|

市場調查報告書

商品編碼

1644450

疫苗物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Vaccine Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

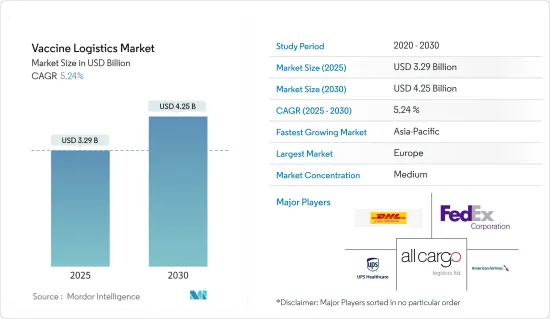

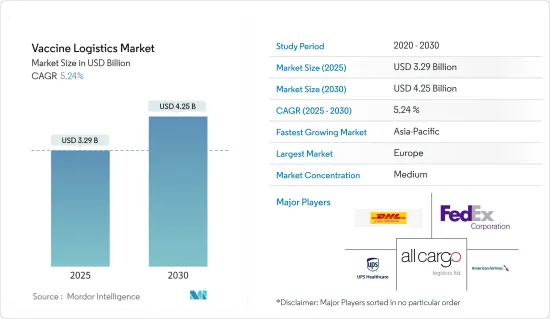

疫苗物流市場規模在 2025 年估計為 32.9 億美元,預計到 2030 年將達到 42.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5.24%。

新型疫苗、不斷發展的疫苗接種時間表、創新的服務提供策略、不斷擴大的目標人口、不斷成長的低溫運輸基礎設施需求以及有限的資金正在重塑疫苗運輸市場的動態。

氣候變遷正在大幅改變感染疾病的性質。氣溫升高擴大了蚊子、蜱蟲等病媒的棲息地,助長了瘧疾、登革熱和萊姆病等疾病的傳播。這些模式,加上極端天氣感染疾病和生態干擾,增加了通用、水傳播和呼吸道感染疾病的風險,感染疾病加劇了對疫苗的需求。

例如,輝瑞-BioNTech 疫苗需要-112°F 至-76°F(-80°C 至-60°C)的超低溫,並且必須存放在專用的溫控熱感運輸箱中。同樣,Moderna 疫苗對溫度的要求也不像輝瑞疫苗那麼極端,後者必須儲存在 -4°F (-20°C) 的環境中。疫苗必須從生產基地直接運送到使用點,避免長時間暴露在高溫下。

運送對溫度敏感的疫苗是最具挑戰性的醫藥產品之一。這些關鍵產品需要在整個供應鏈中小心處理,並依賴精確協調、溫控的物流。保持恆定的溫度至關重要,疫苗從生產到管理都必須保持在指定的範圍內。任何偏離該範圍的行為都會損害疫苗的功效及其預防目標疾病的能力。

此外,由於疫苗要求的不斷變化、氣候變遷的影響以及嚴格的溫度控制的需要,疫苗運輸市場面臨許多挑戰。應對這些挑戰對於確保全球疫苗的有效性和安全性至關重要。

疫苗物流市場趨勢

北美疫苗物流市場的成長與轉型

北美疫苗物流市場正在經歷成長,主要受溫控運輸和儲存解決方案需求激增的推動。物流供應商正在加強其低溫運輸能力,以確保疫苗在運輸過程中保持其有效性。例如,聯邦快遞擴大了其在美國範圍內的溫控設施網路,以便高效處理符合嚴格溫度規定的疫苗。這項策略性舉措不僅解決了物流挑戰,而且透過費城和達拉斯等城市的關鍵設施顯著增強了我們的冷鏈能力。

此外,新疫苗的推出和疫苗接種時間表的改變正在顯著改變北美的物流格局。 2024年,XPO部署了一輛熱敏疫苗運輸車,監督全國熱敏疫苗的分發。該公司已成功向芝加哥和休士頓等主要城市完成疫苗配送,確保疫苗從源頭到醫護人員的運輸過程均保持在規定的溫度範圍內。

總之,在低溫運輸技術進步和新疫苗推出的推動下,北美疫苗物流市場正在快速發展。這些公司也確保全部區域疫苗分發高效、可靠。

疫苗物流服務的低溫運輸技術創新

首先,對低溫運輸解決方案的需求日益增加。從2024年開始的十年間,低溫運輸物流領域的投資激增。根據《生物製藥低溫運輸原始資料》報道,2020 年,溫控物流約佔生物物流支出的 18%。沒有跡象顯示這種成長趨勢將會停止。

例如,許多疫苗不耐熱,如白喉、破傷風和百日咳 (DTP) 疫苗以及麻疹、腮腺炎和德國麻疹(MMR) 疫苗。這些對熱敏感的疫苗必須保存在2°C至8°C的溫度下,否則它們會因其生物成分而迅速分解。因此,他們嚴重依賴多級冷藏或低溫運輸配送系統。

此外,隨著人工智慧和區塊鏈等先進技術的出現,製藥業正經歷著供應鏈可視性提高的一個重要趨勢。現在,追蹤、監控和管理溫度敏感產品會產生比以往更多的資料。這種增強可視性的技術不僅可以降低腐敗風險,還能確保遵守監管標準。

此外,公司正在創新具有密封溫控系統的高科技容器。這些貨櫃促進了貨倉和飛機之間溫度敏感貨物的無縫運輸,特別滿足了製藥業的需求。

例如,英國泰恩港正在部署支援5G的自主無人機。這些無人機將提高業務效率,監督貨物處理並加快流程,加強低溫運輸並減少對溫度敏感的物資的延誤。

總之,對低溫運輸解決方案日益成長的需求加上技術進步正在顯著改變疫苗物流格局。提高供應鏈可視性和創新的溫度控制系統對於確保疫苗安全有效分發至關重要。

疫苗物流行業概況

疫苗物流市場較為分散,主要由 DHL Global Forwarding、AllCargo Logistics、美國航空、聯邦快遞、UPS Healthcare 等國際公司主導。這些大公司主要透過收購來推行擴大策略。與小公司相比,他們的現有業務使得市場擴張更加順利。

冷藏、加急配送服務和散裝疫苗運輸的需求正在上升。政府投資的活性化進一步推動了這一成長,為市場參與者提供了擴大影響力和提高效率的機會。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態與洞察

- 當前市場狀況

- 市場動態

- 驅動程式

- 溫控包裝的創新

- 跨國合作及加強醫療基礎設施的舉措

- 限制因素

- 供應鏈中斷和運輸瓶頸可能會阻礙疫苗的及時分發。

- 監理與合規挑戰

- 機會

- 區塊鏈和物聯網技術的採用將提高透明度和可追溯性。

- 下一代疫苗

- 驅動程式

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/購買者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術趨勢和自動化

- 政府法規和舉措

- 產業價值鏈/供應鏈分析

- 專注於環境和溫度控制存儲

- 地緣政治與疫情將如何影響市場

第5章 市場區隔

- 按服務

- 運輸

- 陸路(公路和鐵路)

- 航空

- 海上運輸

- 倉庫

- 附加價值服務(包裝、標籤等)

- 運輸

- 按最終用戶

- 醫院

- 藥品製造商和經銷商

- 其他最終使用者(血庫、診所等)

- 按地區

- 亞太地區

- 中國

- 日本

- 澳洲

- 印度

- 新加坡

- 馬來西亞

- 印尼

- 泰國

- 韓國

- 其他亞太地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 其他歐洲國家

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 哥倫比亞

- 阿根廷

- 南美洲其他地區

- 中東

- 埃及

- 卡達

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 亞太地區

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- DHL Global Forwarding

- AllCargo Logistics

- American Airlines

- DB Schenker

- FedEx Corporation

- Kuehne Nagel

- Nippon Express

- Yamato Logistics

- Americold Logistics

- lynden international logistics

- DP World

- Coldman Logistics

- Cavalier Logistics*

- 其他公司

第7章:市場的未來

第 8 章 附錄

- 宏觀經濟指標(GDP分佈,依活動分類)

- 經濟統計 - 運輸及倉儲業對經濟的貢獻

- 對外貿易統計 - 按商品、目的地和原產國分類的進出口數據

The Vaccine Logistics Market size is estimated at USD 3.29 billion in 2025, and is expected to reach USD 4.25 billion by 2030, at a CAGR of 5.24% during the forecast period (2025-2030).

New vaccines, evolving immunization schedules, innovative service delivery strategies, a broader target population, heightened cold-chain infrastructure demands, and limited funding are reshaping the dynamics of the vaccine transportation market.

Climate change has significantly altered the landscape of infectious diseases. Rising temperatures are broadening the habitats of disease vectors like mosquitoes and ticks, facilitating the spread of diseases such as malaria, dengue fever, and Lyme disease. This pattern, alongside extreme weather events and ecosystem disruptions, heightens the risk of zoonotic diseases, waterborne illnesses, and respiratory infections, underscoring the growing demand for vaccines.

For example, the Pfizer-BioNTech Vaccine mandates storage in specialized temperature-controlled thermal shippers, requiring ultra-low temperatures between -112°F and -76°F (-80°C to -60°C). Similarly, while the Moderna Vaccine doesn't demand the extreme temperatures of its Pfizer counterpart, it still requires storage at -4°F (-20°C). This vaccine must be transported directly from the manufacturing facility to its point of use, avoiding any prolonged exposure to elevated temperatures.

Transporting temperature-sensitive vaccines stands out as a particularly challenging endeavor among pharmaceuticals. These vital products necessitate meticulous handling throughout the supply chain, relying on precisely coordinated temperature-controlled logistics. Maintaining a consistent temperature is crucial, vaccines must remain within a specified range from production to administration. Deviating from this range jeopardizes the vaccine's potency and its protective efficacy against targeted diseases.

Moreover, the vaccine transportation market faces numerous challenges due to evolving vaccine requirements, climate change impacts, and stringent temperature control needs. Addressing these challenges is crucial to ensuring the efficacy and safety of vaccines worldwide.

Vaccine Logistics Market Trends

Growth and Transformation in the North American Vaccine Logistics Market

The North American vaccine logistics market is witnessing growth, primarily fueled by the surging demand for temperature-controlled transportation and storage solutions. Logistic providers are bolstering their cold chain capabilities to ensure vaccines retain their efficacy during transit. For example, FedEx has broadened its network of temperature-controlled facilities throughout the U.S., facilitating the efficient handling of vaccines that adhere to stringent temperature regulations. This strategic move not only addresses logistical challenges but also significantly enhances its cold chain capabilities, with key facilities in cities like Philadelphia and Dallas.

Furthermore, the rollout of new vaccines and the shifting immunization schedule are transforming North America's logistics landscape. In 2024, XPO has rolled out its thermally mapped transportation fleet to oversee the distribution of heat-sensitive vaccines nationwide. The company has successfully orchestrated deliveries in major cities like Chicago and Houston, guaranteeing that vaccines stay within the mandated temperature ranges from their origin to healthcare providers.

In conclusion, the North American vaccine logistics market is evolving rapidly, driven by advancements in cold chain technology and the introduction of new vaccines. Companies are also ensuring efficient and reliable vaccine distribution across the region.

Cold Chain Innovations in Vaccine Logistics Services

First, the demand for cold chain solutions is on the rise. Over the past decade from 2024, investments in the cold chain logistics sector have surged. As reported by the Biopharma Cold Chain Sourcebook, in 2020, temperature-controlled logistics made up nearly 18% of biopharma logistics expenditures. This upward trend shows no signs of slowing down.

For instance, many vaccines, such as those for diphtheria, tetanus, pertussis (DTP), and measles, mumps, and rubella (MMR), lack thermal stability. These heat-sensitive vaccines, if not kept between 2°C and 8°C, degrade quickly due to their biological components. Consequently, they depend heavily on a multi-stage refrigerated or cold-chain distribution system.

Moreover, with the advent of advanced technologies like artificial intelligence (AI) and blockchain, the pharmaceutical sector is witnessing a crucial trend: enhanced supply chain visibility. The tracking, monitoring, and management of temperature-sensitive products now generate more data than ever. Technologies that bolster this visibility not only mitigate spoilage risks but also ensure adherence to regulatory standards.

In addition, companies are innovating high-tech containers equipped with closed temperature-controlled systems. These containers facilitate the seamless transport of temperature-sensitive goods between cargo warehouses and aircraft, specifically catering to the pharmaceutical sector.

For instance, at the Port of Tyne in the UK, 5G-enabled autonomous drones have been deployed. These drones boost operational efficiency and oversee cargo handling, bolstering the cold chain by expediting processes and reducing delays for temperature-sensitive supplies.

In conclusion, the increasing demand for cold chain solutions, coupled with technological advancements, is transforming the vaccine logistics landscape. Enhanced supply chain visibility and innovative temperature-controlled systems are critical in ensuring the safe and efficient distribution of vaccines.

Vaccine Logistics Industry Overview

The vaccine logistics market is fragmented and is dominated by international companies, such as DHL Global Forwarding, AllCargo Logistics, American Airlines, FedEx Corporation and UPS Healthcare . These giants are pursuing expansion strategies, primarily through acquisitions. Their established presence allows for smoother market expansion compared to smaller players.

The demand for refrigerated warehouses, expedited delivery services, and bulk vaccine transportation is on the rise. This surge is further bolstered by heightened government investments, offering market players a chance to broaden their reach and enhance efficiency over time.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Technology innovation in temperature controlled packaging

- 4.2.1.2 Cross Border collaborations and initiative to enhance healthcare infrastructure

- 4.2.2 Restraints

- 4.2.2.1 Supply chain distruption and transportation bottlenecks can hinder timely vaccine distribution

- 4.2.2.2 Regulatory and Compiliance Challenges

- 4.2.3 Opportunities

- 4.2.3.1 Adoption of blockchain and IoT technology can improve transparency and tracebility

- 4.2.3.2 Next-Generation Vaccines

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers/Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technological Trends and Automation

- 4.5 Government Regulations and Initiatives

- 4.6 Industry Value Chain/Supply Chain Analysis

- 4.7 Spotlight on Ambient/Temperature-controlled Storage

- 4.8 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.1.1 Land (Road and Rail)

- 5.1.1.2 Air

- 5.1.1.3 Sea

- 5.1.2 Warehousing

- 5.1.3 Value-added Services (Packaging, Labeling, etc.)

- 5.1.1 Transportation

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Drug Manufacturers and Distributors

- 5.2.3 Other End Users (Blood Banks, Clinics, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 Australia

- 5.3.1.4 India

- 5.3.1.5 Singapore

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Thailand

- 5.3.1.9 South Korea

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 North America

- 5.3.3.1 United States

- 5.3.3.2 Canada

- 5.3.3.3 Mexico

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Colombia

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Egypt

- 5.3.5.2 Qatar

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Rest of the Middle East

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL Global Forwarding

- 6.2.2 AllCargo Logistics

- 6.2.3 American Airlines

- 6.2.4 DB Schenker

- 6.2.5 FedEx Corporation

- 6.2.6 Kuehne Nagel

- 6.2.7 Nippon Express

- 6.2.8 Yamato Logistics

- 6.2.9 Americold Logistics

- 6.2.10 lynden international logistics

- 6.2.11 DP World

- 6.2.12 Coldman Logistics

- 6.2.13 Cavalier Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin