|

市場調查報告書

商品編碼

1644479

歐洲糖果零食包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Europe Confectionery Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

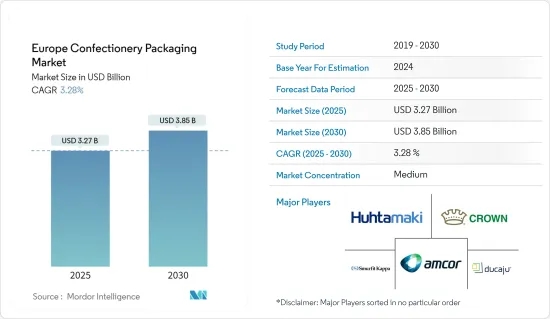

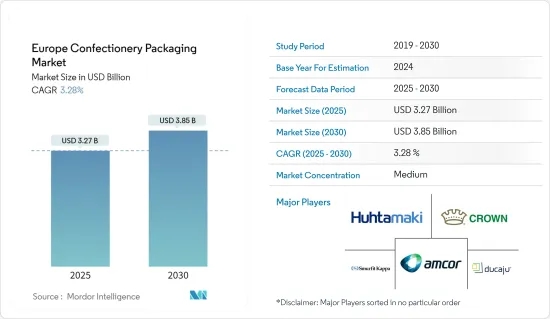

預計2025年歐洲糖果零食包裝市場規模為32.7億美元,預計到2030年將達到38.5億美元,預測期內(2025-2030年)的複合年成長率為3.28%。

這場疫情無疑擾亂了全球貿易,並凸顯了供應鏈的重要性。與其他重要基礎設施產業一樣,糖果零食產業也受到這些挑戰的嚴重影響。例如,截至2021年6月,德國糖果零食業表示,業務最快要到明年才能恢復正常。德國糖果零食工業聯邦協會(BDSI)的一項調查研究了2021年第一季中型會員的經濟發展。調查發現,由於冠狀病毒危機,該行業仍面臨壓力。

關鍵亮點

- 受新冠疫情影響,糖果零食消費量出現創紀錄下降。例如,德國糖果零食出口經歷了20年來的首次下滑。其中,歐盟成員國佔德國糖果零食出口的80%左右。門外鎖門、物流中斷、失業率上升和家庭收入下降是糖果零食銷售下降的主要因素。

- 塑膠糖果零食包裝比其他產品更受消費者歡迎,因為塑膠材質重量輕且易於處理。大型製造商也青睞塑膠包裝,如容器和站立袋,因為它們的製造成本低。

- 市場上有各種先進、經濟高效且永續的包裝解決方案,塑膠作為一種產品正在獲得全球認可。這促使安姆科等區域參與企業推出新的塑膠產品形式,以滿足糖果零食包裝的需求。

- 然而,立式袋(SUP)在研究區域內正受到巨大的需求和消費者的興趣。人們對 SUP 興趣重新燃起的背後有許多因素,包括新型包裝器材的開發,這種包裝機械可以實現更快的生產和填充速度以及更先進的密封效率。此外,其他技術進步也正在改善層壓材料的功能,使其更耐熱、更耐穿透。

- 據歐洲糖果零食稱,健康的成長正在推動大多數終端用戶市場的產量增加,包括糖果零食、巧克力和生鮮食品。人們認為,對輕巧、易於攜帶和客戶友好型產品的需求不斷成長是歐洲在全球糖果零食包裝市場佔據高市場佔有率的關鍵因素。對永續性的日益關注、對延長產品保存期限的需求不斷成長、衛生標準的提高以及客戶對易用性的關注是所研究市場的主要促進因素。

- 此外,包裝指令旨在協調各國關於包裝和包裝廢棄物管理的措施。此外,歐盟國家也被要求對所有包裝建立生產者責任制度。歐盟的目標是到2025年回收65%的所有包裝,其中包括50%的塑膠包裝、50%的鋁包裝和75%的紙和紙板包裝。此外,歐盟的目標是到2030年回收70%的包裝。

歐洲糖果零食包裝市場的趨勢

巧克力有望佔據主要市場佔有率

- 巧克力採用一種可以防止氧化並保留巧克力味道和香氣的材料進行包裝。巧克力暴露在氧氣中就會變質並失去味道。因此,使用原生纖維板,但也需要屏障來減輕外部氣味的轉移並確保保存期限。

- 此外,巧克力棒通常採用以下兩種方式包裝:直接與巧克力接觸的鋁箔,覆蓋整個巧克力棒的裝飾紙套,或作為初級包裝和次級包裝的 PET 薄膜。

- 包裝在巧克力購買行為中起著至關重要的作用。巧克力的包裝尤其重要,因為它們通常是作為禮物購買的。因此,許多研究指出,巧克力的品質與其包裝同樣重要。如果消費者不熟悉產品,他們往往會選擇包裝最令人賞心悅目的產品。

- 根據 Revolar 的一項研究,消費者的目光主要被包裝上資訊的數量所吸引。我們傾向於從左到右、從上到下關注元素。消費者認為將這兩種模式結合的包裝訊息具有更大的影響力。

- 此外,2021年2月,雀巢旗下Smarties品牌宣布計畫採用可回收紙質包裝來包裝其巧克力糖果零食。 Smarties 是全球首批改用可回收紙包裝的糖果零食品牌之一,減少了全球每年銷售的約 2.5 億個塑膠包裝。

英國佔有最大市場佔有率

- 隨著製造商不斷開發新方法以甜食吸引英國消費者,英國糖果零食市場正在不斷擴大。由於消費者對創新產品的需求不斷成長,英國消費者在零售店可以買到的產品數量大幅增加。雀巢的旺卡品牌和吉百利牛奶巧克力的奇妙創意等更具冒險精神的產品很快就被風格模仿。此外,口味和品牌偏好也推動了強勁的個人需求。

- confectionerynews.com 於 2020 年 11 月發布的一份報告發現,消費者購買的巧克力比 2019 年多出 5000 萬英鎊,其中封鎖期間在超級市場購買多件裝和共享巧克力棒是一個主要因素。該雜貨店還透露,其受歡迎的共享酒吧品牌的需求成長了 37%,該品牌的銷量成長了五分之一。糖果零食產業不斷成長的需求趨勢預計將增加該國對包裝解決方案的需求。

- 隨著人們對塑膠包裝廢棄物的擔憂日益加劇,市場上幾家大型糖果零食公司正在轉向無塑膠解決方案。例如,Flower & White 在從 Selfridges 到 QVC 以及海外的門市銷售美味糖果零食,最近推出了其最新美食系列,該系列使用帶有熱封塗層的紙質袋。此外,該公司重新推出了採用紙質包裝的熱門蛋白酥條系列,作為改善永續性和減少能源消耗的更廣泛承諾的一部分。

- 此外,2020年,雀巢在英國為其知名的Smarties糖果零食品牌推出了可回收紙包裝。這意味著 90% 的 Smarties 產品和 10% 的已採用可回收紙包裝的產品將轉型。 Smarties 成為第一個改用可回收紙包裝的全球糖果零食品牌,從而消除了全球每年銷售的約 2.5 億個塑膠包裝。

- 此外,雀巢英國和愛爾蘭業務部門每年在英國和愛爾蘭銷售約 1.4 億個糖果零食包裝袋,該部門將重新設計包裝袋,以減少 15% 的包裝。這將使該公司每年的供應鏈中減少83噸塑膠。

歐洲糖果零食包裝產業概況

歐洲糖果零食包裝市場競爭激烈。擁有較大市場佔有率的大公司正在各個地區擴大基本客群。此外,許多公司正在與多家公司形成策略合作關係,以增加市場佔有率和盈利。以下是市場的一些最新發展。

- 2021年7月-義大利費列羅為其糖果零食系列開發了紙質包裝。新包裝採用了紙質薄膜來包裝 Kinder Bakery 產品的新方式,適合在該國的紙張流中回收利用。

- 2020 年 9 月-Amcor 宣布推出用於糖果零食和零食的可回收軟性殺菌袋。該袋保存期限長,具有阻隔性和耐熱性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 市場促進因素

- 單位銷售成長得益於歐洲規模縮小和基準溫和成長

- 永續性所推動的包裝創新,例如使用可回收和生物分解性的材料

- 產品製造商持續專注於包裝,利用印刷和包裝創新來獲得競爭優勢

- 市場問題

- 包裝法規的動態性持續影響硬質塑膠產品的銷售

- 生態系分析

- 產業吸引力-波特五力分析

- COVID-19 對糖果零食包裝產業的影響

第5章歐洲糖果零食市場概述

- 當前市場狀況

- 全面覆蓋歐洲分銷管道和平均包裹尺寸

- 歐洲五大供應商分析

第6章 市場細分

- 按類型

- 塑膠(包裝、薄膜、容器、站立袋)

- 紙和紙板(包裝紙、二次包裝等)

- 金屬容器

- 玻璃瓶和玻璃罐

- 糖果零食類

- 巧克力

- 糖基

- 膠

- 其他糖果零食

- 按國家

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 歐洲其他地區

第7章 競爭格局

- 公司簡介

- Huhtamaki OYJ

- Ducaju NV

- Amcor PLC

- Smurfit Kappa Group

- Crown Holdings

- WestRock Company

- Berry Global

- International Paper

第8章 市場展望

The Europe Confectionery Packaging Market size is estimated at USD 3.27 billion in 2025, and is expected to reach USD 3.85 billion by 2030, at a CAGR of 3.28% during the forecast period (2025-2030).

The pandemic undoubtedly disrupted commerce across the globe, primarily highlighting the critical nature of the supply chain. Like the other essential infrastructure sectors, the confectionery industry has also been significantly affected by these challenges. For instance, as of Jun 2021, the German confectionery industry stated that it does not expect the business to return to normal until next year at the earliest. A survey by the Federal Association of the German Confectionery Industry (BDSI) examined the economic development of medium-sized members in the first quarter of 2021. It stated that the industry remains tense owing to the coronavirus crisis.

Key Highlights

- Consumption of confectionery products witnessed a record fall due to the COVID-19 pandemic lockdowns. For instance, the German confectionery registered the first slump in exports in the past 20 years. Notably, member countries of the European Union receive around 80% of the German confectionery exports. With lockdowns, logistical hurdles, and increased unemployment, falling household incomes were the significant drivers for declining confectionery sales.

- Plastic Confectionery packaging has become popular among consumers over other products, as plastic material is lightweight and easier to handle. Even significant manufacturers have preferred to use plastic packaging like Containers & Stand-up Pouches, owing to the lower cost of production.

- A wide variety of advanced, cost-effective, and sustainable packaging solutions emerging in the market, and plastic as a product, has been accepted globally. This has led to the regional players, such as Amcor, introducing new plastic product formats to cater to the demand for confectionery packaging.

- However, Stand-up Pouches (SUPs) are witnessing significant demand and consumer interest in the studied region. The revived interest in SUPs can be attributed to various factors, including developing new packaging machinery, which delivers higher production and filling speeds, and advances in sealing efficiencies. In addition, other technological advances have helped to improve functionality and better heat and puncture resistance of the laminate material.

- According to Confectionery Packaging Europe, healthy growth has increased production for most end-user markets, including sweets, chocolate, and fresh foods. The increased demand for customer-friendly products which are lightweight and easily transportable can be considered as a significant factor behind Europe's high market share in the global confectionery packaging market. Increasing focus on sustainability, the increased need for extended product shelf life, rising standards of hygiene, and customer focus on ease of use are the primary drivers of the studied market.

- Further, the Packaging Directive aims to harmonize national measures on the packaging and the management of packaging waste. Moreover, the EU countries are directed to ensure that producer responsibility schemes are established for all packaging. The EU has targeted to recycle 65% of all packaging materials, of which they have planned to recycle 50% of plastic packaging, 50% of Aluminum packaging, and 75% of paper and cardboard packaging by 2025. Further, the EU targets to recycle 70% of all packaging materials by 2030.

Europe Confectionery Packaging Market Trends

Chocolate is Expected to Hold Significant Market Share

- Chocolate is packaged in materials that prevent oxidation and protect the taste and aroma of the chocolate. Chocolate can get stale when exposed to oxygen and lose its flavor; therefore, it becomes inedible, rendering it unfit to sell. Hence, virgin fiber paperboard is used, but barriers are also needed to mitigate the transfer of external odors and ensure shelf life.

- Moreover, chocolate bars are typically wrapped in one of two ways: aluminum foil which is in direct contact with the chocolate, and a decorative paper sleeve that fits over the entire bar, or PET films, that serves as primary and secondary packaging.

- Packaging plays a vital role in chocolate purchasing behavior. Packaging of chocolates is particularly relevant as chocolate is often purchased as a gift for someone else. Thus, many studies indicated that the quality of the chocolate is as important as the packaging that wraps it. If the consumer is not familiar with the product, then the consumer tends to choose the one with the most pleasant packaging.

- According to a study conducted by Rebollar, the consumer's eye is primarily drawn to the size of the information on the packaging. It tends to focus on the elements from left to right and from top to bottom. The consumers perceive the packaging message that combines these two patterns with a more significant impact.

- Furthermore, in February 2021, Nestle's Smarties brand planned to adopt recyclable paper packaging for its chocolate confectionery products. Smarties is one of the first global confectionery brands to switch to recyclable paper packaging, removing around 250 million plastic packs sold worldwide every year.

United Kingdom Accounts for the Largest Market Share

- The UK confectionery market is expanding as manufacturers develop new means of tempting the UK consumer base to indulge its sweet tooth. A vast number of products available to UK consumers at retail is expanding due to the increasing consumer demand for innovation. More adventurous products are quickly imitated in style, as exemplified by Nestle's Wonka brand and Cadbury Dairy Milk's Marvellous Creations. Besides, the taste and brand preferences allow for individual solid demand.

- According to a report published on confectionerynews.com in November 2020, consumers have reportedly bought GBP 50 million more chocolates than they did in 2019, majorly driven by multipacks and sharing bars purchases at supermarkets during the lockdown. The grocers also revealed that the demand for popular brand sharing bars rose by 37%, while sales for its labels jumped by a fifth. Such increasing demand trends in the confectionery industry will likely increase the demand for packaging solutions in the country.

- With rising concerns over plastic packaging wastes, several leading confectionery players in the market are switching over to plastic-free solutions. For instance, recently, Flower & White, which sells its gourmet treats in outlets from Selfridges to QVC, and overseas, unveiled its latest gourmet product using a paper-based pouch with a heat-sealable coating. Further, the company has also relaunched its successful Meringue Bars' range in paper sleeves as part of a broader commitment to improve sustainability and reduce energy.

- Further, in 2020, Nestle's famous brand Smarties was launched with recyclable paper packaging for its confectionery products in the United Kingdom. It represents the transition of 90% of the Smarties range and 10% of the range already packed in recyclable paper packaging. Smarties will be the first global confectionery brand to switch to recyclable paper packaging, omitting approximately 250 million plastic packs sold globally every year.

- Further, Nestle UK and Ireland operations, which sell approximately 140 million confectionery sharing bags in the United Kingdom and Ireland every year, are redesigning their bags to deliver a 15% cut in packaging. This would remove 83 tons of plastic from its annual supply chain.

Europe Confectionery Packaging Industry Overview

The European Confectionery Packaging Market is competitive. The major players with a significant share in the market are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability. Some of the recent developments in the market are:

- July 2021 - Ferrero developed a paper-based packaging material for its confectionary range in Italy. The new packaging features a new method of wrapping Kinder Bakery products using paper film, suitable for recycling in the country's paper stream.

- September 2020 - Amcor announced the launch of a recyclable flexible retort pouch for confectioneries and snacks. This pouch has a long shelf life and offers a high barrier along with a heat-resistant feature.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Unit Volumes Driven by Downsizing and Baseline Growth Albeit Marginal in Europe

- 4.2.2 Packaging Innovations Driven by Sustainability, such as the Use of Recyclable and Biodegradable Materials

- 4.2.3 Product Manufacturers Continue to Focus on Packaging to Gain a Competitive Advantage by Leveraging Printing and Packaging Innovations

- 4.3 Market Challenges

- 4.3.1 Dynamic Nature Of Packaging Regulation Continues to Affect Rigid Plastic-based Product Sales

- 4.4 Industry Ecosystem Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6 Impact of COVID-19 on the Confectionery Packaging Industry

5 OVERVIEW OF CONFECTIONERY MARKET IN EUROPE

- 5.1 Current Market Scenario

- 5.2 Coverage on Distribution Channels and Average Pack Size in Europe

- 5.3 Analysis of the Top Five Vendors in Europe

6 MARKET SEGMENTATION

- 6.1 BY TYPE

- 6.1.1 Plastic (Wraps, Films, Containers, and Stand-up Pouches)

- 6.1.2 Paper and Paperboard (Wrappers, Secondary Packs, etc.)

- 6.1.3 Metal Containers

- 6.1.4 Glass Bottles and Jars

- 6.2 BY CONFECTIONERY TYPE

- 6.2.1 Chocolate

- 6.2.2 Sugar-based

- 6.2.3 Gums

- 6.2.4 Other Confectionery Types

- 6.3 BY COUNTRY

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki OYJ

- 7.1.2 Ducaju NV

- 7.1.3 Amcor PLC

- 7.1.4 Smurfit Kappa Group

- 7.1.5 Crown Holdings

- 7.1.6 WestRock Company

- 7.1.7 Berry Global

- 7.1.8 International Paper