|

市場調查報告書

商品編碼

1644419

歐洲自升式鑽井:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Europe Jackup Rig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

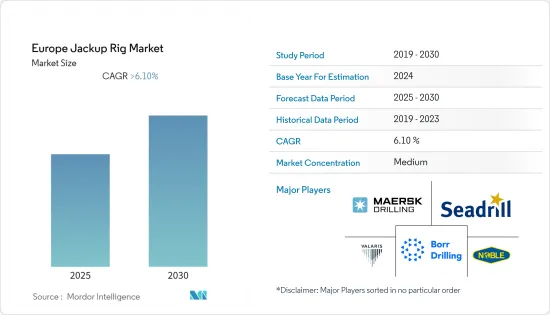

預測期內,歐洲自升式鑽井市場預計將以超過 6.1% 的複合年成長率成長。

由於供應鏈中斷和油價暴跌,歐洲自升式鑽井平台市場受到了新冠疫情的不利影響。不過,市場在 2021 年已經復甦。

關鍵亮點

- 預計預測期內,對現代和新興鑽機以及海上石油和天然氣活動的需求不斷成長等因素將推動歐洲自升式鑽井市場的成長。

- 然而,原油和天然氣價格的波動可能會在預測期內阻礙市場成長。

- 歐盟的能源目標要求在2030年清潔和永續電力生產佔比達到32%,其餘68%則來自石油和天然氣等其他能源。因此,歐洲海上探勘和生產預計在市場上具有更大的潛力,從而可能在未來為自升式鑽井供應商提供機會。

- 預計預測期內挪威將主導歐洲自升式鑽井市場。

歐洲自升式鑽井市場趨勢

未來石油和天然氣生產活動將推動市場

- 歐洲大部分石油和天然氣產量來自海上蘊藏量。大部分產量來自北海地區,其中大部分石油來自英國和挪威。預計海上活動的活性化將推動歐洲自升式鑽井市場的需求。

- 截至2022年1月,歐洲共有32座海上鑽機。淺水開發投資在英國淺水區發現了多個油氣田,並催生了一系列開發領域。

- 此外,2022 年 10 月,英國北海過渡局 (NSTA) 啟動了新一輪海上石油和天然氣許可發放,目前共有 898 個區塊和部分區塊可供發放,超過 100 個許可證可供授予。包括設得蘭群島以西的水域、北海北部、中部和南部以及愛爾蘭海東部。首批許可證預計將於2023年第二季頒發,預計將為未來歐洲自升式鑽井市場提供充足的機會。

- 2022年1月,馬士基鑽井公司與丹麥道達爾能源探勘與生產公司簽署契約,使用高效自升式鑽井馬士基伸臂號在丹麥北海執行修井服務。該合約將於2022年7月開始,為期21個月。

- 此外,Shelf Drilling 還獲得了 Eni訂單的一份為期三年的自升式鑽井Resolute 契約,以及一份為期兩年的自升式鑽井Key Manhattan 契約,該鑽井平台位於義大利沿海亞得里亞海。 Shelf Drilling Resolute 預計將於 2023 年第二季開始營運,Key Manhattan 計劃於 2023 年第四季開始營運。

- 因此,由於即將到來的海上石油和天然氣活動,歐洲自升式鑽井市場在預測期內可能會大幅成長。

挪威可望主導市場

- 挪威憑藉新的石油和天然氣發現引領市場,其中包括巨大的約翰斯維爾德魯普油田。截至 2022 年 1 月,挪威持有17 個海上鑽機,是歐洲最多的,這很可能在預測期內支持目標市場的成長。

- 2020年,挪威的探勘活動顯著活性化。截至6月底,2021年已鑽探約31口探勘井,總合發現8處油氣田。

- 2021年,挪威石油管理局估計挪威大陸架未發現資源量約40億標準立方公尺可採油當量,約佔大陸棚剩餘資源量的47%,並可能在未來幾年為歐洲自升式鑽井市場提供機會。

- 此外,2021 年 12 月,馬士基鑽井公司與 Aker BP 簽署了一項協議,將鑽井合約續約並延長五年,價值約 10 億美元。該合約包括交付適用於超惡劣環境的自升式鑽井“Maersk Integrator”和“Maersk Invincible”,用於挪威近海作業。

- 此外,2022年12月,NOV與中集來福士簽署契約,為挪威離岸風力發電公司Havfram提供一艘用於自航式風力發電機的自升式船。

- 憑藉如此龐大的資源和石油和天然氣活動,挪威的海上石油和天然氣產業可能會進一步成長,從而在預測期內推動該國對自升式鑽井的需求。

歐洲自升式鑽井產業概況

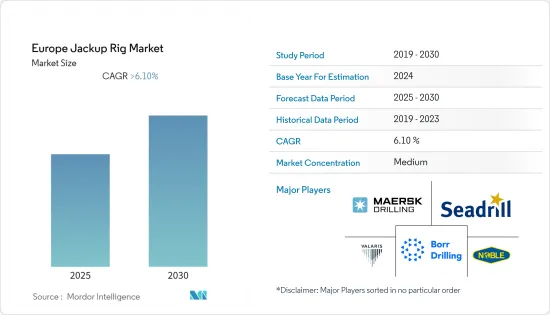

歐洲自升式鑽井市場適度細分。市場的主要企業包括(不分先後順序)Noble Corporation PLC、Maersk Drilling AS、Seadrill Ltd、Borr Drilling Ltd 和 Valaris PLC。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 地區

- 英國

- 俄羅斯

- 挪威

- 荷蘭

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Noble Corporation PLC

- Maersk Drilling AS

- Seadrill Ltd

- Borr Drilling Ltd.

- KCA DEUTAG Drilling Ltd.

- Nabors Industries Ltd.

- Valaris PLC

- Saipem SpA

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 71661

The Europe Jackup Rig Market is expected to register a CAGR of greater than 6.1% during the forecast period.

The Europe jack-up market was adversely affected by COVID-19 due to disruptions in the supply chain and oil price crashes. However, the market rebounded in 2021.

Key Highlights

- Factors such as increasing demand for modern new rigs and offshore oil and gas activities will likely drive the European jack-up rig market's growth during the forecast period.

- However, volatile crude oil and gas prices are likely to hinder the market's growth during the forecast period.

- The EU's energy goals call for 32% clean and sustainable power generation by 2030, leaving 68% for other sources like oil and gas.Hence, Europe's offshore exploration and production are expected to have more potential in the market, which, in turn, is likely to provide an opportunity for jackup rig providers in the future.

- Norway is expected to dominate the European jackup rig market over the forecast period.

Europe Jackup Rigs Market Trends

Upcoming Offshore Oil and Gas Activities to Drive the Market

- The majority of oil and gas production in Europe comes from offshore reserves. Most of the production is from the North Sea region, and most of the oil comes from the United Kingdom and Norway. The increasing offshore activities are expected to drive demand for the European jack-up rig market.

- As of January 2022, Europe accounted for 32 offshore rigs. Investment in shallow water resulted in a few discoveries and various fields of development in the shallow water areas of the United Kingdom.

- Besides, in October 2022, the United Kingdom North Sea Transition Authority (NSTA) launched a new offshore oil and gas licensing round, making 898 blocks and part blocks available with over 100 licenses up for grabs. Acreage will be offered in the west of Shetland, the northern, central, and southern North Sea, and the east Irish Sea. The first licenses are expected to be awarded in Q2 2023, which will likely provide ample opportunities for the Europe Jack-up rig market in the future.

- In January 2022, Maersk Drilling was awarded a contract with TotalEnergies E&P Denmark, which will employ the high-efficiency jack-up rig Maersk Reacher for well intervention services in the Danish North Sea. The contract commenced in July 2022, with a duration of 21 months.

- Further, Shelf Drilling received a three-year contract for the Shelf Drilling Resolute jack-up rig and a two-year contract for the Key Manhattan jack-up rig from Eni in the Adriatic Sea offshore Italy. The Shelf Drilling Resourceful rig is scheduled to start work in Q2 2023, while the Key Manhattan rig is anticipated to kick off its new gig in Q4 2023.

- Hence, due to the upcoming offshore oil and gas activities, the market for jackup rigs in Europe is likely to have substantial growth over the forecast period.

Norway is Expected to Dominate the Market

- Norway is leading the market with new oil and gas discoveries, including the giant Johan Sverdrup field. As of January 2022, Norway accounted for 17 offshore rigs, the highest in Europe, which may support the growth of the target market over the forecast period.

- In 2020, there were considerably higher exploration activities in Norway. About 31 exploration wells were drilled, and in 2021, by the end of June, a total of eight oil and gas discoveries were made.

- In 2021, the Norwegian Petroleum Directorate estimated that the undiscovered resources on the Norwegian shelf were at approximately 4 billion standard cubic meters of recoverable oil equivalents, which corresponds to around 47% of the remaining resources on the shelf, which is likely to provide opportunities for the Europe jack-up rig market in the coming years.

- Moreover, in December 2021, Maersk Drilling and Aker BP signed a deal to renew and extend a drilling agreement for a five-year period in a contract valued at around USD 1 billion. The deal includes the provision of the ultra-harsh environment jack-up rigs Maersk Integrator and Maersk Invincible for activities offshore Norway.

- Further, in December 2022, NOV signed contracts with CIMC Raffles to supply a self-propelled wind turbine installation jack-up vessel design for Havfram (an offshore wind services company) based in Norway.

- With such enormous resources and oil and gas activities, Norway's offshore oil and gas industry is likely to grow further, driving the demand for jackup rigs in the country during the forecast period.

Europe Jackup Rigs Industry Overview

The European jack-up rig market is moderately fragmented. Some of the major players in the market include (not in any particular order) Noble Corporation PLC, Maersk Drilling AS, Seadrill Ltd, Borr Drilling Ltd, and Valaris PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 United Kingdom

- 5.1.2 Russia

- 5.1.3 Norway

- 5.1.4 Netherlands

- 5.1.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Noble Corporation PLC

- 6.3.2 Maersk Drilling AS

- 6.3.3 Seadrill Ltd

- 6.3.4 Borr Drilling Ltd.

- 6.3.5 KCA DEUTAG Drilling Ltd.

- 6.3.6 Nabors Industries Ltd.

- 6.3.7 Valaris PLC

- 6.3.8 Saipem SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219