|

市場調查報告書

商品編碼

1644377

印度金屬包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)India Metal Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

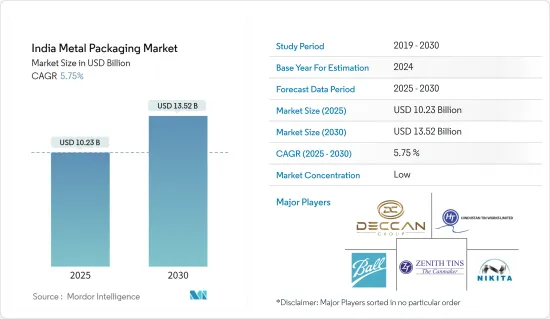

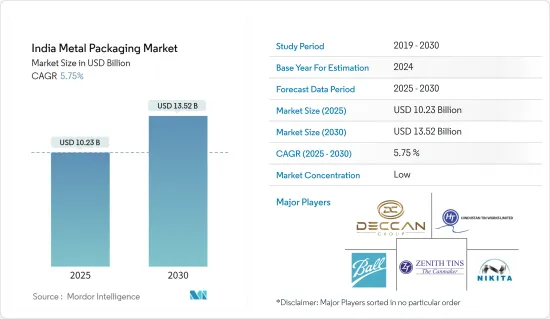

印度金屬包裝市場規模預計在 2025 年為 102.3 億美元,預計到 2030 年將達到 135.2 億美元,預測期內(2025-2030 年)的複合年成長率為 5.75%。

受食品、食品和飲料、製藥和個人護理行業需求不斷成長的推動,印度的金屬包裝市場正在經歷顯著成長。

關鍵亮點

- 鋁和鋼等金屬因其耐用性、安全性和保存性而受到青睞。不斷擴大的中階人口和消費者對包裝商品的偏好正在推動市場成長。

- 印度金屬包裝市場以鋁為主,尤其是在飲料領域。軟性飲料、機能飲料和酒精飲料的消費量不斷增加,推動了鋁罐的使用。該材料可回收,因此它是一種越來越環保的選擇。公司正在開發創新設計並改進鋁罐技術,以確保便利性、產品安全性和永續性。

- 金屬包裝對於維持食品品質和延長保存期限至關重要。罐頭和鐵罐常用於包裝已調理食品、加工食品、水果、蔬菜等。簡便食品消費的增加和勞動人口的增加正在推動罐頭食品的需求。醫療領域也是一個主要的貢獻者,金屬包裝因其保護性能而被用於藥品、藥膏和乳霜。

- 永續性正在推動印度金屬包裝市場的成長。環保意識正在推動消費者和企業偏好可回收和可重複使用的包裝。金屬包裝,尤其是鋁包裝,透過反覆回收仍能保持其質量,因此成為品牌的青睞的選擇。市場的發展顯示人們持續專注於創新,新技術和新設計增強了印度金屬包裝的功能性和吸引力。

- 印度公司正在增加對金屬包裝(尤其是罐頭)的投資,以滿足食品飲料、個人護理和家用產品行業日益成長的需求。這些公司正在改進罐頭設計、升級技術並實施環保實踐,以提供永續、高效的包裝解決方案。 2024 年 5 月,Ball Corporation 與 CavinKare 合作,在印度酪農產業推出用於奶昔的蒸餾鋁罐。這項發展滿足了人們對即飲(RTD)飲料日益成長的需求,同時也滿足了消費者對便利性和永續性的偏好。

- 在印度,金屬包裝市場面臨成長挑戰,主要是由於替代包裝解決方案的興起。金屬包裝,尤其是罐頭,具有耐用性、可回收性和實用的產品保存性。然而,塑膠、玻璃和軟包裝等替代品正在成為強大的競爭對手。這些替代品由於其成本效益、多功能性和在某些行業中的獨特優勢而被經常選用,這對金屬包裝的廣泛接受構成了挑戰。

印度金屬包裝市場趨勢

飲料罐預計將佔很大佔有率

- 在印度,由於人們對酒精和非酒精飲料的偏好日益增加,金屬包裝市場擴大被飲料罐所主導。軟性飲料、能量飲料、冰茶、啤酒和即飲雞尾酒等酒精飲料消費量的急劇增加證明了這一趨勢。鋁罐和鋼罐因其方便、便攜和能夠保持產品品質而廣受歡迎。隨著印度即飲飲料消費量的飆升,尤其是在年輕的都市區人群中,飲料罐已成為即飲飲料的首選包裝。

- 說到非酒精飲料,罐裝飲料無疑是個實用的選擇。罐裝飲料能更好地保存蘇打水、能量飲料和果汁的風味、氣泡和新鮮度。其密封性可保護碳酸飲料和調味飲料的完整性。此外,鋁罐的可回收性與消費者日益成長的永續性需求相呼應,增加了其在非酒精飲料領域的吸引力。隨著永續性發展在印度日益普及,各大品牌擴大考慮使用鋁罐作為寶特瓶的環保替代品。

- 印度酒精飲料產業也正向罐裝飲料轉變,尤其是啤酒和即飲(RTD)雞尾酒領域。啤酒製造商正將注意力轉向鋁罐,因為鋁罐可以防止啤酒因光線和空氣劣化,並保持碳酸化和新鮮度。罐子重量輕,非常適合分發和消費,特別是在戶外或活動中。隨著都市區酒精消費趨勢的演變,罐裝飲料逐漸成為人們的首選,為各類消費者提供了便利性、便攜性和成本效益。

- 印度的啤酒消費量正在成長,預計將從 2020 年的 16.3 億公升成長到 2025 年的 34 億公升。受都市化、生活方式轉變和可支配收入增加(尤其是年輕人的可支配收入)的推動,啤酒銷量激增凸顯了該國啤酒的吸引力日益增強。國內外各種啤酒品牌的湧入進一步刺激了這個趨勢。隨著啤酒消費量的不斷成長,對高效、永續包裝解決方案的需求也不斷成長。金屬罐因其重量輕且能保持啤酒的品質和新鮮度而越來越受歡迎。快速成長的啤酒市場對印度製造業和包裝業來說是一個光明的前景。

- 酒精和非酒精飲料製造商正在利用罐頭的品牌力量來吸引消費者的注意。光滑的鋁表面非常適合生動、高品質的設計,可以在繁忙的商店上吸引眼球——這是競爭環境中的關鍵優勢。易開標籤和獨特格式等創新為消費者帶來了便利。隨著飲料業的不斷擴張,罐頭在印度金屬包裝市場的主導地位很可能因其功能性、環保性和美觀性而得到確保。

食品業可望大幅成長

- 在印度,由於人們對便利性、延長保存期限和改善產品保存的需求日益成長,食品業對金屬包裝的需求也在成長。金屬包裝,尤其是罐頭、錫罐和廣口瓶,可以保護食物免受污染、光照、空氣和濕氣的影響,確保食物的新鮮度和保存期限。隨著即食食品、罐裝蔬菜、水果、醬料和零嘴零食的需求不斷飆升,金屬包裝在食品領域的地位正在加強。

- 消費者越來越傾向於簡便食品和加工食品,這推動了對金屬包裝解決方案的需求。金屬罐是包裝罐裝湯、已調理食品和飲料甚至寵物食品的絕佳選擇,因為密封的環境可以保護風味、營養和安全。此外,金屬包裝的可回收性與消費者對永續解決方案日益成長的需求相呼應,進一步鞏固了其在食品業的地位。

- 中產階級的不斷壯大、都市化和生活方式的不斷改變等因素正在推動印度對包裝食品的需求。隨著人們對方便、即食食品的偏好日益成長,金屬包裝是實用性與永續性的理想結合。輕量化罐頭、易開蓋、多功能設計等創新讓金屬包裝更具吸引力,推動了其在食品領域的應用。

- 預計 2022 年印度包裝食品市場價值將達到 513 億美元,到 2024 年將達到 702 億美元。這種快速成長與對金屬包裝解決方案的日益偏好密切相關。隨著消費者越來越傾向於方便、即食食品和包裝食品,金屬包裝正成為確保食品品質、安全和延長保存期限的關鍵參與企業。罐頭、錫罐和鋁包裝等流行選擇可以保護產品免受光照、空氣和濕氣的影響,保持其風味和營養。

- 包裝食品消費量的增加推動了對高效和永續包裝的需求。金屬罐是最合適的選擇,因為它們密封並且可回收。隨著市場的擴大,製造商擴大轉向金屬包裝,證明它在受便利性、永續性和產品保存需求推動的不斷發展的食品產業中發揮著至關重要的作用。

- 隨著印度對加工和包裝食品的需求不斷成長,對金屬包裝的需求也隨之成長。隨著對產品品質、安全性和永續性的日益關注,製造商擴大轉向金屬包裝,特別是罐頭和錫罐,因為它們具有耐用性、可回收性和出色的保存期限。

印度金屬包裝產業概況

印度金屬包裝市場細分為 Hindustan Tin Works Ltd.、Deccan Cans &Printers Pvt. Ltd.、Zenith Tins Private Limited、Ball Corporation、NIKITA CONTAINERS PVT.LTD. 等。許多公司正在擴大業務並進行策略併購以增加其市場佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 金屬包裝回收率高

- 金屬罐對不同終端使用者群體的適應性強

- 市場問題

- 替代包裝解決方案導致的市場限制

第6章 市場細分

- 依材料類型

- 鋁

- 鋼

- 依產品類型

- 能

- 食品罐

- 飲料罐

- 氣霧罐

- 散裝容器

- 運輸桶和鼓

- 瓶蓋和瓶塞

- 其他

- 能

- 按行業

- 飲料

- 食物

- 油漆和化學品

- 工業的

- 其他

第7章 競爭格局

- 公司簡介

- AJ Packaging Limited

- Casablanca Industries Pvt. Ltd .

- NIKITA CONTAINERS PVT. LTD.

- Zenith Tins Private Limited

- Petrox Packaging(I)Pvt. Ltd

- Deccan Cans & Printers Pvt. Ltd

- Hindustan Tin Works Ltd

- Hi-Can Industries Pvt. Ltd

- Kaira Can Company Limited

- Ball Corporation

第8章投資分析

第9章:未來市場展望

The India Metal Packaging Market size is estimated at USD 10.23 billion in 2025, and is expected to reach USD 13.52 billion by 2030, at a CAGR of 5.75% during the forecast period (2025-2030).

The metal packaging market in India is experiencing significant growth, driven by increasing demand across the food, beverages, pharmaceuticals, and personal care industries.

Key Highlights

- Metals like aluminum and steel are preferred for their durability, safety, and preservation capabilities. The expanding middle-class population and consumer preferences for packaged goods fuel market growth.

- Aluminum dominates the Indian metal packaging market, particularly in the beverage sector. The increased consumption of soft drinks, energy drinks, and alcoholic beverages has boosted aluminum can usage. The material's recyclability has enhanced its adoption as an environmentally responsible choice. Companies are developing innovative designs and improving aluminum can technology to ensure convenience, product safety, and sustainability.

- Metal packaging is essential for quality preservation and shelf life extension in the food sector. Cans and tins are ordinary for packaging ready-to-eat meals, processed foods, fruits, and vegetables. The rise in convenience food consumption and the growing working professional population have increased the demand for canned foods. The healthcare sector also contributes significantly, using metal packaging for medicines, ointments, and creams due to its protective properties.

- Sustainability is driving the growth of India's metal packaging market. Environmental awareness has increased consumer and business preference for recyclable and reusable packaging. Metal packaging, especially aluminum, maintains its quality through multiple recycling cycles, making it a preferred choice for brands. The market evolution indicates a continued focus on innovation, with new technologies and designs enhancing metal packaging functionality and appeal in India.

- Companies in India are increasing their investments in metal packaging, particularly cans, to meet the growing demand across beverages, food, personal care, and household products industries. These companies are improving can design, upgrading technology, and implementing eco-friendly practices to provide sustainable and efficient packaging solutions. In May 2024, Ball Corporation partnered with CavinKare to introduce retort aluminum cans for milkshakes in India's dairy sector. This development addresses the increasing demand for ready-to-drink (RTD) beverages while meeting consumer preferences for convenience and sustainability.

- In India, the metal packaging market faces growth challenges, mainly due to the rise of alternative packaging solutions. Metal packaging, particularly cans, boasts durability, recyclability, and practical product preservation. However, alternatives like plastic, glass, and flexible packaging are emerging as formidable competitors. These alternatives are frequently chosen for their cost-effectiveness, versatility, and distinct benefits in specific industries, posing a challenge to the widespread acceptance of metal packaging.

India Metal Packaging Market Trends

Beverage Cans are Expected to Hold Significant Share

- In India, the metal packaging market is increasingly dominated by beverage cans, fueled by a rising appetite for alcoholic and non-alcoholic drinks. The surging consumption of soft drinks, energy drinks, iced teas, and alcoholic options like beer and ready-to-drink cocktails underscores the trend. Aluminum and steel cans are favored for their convenience, portability, and prowess in preserving product quality. As on-the-go consumption surges, especially among the younger urban demographic, beverage cans have become India's go-to packaging for ready-to-drink beverages.

- When it comes to non-alcoholic drinks, cans shine as a practical choice. They are adept at preserving the taste, carbonation, and freshness of sodas, energy drinks, and fruit juices. Their sealed, airtight nature safeguards the integrity of carbonated and flavored beverages. Moreover, the recyclability of aluminum cans resonates with the rising consumer demand for sustainability, bolstering their appeal in the non-alcoholic segment. With sustainability gaining traction in India, brands increasingly gravitate towards aluminum cans, viewing them as a greener alternative to plastic bottles.

- India's alcoholic beverage sector is also pivoting towards cans, especially in the beer and ready-to-drink (RTD) cocktail arenas. Beer producers are turning to aluminum cans, valuing their ability to maintain carbonation and freshness while shielding the product from light and air degradation. The lightweight nature of cans further enhances their appeal for distribution and consumption, particularly in outdoor and event contexts. As urban alcohol consumption trends evolve, cans emerge as a favored choice, offering convenience, portability, and cost-effectiveness to a diverse audience.

- India's beer consumption is rising, with volumes jumping from 1.63 billion liters in 2020 to an anticipated 3.40 billion liters by 2025. This surge underscores the growing allure of beer in the country, spurred by urbanization, evolving lifestyles, and rising disposable incomes, especially among the youth. The influx of diverse domestic and international beer brands has further fueled this trend. As beer consumption escalates, so does the demand for efficient and sustainable packaging solutions. Metal cans, known for their lightweight nature and ability to preserve beer's quality and freshness, are becoming increasingly popular. This burgeoning beer market signals a bright future for manufacturers and the packaging industry in India.

- Manufacturers of alcoholic and non-alcoholic beverages are harnessing the branding potential of cans to engage consumers. The smooth aluminum surface lends itself to vibrant, high-quality designs, ensuring they can catch the eye of crowded store shelves-a vital edge in a competitive landscape. Innovations like easy-open tabs and distinctive shapes amplify consumer convenience. As both beverage sectors expand, the dominance of cans in India's metal packaging market seems assured, bolstered by their functional, eco-friendly, and aesthetic merits.

Food Industry is Expected to Witness Significant Growth

- In India, the food industry's demand for metal packaging is rising, spurred by a growing appetite for convenience, extended shelf life, and enhanced product preservation. Metal packaging, notably cans, tins, and jars, safeguards food from contamination, light, air, and moisture, ensuring freshness and longevity. With a surge in demand for ready-to-eat meals, canned vegetables, fruits, sauces, and snacks, metal packaging has cemented its place in the food sector.

- Consumers increasingly gravitate towards convenience and processed foods, so the appetite for metal packaging solutions has intensified. Metal cans are the go-to choice for packaging canned soups, ready-to-eat meals, beverages, and even pet food, owing to their sealed environment that safeguards taste, nutrition, and safety. Moreover, the recyclability of metal packaging resonates with the rising consumer demand for sustainable solutions, further cementing its role in the food industry.

- Factors like a burgeoning middle class, urbanization, and evolving lifestyles drive India's appetite for packaged food. With a growing preference for convenient, ready-to-eat meals, metal packaging is the ideal blend of practicality and sustainability. Innovations like lightweight cans, easy-open lids, and versatile designs have further enhanced metal packaging's appeal, boosting its adoption in the food sector.

- India's packaged food market, valued at USD 51.3 billion in 2022, is set to reach an estimated USD 70.2 billion by 2024. This surge is intricately tied to a rising preference for metal packaging solutions. With consumers gravitating towards convenient, ready-to-eat meals and processed foods, metal packaging emerges as a key player, ensuring food quality, safety, and extended shelf life. Popular choices like cans, tins, and aluminum packaging shield products from light, air, and moisture, safeguarding taste and nutrition.

- The uptick in packaged food consumption has amplified the demand for efficient, sustainable packaging. Metal cans, favored for their airtight seals and recyclability, have become the go-to option. As the market expands, manufacturers increasingly turn to metal packaging, underscoring its pivotal role in the evolving food industry, driven by demands for convenience, sustainability, and product preservation.

- As India's appetite for processed and packaged foods grows, so does the demand for metal packaging. With a keen focus on product quality, safety, and sustainability, manufacturers increasingly turn to metal packaging, especially cans and tins, for their durability, recyclability, and superior preservation qualities.

India Metal Packaging Industry Overview

The Indian metal packaging market is fragmented and consists of significant individual players, such as Hindustan Tin Works Ltd., Deccan Cans & Printers Pvt. Ltd., Zenith Tins Private Limited, Ball Corporation, NIKITA CONTAINERS PVT. LTD. Many companies are increasing their market presence by expanding their operations or entering into strategic mergers and acquisitions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of the Impact of Macro-economic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Metal Packaging

- 5.1.2 High Adaptability of Metal Cans in different End User Segments

- 5.2 Market Challenges

- 5.2.1 Presence of Alternate Packaging Solutions Limit the Market

6 MARKET SEGMENTATION

- 6.1 By Materials Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By Product Type

- 6.2.1 Cans

- 6.2.1.1 Food Cans

- 6.2.1.2 Beverage Cans

- 6.2.1.3 Aerosol Cans

- 6.2.2 Bulk Containers

- 6.2.3 Shipping Barrels and Drums

- 6.2.4 Caps and Closures

- 6.2.5 Other Product Types

- 6.2.1 Cans

- 6.3 By End-User Vertical

- 6.3.1 Beverage

- 6.3.2 Food

- 6.3.3 Paints and Chemicals

- 6.3.4 Industrial

- 6.3.5 Other End-users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AJ Packaging Limited

- 7.1.2 Casablanca Industries Pvt. Ltd .

- 7.1.3 NIKITA CONTAINERS PVT. LTD.

- 7.1.4 Zenith Tins Private Limited

- 7.1.5 Petrox Packaging (I) Pvt. Ltd

- 7.1.6 Deccan Cans & Printers Pvt. Ltd

- 7.1.7 Hindustan Tin Works Ltd

- 7.1.8 Hi-Can Industries Pvt. Ltd

- 7.1.9 Kaira Can Company Limited

- 7.1.10 Ball Corporation