|

市場調查報告書

商品編碼

1644446

北美豪華乙烯基瓷磚 (LVT) 市場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Luxury Vinyl Tile (LVT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

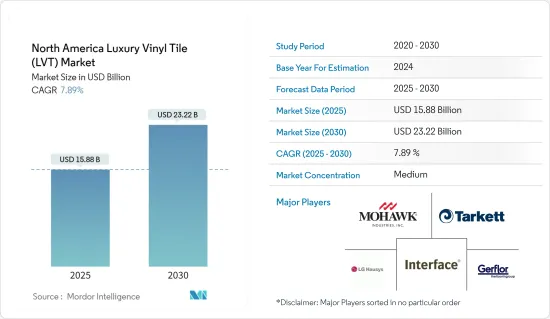

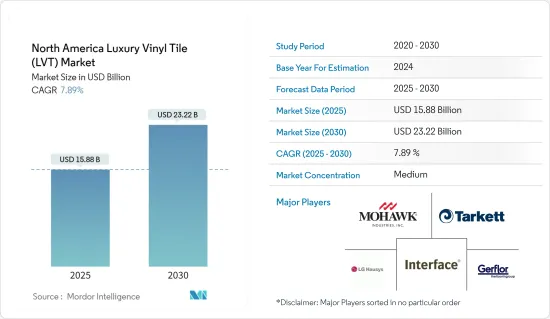

北美豪華乙烯基瓷磚 (LVT) 市場規模預計在 2025 年為 158.8 億美元,預計到 2030 年將達到 232.2 億美元,預測期內(2025-2030 年)的複合年成長率為 7.89%。

預計,建築業的擴張、改造和裝修計劃的增加以及瓷磚日益成長的吸引力將推動對豪華乙烯基瓷磚 (LVT) 的需求。由於房地產投資的增加,建築業正在擴張。辦公室、購物中心和教育設施等商業建築的建設不斷增加,推動了豪華乙烯基瓷磚 (LVT) 的市場需求。隨著全球住宅建築計劃的增加,對豪華乙烯基瓷磚 (LVT) 的需求預計也會增加。此外,隨著製造流程技術的進步,乙烯基地板材料市場在性能、應用和設計方面都在不斷擴大。裝修和建築計劃成本上升等變數將對市場產生正面影響。

此外,旨在加強基礎設施和房地產行業擴張的政府變化和法規可能會促進建築業的成長,從而增加對豪華乙烯基瓷磚(LVT)的需求。豪華乙烯基瓷磚 (LVT) 的需求是由不斷提高的生活水準和客戶對改善室內設計和美觀度(尤其是在地板材料方面)的渴望所推動的。

北美豪華乙烯基瓷磚 (LVT) 市場趨勢

住宅領域領先市場

除了提高建築的視覺吸引力之外,LVT 還具有抵抗惡劣天氣、舒適性和耐用性等特性。預計這些因素將在預測期內推動住宅市場的發展。此外,人均收入的提高和都市化的快速發展也推動了現有住宅翻新和修復計劃的增加。預計住宅市場對豪華乙烯基瓷磚 (LVT) 的需求也將受到維護成本上升的推動。豪華乙烯基瓷磚 (LVT) 具有防水功能,是地下室、洗衣房、廚房和浴室的理想選擇。此外,臥室中的 LVT 可防止灰塵和寵物皮屑進入。

美國豪華乙烯基瓷磚 (LVT) 市場的擴張

近年來,美國豪華乙烯基瓷磚 (LVT) 市場經歷了顯著成長。 LVT 因其耐用性、經濟性和美觀的多功能性而受到消費者和商業領域的歡迎。包括 LVT 在內的彈性地板材料在美國消費者中越來越受歡迎。 LVT 的多功能性使其適用於住宅和商業的各種應用。它非常適合零售店、醫療機構和辦公室等商業空間以及廚房、浴室和走廊等人流量大的區域。在商業領域,酒店、醫療保健、零售和辦公室等行業都採用了 LVT,因為它耐用、設計靈活且易於維護。隨著商業建築和維修計劃不斷增加,這些領域對 LVT 的需求預計將成長。

北美豪華乙烯基瓷磚 (LVT) 行業概況

北美豪華乙烯基瓷磚(LVT)市場需要變得更有凝聚力。該研究涵蓋了參與北美LVT市場的外國主要公司。就市場佔有率而言,少數大公司佔據市場主導地位,包括 Mohawk Industries、LG Hausys、Tarkett、Interface 和 Gerflor。然而,隨著產品和技術的改進,中小企業正在透過擴大市場佔有率來獲得新業務並擴展到尚未開發的領域。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 房地產市場的擴張正在推動市場

- 建設產業的成長推動了市場

- 市場限制

- 與其他地板選項的競爭

- 原料成本上漲

- 市場機會

- 網路零售和電子商務的成長創造了機遇

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察市場技術進步

- COVID-19 市場影響

第5章 市場區隔

- 依產品類型

- 難的

- 柔軟的

- 按最終用戶

- 住宅

- 商業的

- 按分銷管道

- 家裝中心

- 旗艦店

- 專賣店

- 網路商店

- 其他分銷管道

- 按國家

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 公司簡介

- Mohawk Industries

- LG Hausys

- Interface

- Gerflor

- Tarkett

- Shaw Industries Group Inc.

- Armstrong Flooring

- Mannington Mills Inc.

- American Biltrite

- Adore Floors Inc.*

第7章 市場趨勢

第8章 免責聲明

The North America Luxury Vinyl Tile Market size is estimated at USD 15.88 billion in 2025, and is expected to reach USD 23.22 billion by 2030, at a CAGR of 7.89% during the forecast period (2025-2030).

Luxury vinyl tile demand is anticipated to be driven by the expanding building sector, an increase in remodeling and renovation projects, and the growing appeal of tiles. The building sector has expanded due to a rise in real estate investments. The growth in constructing commercial structures, including offices, commercial complexes, and educational facilities, drives the market's desire for high-end vinyl tiles. The demand for premium vinyl tiles will rise as more housing projects are built globally. In addition, the market for vinyl flooring has expanded in terms of performance, installation, and design due to growing technological developments in the manufacturing process. The market is positively impacted by variables, including rising costs for remodeling and construction projects.

Furthermore, government changes and regulations aimed at bolstering the expansion of their infrastructure and real estate sectors may boost the growth of the building sector and increase demand for high-end vinyl tiles. The need for luxury vinyl tiles is driven by customers' inclination towards improved interior design and aesthetics, particularly regarding flooring, as living standards rise.

North America Luxury Vinyl Tile Market Trends

The Residential Segment Leads the Market

LVTs have several qualities, including resilience to harsh weather, comfort, and durability, in addition to improving a building's visual attractiveness. During the forecast period, these factors are anticipated to propel the residential segment of the market. Furthermore, the rising number of existing home remodeling and restoration projects is being driven by rising per capita income and fast urbanization. Luxury vinyl tile demand in the residential market is also anticipated to be driven by rising maintenance costs. Because luxury vinyl tiles are waterproof, they are ideal for basements, laundry rooms, kitchens, and bathrooms. Moreover, LVTs in bedrooms don't collect dust or pet dander.

Increasing Luxury Vinyl Tile Market in United States

The luxury vinyl tile (LVT) market in the United States has been experiencing significant growth in recent years. LVT has gained popularity among consumers and commercial sectors due to its durability, affordability, and aesthetic versatility. Resilient flooring, including LVT, has become increasingly popular among consumers in the United States. LVT's versatility makes it suitable for various applications in both residential and commercial settings. It is suitable for installation in commercial spaces like retail stores, healthcare facilities, and offices, as well as high-traffic areas like kitchens, bathrooms, and corridors. The commercial sector has been significantly used in Industries such as hospitality, healthcare, retail, and offices, which have embraced LVT for its durability, design flexibility, and ease of maintenance. As commercial construction and renovation projects continue to rise, the demand for LVT in these sectors is expected to increase.

North America Luxury Vinyl Tile Industry Overview

The luxury vinyl tile (LVT) market in North America needs to be more cohesive. Major foreign companies involved in the LVT market in North America are included in the research. In terms of market share, a select group of large enterprises now dominate the market, including Mohawk Industries, LG Hausys, Tarkett, Interface, and Gerflor. But with product and technology advances, by expanding market share, mid-size and smaller businesses win new business and break into untapped sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Real Estate Market is Driving the Market

- 4.2.2 Increasing Construction Industry is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Competition from Other Flooring Options

- 4.3.2 Rise in Raw Material Costs

- 4.4 Market Opportunities

- 4.4.1 Growth of Online Retail and E-Commerce is Creating an Opportunity

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Advancements in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Rigid

- 5.1.2 Flexible

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Home Centers

- 5.3.2 Flagship Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online Stores

- 5.3.5 Other Distribution Channels

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mohawk Industries

- 6.1.2 LG Hausys

- 6.1.3 Interface

- 6.1.4 Gerflor

- 6.1.5 Tarkett

- 6.1.6 Shaw Industries Group Inc.

- 6.1.7 Armstrong Flooring

- 6.1.8 Mannington Mills Inc.

- 6.1.9 American Biltrite

- 6.1.10 Adore Floors Inc.*