|

市場調查報告書

商品編碼

1644411

OpenStack 服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)OpenStack Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

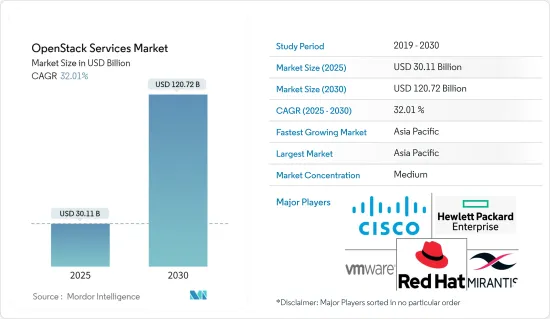

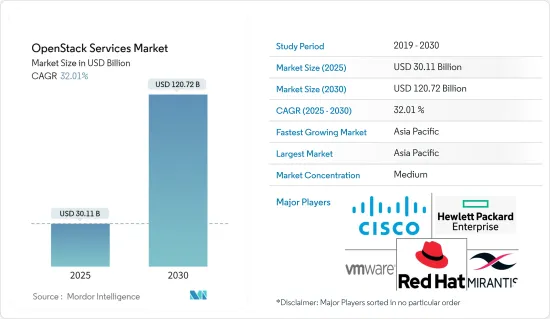

OpenStack 服務市場規模預計在 2025 年為 301.1 億美元,預計到 2030 年將達到 1207.2 億美元,預測期內(2025-2030 年)的複合年成長率為 32.01%。

擴大採用計量收費模式以及在虛擬環境中開發具有成本效益的IT基礎設施(其中所有工作負載由雲端供應商承擔)是預計推動全球 OpenStack 服務市場成長的因素。

主要亮點

- 世界各地的公司都傾向於採用雲端服務。雲端運算巨頭Oracle預測,到 2025 年,80% 的企業業務功能將透過其雲端相關服務轉移到雲端。近年來,雲端服務供應商從專業服務和其他雲端服務中獲得了巨額收益和利潤。微軟是成長最快的雲端服務供應商之一,2022 年其 Azure 和其他雲端服務與前一年同期比較增 31%。

- 雲端和工業化服務的成長以及傳統資料中心外包(DCO)的衰退標誌著混合雲端基礎設施服務的巨大變化。這有望推動向雲端 IaaS 和託管的轉變。由於專業雲端運算提供的優勢,預計這些細分市場對專業雲端運算的需求將會增加。

- 基礎設施即服務 (IaaS) 被視為雲端服務頻譜中的第三級(最低級),其中供應商為客戶提供包括付費使用制存取雲端中的儲存、伺服器、網路和其他運算資源的解決方案。 IaaS 硬體通常由外部提供者提供並由組織管理。

- 此外,2023 年 10 月—Ironic 宣布推出一個新的服務步驟框架,供基礎設施營運商修改現有節點。使用服務步驟,操作員可以利用該步驟執行修改處於 ACTIVE 狀態的已部署節點的操作,例如清理或自訂配置。

- OpenStack是一個動態的、開放的雲端運算解決方案,需要定期升級。定期新增功能和功能並刪除舊特性和功能。如此高度動態的能力範圍可能對市場成長構成挑戰。

OpenStack服務市場趨勢

通訊業擴大使用 OpenStack 服務,推動市場

- 過去幾年來,通訊業經歷了顯著的成長。在競爭激烈的市場中,電信業者不斷面臨以低成本提供創新服務以留住客戶的壓力。 OpenStack 使通訊業者能夠部署和管理雲端基礎設施,而無需支付專有解決方案帶來的高昂成本。

- OpenStack 是一個開放原始碼系統,可讓您透過虛擬資源池建構和管理私有雲端雲和公有雲。運算、網路、儲存、身分和映像等雲端處理服務由組成 OpenStack 平台中「計劃」的工具處理。對於尋求改善服務交付和營運效率的通訊業者來說,此功能至關重要。

- OpenStack作為通訊業者的首選基礎設施,是網路功能虛擬(NFV)的選擇。 NFV與OpenStack是廣大通訊業者和企業領導者的選擇。例如 AT&T、彭博資訊、中國行動、德國電信、日本電報電話公司、SK 電訊和 Verizon。

- 此外,OpenStack 也用於支援一些最大的行動通訊網路,包括 5G 等工作負載。中國移動的行動網路擁有超過300萬基地台、8億用戶,而迄今規模最大的NFV網路,擁有超過5萬台伺服器,就是中國行動利用OpenStack建構的。

預計亞太地區將出現顯著成長

- 大多數中國超大規模雲端運算和通訊業者正在主導亞太全部區域OpenStack 服務的採用。 OSF 指出,騰訊、中國移動等公司對 OpenStack 的使用在亞太地區快速成長的 OpenStack 市場中發揮重要作用。

- 超級應用微信的營運商和超大規模雲端供應商騰訊使用 OpenStack 為其跨產業的業務和公有雲端服務提供支援。中國移動也使用 OpenStack 提供私有雲端服務以及電信雲來支援其下一代通訊網路。

- 該地區的用戶正在結合 OpenStack 和 Kubernetes 來解決大型開放基礎架構問題。我們擴大利用 Airship 和 StarlingX 等計劃來使用開放、可組合的基礎設施來滿足該地區營運的應用程式的需求。

- 中國預計將佔全球 OpenStack配置的近一半,是 OSF 的第三大成員國,OSF 是一個由該組織實驗性主辦的開放基礎設施計劃的使用者和貢獻者組成的組織。中國移動以OpenStack作為雲端部署的關鍵技術之一,建構了AUTO自動化測試平台。 AUTO 專注於可擴充性和效能,廣泛使用 OpenStack SDK 和現有測試工具來評估和驗證雲端部署。

- 九九雲、中國銀聯、烽火通訊等多家中國公司正為StarlingX計劃上游做出貢獻。例如,中國銀聯國家電子商務與電子付款工程技術研究中心正在研究由 StarlingX 支援的安全邊緣基礎設施,用於非接觸式付款用例。隨著5G的發展,多接取邊緣運算(MEC)、媒體雲端等技術不斷湧現。

- 隨著5G網路基礎設施快速發展,人工智慧(AI)也蓬勃興起。為了全面支援開發,基礎設施本身必須發展為雲端原生服務。總部位於韓國的 SK 電信在過去幾年中一直在開發雲端原生基礎設施技術,並且積極參與 OpenStack 基金會 (OSF) 的兩個全球計劃,尤其是 OSF 的 Airship計劃。

OpenStack服務產業概覽

OpenStack 服務市場處於半固體狀態,主要參與者如下:思科系統公司、紅帽公司、惠普企業發展有限公司、Mirantis 公司等。

203年6月,全球領先的開放原始碼解決方案供應商之一諾基亞與紅帽公司宣布達成協議,將諾基亞的核心網路應用程式與紅帽 Openstack 平台和紅帽 OpenShift 緊密整合。作為協議的一部分,諾基亞和紅帽公司將共同支援和發展現有的諾基亞容器服務 (NCS) 和諾基亞 CloudBand 基礎設施軟體 (CBIS) 客戶,並隨著時間的推移開發向紅帽公司平台的遷移路徑。此外,諾基亞將利用紅帽公司的基礎設施平台來快速開發和測試諾基亞廣泛的核心網路產品組合。

2022 年 10 月,紅帽公司在其 MWC 拉斯維加斯活動上宣布了 OpenStack Platform 17。這涵蓋了以開放、混合雲端架構為重點的廣泛改進,以幫助服務供應商建立擴充性的下一代網路。

2022 年 6 月,愛立信和紅帽公司宣布合作部署該解決方案,為服務供應商提供一個跨 vEPC、5G Core、IMS、OSS 和 BSS 網路的開放平台。團隊將愛立信的網路功能解決方案與 Red Hat OpenShift 和 Red Hat OpenStack 平台結合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19影響評估

- 市場促進因素

- 組織對提高業務敏捷性和效率的需求日益增加

- OpenStack 是開放原始碼的,為客製化解決方案提供了靈活性

- 通訊業擴大使用 OpenStack 服務

- 市場限制

- 缺乏公司對資料中心所要求的穩健性,包括可用性和安全性等 IT 管理功能

- 技術簡介

- 用於管理OpenStack應用程式的框架

- 由 OpenStack 基金會營運並作為試點計畫營運的開放基礎設施計劃。

- 跨組織 OpenStack使用案例

第5章 市場區隔

- 按部署模型

- 在雲端

- 本地

- 按最終用戶產業

- IT

- 通訊

- 銀行和金融服務

- 學術的

- 零售/電子商務

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Cisco Systems, Inc.

- Red Hat, Inc.

- Hewlett Packard Enterprise Development LP

- VMware, Inc.

- Mirantis, Inc.

- Canonical Ltd.

- Dell Inc.

- Rackspace US, Inc.

- Huawei Technologies Co., Ltd.

- NetApp, Inc.

第7章投資分析

第 8 章:市場的未來

The OpenStack Services Market size is estimated at USD 30.11 billion in 2025, and is expected to reach USD 120.72 billion by 2030, at a CAGR of 32.01% during the forecast period (2025-2030).

The growing adoption of the pay-as-you-go model and the cost-effective IT infrastructure development in a virtual environment (where every workload is taken care of by the cloud vendors) are certain factors expected to drive market growth for OpenStack services globally.

Key Highlights

- Enterprises across the world are inclined towards the adoption of cloud services. Oracle Corporation, the cloud giant, has predicted that owing to the cloud-related service offerings, 80% of the enterprise business functions will move to the cloud by 2025. In recent years, cloud service providers have experienced huge revenues and profit gains due to their professional and other cloud services. Microsoft, one of the fastest-growing cloud service providers, registered a year-on-year growth of 31% in Azure and other cloud services in 2022.

- The growth of cloud and industrialized services and the decline of traditional data center outsourcing (DCO) indicate a massive shift toward hybrid cloud infrastructure services. This is expected to drive the shift toward cloud IaaS and hosting. Owing to its benefits, professional cloud deployment is expected to experience an improved demand for these market segments.

- Infrastructure-as-a-Service (IaaS) is considered the third (lowest) level in the spectrum of cloud services, where a vendor provides clients with solutions such as pay-as-you-go access to storage, servers, networking, and other computing resources in the cloud. IaaS hardware is usually offered and managed by the organization by an external provider.

- Moroever , October 2023 - Ironic has announced the launch of infrastructure operators to modify existing nodes using the "service steps" framework. Servicing allows operators to leverage steps, like you would for cleaning or customized deployments, to perform actions to modify deployed nodes in an ACTIVE state.

- OpenStack is a dynamic and open cloud-computing solution that needs to be upgraded regularly. The new functions & features are added regularly, and other old functions are removed. This high-dynamic range of functions may create challenges for market growth.

OpenStack Services Market Trends

Increasing use of OpenStack Services Across Telecommunication Sector is Driving the Market

- The telecom industry has observed extensive growth during the past few years. Telecommunication companies are encountering constant pressure to deliver innovative services at lower costs to retain their customers in the competitive market. It allows telecom companies to deply and manage their cloud infrastructure without the high costs associated with proprietary solutions.

- OpenStack is an open source system that allows private and public clouds to be built and managed through a pooling of virtual resources. The core clouds computing services, such as compute, networking, storage, identities and images are handled by tools that comprise the OpenStack platform 'projects'. This capability is crucial for telecom operators looking to enhance their service offerings and operational efficiency.

- As a base of choice for operators, OpenStack has been chosen as their Network Function Virtualization NFV. NFV with OpenStack has been chosen by a wide range of telecom operators and business leaders. AT&T, Bloomberg LP., China Mobile, Deutsche Telekom, Nippon Telegraph & Telephone Corporation, SK Telecom and Verizon are among them.

- Moreover, OpenStack, including workloads such as 5G, has been used to power the biggest mobile telecommunications network. The mobile network of China Mobile has over 3 million base stations and 800 million subscribers an With over 50,000 servers, the largest Network of NFV today is built by China Mobile using OpenStack.

Asia-Pacific is Expected to Hold Significant Growth

- The majority of hyperscale cloud and telecom organizations in China are taking charge of adopting OpenStack services across the Asia Pacific region. Citing the use of OpenStack by companies such as Tencent and China Mobile, the OSF said these companies play a critical role in the rapidly growing OpenStack market in Asia-Pacific.

- Tencent, the company behind the WeChat super app and hyperscale cloud supplier, has been using OpenStack to power its operations and public cloud services that are being used by different industries. Also, at China Mobile, OpenStack is being used to deliver public and private cloud services and its telecom cloud to power its next-generation telco network.

- Users throughout the region are combining OpenStack and Kubernetes to solve big open infrastructure problems. They're increasingly leveraging projects like Airship and StarlingX, using open, composable infrastructure to meet the demands of applications operating in the region.

- China, which is expected to account for almost half of the world's OpenStack deployments, has the third-highest number of members in the OSF, an organization comprising users and contributors to the open infrastructure projects piloted and hosted by the organization. China Mobile has created an automated testing platform dubbed AUTO with OpenStack as one of its primary cloud deployment technologies. With an emphasis on scalability and performance, AUTO extensively utilized the OpenStack SDK and pre-existing testing tools to evaluate and confirm the cloud deployment.

- Multiple Chinese companies contribute upstream to the StarlingX project, including 99cloud, China UnionPay, and FiberHome. For instance, the Electronic Commerce and Electronic Payment National Engineering Laboratory of China UnionPay has researched a secured edge infrastructure powered by StarlingX for a contactless payment use case; with the evolution of 5G, technologies such as Multi-Access Edge Computing (MEC), Media Cloud.

- Artificial Intelligence (AI) has strongly emerged along with rapid growth in 5G network infrastructure. The infrastructure itself must evolve as a cloud-native service to fully support the development. Korea-based SK Telecom has been developing cloud-native infrastructure technology for the past few years and actively participates in global projects both in OpenStack Foundation (OSF), especially the Airship project in OSF.

OpenStack Services Industry Overview

The OpenStack Services Market is semi-consolidated due to the presence of significant players such as Cisco Systems, Inc., Red Hat, Inc., Hewlett Packard Enterprise Development LP, Mirantis, Inc., etc. The players in the market are frequently launching innovative solutions, forming partnerships, and mergers to increase their market share and expand their geographical presence.

In June 203, Nokia and Red Hat, Inc., one of the leading global providers of open-source solutions, announced that they had agreed to tightly integrate Nokia's core network applications with Red Hat Openstack Platform and Red Hat OpenShift. As part of the agreement, Nokia and Red Hat would jointly support and evolve existing Nokia Container Services (NCS) and Nokia CloudBand Infrastructure Software (CBIS) customers while developing a path to migrate to Red Hat's platforms over time. Additionally, Nokia would leverage Red Hat's infrastructure platforms to enable faster development and testing of Nokia's extensive core network portfolio.

In October 2022, RedHat announced the launch of OpenStack Platform 17 at the MWC Las Vegas event, covering a wide range of improvements with a focus on open hybrid cloud architectures that are meant to aid service providers as they construct expansive next-generation networks.

In June 2022, Ericsson and Red Hat announced the partnership to deploy solutions, empowering service providers with an open platform that extended across a network for vEPC, 5G Core, IMS, OSS, and BSS. The team integrated Ericsson's network function solutions with Red Hat OpenShift and Red Hat OpenStack Platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment on the Impact due to COVID-19

- 4.4 Market Drivers

- 4.4.1 Increasing Need for Organizations to Improve Their Business Agility and Efficiency

- 4.4.2 OpenStack Being Open Source Provides the Flexibility for Customized Solution

- 4.4.3 Increasing use of OpenStack Services in Telecommunication Sector

- 4.5 Market Restraints

- 4.5.1 Lack of Robustness that Enterprises Desire for Their Data Centers, Including IT Management Features, Such as Availability and Security

- 4.6 Technology Snapshot

- 4.6.1 Frameworks Utilized to Manage OpenStack Applications

- 4.6.2 Open Infrastructure Projects Hosted and Piloted by OpenStack Foundation

- 4.6.3 Use Cases of OpenStack Across Organizations

5 MARKET SEGMENTATION

- 5.1 By Deployment Model

- 5.1.1 On-Cloud

- 5.1.2 On-Premise

- 5.2 By End-user Industry

- 5.2.1 Information Technology

- 5.2.2 Telecommunication

- 5.2.3 Banking and Financial Services

- 5.2.4 Academic

- 5.2.5 Retail/E-Commerce

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems, Inc.

- 6.1.2 Red Hat, Inc.

- 6.1.3 Hewlett Packard Enterprise Development LP

- 6.1.4 VMware, Inc.

- 6.1.5 Mirantis, Inc.

- 6.1.6 Canonical Ltd.

- 6.1.7 Dell Inc.

- 6.1.8 Rackspace US, Inc.

- 6.1.9 Huawei Technologies Co., Ltd.

- 6.1.10 NetApp, Inc.