|

市場調查報告書

商品編碼

1644452

美國智慧家庭:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)United States Smart Homes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

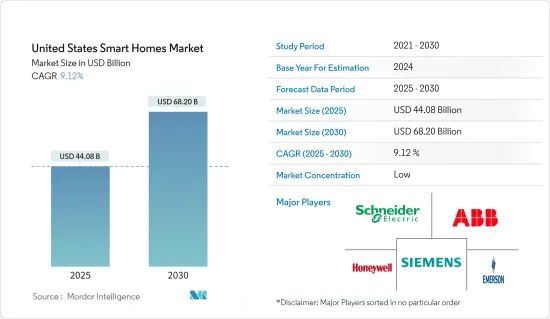

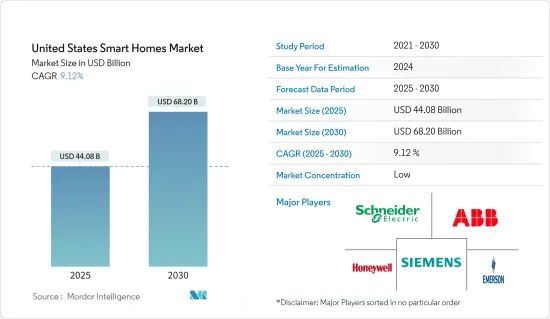

2025年美國智慧家庭市場規模預估為440.8億美元,預估至2030年將達682億美元,預測期間(2025-2030年)的複合年成長率為9.12%。

家庭自動化和智慧家庭是兩個廣泛的術語,用於描述控制和自動化家庭內部功能的各種監控解決方案。與簡單的家庭自動化解決方案(從馬達車庫門到自動安全系統)不同,智慧家庭系統需要入口網站入口網站或智慧型手機應用程式作為使用者介面來與電腦系統互動。

主要亮點

- 解決安全問題日益重要,預計將在預測期內推動對智慧家庭和連網家庭的需求。此外,安全和存取控制、娛樂控制和 HVAC 控制器等創新無線技術預計將推動市場成長。物聯網 (IoT) 的最新進展降低了處理器和感測器的價格,預計這將鼓勵製造商提高家居領域的自動化程度。

- 為了融入更多永續能源,家庭能源管理受到越來越多的關注。此外,能源價格上漲和需求增加迫使家庭提高能源效率,以降低能源成本。借助家庭能源管理系統(HEMS),能夠有效監控和管理發電、節電和能源儲存技術的能源管理服務正在為智慧家庭開發。

- 一些智慧型設備,如智慧恆溫器及其相關應用程式,當您的暖氣和冷氣系統出現問題時,也可以更快地向您發出警報。如果家裡的溫度比預設溫度更高或更低,一些智慧恆溫器可以讓使用者設定警報,讓他們知道系統出現了問題。與使用傳統恆溫器相比,此功能可讓使用者更快地預約損壞或故障系統的服務。

- 目前,智慧家居市場瞄準的是豪華住宅。但預計未來這將成為所有住宅類別的強制性要求。受過良好教育的人們紛紛前往都市區尋找工作,這種趨勢日益明顯。希望擁有住宅,許多都市區嚮往智慧家庭、能夠適應不斷發展的科技的住宅。該行業因其多種優勢而實現了顯著成長。除豪華住宅領域外,預計各領域的住宅者都將開始選擇智慧家庭及其優勢,使家庭自動化變得更加經濟實惠。

美國智慧家庭市場的趨勢

智慧家電佔最高市場佔有率

- 市場上的公司正專注於提高食品意識,並將類似的功能擴展到全尺寸烤箱和冰箱等廚房應用。過去幾年的大部分展會上都有ABB有限公司、艾默生電氣公司、西門子股份公司和其他智慧家居領域的新興參與者的身影,展示了諸如透過行動裝置控制百葉窗和燈光(無需額外佈線)、遠端監控爐灶以及將人工智慧整合到電器中以提供建議等概念。

- 廚房的作用已經改變了。它從一個簡單的烹飪空間演變成與娛樂、社交、飲食和工作等活動相關的空間。科技也幫助人們實現了類似的生活方式的改變。例如,家用電器的設計擴大附加功能,以使其更易於使用。這是採用和發展智慧連網電器產品的關鍵促進因素之一。此外,人們對烹飪日益成長的興趣也促進了招募的增加。

- 此外,地理圍欄技術的發展可以精確定位智慧型手機的位置,防止您在沒有關閉烤箱的情況下離開家,或向您發送警報,以幫助避免意外的住宅火災。根據紐約市消防局統計,無人看管的烹飪平均佔住宅火災的33%。此外,當爐灶或烤箱靠近紙巾等易燃物體,或烤箱內留有食物或油脂時,也會引起火災。

- 這個專有家庭自動化標準稱為 Matter(以前稱為 Project Connected Home over IP(CHIP)),對製造商免收版權費。 Matter 兩年前在美國加州推出,旨在減少供應商碎片化,並實現不同供應商的創新家庭技術與物聯網 (IoT) 平台之間的互通性。亞馬遜、蘋果、谷歌、康卡斯特和Zigbee聯盟(現稱為連接標準聯盟)已推出並引入計劃組,致力於開發智慧家居設備的開放標準。該規範的第一個版本1.0於今年10月發布。

能源管理蓬勃發展

- 政府對安裝暖通空調系統的優惠法規和稅額扣抵以及最終用戶對減少電費的興趣日益濃厚,都對所調查市場的成長做出了重大貢獻。

- 根據 Project Drawdown 的預測,到 2050 年,美國預計有 4% 至 46% 的網路家庭將擁有智慧恆溫器。這意味著大約7.04億個家庭將擁有智慧恆溫器。

- UEI TBH300 智慧恆溫器由 Universal Electronics 今年推出,該公司是家庭娛樂和智慧家庭設備無線通用控制解決方案的領先創新者之一。康普與 RUCKUS 的整合顯示了 Ruckus Network 致力於與專注於綠色能源計劃的合作夥伴進行整合,其中包括在 UEI 的建築網路設施中使用 UEI 的能源管理解決方案。 UEI 連接恆溫器是一個完整的端到端解決方案,配備可用的感測器,可使用 Zigbee 技術整合到 RUCKUS 無線閘道器中,為消費者提供即時節能選項。一旦安裝,它將提供遠端系統管理功能,讓您即使不在家也可以監控和管理您的能源系統。

- 此外,大多數大型規劃社區的建築商都會提供各種智慧家庭產品,包括恆溫器、照明、門鎖和車庫開啟器,作為標準設備或可用選項。同時,智慧家電和熱水器也普遍被視為升級。

美國智慧家庭產業概況

美國智慧家庭市場的競爭格局顯示市場較為分散。該市場的一些全球主要企業包括 ABB 有限公司、施耐德電氣公司、霍尼韋爾國際公司、艾默生電氣公司、西門子股份公司、LG 電子公司、思科系統公司、Google公司和微軟公司。產品發布、收購和夥伴關係是該市場企業發展採用的一些關鍵策略。例如:

- 2022 年 6 月,西門子股份公司宣布推出開放式數位業務平台西門子 Xcelerator,旨在為工業、建築、電網和交通領域各種規模的客戶加速數位轉型和價值創造。該業務平台將加速、加速和擴大您的數位轉型。西門子收購了美國主要企業的資產和維護管理軟體公司 Brightly Software。 Brightly Software 在關鍵學科領域的成熟能力將增強西門子在建築領域的數位和軟體專業知識。這將成為西門子建築加速器產品組合的基礎。

- 2022 年 3 月,美國波士頓Schneider Electric宣布推出 Wiser Gateway 和 Wiser Smart Plug,這是全球首批獲得 Matter 認證的產品之一,並擴展了該公司完整的家庭能源管理產品。 Wiser 閘道器是更大的 Wiser 生態系統的中央通訊介面,而 Wiser 智慧插頭是家庭能源管理系統 (HEMS) 網路的小型但至關重要的發送器,它們是Schneider Electric綜合 HEMS 解決方案中採用 Matter 標準的前兩款產品。此舉鞏固了Schneider Electric在家庭能源管理系統開發方面的先鋒地位,該系統可最佳化能源使用,降低成本和住宅的碳排放,同時保持舒適的環境。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

- 技術簡介

- Bluetooth

- Wi-Fi

- GSM/GPRS

- ZigBee

- RFID

- Z-Wave

- 智慧音箱

- 控制設備

第5章 市場動態

- 市場促進因素

- 對節能解決方案的需求不斷增加

- 安全系統自動化的需求日益增加

- 市場限制

- 安裝和更換成本高以及隱私問題

第6章 市場細分

- 依產品類型

- 舒適與照明

- 控制和連接

- 能源管理

- 家庭娛樂

- 安全功能

- 智慧家電

第7章 競爭格局

- 公司簡介

- ABB Limited

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Siemens AG

- LG Electronics Inc.

- Cisco Systems Inc.

- Google Inc.(Alphabet Inc.)

- Microsoft Corporation

- GE Appliances(Haier Group)

- Legrand SA

- Lutron Electronics Co. Inc.

- Whirlpool Corporation

- Smart Home Inc.

- Smart Home Inc.

- Control4 Corporation

- Savant Systems Inc.(GE Lighting)

第8章投資分析

第9章:市場的未來

The United States Smart Homes Market size is estimated at USD 44.08 billion in 2025, and is expected to reach USD 68.20 billion by 2030, at a CAGR of 9.12% during the forecast period (2025-2030).

Home automation and smart homes are two ambiguous terms used for a wide range of monitoring solutions that control and automate functions in a home. Unlike simple home automation solutions (which could range from motor-operated garage doors to automated security systems), smart home systems require a web portal or a smartphone application as a user interface to interact with a computerized system.

Key Highlights

- The increasing importance of the need to counter security issues is anticipated to fuel the demand for smart and connected homes over the forecast period. Moreover, innovative wireless technologies, including security and access regulators, entertainment controls, and HVAC controllers, are expected to foster market growth. The recent advancements in the Internet of Things (IoT), which resulted in price drops for processors and sensors, are expected to encourage manufacturers to promote automation in the household sector.

- In an effort to include more sustainable energy resources, household energy management is receiving a growing level of attention. Further, to reduce their energy costs, homes must become more efficient due to growing energy prices and increased demand. With the help of the Home Energy Management System (HEMS), the enablement of energy management services for effective monitoring and management of electricity generation, power conservation, and energy storage techniques are being developed for smart homes.

- Some smart devices like smart thermostats and their associated apps can assist users in receiving faster alerts when a heating or cooling system is experiencing issues. When a home warms or cools past a preset temperature, some smart thermostats let the user set alarms, potentially signaling system issues. As opposed to using a conventional thermostat, this functionality enables users to schedule service for a damaged or malfunctioning system more rapidly.

- Currently, the smart homes market refers to luxury projects. However, it is expected to become a requirement in all housing categories. The educated population is increasingly migrating to urban areas in search of jobs. With the desire to own a house in sync with the current trends, several people living in urban locations aspire for smart homes or homes that can adapt to evolving technologies. The sector is witnessing prominent growth due to its various advantages. Apart from the luxury segment, homebuyers from multiple components are expected to begin opting for smart homes and their benefits, with home automation being offered at affordable prices.

United States Smart Homes Market Trends

Smart Appliances Accounted for the Highest Market Share

- Companies in the market have been focusing on improving food recognition and extending the same into their kitchen applications, such as full-size ovens and fridges. The majority of the trade shows across the past few years have observed the presence of ABB Limited, Emerson Electric Co., Siemens AG, and other emerging players in the smart home segment, launching concepts such as control over blinds and lights from a mobile device without needing additional wiring, remote monitoring of a stovetop, and integrating AI into appliances for recommendations.

- The role of a kitchen has evolved. It has evolved from a simple space for food preparation to be associated with activities such as entertainment, socializing, dining, and working. Technology has aided similar lifestyle changes. For instance, appliances are being designed to have added functionality to make them easier to use. This is one of the significant drivers for the adoption and development of smart and connectable appliances. Additionally, increased interest in cooking has been contributing to the growing adoption.

- Moreover, developments in the field of geofencing technology to determine smartphone locations to prevent leaving home without turning off an oven or receiving an alert to avoid accidental house fires are being observed. As per the New York City Fire Department, "unattended cooking" accounts for 33% of home fires on average. Moreover, it stated that the fire starter is attributed to when a stove or oven is near items that can catch fire, like paper towels, or when food or grease is left in the oven.

- A proprietary standard for home automation called Matter, formerly Project Connected Home over IP (CHIP) is royalty-free for manufacturers. Two years ago, Matter was launched in California, US, to reduce fragmentation among vendors and achieve interoperability between innovative home technology and Internet of Things (IoT) platforms from various suppliers. Amazon, Apple, Google, Comcast, and the Zigbee Alliance, now known as the Connectivity Standards Alliance, launched and introduced the project group to develop an open standard for smart home devices. The specification's first version, version 1.0, was released this year in October.

Energy Management to Witness the Fastest Growth

- Favorable government regulations and tax credit facilities for the installation of HVAC systems and the increasing focus of end users on reducing electricity bills have significantly contributed to the growth of the market studied.

- As per Project Drawdown, approximately 4-46% of households with internet access in the United States are expected to install a smart thermostat by 2050. This means that around 704 million homes would have a smart thermostat installed.

- The UEI TBH300 Smart Thermostat was launched this year by Universal Electronics Inc., one of the innovators in wireless universal control solutions for home entertainment and smart home devices. Ruckus Network's dedication to integrating with partners focused on green energy projects, including UEI's Energy Management Solution, within UEI's building network installation environment is shown in its integration with CommScope's RUCKUS. The UEI-connected thermostat offers consumers an immediate energy-saving option because it is a complete end-to-end solution with available sensors that can be incorporated into the RUCKUS wireless gateway using Zigbee technology. Once installed, it offers remote management features that help keep an eye on and manage the energy systems even when somebody is not there.

- Furthermore, most of these builders of large, planned communities offer various smart-home products like thermostats, lights, door locks, and garage openers as either standard equipment or available options. At the same time, smart appliances and water heaters are typically known as upgrades.

United States Smart Homes Industry Overview

The competitive landscape of the US smart home market shows market fragmentation. Some of the global key players in this market are ABB Limited, Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., Siemens AG, LG Electronics Inc., Cisco Systems Inc., Google Inc., and Microsoft Corporation. Product launch, acquisition, and partnership are some of the key strategies adopted by market players operating in the market. For instance:

- In June 2022, Siemens AG launched Siemens Xcelerator, an open digital business platform, to accelerate digital transformation and value creation for customers of all sizes in industries, buildings, grids, and mobility. The business platform facilitates, accelerates, and scales digital transformation. Siemens has acquired Brightly Software, a leading asset, and maintenance management software company based in the United States. Brightly's well-established capabilities across key sectors will be added to Siemens' digital and software know-how in buildings. It will form the foundation of the Siemens Xcelerator for Buildings portfolio.

- In March 2022, Schneider Electric in Boston, USA, introduced the Wiser Gateway and Wiser Smart Plug, among the first products in the world to receive Matter certification, expanding the company's complete home energy management offering. The Wiser Gateway, the central communication interface for the larger Wiser ecosystem, and the Wiser Smart Plug, a small but critical transmitter for the Home Energy Management System (HEMS) network, are the first two products from Schneider Electric's holistic HEMS solution to incorporate the Matter Standard. It strengthens the company's position as a pioneer in developing home energy management systems that optimize energy usage and help reduce costs and residential carbon dioxide emissions while maintaining comfort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Technology Snapshot

- 4.4.1 Bluetooth

- 4.4.2 Wi-Fi

- 4.4.3 GSM/GPRS

- 4.4.4 ZigBee

- 4.4.5 RFID

- 4.4.6 Z-Wave

- 4.4.7 Smart Speakers

- 4.4.8 Control Devices

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy-efficient Solutions

- 5.1.2 Growing Need for Automation of Security Systems

- 5.2 Market Restraints

- 5.2.1 High Installation and Replacement Costs, along with Privacy Concerns

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Comfort and Lighting

- 6.1.2 Control and Connectivity

- 6.1.3 Energy Management

- 6.1.4 Home Entertainment

- 6.1.5 Security

- 6.1.6 Smart Appliances

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Limited

- 7.1.2 Schneider Electric SE

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Co.

- 7.1.5 Siemens AG

- 7.1.6 LG Electronics Inc.

- 7.1.7 Cisco Systems Inc.

- 7.1.8 Google Inc. (Alphabet Inc.)

- 7.1.9 Microsoft Corporation

- 7.1.10 GE Appliances (Haier Group)

- 7.1.11 Legrand SA

- 7.1.12 Lutron Electronics Co. Inc.

- 7.1.13 Whirlpool Corporation

- 7.1.14 Smart Home Inc.

- 7.1.15 Smart Home Inc.

- 7.1.16 Control4 Corporation

- 7.1.17 Savant Systems Inc. (GE Lighting)