|

市場調查報告書

商品編碼

1644394

供應商風險管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Vendor Risk Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

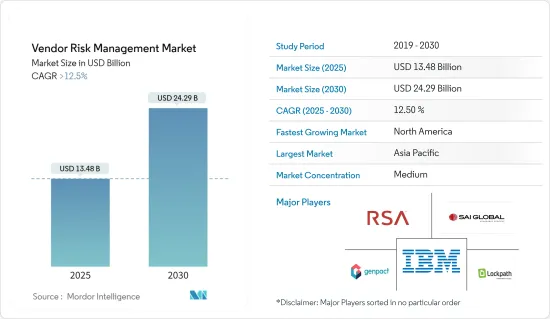

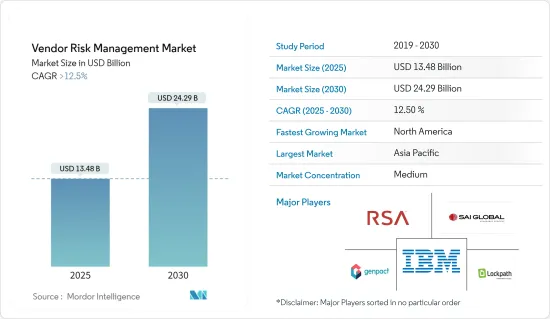

供應商風險管理市場規模在2025年估計為134.8億美元,預計到2030年將達到242.9億美元,在預測期內(2025-2030年)的複合年成長率將超過12.5%。

大型和小型企業中第三方供應商的數量不斷增加、不同地區法規的快速變化以及持續監控和分析供應商績效的需求是推動供應商風險管理需求的一些因素。

主要亮點

- 供應商風險管理計劃包括一個全面的計劃,以識別和減輕業務不確定性、法律責任和聲譽損害。隨著公司擴大外包的使用,VRM 和第三方風險管理已成為其風險管理框架中越來越不可或缺的一部分。供應商風險計劃允許公司隨著時間的推移觀察供應商關係、識別新出現的風險並衡量供應商的績效。

- 許多公司發現他們需要從純粹的商業角度重新審視與 VRM 相關的系統和程序。由於供應商風險管理架構不完善,您可能需要支付巨額賠償金。例如,製造一輛汽車平均需要30,000個不同的零件,這增加了全球製造汽車所需流程和供應鏈協調的複雜性。擁有眾多第三方製造商和服務提供者的供應鏈會為製造商帶來巨大的風險源,產生骨牌效應,預計會增加供應商風險管理的需求。

- 2023 年 7 月,AuditBoard 為 CISO 及其團隊推出了一項新的 IT 風險管理解決方案:AuditBoard ITRM。據 AuditBoard 稱,AuditBoard ITRM 旨在促進IT安全與其他組織職能之間的協作,以加速 IT 系統的識別和分類、執行業務影響評估以及對已發現的問題進行補救。

- 此外,各種法律和機構,例如貨幣監督(OCC)、健康保險互通性與課責法案(HIPAA)、消費者金融保護局(CFPB)、反海外腐敗法案(FCPA)、多德—弗蘭克法案、HITECH法案、美國金融服務業現代化法等都要求企業建立強大的VRM框架,從而最終用戶採用這些解決方案。

- COVID-19 的蔓延凸顯了對能夠幫助組織有效管理其供應鏈、識別關鍵供應商和消除任何風險的解決方案的需求。雲端運算的不斷普及和對即時分析的需求預計將推動市場成長。

供應商風險管理市場趨勢

BFSI 預計將大幅成長

- 就其業務性質而言,銀行業是一個高度互聯的行業,因為第三方整合迅速擴大、連網設備數量不斷增加、網路銀行以及對更快交易的需求。隨著互聯互通程度的提高,需要保護和監控的事物也越來越多,這也增加了網路安全風險。互聯的實體可能會與新的實體相連,這也可能帶來網路安全風險。

- 第三方供應商可能會為外包銀行帶來嚴重的網路安全風險,包括財務和聲譽損失、監管問題和業務中斷。例如,澳洲P&N銀行最近向客戶發送了通知信,表示資料外洩可能導致他們的個人和敏感帳戶資訊面臨風險。該銀行表示,此次入侵是透過第三方託管公司營運的客戶關係管理 (CRM) 平台發生的。洩漏的資訊包括姓名、地址、聯絡方式(電子郵件、電話號碼、客戶號碼、年齡、帳號、帳戶餘額等)。

- 2023 年 11 月,True Digital Group 與 FiscalNote Holdings, Inc.(一家提供政策和全球情報的人工智慧主導企業 SaaS 技術供應商)進行策略合作,繪製第三方和第四方供應商圖並監控關鍵風險,為金融機構提供了解和監控其不斷擴大的供應商網路中風險的機會,並提高其整個生態系統的透明度。

- 在銀行業,重點可能是 IT 部門、資料保護問題以及與第三方交換資料的危險。在消費品產業,重點可能放在產品品質和安全風險上,目的是保護最終消費者和品牌聲譽。雖然組織主動管理特定功能或業務方面的風險是正確的,但許多組織並沒有放棄這種集中的觀點,並考慮他們對更廣泛業務的風險敞口——這種整體觀點對於理解和管理整個企業的第三方整體風險敞口至關重要。

- 在 BFSI 行業,由於風險敞口的增加和監管的持續變化,對供應商風險管理(包括合規管理、供應商資訊管理和財務管理)的需求正在迅速增加。例如,貨幣監督(OCC)提供的指導涵蓋某些類型的第三方,例如雲端服務供應商、資料聚合商、金融科技公司和分包商,以及與這些提供者開展業務時必須遵守的法規。

預計北美將佔很大佔有率

- 由於人工智慧、機器學習、雲端和物聯網領域的先進技術發展、BFSI 和醫療保健等終端用戶行業的成長、投資水平的提高以及對資料安全的日益關注,該地區的供應商風險管理市場正在迅速擴張。

- 在北美,由於監管要求不斷提高、合規相關處罰不斷增加以及對第三方的審查越來越嚴格,企業風險管理已成為企業關注的主要問題,因為他們需要努力減少受第三方事件影響的風險並在市場上保護自有品牌。透過創建整合的企業技術基礎設施並遵循明確定義的程序,公司正在改善風險管理並利用第三方夥伴關係關係為整個組織創造價值。

- 此外,2023 年 6 月,美國主要監管機構——聯準會、聯邦存款保險公司和貨幣監督署——發布了最終指南,以幫助銀行管理與第三方關係相關的風險。無論第三方關係的性質為何,《指南》都規定了有效的第三方風險管理原則。

- 此外,該地區還擁有許多擁有國際供應鏈的大公司,例如亞馬遜和沃爾瑪。因此,供應商風險管理參與者有機會藉助人工智慧和機器學習提供先進的功能,進一步滲透該地區。

供應商風險管理產業概況

供應商風險管理市場處於半固體,少數現有參與者佔大部分市場佔有率,市場競爭非常激烈。龐大的前期投資和快速的技術應對力使得新供應商難以進入市場。

- 2023 年 11 月 - Metric Stream 宣布推出一款雲端 GRC 解決方案,該解決方案以 MetricStream CyberGRC 和適用於 Amazon Web Services (AWS) 的 AWS Audit Manager 為特色。 MetricStream 的新雲端 GRC 解決方案旨在讓客戶能夠集中管理風險、合規標準、框架和控制,並在本地和 AWS 環境中提供自動證據收集和評估。

- 2022 年 8 月-Prevalent, Inc. 推出其第三方風險管理平台的最新版本。 3.28 版引入了自動文件分析和客製化儀表板,以加快和簡化整個第三方生命週期中的供應商管理,並簡化支援文件的調查。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對供應商風險管理市場的影響評估

第5章 市場動態

- 市場促進因素

- 需要有效管理複雜的供應商生態系統

- 查看與各種任務相關的風險級別

- 市場限制

- 許多組織依賴非正式、手動的流程

- 市場挑戰

- 解決方案與現有應用程式整合

第6章 市場細分

- 按類型

- 解決方案(子區隔的定性分析)

- 供應商資訊管理

- 品質保證管理

- 財務管理

- 合規管理

- 審核管理

- 合約管理及其他

- 服務

- 解決方案(子區隔的定性分析)

- 依部署類型

- 本地

- 雲

- 按組織規模

- 中小型企業

- 大型企業

- 按行業

- 銀行、金融服務和保險

- 通訊和 IT

- 製造業

- 政府

- 衛生保健

- 其他(能源及公共產業、零售及消費品)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- RSA Security LLC

- Genpact Limited

- LockPath

- MetricStream

- IBM Corporation

- Resolver Inc.

- SAI Global

- Rapid Ratings International Inc.

- Quantivate

- Optiv Security, Inc.

第8章投資分析

第9章:市場的未來

The Vendor Risk Management Market size is estimated at USD 13.48 billion in 2025, and is expected to reach USD 24.29 billion by 2030, at a CAGR of greater than 12.5% during the forecast period (2025-2030).

The increasing number of third-party vendors in large as well as in small and medium enterprises, rapidly changing regulations across different regions, and the need to continuously monitor and analyze vendor performance are some of the factors responsible for the growing demand for vendor risk management.

Key Highlights

- Vendor risk management programs have an exhaustive plan for identifying and mitigating business uncertainties, legal liabilities, and reputational harm. As companies increase their use of outsourcing, VRM and third-party risk management evolve into an increasingly essential part of any enterprise risk management framework. A vendor risk program can enable organizations to observe supplier relationships over time, identify new risks, and measure supplier performance.

- Many extensive businesses are discovering that their systems and procedures related to VRM need to be revised from a purely business standpoint. They might have to pay substantial damages due to inadequate vendor risk management framework. For instance, an average of 30,000 different parts is required to create a single vehicle, increasing the complex processes and supply chain coordination necessary to manufacture automobiles globally. The supply chains, with numerous third-party manufacturers and service providers, contain a significant source of risk for manufacturers in a domino effect, which, in turn, is expected to increase the need for vendor risk management.

- In July 2023, AuditBoard launched its new IT risk management offering, AuditBoard ITRM, a purpose-built solution for CISOs and their teams. AuditBoard ITRM is designed to enable collaboration between IT security and other organizational functions to accelerate the identification and classification of IT systems, perform business impact assessments, and remediate identified issues, according to AuditBoard.

- Moreover, various laws and agencies such as the Office of the Comptroller of the Currency (OCC), the Health Insurance Portability and Accountability Act (HIPAA), the Consumer Financial Protection Bureau (CFPB), the Foreign Corrupt Practices Act (FCPA), Dodd-Frank, the HITECH Act, and the Gramm-Leach-Bliley Act require enterprises to set up a robust VRM framework, driving the end-user to adopt these solutions.

- The spread of the COVID-19 pandemic emphasized the need for solutions that would help organizations efficiently manage supply chains, identify critical suppliers, and omit any risks that are expected to augment the growth of vendor risk management solutions across various industries. The increased adoption of the cloud and the need for real-time analytics are expected to proliferate the market growth.

Vendor Risk Management Market Trends

BFSI is Expected to Witness Significant Growth

- The Banking sector is, by the nature of its business, a highly interconnected sector owing to rapidly growing third-party integration, increasing connected devices, online banking, and the need for faster transactions. Greater interconnectivity introduces higher cybersecurity risks, given that there are too many things to secure and monitor. The interconnected entities are likely connected to new entities, which could also be the source of cybersecurity risk.

- Third-party vendors can often pose some serious cybersecurity risks to outsourcing banks, such as financial/reputational damage, regulatory problems, operational disruptions, etc. For instance, Australian P&N Bank recently sent its customers a notification letter about a data breach that put the personal and sensitive account information of customers at risk. The bank stated that the breach occurred through its customer relationship management (CRM) platform operated by a third-party hosting firm. The information exposed included name, address, and contact details, e.g., email, phone number, customer number, age, account number, and account balance.

- In November 2023, True Digital Group strategically collaborated with FiscalNote Holdings, Inc., an AI-driven enterprise SaaS technology provider of policy and global intelligence, to map 3rd and 4th party vendors and monitor critical risks, presenting an opportunity for financial institutions to understand and monitor risks within their expansive supplier networks and elevate transparency throughout the vendor ecosystem.

- The IT department, data protection concerns, and the dangers of exchanging data with third parties may be the emphasis in the banking industry. Risks to product quality and safety may be the emphasis in the consumer products industry, with a goal of protecting both end consumers and the brand's reputation. Although organizations have been right to be proactive in managing risks to specific functions or aspects of the business, many haven't stepped back from this focused perspective to examine the broader business exposure, the holistic view that's essential to understanding overall risk exposure resulting from third parties and managing it enterprise-wide.

- The need for vendor risk management for compliance management, vendor information management, and financial control is rapidly increasing in the BFSI industry due to greater exposure and continuously changing regulations. For instance, the guidance provided by the Office of the Comptroller of the Currency (OCC) addresses specific types of third parties, such as cloud service providers, data aggregators, fintech companies, and subcontractors, and how regulations to follow while conducting business with these providers.

North America is Expected to Hold Major Share

- The vendor risk management market in the region is proliferating owing to advanced technological developments in the field of AI, machine learning, cloud, and IoT, growth of end-user industries such as BFSI, healthcare, and others, increasing levels of investments, and a growing emphasis on data security.

- In North America, extended enterprise risk management is a primary concern for companies as they work to reduce their exposure to third-party incidents and safeguard their brand in the market due to rising regulatory demands, compliance-related punishments, and heightened scrutiny regarding third parties. By creating an integrated enterprise technology infrastructure and following well-defined procedures, businesses are improving risk management and making use of their partnerships with third parties to generate value throughout the entire organization.

- Further, in June 2023, The Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency, the major regulating agencies in the United States, issued final guidelines to help banks manage risks associated with their third-party relationships. The guidance provides principles for effective third-party risk management for all types of relationships, regardless of how they may be structured.

- Moreover, the region is home to numerous major business players who have supply chains spread on an international level, such as Amazon and Walmart, among others. Thus, the vendor risk management players have the opportunity to penetrate further in the region by offering advanced functionalities with the help of AI and machine learning.

Vendor Risk Management Industry Overview

The market for vendor risk management is semi-consolidated as few established players in the market have gained the majority of the market share and thus are highly competitive. The huge initial investment and capability to cope with the rapidly changing technology have made it difficult for new vendors to enter the market.

- November 2023 - Mertic Stream has announced a cloud GRC solution powered by MetricStream CyberGRC and AWS Audit Manager from Amazon Web Services (AWS), MetricStream's new cloud GRC solution is designed to provide customers with the ability to centrally manage risks, compliance standards, frameworks, and controls, and provides automated evidence gathering and assessments across on-premises and AWS environments.

- August 2022 - The most recent version of Prevalent, Inc.'s Third-Party Risk Management Platform was launched. Automated document analysis and customized dashboards are introduced in version 3.28 to expedite and streamline vendor management throughout the third-party lifecycle and the examination of supporting documentation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on Vendor Risk Management Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for the Efficient Management of Complex Vendor Ecosystems

- 5.1.2 View the Risk Levels Associated With Various Tasks

- 5.2 Market Restraints

- 5.2.1 Dependence on Non-Formal and Manual Processes By Many Organizations

- 5.3 Market Challenge

- 5.3.1 Solution Integration With Existing Applications

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions (Qualitative Analysis for Sub-Segments)

- 6.1.1.1 Vendor Information Management

- 6.1.1.2 Quality Assurance Management

- 6.1.1.3 Financial Control

- 6.1.1.4 Compliance Management

- 6.1.1.5 Audit Management

- 6.1.1.6 Contract Management and Others

- 6.1.2 Services

- 6.1.1 Solutions (Qualitative Analysis for Sub-Segments)

- 6.2 By Deployment Type

- 6.2.1 On-Premises

- 6.2.2 Cloud

- 6.3 By Organization Size

- 6.3.1 Small and Medium-Sized Enterprises

- 6.3.2 Large Enterprises

- 6.4 By Industry Vertical

- 6.4.1 Banking, Financial Services, and Insurance

- 6.4.2 Telecom and IT

- 6.4.3 Manufacturing

- 6.4.4 Government

- 6.4.5 Healthcare

- 6.4.6 Others (Energy and Utilities, Retail and Consumer Goods)

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 RSA Security LLC

- 7.1.2 Genpact Limited

- 7.1.3 LockPath

- 7.1.4 MetricStream

- 7.1.5 IBM Corporation

- 7.1.6 Resolver Inc.

- 7.1.7 SAI Global

- 7.1.8 Rapid Ratings International Inc.

- 7.1.9 Quantivate

- 7.1.10 Optiv Security, Inc.