|

市場調查報告書

商品編碼

1644432

深層封包檢測與處理 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Deep Packet Inspection And Processing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

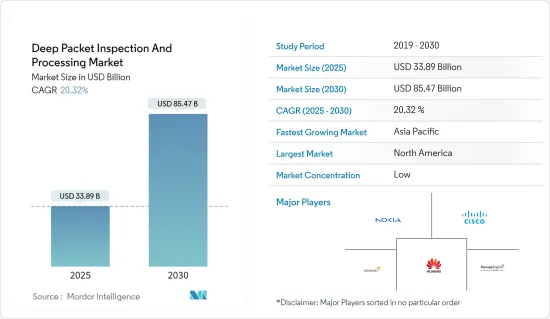

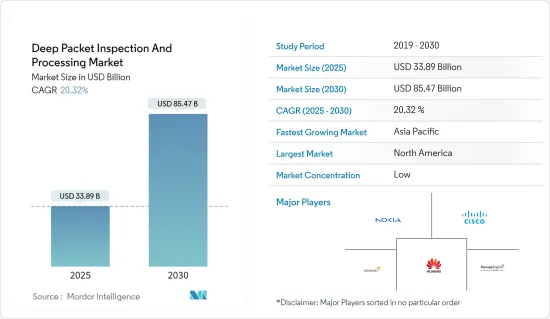

深層封包檢測和處理市場規模預計在 2025 年為 338.9 億美元,預計到 2030 年將達到 854.7 億美元,預測期內(2025-2030 年)的複合年成長率為 20.32%。

DPI 結合簽章匹配技術和資料分析演算法來確定通訊流的影響。基於硬體的中間盒在電腦網路中很普遍,通常需要較高的部署和管理成本。

關鍵亮點

- 最近的發展提案了兩種實現雲端基礎的DPI 中間盒的實用方法:外包的 DPI 中間盒對加密流量執行有效載荷檢查,同時保護通訊資料和檢查規則的隱私。

- 雲端採用、遠端工作、BYOD 和 SaaS 應用等技術的激增增加了網路攻擊的載體數量。應用程式已成為網路犯罪分子的熱門目標,但保護和控制連接它們的網路對網路安全提供者提出了重大挑戰。

- 相較之下,歐盟使用DPI的方式則非常不同。它是打擊販毒和兒童色情活動的一部分。歐盟一旦確定了意圖,就會迅速實施控制資料使用的法律。這屬於《一般資料保護規範》(GDPR),這是一部保護歐盟公民及其敏感資料的綜合性法律。

- 物聯網 (IoT) 和雲端運算的出現,以及行動裝置推動的全球 IP 流量的不斷增加,需要細心關注和強大的工具來確保企業網路的安全運作。

- 許多雲端服務都可以透過網際網路訪問,因此提高系統可訪問性是雲端遷移的關鍵促進因素。然而,雲端伺服器和應用程式經常受到來自世界各地的各種方式的攻擊。深層封包檢測和處理對於阻止不良流量並允許良好流量不受干擾地通過至關重要。超越這基於邊界的防禦層也很重要。有幾種方法可以在公共雲端環境中成功部署深層封包檢測安全控制,包括利用已為此目的建置的供應商解決方案,以及在客戶端上執行的基於代理程式的產品。

- 此外,攻擊者已經開始利用有關 COVID-19 相關新聞的資訊激增和公眾警惕性增強的現象。網路釣魚、垃圾宣傳活動以及惡意網站和網域名稱顯著增加。 F-Secure 建議在 VPN 集中器和其他網路周邊設備中使用深層封包檢測,以減少 VPN 上的負載並降低惡意軟體成功建立命令和控制 (C2) 通道的機會。某些頻寬密集的線上服務(例如串流媒體和各種遊戲服務)可能會被此類網站阻止。僅允許在已知和核准的連接埠(例如 HTTPS)上進行通訊也是一個好主意。疫情顯著提高了採用率。

深層封包檢測與處理市場趨勢

隨著企業網路流量的增加,軟體解決方案成長強勁

- 近年來,深層封包檢測(DPI)軟體已發展成為應對新網路挑戰的有力工具,並在當今的網路和網路基礎設施中發揮核心作用。由於現在大多數網路流量都經過加密,可靠的 DPI 軟體引擎需要具有先進流量分類技術的套件。

- DPI 根據包含從資料包資料部分提取的資訊的簽章資料庫來識別和分類流量,從而實現比僅基於報頭資訊的分類更精細的控制。P2P(P2P)流量等應用正成為寬頻服務供應商日益嚴重的問題。

- P2P 流量通常由提供檔案共用的應用程式使用。由於傳輸的媒體檔案通常很大,P2P 會增加流量負載並需要額外的網路容量。 DPI 允許營運商超額銷售可用頻寬,同時透過防止網路擁塞來確保所有用戶公平共享頻寬。

- 網路必須能夠分析內容,完整地組裝應用程式訊息,並使用該資訊來識別流量使用情況和模式。 DPI 功能分為四類:通訊協定分析/應用程式感知、反惡意軟體/防毒、入侵偵測和預防 (IDS/IPS) 和 URL 過濾。

- 根據 Enea AB 的一項調查,70% 的受訪者(高科技產品經理)需要對企業和物聯網/工業網路中的連接設備進行分類。此外,加強加密和採用嚴格的 TLS 1.3 安全通訊協定(5G 強制性要求)威脅到許多供應商至關重要的流量可見度。這需要深層封包檢測和處理才能跟上未來的市場成長。

- 此外,大多數供應商表示他們已經或正在開發雲端解決方案,其中一半計劃提供將安全性和網路與基於雲端基礎的服務相結合的安全存取服務邊際(SASE) 解決方案。這就需要使用支援市場成長的 DPI 軟體。

北美佔據主要市場佔有率

- 近年來,深層封包檢測(DPI)和處理市場在亞太地區取得了顯著成長。 DPI 技術能夠檢查和分析傳輸到網路的資料封包,從而深入了解網路流量的內容和環境。加強網路安全、最佳化網路效能、實現服務品質和流量管理等先進服務至關重要。

- 預計未來幾年該地區的深層封包檢測和處理市場將顯著成長。需求的特點是 5G、物聯網和雲端運算等先進技術的日益普及,這些技術產生了大量的資料流量。 DPI技術使網路管理員和服務供應商能夠對這些資料進行細粒度的檢視和控制,從而實現更有效率的網路管理並改善使用者體驗。

- 網路流量分析和管理隨著資料流量的指數級成長,網路營運商需要先進的工具來有效分析和管理網路流。 DPI技術提供網路行為的詳細洞察,使營運商能夠最佳化頻寬分配並提高網路效能。

- 醫療保健和金融等各行業都受到嚴格的資料隱私和安全法規的約束。 DPI 技術透過檢查網路流量中是否存在違反政策和未授權存取來確保合規性。

- 物聯網設備的日益普及和工業自動化解決方案的採用也推動了該地區對 DPI 技術的需求。 DPI 即時分析物聯網設備流量,確保設備和資料中心之間的安全可靠通訊。

- 5G網路的出現為DPI技術帶來巨大機會。 5G網路具有高頻寬、低延遲和海量連接密度的特點,將產生大量資料流量,需要高效率的管理和分析。

深層封包檢測與處理行業概覽

深層封包檢測和處理市場比較分散,因為每個參與企業都在不斷創新新的硬體和軟體解決方案,而且新參與企業也在加入市場,從而產生了巨大的競爭。深層封包檢測和處理市場正在經歷多項創新,包括可以檢查 OSI 模型七個應用層的網路封包的下一代防火牆 (NGFW) 的開發。此類案例導致試圖提供獨特解決方案的參與企業之間展開激烈競爭。主要企業包括諾基亞(阿爾卡特朗訊)、SolarWinds Worldwide, LLC、思科系統公司和華為科技公司。近期市場發展趨勢如下:

- 2023 年 2 月-思科宣布計畫收購以色列雲端安全供應商 Lightspin。思科和 Lightspin 實現了我們的共同目標,即透過從建置到運作提供端到端的安全性和可觀察性,幫助客戶實現其雲端基礎架構的現代化。

- 2023 年 1 月 - 羅德與施瓦茨旗下公司 ipoque GmbH 與美國資料中心網路可視性保全服務供應商 APCON 宣佈建立新的夥伴關係。該協定指定 Epoch 先進的深層封包檢測(DPI) 軟體庫 R&S®PACE 2 作為 APCON 的 IntellaView HyperEngine 硬體平台 (HyperEngine) 的可授權附加元件軟體工具。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 監管影響

- COVID-19 市場影響評估

- 市場促進因素

- 越來越多採用法規和資料保護法

- 高度採用雲端基礎的安全技術

- 市場限制

- DPI 增加了現有防火牆和其他安全相關軟體的複雜性和繁瑣性

第5章 市場區隔

- 解決方案

- 硬體

- 軟體

- 擴張

- 本地

- 雲

- 最終用戶

- 通訊和 IT

- BFSI

- 醫療

- 零售

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Nokia Corporation(Alcatel Lucent)

- Allot Ltd.

- Bivio Networks, Inc.

- Huawei Technologies Co., Ltd.

- Enea AB(Qosmos SA)

- WiseSpot Company Limited

- SolarWinds Worldwide, LLC.

- NetFort Technologies Limited(Rapid7)

- Netify

- AppNeta, Inc.

- ManageEngine(Zoho Corporation)

- Cisco Systems, Inc.

- ipoque GmbH

第7章投資分析

第8章 市場機會與未來趨勢

The Deep Packet Inspection And Processing Market size is estimated at USD 33.89 billion in 2025, and is expected to reach USD 85.47 billion by 2030, at a CAGR of 20.32% during the forecast period (2025-2030).

DPI combines signature matching technology with a data analysis algorithm to determine a communication stream impact. Hardware-based middleboxes are prevalent in computer networks, which usually incur high deployment and management expenses.

Key Highlights

- A recent trend addresses those problems where researchers propose two practical approaches to implement a cloud-based DPI middlebox. The outsourced DPI middlebox performs payload inspection over encrypted traffic while preserving the privacy of both communication data and inspection rules.

- The proliferation of technologies, such as cloud deployment, remote working, BYOD, SaaS applications, etc., are increasing the paths available to cyberattacks. Applications have become inviting targets for cybercriminals, but securing, protecting, and controlling the networks that connect them is a huge challenge for network security providers.

- In contrast, DPI in the European Union is used very differently. It is used as part of mechanisms to clamp down on drug trafficking and child pornography. When the EU established its intent, they were quick to enforce laws that controlled the use of data. The consideration falls under the General Data Protection Regulation (GDPR), a comprehensive set of laws protecting EU citizens and their sensitive data.

- With the growing global IP traffic augmented by mobile devices, the emergence of the Internet of Things (IoT) and cloud computing require close attention and powerful tools to ensure secure operations on an enterprise network.

- Many cloud services are accessible to the entire internet, which means improved system accessibility is an important driver for cloud migrations. However, cloud servers and applications are regularly attacked using various methods from anywhere globally. Deep packet inspection and processing are essential to keep the bad traffic out while letting the good traffic through without too much interruption. It is also important to look beyond this perimeter-based defense layer. There are several approaches to successfully deploying a security control based on Deep Packet Inspection within a public cloud environment, such as using the vendor solutions already built for this exact purpose, and another product range is based on agents running on customer endpoints.

- Moreover, attackers started exploiting the burst of information and heightened public alertness for COVID-19-related news. Phishing, spam campaigns, and malicious websites/domains significantly increased. To relieve the load on VPNs and mitigate the chances of successful command and control (C2) channels for malware to be established, F-Secure recommends using deep packet inspection on VPN concentrators and other network perimeter devices. Certain bandwidth-heavy online services, such as streaming and various gaming services, can be blocked with such a stand. It is also recommended to allow communication on only known and approved ports, such as HTTPS. The pandemic is significantly increasing the adoption rate.

Deep Packet Inspection and Processing Market Trends

Software Solution to Witness Significant Growth With Increasing Enterprise Internet Traffic

- In recent years, DPI (Deep Packet Inspection) software has evolved into a powerful tool to meet new network challenges, playing a central role in today's internet and network infrastructure. As most internet traffic is now encrypted, a reliable DPI software engine needs a tool kit of advanced techniques to classify traffic.

- DPI identifies and classifies traffic based on the signature database that includes information extracted from the data part of a packet, allowing finer control than classification based only on header information. Applications such as peer-to-peer (P2P) traffic provide increasing problems for broadband service providers.

- Typically, P2P traffic is used by applications providing file sharing. Due to its frequently large size of media files being transferred, P2P drives the increasing traffic loads, which requires additional network capacity. DPI allows operators to oversell their available bandwidth while ensuring equitable bandwidth distribution to all users by preventing network congestion.

- The network must be able to parse through content, assemble enough of an application message, and identify traffic usage and patterns based on the information. DPI functions fall into four categories: Protocol analysis/application recognition, Anti-malware/anti-virus, Intrusion Detection and Prevention (IDS/IPS), and URL filtering.

- According to the Enea AB survey, 70 percent of respondents (high-tech product managers) require the classification of connected devices in the enterprise and IoT/industrial networks. And also, the increased use of encryption and the adoption of the stringent TLS 1.3 security protocol (mandatory in 5G) threatens essential traffic visibility for many vendors. This requires Deep packet inspection and processing catering to future market growth.

- Further, most vendors report that they have or are developing cloud solutions, with half planning to offer a Secure Access Service Edge (SASE) solution that integrates security and networking in a cloud-based service. This requires the use of DPI software, which adheres to market growth.

North America Accounts for the Significant Market Share

- The deep packet inspection and processing market has grown in Asia Pacific significantly in recent years. DPI technology enables the inspection and analysis of data packets passing through a network, providing insights into the content and context of network traffic. Enhancing network security, optimizing network performance, and enabling advanced services such as Quality Services and traffic management is crucial.

- The region is expected to grow substantially in the DPI market in the coming years. The demand is characterized by the rising adoption of advanced technologies, including 5G, IoT, and cloud computing, which generate massive data traffic. DPI technology enables network administrators and service providers to gain granular visibility and control over this data, ensuring efficient network management and enhanced user experiences.

- Network traffic analysis and management With the exponential growth in data traffic, network operators require advanced tools to analyze and manage network flows effectively. DPI technology provides granular insights into network behavior, enabling operators to optimize bandwidth allocation and enhance network performance.

- Different industries, like healthcare and finance, are subject to strict data privacy and security regulations. DPI technology ensures compliance by inspecting network traffic for policy violations and unauthorized access attempts.

- The proliferation of IoT devices and the adoption of industrial automation solutions in the region also drive the demand for DPI technology. DPI enables real-time analysis of IoT device traffic, delivering secure and reliable communication between devices and data centers.

- The emergence of the 5G network presents significant opportunities for DPI technology. With its high bandwidth, low latency, and massive connection density, 5G networks generate vast amounts of data traffic that require efficient management and analysis.

Deep Packet Inspection and Processing Industry Overview

The deep packet inspection and processing market is fragmented as the players are increasingly innovating new hardware and software solutions, and also new entrants are adding to this market that caters to the significant competition. Several innovations have been witnessed in the deep packet inspection and processing market, including developing Next-Generation Firewalls (NGFWs) that can investigate the network packets up to 7 application layers of the OSI model. Such instances provide intense rivalry among the players to provide unique solutions. Nokia (Alcatel Lucent), SolarWinds Worldwide, LLC, cisco systems, and Huawei Technologies are key players. Recent developments in the market are -

- February 2023 - Cisco announced plans to purchase Lightspin, an Israeli cloud security business. Cisco and Lightspin will achieve their mutual goal of assisting customers in modernizing their cloud infrastructures by providing end-to-end security and observability from construction to runtime.

- January 2023 - ipoque GmbH, a Rohde & Schwarz company, and APCON, Inc., a US-based network visibility and security services provider for data centers, announced their new partnership. The agreement specifies the advanced deep packet inspection (DPI) software library from Epoque, R&S(R)PACE 2, as a licensable add-on software tool for the IntellaView HyperEngine hardware platform (HyperEngine) from APCON.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Regulatory Implications

- 4.5 Assessment of COVID-19 Impact on the Market

- 4.6 Market Drivers

- 4.6.1 Increasing Adoption of Regulatory and Data Protection Laws

- 4.6.2 High Adoption of Cloud Based Security Technologies

- 4.7 Market Restraints

- 4.7.1 DPI Adds to the Complexity and Unwieldy Nature of Existing Firewalls and Other Security-Related Software

5 MARKET SEGMENTATION

- 5.1 Solution

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 End-User

- 5.3.1 Telecom and IT

- 5.3.2 BFSI

- 5.3.3 Healthcare

- 5.3.4 Retail

- 5.3.5 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nokia Corporation (Alcatel Lucent)

- 6.1.2 Allot Ltd.

- 6.1.3 Bivio Networks, Inc.

- 6.1.4 Huawei Technologies Co., Ltd.

- 6.1.5 Enea AB (Qosmos SA)

- 6.1.6 WiseSpot Company Limited

- 6.1.7 SolarWinds Worldwide, LLC.

- 6.1.8 NetFort Technologies Limited (Rapid7

- 6.1.9 Netify

- 6.1.10 AppNeta, Inc.

- 6.1.11 ManageEngine (Zoho Corporation)

- 6.1.12 Cisco Systems, Inc.

- 6.1.13 ipoque GmbH