions during the forecast period. Consumers in urban areas often have busier lifestyles and less time for meal preparation, leading to a greater reliance on convenience foods that require efficient packaging.

- The rise of food delivery services and takeaway options in cities has further amplified this demand. In key regions, urbanization, lifestyle changes, adaptation to fast-paced work environments, and increased reliance on online food platforms rapidly transform the foodservice industry dynamics, further boosting the demand for single-use plastic packaging solutions. These factors collectively contribute to a growing market for packaging that prioritizes convenience, portability, and food preservation, characteristics often associated with single-use plastic packaging in the foodservice industry.

- The growth of end users, including quick-service restaurants, full-service restaurants, coffee shops, snack outlets, and institutional facilities, drives the demand for convenient packaging solutions. This trend is expected to increase the production of single-use packaging formats. The shift from rigid to flexible packaging is gaining momentum as consumers seek convenience and adapt to changing lifestyles, particularly in smaller households. Consequently, single-use plastic packaging is experiencing increased popularity across various food service segments.

- The rapid expansion of fast-food franchises and quick-service restaurants drives the market's growth, responding to changing demographics, employment patterns, and lifestyles. Fast food's affordability and quick preparation times align with consumers' demand for convenient meal options. This global increase in fast food consumption directly supports the growth of single-use plastic packaging in the food service industry.

- The growing demand for consumer convenience is a crucial factor driving the single-use plastic packaging market. Manufacturers adapt to evolving customer preferences by offering packaging solutions catering to these changing needs. The busy lifestyles of working professionals have increased the demand for convenient food packaging options. Additionally, producers are now considering post-use disposal, leading to the development of packaging items that can be easily discarded.

- Regulations on single-use plastics and the growing preference for sustainable packaging alternatives, such as fiber and paper-based products, challenge the market's growth. These regulations aim to reduce plastic waste and promote environment-friendly packaging solutions. The shift towards sustainable alternatives is driven by both consumer demand and governmental policies.

- Increasing consumer awareness about the environmental impact of single-use plastics and unsustainable practices has led to demands for higher development standards with positive ecological outcomes. This awareness has prompted many consumers to actively seek out products with eco-friendly packaging, putting pressure on companies to adapt their packaging strategies. As a result, businesses across various industries are investing in research and development of innovative, sustainable packaging solutions to meet these evolving consumer expectations and comply with regulatory requirements.

Single Use Plastic Packaging Market Trends

Quick Service Restaurants Segment to Hold a Significant Share

- Quick-service restaurants (QSRs) provide affordable food options focusing on rapid service. These establishments are characterized by limited table service and a strong emphasis on self-service, setting them apart from traditional restaurants. QSRs typically offer a streamlined menu of easily prepared items, such as burgers, sandwiches, and fried foods, which can be quickly assembled and served. The efficiency of their operations allows them to serve a high volume of customers quickly, making them popular for those seeking quick meals.

- The majority of single-use plastic food service products utilized in QSRs are made from expanded polystyrene (EPS), polypropylene (PP), polyethylene terephthalate (PET), and polylactic acid (PLA). These materials are chosen for their durability, cost-effectiveness, and ability to maintain food temperature, contributing to the overall efficiency and customer experience in quick-service settings.

- Quick-service restaurant (QSR) menu items are typically consumed directly from their packaging. Consumers opt for fast food due to its convenience, rapid preparation, value, and affordability. Consequently, packaging is an essential food product component and must align with consumers' motivations and expectations for fast food. The packaging serves multiple purposes, including maintaining food temperature, preserving freshness, and facilitating easy consumption. It also plays a crucial role in brand identity and customer perception.

- As sustainability concerns grow, many QSRs are exploring eco-friendly packaging options to meet consumer demands for environmental responsibility while maintaining the convenience and functionality that fast food customers expect. The design and materials used in fast food packaging must balance practicality, cost-effectiveness, and environmental impact, all while enhancing the overall dining experience for consumers.

- In today's fast-paced environment, single-use plastic packaging has become integral to Quick Service Restaurants (QSRs). Consumers need more time for meal preparation at home, so they increasingly rely on fast food options. This shift in consumer behavior has led to a greater demand for convenient, on-the-go meal solutions. Single-use plastic packaging allows QSRs to meet this demand by packaging food efficiently, safely, and cost-effectively. These packaging solutions are designed to withstand various temperatures and maintain food quality during transportation. They also offer practical benefits such as leak resistance and easy handling, which are crucial for customers who often consume their meals while commuting or at their workplaces.

- The growing popularity of restaurants drives the expansion of the fast-food and quick-service restaurant (QSR) market. As major QSR brands increase their outlets, they create demand for single-use plastic packaging. This expansion is evident across various regions and cuisines, reflecting changing consumer preferences for convenient and affordable dining options.

- The trend is particularly noticeable in urban areas and emerging markets, where rapid urbanization and busier lifestyles contribute to the increased patronage of QSRs. For example, McDonald's, a global QSR brand, has been steadily growing its store count worldwide in response to the rising demand for quick meals. The company's global store count grew from 37,241 in 2017 to 41,822 in 2023, illustrating this trend. This growth was not limited to McDonald's alone; other major QSR chains expanded their footprints, further driving the demand for single-use packaging.

Asia-Pacific Expected to Hold Significant Share in the Market

- In Asia-Pacific, many densely populated countries and emerging economies, such as China and India, have a high demand for food services. Consequently, the need for single-use plastic packaging is increasing and will remain elevated during the forecast period. Plastic has been a crucial component of the packaging sector, which is central to consumer convenience culture. The versatility and durability of plastic make it an attractive option for various food packaging applications, from takeaway containers to beverage bottles.

- Due to plastic packaging's favorable cost-performance ratio compared to other materials, many food service and packaging applications have transitioned from traditional packaging materials like corrugated paper boards, glass, and metal to plastics. This shift is particularly noticeable in urban areas where the food delivery and quick-service restaurant sectors are rapidly expanding. The lightweight nature of plastic packaging also contributes to reduced transportation costs and lower carbon emissions in the supply chain, further driving its adoption in the food service industry across Asia.

- The region is expected to grow in terms of producing packaging products for domestic and off-premise food and beverage items, often ordered in bulk. This increase is driven by changing consumer habits and the growing demand for convenient, portable food options. Single-use plastic packaging is widely used in the region for various applications, including clamshells, bottles, trays, cups, and lids, particularly in fast-food establishments. The versatility and cost-effectiveness of these packaging solutions make them popular choices for businesses in the food service industry. However, this trend also raises concerns about environmental sustainability, prompting discussions about alternative packaging materials and recycling initiatives in the region.

- Due to its numerous end-user industries, the region is a significant investor and adopter of single-use plastic packaging. This adoption is evident across various sectors, including food and beverage, healthcare, and consumer goods. Several factors drive the regional market growth. Firstly, there is an increasing demand for packaged meals, particularly in urban areas where convenience is highly valued. Secondly, the expansion of restaurants and supermarkets has created a need for more packaging solutions to maintain food freshness and safety. Lastly, the rising consumption of bottled water and beverages, fueled by changing consumer preferences and lifestyle habits, has further boosted the demand for single-use plastic packaging in the region. These trends collectively contribute to the sustained growth and development of this area's single-use plastic packaging market.

- India stands out as a robust market in the region due to its large population and developing economy, leading to a significant increase in bottled water consumption. The Indian Railway Catering and Tourism Corporation Limited (IRCTC) has introduced its own bottled water brand, "Rail Neer," primarily sold on trains and at railway stations. With the rising demand for bottled water and the expanding railway sector, IRCTC has substantially increased production. In 2021, the corporation produced 75.30 million bottles, which grew to 357.70 million bottles in 2023.

- The packaging industry in India and China has experienced significant growth in recent years. This expansion is attributed to several factors, including establishing new manufacturing units, adopting eco-friendly materials, and increasing focus on research and development. These developments have led to the creation of innovative and visually appealing products, all manufactured locally at competitive costs. Additionally, government initiatives such as India's 'Make in India' program are expected to accelerate these further advancements in the packaging industry.

- The increasing production and consumption of bottled water in China have positively influenced the market. Chinese consumers are increasingly adopting more active and healthier lifestyles, which has led to a surge in demand for bottled water. This trend is further fueled by rising concerns about water contamination in the country's tap water supply. As a result, China has experienced a significant increase in demand for bottled water across various demographics.

- The growing health consciousness among consumers has prompted them to seek safer and more convenient hydration options, making bottled water an attractive choice. According to Eastmoney.com, this shift in consumer behavior is reflected in the projected retail sales figures for bottled water in China. The market is expected to show substantial growth, with retail sales projected to reach CNY 353.6 billion (USD 49.67 billion) in 2025, a notable increase from CNY 200.2 billion (USD 28.12 billion) in 2020. This growth trajectory underscores the expanding market potential and the changing preferences of Chinese consumers toward bottled water products.

Single Use Plastic Packaging Industry Overview

The single-use plastic packaging market is fragmented. Several global and regional players, such as Berry Global Inc., Amcor Group GmbH, Huhtamaki Oyj, and Hotpack Packaging Industries LLC, are vying for attention in this contested space. This market is characterized by low product differentiation, growing product penetration, and high competition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industrial Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Number of Quick-Service Restaurants and Food Establishments has Driven Market Demand

- 5.2 Market Restraints

- 5.2.1 Environmental Concerns and Government Regulations Regarding Use of Plastic in Packaging

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Polylactic Acid (PLA)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polyethylene (PE)

- 6.1.4 Other Material Types

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Bags and Pouches

- 6.2.3 Clamshells

- 6.2.4 Trays, Cups, and Lids

- 6.2.5 Other Product Types

- 6.3 By End User

- 6.3.1 Quick Service Restaurants

- 6.3.2 Full Service Restaurants

- 6.3.3 Institutional

- 6.3.4 Retail

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Columbia

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Novolex

- 7.1.2 Pactiv LLC

- 7.1.3 Dart Container Corporation

- 7.1.4 Winpak Ltd

- 7.1.5 Berry Global Inc.

- 7.1.6 Amcor Group

- 7.1.7 Huhtamaki Oyj

- 7.1.8 Hotpack Packaging Industries LLC

- 7.1.9 Graphic Packaging International LLC

- 7.1.10 Pactiv Evergreen Inc.