|

市場調查報告書

商品編碼

1644387

串流媒體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Media Streaming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

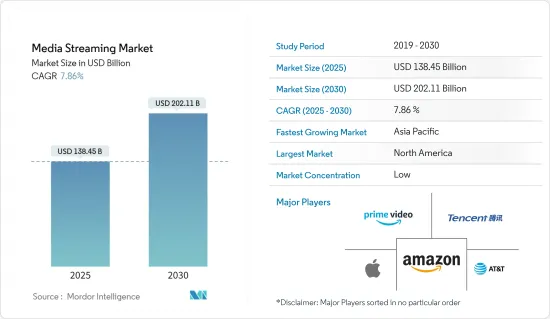

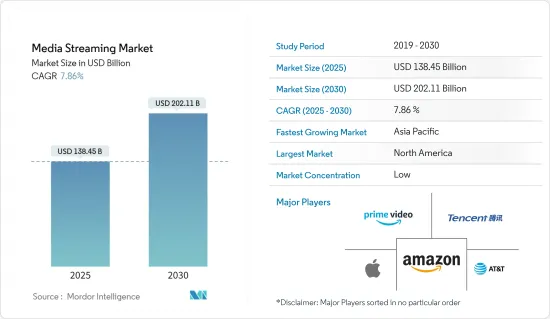

預計 2025 年串流媒體市場規模為 1,384.5 億美元,到 2030 年將達到 2021.1 億美元,預測期內(2025-2030 年)的複合年成長率為 7.86%。

該市場的成長得益於訂閱服務需求的不斷成長、本地和原創內容的日益普及以及體育賽事直播的普及。這些市場促進因素正在推動供應商策略的轉變,越來越重視透過個人化和提供實惠的服務來改善客戶體驗。

關鍵亮點

- 利用區塊鏈技術和人工智慧(AI)等創新將提高媒體品質。編輯、拍攝、畫外音、腳本以及影片創作和上傳的許多其他方面都得到了人工智慧的大力協助。這些進步預計將對市場擴張產生正面影響。許多支援人工智慧的媒體串流解決方案供應商正在提高媒體內容品質。如今,這些頻道比 YouTube 和 Netflix 等主流媒體更受歡迎。

- 此外,廣告和收益模式在這個市場中發揮關鍵作用。與社群媒體相比,許多人更關注串流平台上的廣告。例如,全球最大的獨立全通路賣方廣告平台Magnite今天發布的一份題為《印度進入串流媒體時代》的報告發現,串流媒體平台上的廣告比社群媒體上的廣告更受關注。近三分之二(64%)的印度主播更傾向於在主播平台上做廣告,其中許多人聲稱他們經常搜尋產品(48%)並隨後進行購買(33%)。

- Netflix 最基本的套餐起價為每月 8.99 美元,而其高清服務起價為 12.99 美元。 Amazon Prime 客戶可以支付 119 美元獲得年度會員費或每月支付 12.99 美元。這場價格戰,加上蘋果、迪士尼等大企業的進入,讓市場競爭更加激烈。

- 此外,智慧型手機和雲端基礎服務的快速普及、OTT平台對傳統付費電視的滲透率不斷提高,以及採用人工智慧和機器學習來規範直播、深入了解消費者使用模式和夥伴關係、提供越來越多的在地化內容,全部區域。例如,Netflix 擁有 75,000 種不同的內容類型,並透過演算法推薦為每個用戶提供個人化內容。

- 由於軟禁措施的實施,冠狀病毒的蔓延對串流媒體產業產生了積極影響。受線上串流媒體需求成長和消費者轉變的推動,供應商看到全部區域的用戶數量激增,收視率達到高峰。例如,截至 3 月 31 日的 2020 年第一季,Netflix 全球用戶數量為 1,580 萬,比預期的 720 萬成長一倍多,比去年同期成長 22.5%。此外,Netflix 報告稱,2020 年 3 月,其行動應用程式的新安裝量在義大利成長了 50% 以上,在西班牙成長了 30% 以上。

串流媒體市場趨勢

音樂串流媒體市場預計將大幅成長

- 音樂串流媒體提供者依靠獨家內容(例如播客和原創內容)首先吸引人們到他們的平台,並最終將他們轉化為用戶。此外,新興市場的訂閱費降價以及通訊業者的捆綁優惠等促銷活動預計將進一步促進成長。

- 例如,根據Spotify的資料,2023年第三季度,音樂串流服務Spotify的全球有效用戶數創下了5.74億的歷史新高。資料進一步顯示,Spotify 平台全球有效用戶數從 2022 年第三季的 4.56 億成長到 2023 年第三季的 5.74 億。

- 全球市場最熱門的趨勢之一是 5G 連接的日益廣泛使用。亞馬遜抓住機遇,推出了新的音樂高清服務,讓美國、英國、德國和日本的音樂愛好者可以享受無損音樂串流和下載。一旦 5G 普及,它將能夠以比 4G 快數倍的速度傳輸資料,使公司能夠提供高保真的音樂串流。虛擬實境(VR)、擴增實境(AR)和全像圖音樂會預計將與音樂視訊直播一起變得非常流行。這些新進展正在加速市場的發展。

- 市場參與企業正在提供精選播放清單、夜間模式、無損音樂和更好的定位等新功能,這使他們比其他公司更具競爭優勢,並使市場競爭更加激烈。隨著市場上的選擇數量不斷增加,這樣做也是為了提高客戶維繫。例如,2021 年 12 月 25 日至 2022 年 1 月 31 日期間,共創建了約 82,000 個除夕夜播放列表,其中除夕夜當天就創建了近 40,000 個播放列表。

- 雖然全球參與企業已經採取了各種策略來強勢滲透音樂串流平台,但本地參與企業憑藉其本地曝光度和對本地內容的高度關注,仍然在各自地區佔據著強勢地位。例如,Gaana 仍然是印度市場的第一大參與企業,而 Yandex Music 在俄羅斯處於領先地位。同樣,騰訊音樂集團以其QQ音樂、酷狗和酷我應用程式引領中國市場。

亞太地區成長強勁

- 內容創作的投入不斷增加,新的內容也不斷出現。印度正在成為一個內容中心,為國內和國際消費創造豐富的內容。此外,串流媒體影片在中國、日本、韓國、印尼和泰國等國家的用戶中非常受歡迎,對市場成長產生了積極影響。

- 雖然北美繼續主導串流媒體市場,但亞太地區的成長率最快。亞太地區行動電話和網路普及率顯著提高,對該地區串流媒體市場供應商的成長產生了積極影響。迪士尼和蘋果等大公司正在利用日益成長的行動電話使用量並迅速改善高速網路存取。

- IFPI 音樂報告 2022《參與音樂 2022》是一份關於世界各地的人們如何享受和參與音樂的全球報告。該報告由代表全球唱片業的國際唱片業聯合會(IFPI)今天發布。這項調查獲得了來自 22 個國家的 44,000 多人的回應,是迄今為止最大的音樂調查。超過45%的客戶選擇付費會員服務,46%的受訪者使用音訊發送服務。

- 此外,97% 的人口使用智慧型手機聽音樂,62% 的人口使用社群媒體網站或應用程式聽音樂或觀看音樂影片。這表明該地區向數位媒體的持續轉變預計將進一步推動串流媒體市場的成長。

串流媒體產業概覽

由於市場參與企業眾多、競爭日益激烈,串流媒體市場變得分散。為了獲得競爭優勢並透過吸引更多客戶來提高市場地位,供應商正專注於提供高價值的捆綁服務、創新功能以及高品質、原創和在地化的內容。供應商也正在透過合作和收購來加強其市場地位。

2023 年 9 月,派拉蒙宣布將推出串流媒體服務 Paramount+,該服務將於 12 月在日本上市,並在有線電視和網路業者J:COM 的平台以及付費電視服務 Wowow 上免費提供。 《塔爾薩之王》、《金斯敦市長》、《星際爭霸戰:奇異新世界》等 Paramount+ 原創影片將在該服務推出的同時首次在日本播放。

2023 年 3 月,蘋果宣布推出一款專門用於串流古典音樂的全新獨立應用程式。 Apple Music Classical 讓您可以存取超過 500 萬首古典音樂歌曲。據蘋果公司稱,該應用程式擁有世界上最廣泛的古典音樂目錄,包含數千張獨家專輯。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對全球串流媒體市場的影響

第5章 市場動態

- 市場促進因素

- 跨各種音訊串流平台輕鬆存取和自訂播放列表

- 訂閱視訊點播 (SVoD) 服務日益流行

- 體育直播串流服務日益普及

- 市場問題

- 延遲、可靠性和設備相容性挑戰

- 市場機會

- 360 度影片、AR 和 VR 的採用率不斷提高

- 利用機器學習和人工智慧簡化和管理內容製作和分發

- 透過廣播網路和 SVoD 平台提供 8K 內容

第6章 市場細分

- 按內容類型

- 音樂串流媒體

- 影片串流

- 按收益模式

- 廣告

- 訂閱

- 透過串流媒體平台

- 智慧型手機和平板電腦

- 筆記型電腦和桌上型電腦

- 智慧型電視

- 遊戲機

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Spotify Technology SA

- Apple Inc.

- Amazon Prime(Amazon.com Inc.)

- Tencent Holdings Limited

- Deezer SA

- YouTube(Alphabet Inc.)

- AT&T Inc.

- Pandora Media Inc.

- The Walt Disney Company

- Baidu Inc.

- British Broadcasting Corporation

第8章投資分析

第9章:市場的未來

The Media Streaming Market size is estimated at USD 138.45 billion in 2025, and is expected to reach USD 202.11 billion by 2030, at a CAGR of 7.86% during the forecast period (2025-2030).

The growth of the market is fuelled by the growing demand for subscription-based services, increasing availability of region-specific and original content, and the popularity of live sports. These drivers are changing the strategies adopted by the vendors in the market as the emphasis on enhanced customer experience by providing personalization and low-cost services is increasing daily.

Key Highlights

- Media quality is improved by using innovations like blockchain technology and artificial intelligence (AI). Editing, cinematography, voice-overs, scriptwriting, and many other facets of video creation and upload are all greatly aided by AI. It is projected that these advancements will have a favorable impact on the market's expansion. The content quality of media is being improved by a number of suppliers of media streaming solutions employing AI. Recently, these channels have become much more popular than mainstream media outlets like YouTube and Netflix.

- Moreover, the advertising and revenue model plays a crucial role in this market. More people pay attention to ads on streaming platforms than on social media. For instance, In a report titled "India Embraces the Streaming Era," published today by Magnite, the largest independent omnichannel sell-side advertising platform in the world, it was discovered that ads on streaming platforms attract more attention than those on social media. Almost two-thirds of streamers in India (64%) are more receptive to advertising on streaming platforms, with many claiming to frequently do a product search (48%) and make a purchase (33%) after the fact.

- Netflix offers its most basic plan starting at USD 8.99 per month and USD 12.99 for its high-definition service. Amazon Prime customers can get an annual membership for USD 119 or pay USD 12.99 a month. The market is, therefore, getting more competitive with such price wars and more big players entering the market, such as Apple and Disney.

- Furthermore, the rapid adoption of smartphones and cloud-based services, increased penetration of OTT platforms as compared to traditional pay-tv, and incorporation of AI and machine learning to help regulate live streaming and provide insights on consumer usage patterns and partnerships to offer more and region-specific content has increased the growth of video streaming segment across regions. For instance, Netflix has 75,000 different content genres and provides personalized content for individual users through recommendation, which is possible due to the algorithms allowing it to do so.

- The ongoing spread of coronavirus has positively impacted the media streaming industry due to enforced home confinement measures. The vendors were witnessing a spike in the number of subscribers and a peak in viewership across regions due to increased demand for online streaming and changed consumers. For instance, In the first quarter of 2020, ending on March 31, Netflix added 15.8 million subscribers globally, which is more than double the 7.2 million that was expected and a growth of 22.5% year on year. Further, Netflix reported a rise in the quantity of new mobile application installations of more than 50% in Italy and more than 30% in Spain in March 2020.

Media Streaming Market Trends

Music Streaming Segment is Expected to Witness Significant Growth

- Music streaming providers are offering exclusive content with podcasts and original content, which first attracts people towards the platform and eventually turns them as subscribers. Moreover, promotional activities like price cuts in subscriptions in growing markets and bundled offers from telecommunications players are expected to boost the growth further.

- For instance, according to the data from Spotify, in the third quarter of 2023, the music streaming service Spotify reached an all-time high with 574 million active users worldwide. Moreover, according to the data, the number of active users worldwide on the Spotify platform grew to 574 million active users in the third quarter of 2023 from 456 million active users in the third quarter of 2022.

- One of the most well-liked trends in the global market is the expanding use of 5G connections. Amazon has taken advantage of this chance by launching a new music HD service that will give music lovers in the United States, the United Kingdom, Germany, and Japan access to lossless music streams and downloads. As 5G becomes more commonly used, businesses will be able to provide high-fidelity music streams because of its ability to transport data multiple times quicker than 4G. Virtual Reality (VR), Augmented Reality (AR), and hologram concerts are anticipated to become quite popular for live-streaming music videos. These new developments are accelerating the market's expansion.

- Players in the market are offering new features such as curated playlists, night mode, and lossless music for improved targeting, which is also providing companies with a competitive edge over others, thus making the market competition stronger. This is also done to improve customer retention as the number of options in the market increase continually. For instance, between December 25, 2021, and January 31, 2022, about 82,000 New Year's Eve playlists were made; on New Year's Eve itself, almost 40,000 playlists were made.

- Although global players are strongly penetrating their music streaming platforms by adopting various strategies, regional players still have a stronghold in their respective regions, owing to regional exposure and a high focus on local content. For instance, Gaana continues to be the number 1 player in the Indian market, whereas Yandex Music is leading in Russia. Similarly, Tencent Music Group is one of the leading players in China market because of its apps QQ Music, Kugou, and Kuwo.

Asia Pacific to Witness Significant Growth

- Rising investment in content creation has led to the creation of new content offerings. Increasingly, India is becoming one of the content hubs, with a wealth of material being created for consumption locally and around the world. Further, the video streaming segment is gaining significant traction among users in countries like China, Japan, South Korea, Indonesia and Thailand, thus positively impacting the growth of the market.

- Although North America still dominates the media streaming market, Asia Pacific is showing a rapid increase in the growth rate. The significantly high penetration of mobile phones and internet in Asia Pacific region is positively impacting the growth of streaming market vendors in the region. Giants such as Disney and Apple Inc. are leveraging growing mobile usage and rapidly improving access to faster-speed Internet.

- According to IFPI Music Report 2022, Engaging with Music 2022 is a global report on how people all around the world enjoy and engage with music. It was published today by IFPI, which represents the recording business globally. The survey, which is based on responses from more than 44,000 people in 22 countries, is the biggest music study ever conducted. More than 45% of customers choose paid membership services, and 46% of respondents use audio streaming subscription services, which provide continuous and on-demand access to millions of licensed songs.

- Moreover, 97% of the population listens to music using a smartphone; 62% use social media sites or apps to listen to music or watch music videos. This shows the ongoing transformation towards digital media in the region is further expected to grow the market for media streaming.

Media Streaming Industry Overview

The media streaming market is fragmented owing to the presence of significant players in the market and growing competitiveness in the market. Vendors in the market are concentrating on providing high-value bundles, innovative features, and High quality, original and region-specific content to gain a competitive advantage and improve their market position by acquiring more customers. Vendors are also adopting partnerships and acquisitions to strengthen their place in the market.

In September 2023, Paramount announced launching the Paramount+ streaming service in Japan in December as a no-extra-charge addition to cable and internet provider J: COM's platform and to pay-TV service Wowow. Paramount+ originals, including Tulsa King, Mayor of Kingstown, and Star Trek: Strange New Worlds, will be available at the service's launch and for the first time in Japan.

In March 2023, Apple announced the launching of a new standalone app designed specifically for streaming classical music. Apple Music Classical will offer access to over five million classical music tracks. The Apple said the app will have the world's most extensive classical music catalog and feature thousands of exclusive albums.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on Global Media Streaming Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Easy Accessibility and Playlist Customization on Various Audio Streaming Platforms

- 5.1.2 Growing Adoption of Subscription Video on Demand (SVoD) Services

- 5.1.3 Increasing Popularity of Live Sports Streaming Services

- 5.2 Market Challenges

- 5.2.1 Challenges Regarding Latency, Reliability, and Device Compatibility

- 5.3 Market Opportunities

- 5.3.1 Increasing Adoption of 360-degree Video, AR, and VR

- 5.3.2 Streamlining and managing Content Production and Distribution by Machine Learning and AI

- 5.3.3 8K Content Offering from Broadcasting Networks and SVoD Platforms

6 MARKET SEGMENTATION

- 6.1 By Content Type

- 6.1.1 Music Streaming

- 6.1.2 Video Streaming

- 6.2 By Revenue Model

- 6.2.1 Advertising

- 6.2.2 Subscription

- 6.3 By Streaming Platform

- 6.3.1 Smartphone & Tablet

- 6.3.2 Laptop and Desktop

- 6.3.3 Smart TV

- 6.3.4 Gaming Console

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 UK

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 UAE

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Spotify Technology S.A.

- 7.1.2 Apple Inc.

- 7.1.3 Amazon Prime (Amazon.com Inc.)

- 7.1.4 Tencent Holdings Limited

- 7.1.5 Deezer SA

- 7.1.6 YouTube (Alphabet Inc.)

- 7.1.7 AT&T Inc.

- 7.1.8 Pandora Media Inc.

- 7.1.9 The Walt Disney Company

- 7.1.10 Baidu Inc.

- 7.1.11 British Broadcasting Corporation