|

市場調查報告書

商品編碼

1644405

美國虛擬行動服務業者(MVNO):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)US Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

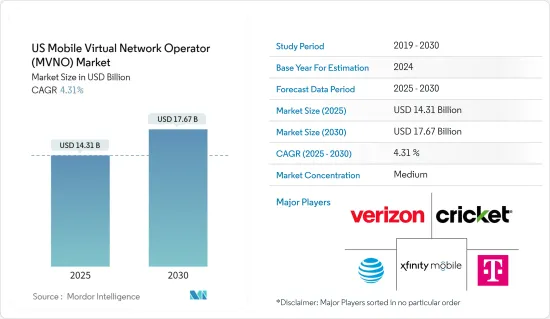

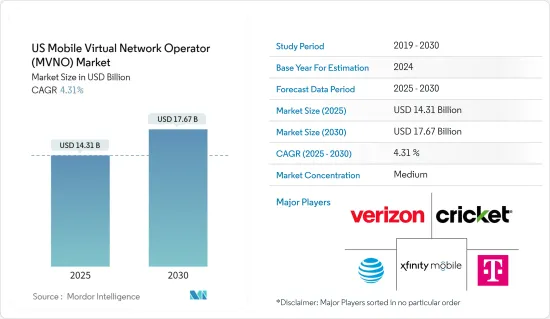

美國虛擬行動服務業者(MVNO)市場規模預計到 2025 年將達到 143.1 億美元,到 2030 年將達到 176.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.31%。

主要亮點

- 虛擬行動服務業者(MVNO)不擁有手機訊號塔和網路設備等實體基礎設施,而是透過從現有行動通訊業者(MNO)租賃網路存取來提供行動通訊服務。 5G MVNO 技術以其卓越的資料速度、最小的延遲和先進的連接性而聞名,為 MVNO 擴展傳統語音和資料之外的服務提供了堅實的基礎。這導致了企業行動虛擬網路營運商 (MVNO) 的興起,其中物流、製造和醫療保健等行業透過建立和管理私有網路引領潮流。

- 同樣,eSIM技術將使MVNO和行動通訊業者受益。借助 eSIM,MVNO 可以輕鬆地在單一裝置上切換通訊業者,而無需實體 SIM 卡。 eSIM 還將使 MVNO 能夠提供新的靈活服務,例如臨時的本地通訊業者連接或垂直特定服務,例如連網型設備的網際網路。例如,2024 年 3 月,大型通訊業者(縮寫為 VI)Vodafone Idea 推出了一項針對預付用戶的服務。

- 人工智慧可以透過多種方式使行動虛擬網路營運商受益。其中之一是利用人工智慧和機器學習演算法來改善客戶個人化和提供最佳優惠。這有助於 MVNO 根據個人客戶的偏好和需求量身定做他們的服務,從而有可能提高客戶滿意度和忠誠度。此外,人工智慧可以幫助最佳化無線電資源分配,這在 MVNO 營運的競爭激烈且受到嚴格監管的通訊業中尤其重要。人工智慧演算法還可以預測維護需求並自動化某些流程,例如客戶服務聊天機器人。整體而言,人工智慧有潛力幫助行動虛擬網路營運商提高效率、降低成本並改善客戶體驗。預計這些趨勢將推動所研究的市場。

- 隨著日本擁抱數位轉型,連網型設備、機器對機器通訊、雲端運算、物聯網 (IoT)、工業 4.0 和邊緣運算等趨勢的興起凸顯了對快速、高效網路的迫切需求。作為回應,MVNO 越來越關注物聯網、M2M 和全球連結。這些 MVNO 正在尋求增強連接解決方案,並將其與汽車、醫療設備、穿戴式裝置和工業機械等設備和服務無縫整合。

- 政府壓力的增加和競爭的加劇迫使通訊供應商降低降價以維持市場地位。這使得通訊業對價格非常敏感。大多數虛擬網路營運商都利用定價模式來吸引客戶。這個市場的利潤率較低,因為虛擬網路營運商透過從主要通訊業者租賃頻寬來向消費者提供低廉的價格。 MVNO 充當批發商,從寬頻業者網路大量購買頻寬,然後以折扣價出售給消費者。

美國虛擬行動服務業者(MVNO) 市場趨勢

經銷商部分預計將佔據大部分市場佔有率

- 經銷商充當仲介業者,銷售供應商和營運商的服務,同時遵守標準服務等級協定 (SLA)。所有服務的提供者和營運商將開立單一發票。經銷商 MVNO 可以以自有品牌或與 MNO 聯合品牌運作。通常,這些品牌經銷商已經建立了品牌銷售管道和大量現有客戶群,可以利用這些客戶群來促進銷售。行動經銷商模式適合希望為客戶提供客製化通訊費率方案的企業。相較之下,品牌經銷商模式適合希望透過行動通訊服務來加強自有品牌的公司。

- 經銷商通常是行動網路營運商 (MNO) 最容易接受的 MVNO 類型。在這種模式下,MVNO 可以推出自己的附加價值服務(VAS)。有限責任意味著行動虛擬網路營運商在這個細分市場中的風險較小,但缺乏營運控制也限制了商機。在這種模式中,MVNO 不擁有任何資產,而是與 MNO 合作。這意味著 MVNO 不擁有客戶、基礎設施、SIM 卡,也沒有定價能力。然而,MVNO 確實可以控制分銷和品牌功能。

- 經銷商 MVNO 受益於更快的市場進入速度和更低的推出成本,因為大多數基礎設施需求由網路營運商管理。然而,經銷商仍需要承擔行銷、銷售和分銷成本。隨著 4G 和 5G 技術的日益普及,經銷商模式將在未來幾年抓住重大機會。例如,新推出的MVNO Venn Mobile 在 Teltik 旗下營運,Teltik 是一家與 T-Mobile 業務策略一致的經銷商。 Venn Mobile 提供無限通話、簡訊、資料和 50GB 行動熱點,每月僅需 30 美元。

- 此外,技術進步也發揮關鍵作用。智慧型手機的廣泛應用和行動網際網路普及率的提高為行動虛擬網路營運商提供創新資料中心服務創造了肥沃的土壤。此外,4G 的推出和 5G 網路的預期擴展為經銷商 MVNO 提供了提供高速資訊服務的機會,而無需進行大量基礎設施投資。這些努力正在推動市場向前發展。根據VIAVISION預計,到2023年,美國將有503個城市可以接入5G網路,比世界上任何其他國家都多。

- 最新一波的虛擬網路營運商正優先推出和維護自己的服務能力。這些功能結合了以雲端為中心的方法、API主導的通訊服務整合以及主要基於網路的自我護理選項,以最大限度地減少對傳統通訊基礎設施的依賴。透過採用精實、敏捷的業務流程,這些 MVNO 不僅可以與現有企業競爭,還可以提高客戶滿意度並引入價格差異化。他們利用 PaaS 實現收費、CRM 整合、產品目錄管理、評級、發票和發票格式化等功能。這種選擇具有戰略意義,因為這些應用程式在運行時無需最終用戶的直接干預,並且可以從非同步後台處理中受益。

在市場區隔方面,預計消費市場將佔很大佔有率

- 推動美國MVNO 成長的主要因素之一是對低成本行動服務的需求不斷成長。該國許多消費者對價格敏感,正在尋找傳統行動行動電話業者的經濟實惠的替代方案。 MVNO 透過提供有競爭力的價格和靈活的計劃來滿足不同群體的需求。

- 推動美國MVNO 成長的另一個因素是行動網路服務的日益普及。根據GSMA報告,到2025年,美國5G連線數量預計將達到2.52億。此外,到2030年,5G連線預計將占美國所有連線的95%。隨著需求的成長,越來越多的消費者正在尋找經濟實惠且可靠的行動網路服務。 MVNO 透過提供各種計劃和套餐來滿足不同需求和預算,從而滿足了這項需求。因此,消費者正在積極尋求該國的 MVNO 服務,從而推動了需求。

- 此外,資料通訊服務需求的不斷成長也推動了該國行動虛擬網路營運商 (MVNO) 的成長。隨著越來越多的美國消費者開始使用行動裝置存取網路、社群媒體和串流媒體服務,行動虛擬網路營運商 (MVNO) 也紛紛推出資料通訊計畫和套餐,以滿足各種需求和預算。據愛立信稱,預計2024年北美5G行動用戶數將達到3.1475億,到2029年將成長到4.3291億。

- 消費者越來越重視能夠直接滿足連結需求的品牌。作為回應,MVNO 正在客製化具有不同資料通訊品質和 5G 選項的套餐以滿足客戶需求。預計這項策略措施將促進市場成長。此外,預計行動虛擬網路營運商採用的多樣化定價策略將在預測期內進一步推動消費者細分市場的擴張。

- 隨著各行各業技術創新的不斷加快,對連網設備的需求也急劇上升。物聯網和汽車產業正在引領這一趨勢,為行動虛擬網路營運商創造巨大商機。美國四大通訊業者都在大力投資開發物聯網和 NB-IoT 基礎設施,其中 Verizon 的投資額約為 10 億美元。 MVNO 格局即將發生巨大變化,尤其是隨著Google等科技巨頭進入市場。這些科技巨頭正在利用 MVNO 模式為其當前提供的服務增值。

美國MVNO 行業概況

美國MVNO 市場是半獨立的,主要企業包括 Verizon Communications Inc.、AT&T Corporation、T-Mobile USA Inc.、Cricket Wireless LLC 和 Xfinity Mobile(康卡斯特公司)。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 7 月:Mediacom Communications 作為 MVNO 與 Verizon 合作,在所有市場推出新的行動產品。在此次發布之前經過了兩個月的測試階段,在此期間,Mediacom 與員工一起試用了行動服務,並採用 Reach 進行後勤部門配置和收費。儘管是 NCTC 的成員,Medicom 還是選擇放棄與 Reach 和 AT&T 達成的現有協議,並獨自開展行動業務。

- 2024 年 4 月,專注於隱私的行動服務先驅 Cape 獲得由 A* 和 Andreessen Horowitz主導的 6,100 萬美元融資。本輪資金籌措的其他參與者包括 XYZ Ventures、ex/ante、Costanoa Ventures、Point72 Ventures、Forward Deployed VC 和 Karman Ventures。利用這筆資金籌措,Cape 的目標是建立一個全國性的行動網路。此網路承諾提供優質的無線覆蓋,同時以獨特的方式確保姓名、號碼和位置等個人識別資訊的保密性。此次資金籌措公告發布之際,美國政府官員對主要通訊的網路安全漏洞的擔憂日益加劇,這增加了其面臨海外威脅的潛在風險。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- 新冠肺炎疫情對市場的影響

第5章 市場動態

- 市場促進因素

- 行動網路用戶和資料用戶的增加

- 對高效率行動電話網路的需求日益增加

- 市場挑戰

- 市場區隔

第6章 市場細分

- 按商業模式

- 經銷商

- 服務提供者

- 完整的 MVNO

- 其他商業模式

- 用戶

- 商業

- 消費者

第7章 競爭格局

- 公司簡介

- Verizon Communications Inc.

- AT&T Corporation

- T-Mobile USA Inc.

- Cricket Wireless LLC

- Xfinity Mobile(Comcast Corporation)

- DISH Network LLC(Boost Mobile LLC)

- TracFone Wireless Inc.(Straight Talk)

- Republic Wireless Inc.

- FreedomPop Inc.

- Consumer Cellular Inc.

第 8 章供應商市場佔有率

第9章投資分析

第10章:市場的未來

The US Mobile Virtual Network Operator Market size is estimated at USD 14.31 billion in 2025, and is expected to reach USD 17.67 billion by 2030, at a CAGR of 4.31% during the forecast period (2025-2030).

Key Highlights

- Mobile virtual network operators (MVNOs) offer mobile communication services by leasing network access from established mobile network operators (MNOs) rather than owning physical infrastructure like cell towers and network equipment. 5G MVNO technology, known for its superior data speeds, minimal latency, and heightened connectivity, offers MVNOs a robust foundation to expand their services beyond traditional voice and data. This has led to the emergence of Enterprise MVNOs, with sectors like logistics, manufacturing, and healthcare spearheading the trend by establishing and managing their private networks.

- Similarly, eSIM technology benefits MVNOs and mobile operators. With eSIM, MVNOs can easily swap carriers on a single device without a physical SIM card. This can significantly reduce the cost and time required to activate new mobile services. eSIM also allows MVNOs to offer new flexible services, such as temporary local operator connectivity or specialized services for specific verticals, such as the Internet of connected devices. For instance, in March 2024, Vodafone Idea, a major telecom operator known by its short form VI, launched services for its prepaid users.

- Artificial intelligence can potentially benefit MVNOs in several ways. One potential application is to improve customer personalization and next-best actions through the use of AI and machine learning algorithms. This could help MVNOs tailor their services to individual customer preferences and needs, leading to increased customer satisfaction and loyalty. Additionally, AI could help optimize wireless resource allocation, which is particularly important in the highly competitive and regulated telecom industry where MVNOs operate. AI algorithms could also predict maintenance needs and automate certain processes, such as customer service chatbots. Overall, AI has the potential to enable MVNOs to improve their efficiency, reduce costs, and enhance the customer experience. Trends like these are expected to drive the studied market.

- As the country embraces digital transformation, trends like the rise of connected devices, machine-to-machine communication, cloud computing, the Internet of Things (IoT), Industry 4.0, and edge computing underscore the urgent need for high-speed, efficient networks. In response, MVNOs are increasingly focusing on IoT, M2M, and global connectivity. These MVNOs are set to enhance connectivity solutions, seamlessly integrating them with devices and services spanning vehicles, medical instruments, wearables, and industrial machinery.

- Rising government pressure and increasing competition are forcing telecom vendors to reduce tariff prices to stay in the market. Thus, the telecom sector is becoming highly price sensitive. Most MVNOs leverage the low-cost model to gain customers. This market has a low profit margin because MVNOs offer consumers cheaper rates by renting spectrum from major carriers. They function as wholesalers who purchase bandwidth in large quantities from extensive carrier networks and sell at a discount to consumers.

US Mobile Virtual Network Operator (MVNO) Market Trends

The Reseller Segment is Expected to Hold a Significant Share in the Market

- Resellers act as intermediaries, selling services from a provider or operator while adhering to a standard service-level agreement (SLA). The overall service provider or operator issues a single bill. A reseller MVNO can operate under its own brand or co-brand with an MNO. Typically, these branded resellers come with established brand distribution channels or a substantial existing customer base, which they can leverage for sales. The mobile reseller model caters to companies aiming to offer customized mobile communication tariffs to their clientele. In contrast, the branded reseller model suits companies looking to enhance their brand with mobile communication services.

- Resellers are typically the most readily accepted type of MVNO by mobile network operators (MNOs), as MNOs retain control over most processes. This model allows MVNOs the potential to offer their own value-added services (VAS). With limited liability, this market segment presents fewer risks for MVNOs, but it also curtails revenue opportunities due to the lack of operational control. In this model, MVNOs partner with MNOs without holding any assets. This means they do not own the client, the infrastructure, or the SIM, nor do they have the ability to set prices. However, MVNOs do maintain control over distribution and branding functionalities.

- Reseller MVNOs benefit from quicker market entry and lower startup costs, as they rely on network operators to manage most infrastructure needs. However, these resellers still bear the expenses for marketing, sales, and distribution. With the increasing adoption of 4G and 5G technologies, the reseller model is poised to seize significant opportunities in the coming years. For example, Venn Mobile, a newly launched MVNO, operates under Teltik, a reseller aligned with T-Mobile's business strategy. Venn Mobile offers a monthly plan priced at USD 30, featuring unlimited talk, text, data, and a 50GB mobile hotspot allowance.

- Additionally, technological advancements have also played a crucial role. The proliferation of smartphones and the increasing mobile internet penetration have created fertile ground for MVNOs to offer innovative data-centric services. Also, the rollout of 4G and the anticipated expansion of 5G networks provide opportunities for reseller MVNOs to deliver high-speed data services without heavy infrastructure investments. Such initiatives are driving the market positively. According to VIAVISION, as of 2023, 5G network access was available in 503 cities in the United States, the most of any country globally.

- The latest wave of MVNOs is prioritizing the launch and upkeep of unique service capabilities. These capabilities blend a cloud-centric approach, API-driven communication service integration, and predominantly web-based self-care options, all while relying minimally on traditional communications infrastructure. By adopting lean and agile business processes, these MVNOs are not only competing with established operators but are also enhancing customer satisfaction and introducing price differentiation. They are leveraging PaaS for functions like billing, CRM integration, product catalog management, rating, invoicing, and bill formatting. This choice is strategic because these applications operate without direct end-user intervention and benefit from asynchronous background processing.

The Consumer Segment is Expected to Hold a Significant Share in the Market

- One of the main factors driving the growth of MVNOs in the United States is the increasing demand for low-cost mobile services. Many consumers in the country are price-sensitive and are looking for affordable alternatives to traditional mobile operators. MVNOs have responded to this demand by offering competitive pricing and flexible plans catering to different segments.

- Another factor contributing to the growth of MVNOs in the United States is the increasing availability of mobile internet services. According to the report by GSMA, by 2025, the United States is expected to have 252 million 5G connections. Further, by 2030, 5G connections are expected to account for 95% of all US connections. As the demand increases, more consumers seek affordable and reliable mobile internet services. MVNOs have responded to this demand by offering various plans and packages catering to different needs and budgets. Hence, consumers actively seek MVNO services in the country, which drives the demand.

- Further, the growth of MVNOs in the country is also driven by the increasing demand for data services. As more consumers in the United States use their mobile devices to access the internet, social media, and streaming services, MVNOs are responding by offering a range of data plans and packages that cater to different needs and budgets. According to Ericsson, there were an estimated 314.75 million 5G mobile subscriptions in North America in 2024, which is predicted to increase to 432.91 million by 2029.

- Consumers increasingly prioritize brands that cater directly to their needs for internet connectivity. In response, MVNOs tailor packages with varied data quality of service and 5G options, aligning closely with customer demands. This strategic move is expected to drive the growth of the market. Additionally, the diverse pricing strategies adopted by MVNOs are projected to further bolster the consumer segment's expansion during the forecast period.

- The demand for connected devices has surged as industries undergo radical technological transformations. The IoT and automotive sectors are leading the charge, presenting substantial opportunities for MVNOs. All four major telecom operators in the United States have invested heavily in developing IoT and NB-IoT infrastructures, with Verizon investing approximately USD 1 billion. The MVNO landscape is on the brink of a significant shift, especially with tech giants like Google making their foray into the market. These tech giants are leveraging the MVNO model to enhance the value of their current offerings.

US Mobile Virtual Network Operator Industry Overview

The US MVNO market is semi-consolidated, with major players like Verizon Communications Inc., AT&T Corporation, T-Mobile USA Inc., Cricket Wireless LLC, and Xfinity Mobile (Comcast Corporation). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2024: Mediacom Communications rolled out its new mobile product in all its markets, partnering with Verizon as its MVNO. This launch follows Mediacom's two-month testing phase, during which it trialed the mobile service with its employees and selected Reach for back-office provisioning and billing. Despite being a member of the National Content & Technology Cooperative (NCTC), Mediacom chose to pursue its mobile venture independently, bypassing the co-op's existing agreements with Reach and AT&T.

- April 2024: Cape, a trailblazer in privacy-centric mobile services, secured USD 61 million in funding, spearheaded by A* and Andreessen Horowitz. Other contributors to this financing round include XYZ Ventures, ex/ante, Costanoa Ventures, Point72 Ventures, Forward Deployed VC, and Karman Ventures. With this influx of capital, Cape aims to establish a nationwide mobile network. This network promises premium wireless coverage while uniquely ensuring the confidentiality of personal identifiers, such as names, numbers, and locations. This funding announcement coincides with heightened concerns from top US officials regarding the cybersecurity lapses of major telecommunications carriers, which potentially expose them to foreign threats.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 The Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Mobile Network Subscribers and the Growing Penetration of Data Users

- 5.1.2 Rising Demand for Efficient Cellular Networks

- 5.2 Market Challenges

- 5.2.1 Fragmented Nature of the Market

6 MARKET SEGMENTATION

- 6.1 By Operating Model

- 6.1.1 Reseller

- 6.1.2 Service Operator

- 6.1.3 Full MVNO

- 6.1.4 Other Operational Models

- 6.2 By Subscriber

- 6.2.1 Business

- 6.2.2 Consumer

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verizon Communications Inc.

- 7.1.2 AT&T Corporation

- 7.1.3 T-Mobile USA Inc.

- 7.1.4 Cricket Wireless LLC

- 7.1.5 Xfinity Mobile (Comcast Corporation)

- 7.1.6 DISH Network LLC (Boost Mobile LLC)

- 7.1.7 TracFone Wireless Inc. (Straight Talk)

- 7.1.8 Republic Wireless Inc.

- 7.1.9 FreedomPop Inc.

- 7.1.10 Consumer Cellular Inc.