|

市場調查報告書

商品編碼

1644397

中東和非洲壓縮機:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030 年)Middle-East And Africa Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

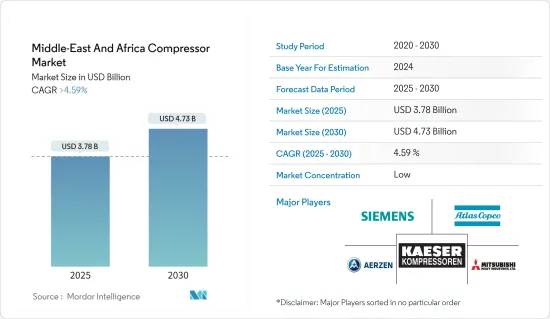

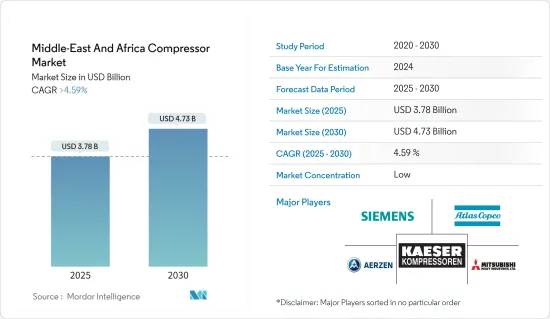

中東和非洲壓縮機市場規模預計在 2025 年為 37.8 億美元,預計到 2030 年將達到 47.3 億美元,預測期內(2025-2030 年)的複合年成長率將超過 4.59%。

關鍵亮點

- 從中期來看,該地區石油、天然氣和產業部門預計的持續成長將在預測期內推動市場發展。

- 然而,預計預測期內石油和天然氣價格波動加劇將阻礙市場成長。

- 磁力軸承等壓縮機技術的進步和能源效率的提高預計將為中東和北非柴油發電機市場創造重大機會。

- 由於該地區對天然氣能源的需求不斷成長,沙烏地阿拉伯有望成為市場主導者。

中東和非洲壓縮機市場趨勢

預計石油和天然氣產業將佔據市場主導地位。

- 中東和非洲豐富的碳氫化合物資源正在加強其作為全球能源樞紐的地位,凸顯了壓縮機在石油和天然氣作業各個階段的不可或缺性。從探勘鑽探到精製和運輸,壓縮機可提高效率、最佳化生產並確保無縫運作。

- 此外,石油和天然氣行業的複雜性正在推動對專用壓縮機解決方案的需求。上游和下游活動的不同需求要求壓縮機能夠適應特定的應用,例如注氣、液化和氣體運輸。對最大化資源開採的創新技術的追求推動了對先進、高效壓縮機系統的需求不斷成長。

- 根據能源研究所《2023年世界能源統計評論》,預計2022年中東和非洲的石油產量將達到3778.6萬桶/日,較2021年的3544.5萬桶/日成長6.6%,從而推動該地區的壓縮機需求。

- 此外,該地區對下游多樣化的戰略重點鞏固了壓縮機在石油和天然氣行業的主導地位。中東和非洲精製和石化產能的擴大需要壓縮機來支援流體化媒裂和乙烯生產。壓縮機是增加整個碳氫化合物價值鏈價值的關鍵部件。

- 例如,2022年4月,沙烏地阿拉伯石油化工綜合體公司宣布已與蘇爾壽簽署協議,以最佳化其石油化學綜合體的能源效率。蘇爾壽補充說,它將專注於設計更高效的壓縮機系統和其他化學工藝,以降低能耗,使石化綜合體更加節能。

- 總之,石油和天然氣產業在中東和非洲壓縮機市場中的地位突出,是由於該產業的經濟需求、複雜的業務和戰略多元化的努力。隨著該地區適應能源動態的細微變化,壓縮機整合正在成為一種變革力量,它將重新定義效率,提高資源利用率,並為該地區在全球能源供應和工業發展中的關鍵作用做出重大貢獻。

沙烏地阿拉伯市場預計將快速成長

- 沙烏地阿拉伯因其龐大的碳氫化合物蘊藏量和在石油和天然氣工業中的關鍵作用,在壓縮機需求方面脫穎而出。隨著石化產業的蓬勃發展和基礎設施計劃的不斷推進,沙烏地阿拉伯對高效可靠壓縮機的需求已不僅限於石油和天然氣,還涉及精製、化學加工和下游產業。

- 例如,根據能源研究所《2023年世界能源評論》,沙烏地阿拉伯的天然氣產量從2021年到2022年增加了5.2%以上。預計 2022 年天然氣產量將達到 1,204 億立方米,而 2021 年為 1,145 億立方米,這表明石油和天然氣產業的成長將推動壓縮機市場的發展。

- 此外,沙烏地阿拉伯雄心勃勃的經濟多元化措施正在提升其影響力。 「2030願景」致力於改變國家經濟,涵蓋採礦業、製造業和可再生能源領域,從而產生了對壓縮機解決方案的需求。壓縮機融入多樣化的工業格局將進一步提高其在沙烏地阿拉伯市場的重要性。

- 2022年9月,沙烏地阿拉伯政府宣布將向11個城市投資106億美元,用於發展基礎建設。該計劃是透過石油和天然氣行業發展城市以增加國內工業並減少收入。

- 此外,沙烏地阿拉伯對先進技術的戰略投資與壓縮機的採用完美契合。隨著沙烏地阿拉伯擁抱工業4.0和創新主導的方法,對智慧、節能壓縮機的需求將會飆升,從而推動市場變革。

- 總之,沙烏地阿拉伯在中東和北非壓縮機市場的崛起深深植根於其能源領導地位、經濟多元化和技術進步。隨著沙烏地阿拉伯在永續成長的複雜過程中不斷探索,壓縮機整合正在成為一種變革力量,它將重新定義工業效率、支持多樣化,並為沙烏地阿拉伯的經濟復原力和在區域壓縮機行業的領導地位做出重大貢獻。

中東和非洲壓縮機產業概況

中東和非洲壓縮機市場適度細分。該市場的主要企業(不分先後順序)包括阿特拉斯·科普柯公司、西門子股份公司、三菱重工有限公司、凱撒壓縮機有限公司和 Aerzener Maschinenfabrik GmbH。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 石油和天然氣工業的成長

- 工業領域快速成長

- 限制因素

- 石油和天然氣價格波動

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 類型

- 體積

- 動態的

- 最終用戶

- 石油和天然氣

- 電力業

- 製造業

- 化學和石化工業

- 其他

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

第6章 競爭格局

- 合併、收購、合作及合資

- 主要企業策略

- 公司簡介

- Siemens AG

- Baker Hughes Co.

- Trane Technologies PLC

- Atlas Copco AB

- Ariel Corporation

- General Electric Company

- Mitsubishi Heavy Industries Ltd

- Aerzener Maschinenfabrik GmbH

- Kaeser Kompressoren GmbH

- 市場佔有率

第7章 市場機會與未來趨勢

- 科技快速進步

簡介目錄

Product Code: 71535

The Middle-East And Africa Compressor Market size is estimated at USD 3.78 billion in 2025, and is expected to reach USD 4.73 billion by 2030, at a CAGR of greater than 4.59% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing growth of the oil and gas and industrial sectors in the region is expected to drive the market during the forecasted period.

- On the other hand, increasing fluctuations in oil and gas prices are expected to hinder the growth of the market during the forecasted period.

- Nevertheless, technological advancements in compressors like magnetic bearings and better energy efficiency are expected to create huge opportunities for the Middle-East and African diesel generator market.

- Saudi Arabia is expected to be a dominant region for the market due to the increasing demand for energy in the region being generated from natural gas.

MEA Compressor Market Trends

Oil and Gas Industry Segment Expected to Dominate the Market

- The Middle-East and Africa's abundant hydrocarbon resources cement their role as global energy hubs, underscoring the indispensability of compressors in various stages of oil and gas operations. From exploration and drilling to refining and transportation, compressors enhance efficiency, optimize production, and ensure seamless operations.

- Moreover, the complexity of the oil and gas sector elevates the demand for specialized compressor solutions. The diverse requirements of upstream and downstream activities necessitate a spectrum of compressors tailored to specific applications, such as gas injection, liquefaction, and gas transportation. The sector's pursuit of innovative technologies to maximize resource extraction further amplifies the demand for advanced and efficient compressor systems.

- According to the Energy Institute Statistical Review Of World Energy 2023, the oil production in the Middle-East and African region in 2022 was 37,786 thousand barrels per day compared to 35,445 thousand barrels per day in 2021, registering a growth rate of 6.6%, consequently driving the demand for compressors in the region.

- Furthermore, the region's strategic focus on downstream diversification lends credence to the dominance of compressors within the oil and gas industry. The Middle-East and Africa's endeavors to expand refining and petrochemical capacities require compressors to support fluid catalytic cracking and ethylene production. Compressors, critical components of these operations, emerge as linchpins for unlocking value across the hydrocarbon value chain.

- For instance, in April 2022, a petrochemical complex company in Saudi Arabia announced that it had signed a contract with Sulzer to optimize the energy efficiency in its petrochemical complex. Sulzer further added that it would focus on designing more efficient compressor systems and other chemical processes to reduce energy consumption and make the petrochemical complex more energy efficient.

- In conclusion, the envisaged prominence of the oil and gas industry segment within the Middle East and Africa compressor market emanates from the sector's economic indispensability, operational complexity, and strategic diversification efforts. As the region navigates the nuances of energy dynamics, the integration of compressors emerges as a transformative force, poised to redefine efficiency, augment resource utilization, and contribute significantly to the region's pivotal role in global energy supply and industry evolution.

Saudi Arabia Expected to be the Fastest-growing Market

- The nation's substantial hydrocarbon reserves and pivotal oil and gas industry position reinforce its prominence in compressor demand. With a thriving petrochemical sector and ongoing infrastructure projects, Saudi Arabia's requirement for efficient and reliable compressors extends beyond oil and gas, encompassing refining, chemical processing, and downstream industries.

- For instance, according to the Energy Institute Review of World Energy 2023, gas production in Saudi Arabia increased by more than 5.2% between 2021 and 2022. In 2022, gas production was 120.4 bcm 2022 compared to 114.5 bcm in 2021, signifying the country's increasing oil and gas sector, which drives the compressor market.

- Moreover, Saudi Arabia's ambitious economic diversification initiatives bolster its prominence. Vision 2030's commitment to transforming the nation's economy encompasses mining, manufacturing, and renewable energy sectors, necessitating compressor solutions. The integration of compressors into a diversified industrial landscape cements Saudi Arabia's significance within the market.

- As per this initiative, in September 2022, the Saudi Arabian government announced that it would invest USD 10.6 Billion in 11 cities to develop the infrastructure in those cities. The plan is to develop cities to increase industries in the country and reduce their income through the oil and gas sector.

- Furthermore, the nation's strategic investments in advanced technologies align seamlessly with compressor adoption. As Saudi Arabia embraces Industry 4.0 and innovation-driven approaches, the demand for intelligent and energy-efficient compressors surges, driving the market's evolution.

- In conclusion, the envisaged ascendancy of Saudi Arabia within the Middle-East and African compressor market is deeply rooted in its energy leadership, economic diversification, and technological advancements. As the nation navigates the complexities of sustainable growth, the integration of compressors emerges as a transformative force, poised to redefine industrial efficiency, support diversification, and contribute significantly to Saudi Arabia's journey toward economic resilience and leadership in the regional compressor landscape.

MEA Compressor Industry Overview

The Middle-East and African compressor market is moderately fragmented. Some of the key players in this market (in no particular order) include Atlas Copco AB, Siemens AG, Mitsubishi Heavy Industries Ltd, Kaeser Kompressoren GmbH, and Aerzener Maschinenfabrik GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Oil and Gas Industry

- 4.5.1.2 Rapid Growth in the Industrial Sector

- 4.5.2 Restraints

- 4.5.2.1 Fluctuation in Oil and Gas Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Positive Displacement

- 5.1.2 Dynamic

- 5.2 End User

- 5.2.1 Oil and Gas Industry

- 5.2.2 Power Sector

- 5.2.3 Manufacturing Sector

- 5.2.4 Chemicals and Petrochemical Industry

- 5.2.5 Other End Users

- 5.3 Middle-East and Africa

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Nigeria

- 5.3.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Baker Hughes Co.

- 6.3.3 Trane Technologies PLC

- 6.3.4 Atlas Copco AB

- 6.3.5 Ariel Corporation

- 6.3.6 General Electric Company

- 6.3.7 Mitsubishi Heavy Industries Ltd

- 6.3.8 Aerzener Maschinenfabrik GmbH

- 6.3.9 Kaeser Kompressoren GmbH

- 6.4 Market Share

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Technological Advancements

02-2729-4219

+886-2-2729-4219