|

市場調查報告書

商品編碼

1644391

地板暖氣 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Underfloor Heating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

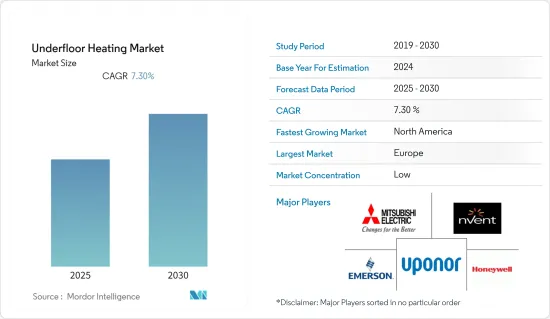

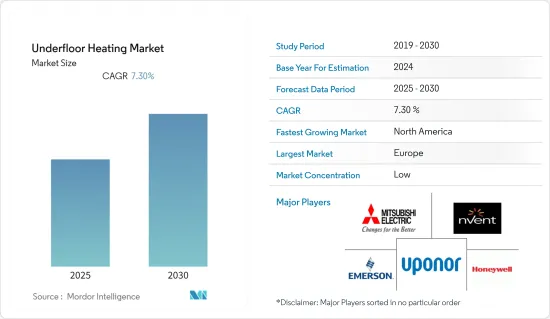

預計預測期內地板暖氣市場複合年成長率為 7.3%。

國際能源總署(IEA)發佈建築能耗報告預計,到2030年,家用電子電器所使用的能源將增加,亞太地區將成為全球最大的能源消耗地區。此外,人們對能源效率和可再生能源技術的認知不斷提高,將極大地影響未來對地板暖氣系統的需求。這些能源和供熱解決方案將顯著節省碳排放,並有助於實現可再生能源目標。

據HCL稱,預計2025年全球10%的家庭將成為智慧家庭。此外,隔熱和控制等新建築技術品質的提高正在刺激地板暖氣系統供應商開發新的解決方案,以滿足日益成長的客戶需求。例如,博世提供智慧家庭室內恆溫器,讓您可以從任何地方控制地板暖氣。此外,政府關於能源效率和電器及電器產品採用標準的嚴格規範凸顯了永續技術的採用,從而推動了市場成長。新型先進地板暖氣系統正日益更換傳統暖氣系統,因為它們運作成本高,能源和熱量損失大。然而,地暖反應時間慢是限制地暖系統發展的一個因素。

COVID-19 疫情導致世界各國政府實施限制措施,暫停日常業務。這對全球建築基礎設施產業產生了重大影響,導致勞動力短缺和計劃延誤,從而導致產品推出減少。因此,市場在復甦之前可能仍將面臨挑戰。地板暖氣的主要缺點是安裝和維護需要大量工作。需要拆除現有的地板材料和暖氣基礎設施,安裝新的暖氣管道並澆築混凝土。這可能會給潛在客戶帶來成本高昂、破壞性和令人沮喪的影響,預計在預測期內抑制市場成長。

地暖市場趨勢

住宅領域推動市場成長

- 隨著生活水準的不斷提高,住宅領域佔據了地板暖氣市場的最大佔有率。此外,整修活動和智慧家庭計劃進一步推動了市場成長。預計未來五年智慧家庭市場規模將達到 2,464.2 億美元,預測期內複合年成長率為 25%。

- 地板暖氣比傳統方法節能15-20%,因此減少了建築物的整體碳排放。這就是為什麼它被認為是住宅供暖的理想解決方案。此外,政府顧問最近建議禁止在新住宅中安裝燃氣鍋爐,以刺激市場成長。

- 此外,由於地板暖氣比散熱器具有許多優勢,因此在住宅領域的應用越來越廣泛。其好處是更加舒適、更加溫暖且能源費用更低。而且,透過地板暖氣循環的空氣比透過散熱器推來的空氣更清潔。

- 此外,供應商正在投資研發以在市場上生產更好的產品。例如,2021年11月,中國智慧家庭設備製造商Meross生產了第一款用於電動式地暖系統的智慧恆溫器。這款創新的小工具使用觸控式照明 LED 顯示器的玻璃螢幕來管理加熱系統的每個部分,其工作原理與普通電纜恆溫器類似。

- 到 2025 年,英國將實施未來住宅標準,住宅。根據英國商業、能源和工業戰略部的數據,按照該標準建造的住宅的碳排放應比按照現有建築要求建造的住宅低 75% 至 80%。

歐洲佔有最大市場佔有率

- 由於羅伯特·博世有限公司、西門子股份公司、施耐德電氣、耐克森公司和 nVent Electric plc 等地板采暖供應商的強大影響力,歐洲佔據了最大的市場佔有率。此外,歐洲節能建築的日益成長的趨勢正在幫助企業從增加的銷售額中獲得更多利益,從而吸引更多公司進入市場。

- 據歐盟委員會稱,考慮到能源管理和基於安全的設備,該地區安裝的智慧家庭和智慧建築設備數量預計未來五年將成長到9.8億以上。經合組織的數據顯示,歐盟在節能建築投資方面處於領先地位。因此,在預測期內,該地區對節能建築的投資增加和重視可能會推動市場的發展。

- 該地區已觀察到一些收購活動。例如,2021年2月,英國水資源管理和氣候管理解決方案製造商Polypipe Group PLC宣布將以無債務現金方式收購英國永續地板暖氣解決方案、空氣和地源熱泵以及其他可再生供暖系統供應商Nu-Heat (Holdings) Limited,總對價為2700萬英鎊。此次收購將使 Polypipe Group PLC 進一步發展其地板暖氣能力,並開發整合地板暖氣、熱泵和空氣氣候控制系統的新方法。

- 活性化研發活動以及對建築領域供暖系統未來前景(特別是在寒冷氣候下)的一般了解對市場成長產生了積極影響。正在進行的大規模維修和政府規定(到 2025 年將禁止在新建住宅中安裝燃氣鍋爐),正在推動電動式暖業務的擴張。該地區寒冷的氣候條件、人們對舒適生活的需求以及輻射熱的好處預計將推動市場成長。

地暖產業概況

全球地板暖氣市場高度分散。市場的主要企業正在採用新產品發布、業務擴展、協議、合作和收購等策略來擴大其在市場上的影響力。參與市場的公司包括 Aponnar Corporation、Emersion Corporation、Honeywell International Inc.、三菱電機株式會社和 nVent Electric PLC。

2022年1月,Feenstra針對荷蘭傳統獨戶住宅推出了高溫熱泵系統。

2021 年 11 月,nVent Electric PLC 推出了具有增強工作打包和熱圖功能的商業軟體。該公司已發布的軟體整合了客戶的 3D 工廠建模系統並結合了熱管理系統 (HMS) 設計功能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 對經濟高效的供暖解決方案的需求很高

- 更嚴格的建築規範以減少整體能源消耗

- 市場限制

- 地板暖氣系統的反應時間比散熱器系統慢。

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場區隔

- 按產品

- 硬體

- 按服務

- 按類型

- 電

- 水力

- 按子系統

- 加熱系統

- 控制系統

- 按安裝類型

- 新安裝

- 維修安裝

- 按應用

- 住宅

- 商業設施

- 設施

- 產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭格局

- 公司簡介

- Uponor Corporation

- Emersion Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- nVent Electric PLC

- Robert Bosch GmbH

- Danfoss Group

- Siemens AG

- Schneider Electric

- Nexans SA

- Amuheat

- Flexel International Limited

第7章投資分析

第8章 市場機會與未來趨勢

The Underfloor Heating Market is expected to register a CAGR of 7.3% during the forecast period.

The International Energy Agency (IEA) released a report on energy consumption in buildings estimating that by 2030, the energy used by household appliances will increase, with Asia-Pacific being the region with the highest energy consumption. Further, the rising awareness about energy efficiency and renewable energy technology significantly impacts the future demand for underfloor heating systems. These energy and heating solutions can achieve substantial carbon savings and help meet renewable energy targets.

According to HCL, an estimated 10% of households worldwide are expected to be smart homes by 2025. Moreover, the growing quality of new building techniques, such as insulation and controls, stimulates the underfloor heating systems vendors to develop new solutions that cater to the increasing customer demand. For instance, Bosch offers an intelligent home and room thermostat to operate underfloor heating from anywhere. Moreover, the stringent government norms for energy efficiency & standards toward adopting electrical & electric appliances emphasize adopting sustainable technologies, which fuel market growth. The new advanced underfloor heating systems boost the replacement rates of the legacy heating systems because of high operational costs and substantial energy & heat loss. However, the slow response time of underfloor heating is one factor limiting the growth of underfloor heating systems.

With the outbreak of COVID-19, governments worldwide imposed restrictions on down day-to-day business operations by implementing lockdowns. Due to this, there were labor shortages and delays in projects, drastically impacting the global construction & infrastructure industry, resulting in a decline in product deployment. Hence, the market is likely to face challenges till the market resurgence. A key drawback of underfloor heating is that installation and maintenance require significant intervention. The existing flooring and heating infrastructure needs to be removed, new heating pipes installed, and concrete poured. This can be costly, destructive, and off-putting to potential customers, which is expected to restrain market growth over the forecast period.

Underfloor Heating Market Trends

Residential Sector to Drive the Market Growth

- The residential sector holds the maximum market share for the underfloor heating market due to people's growing inclination toward a better standard of living. Moreover, refurbishment activities and smart home initiatives further boost the market growth. The smart home market is anticipated to register a CAGR of 25% over the forecast period and is expected to reach USD 246.42 billion in the next five years.

- Underfloor heating is 15-20% more energy efficient than traditional methods and, therefore, reduces the overall carbon footprint of a building. It is, therefore, considered an optimal solution for heating homes. Further, government advisers have recently recommended banning gas boilers installation in new homes, stimulating market growth.

- Moreover, the increasing adoption of underfloor heating in the residential sector is due to its advantages over radiators. The advantages include more comfort, adequate heat, and less expensive bills. Moreover, the air circulated from underfloor heating is cleaner than the air pushed around by radiators.

- Further, vendors are investing in research & development to create better products in the market. For instance, in November 2021, Meross, a Chinese smart home gadget maker, produced its first smart thermostat for electrically underfloor heating systems. The innovative gadget uses a glass screen featuring a touch-sensitive, illuminated LED display to manage every part of the heater system and functions broadly similar to any regular cable thermostat.

- By 2025, the United Kingdom is expected to have a Future Homes Standard that will require new homes to be future-proofed with low-carbon heating and world-leading energy efficiency. According to the UK Department for Business, Energy & Industrial Strategy, homes built to this standard should emit 75% to 80% less CO2 than homes built to current construction requirements.

Europe Holds Maximum Market Share

- Europe holds the maximum market share as the region has a strong presence of underfloor heating vendors, such as Robert Bosch GmbH, Siemens AG, Schneider Electric, Nexans S.A., and nVent Electric plc, among others. Moreover, Europe has been witnessing an increasing number of players entering the market, owing to the rising inclination toward energy-efficient buildings that are enabling companies to earn more profit by expanding their sales.

- According to the European Commission, by volume, the installed base of smart home and intelligent building devices in the region is expected to grow to over 980 million units in the next five years, considering energy management and security-based devices. Additionally, the European Union topped the investments in energy-efficient buildings, according to OECD. Therefore, with the increase in investments and emphasis on energy-efficient buildings in the region, the market is likely to grow over the forecast period.

- The region is witnessing multiple acquisition activities. For instance, in February 2021, the UK-based Polypipe Group PLC, the manufacturer of water management and climate management solutions, announced its acquisition of the UK-based Nu-Heat (Holdings) Limited, the supplier of sustainable underfloor heating solutions, air and ground source heat pumps, and other renewable heating systems, for a total consideration of GBP 27 million on a cash-free, debt-free basis. This acquisition will enable Polypipe Group to further develop underfloor heating capabilities and new ways to integrate underfloor heating, heat pumps, and air-based climate management systems.

- Intense R&D operations and public knowledge about the prospects of heating systems in the building sector, particularly in cold locations, had a favorable impact on market growth. The continuous large-scale renovations and government rules prohibiting the installation of gas boilers in new homes by 2025 have fueled the expansion of the electric underfloor heating business. Colder climatic conditions in this region, people's demand for comfort in their homes, and the benefits of radiant heat are expected to propel the market growth.

Underfloor Heating Industry Overview

The global underfloor heating market is highly fragmented. Major players in the market are using strategies, such as new product launches, expansions, agreements, partnerships, acquisitions, and others, to increase their footprints in this market. Some players operating in the market include Uponor Corporation, Emersion Electric Co., Honeywell International Inc., Mitsubishi Electric Corporation, and nVent Electric PLC.

In January 2022, Feenstra announced a high-temperature heating pump system for traditional single-family houses in the Netherlands that are said to be a simple replacement for typical gas centralized heating boilers.

In November 2021, nVent Electric PLC launched commercial software with enhanced work packing and heat mapping features. It introduced software that integrates 3D plant modeling systems from the customer with incorporated heat management system (HMS) design capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Demand for Cost-Effective Heating Solutions

- 4.2.2 Stringent Building Codes to Reduce Overall Energy Consumption

- 4.3 Market Restraints

- 4.3.1 Slower Response Time of Underfloor Heating Systems than Radiator Systems

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment on the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Services

- 5.2 By Type

- 5.2.1 Electric

- 5.2.2 Hydronic

- 5.3 By Subsystem

- 5.3.1 Heating Systems

- 5.3.2 Control Systems

- 5.4 By Installation Type

- 5.4.1 New Installations

- 5.4.2 Retrofit Installations

- 5.5 By Application

- 5.5.1 Residential

- 5.5.2 Commercial

- 5.5.3 Institutional

- 5.5.4 Industrial

- 5.6 Geography

- 5.6.1 North America

- 5.6.2 Europe

- 5.6.3 Asia-Pacific

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Uponor Corporation

- 6.1.2 Emersion Electric Co.

- 6.1.3 Honeywell International Inc.

- 6.1.4 Mitsubishi Electric Corporation

- 6.1.5 nVent Electric PLC

- 6.1.6 Robert Bosch GmbH

- 6.1.7 Danfoss Group

- 6.1.8 Siemens AG

- 6.1.9 Schneider Electric

- 6.1.10 Nexans S.A.

- 6.1.11 Amuheat

- 6.1.12 Flexel International Limited